How Trump Can Make America Great Again

![]() Trump’s Public-Private Partnership

Trump’s Public-Private Partnership

“Trump is not so much breaking the Reagan-Thatcher free-market model as he is returning the U.S. to an earlier model that worked well,” writes Paradigm’s macro expert Jim Rickards.

“Trump is not so much breaking the Reagan-Thatcher free-market model as he is returning the U.S. to an earlier model that worked well,” writes Paradigm’s macro expert Jim Rickards.

The Reagan Revolution aimed to dismantle the bureaucratic state built under Wilson and FDR. Trump, Jim says, “is leapfrogging all three episodes and going back to a 19th-century model that made America great the first time.”

- He points to the Homestead Act of 1862, which gave settlers land to cultivate — more than 270 million acres across 30 states — at virtually no cost to the government. It was a partnership between public resources and private initiative

- The same logic applied to the railroad land grants of the 1850s–1870s, rural electrification in the 1930s and the massive engineering projects of the New Deal era.

“In short,” says Jim, “Trump is not destroying private-sector capitalism. He’s returning America to a period when private capital could thrive with a boost from the government and when the benefits to citizens were far greater than any government could provide on its own.

“It’s not socialism. It’s not fascism. It’s not free-market capitalism. It’s a pragmatic return to a time when locked-up government wealth and private-sector genius worked together to make life better for all Americans.”

Trump’s presidency is redrawing the map of the U.S. economy itself, and the pace of Trump’s deal-making has been dizzying.

Trump’s presidency is redrawing the map of the U.S. economy itself, and the pace of Trump’s deal-making has been dizzying.

In June 2025, his administration approved Nippon Steel’s acquisition of U.S. Steel, but with a twist: the U.S. received a “golden share” — giving veto power over plant closings, salary cuts or name changes. Nippon also pledged billions in U.S. facility upgrades.

In July, the government became the largest shareholder in MP Materials, the country’s only rare-earth mine. That was followed by equity stakes in Lithium Americas and Trilogy Metals — all aimed at securing critical minerals vital for defense and clean-tech supply chains.

Trump cut a deal in August with Nvidia and AMD, allowing limited chip sales to China in exchange for a 15% profit royalty to the U.S. taxpayer. The same month, Apple agreed to invest $600 billion domestically and expand U.S. chip, glass and software production. Trump leveraged tariff threats to seal the deal.

Plus, Intel received $8.9 billion in federal investment, giving taxpayers upside in its recovery and securing future chip manufacturing on U.S. soil.

Jim believes the natural destination for these holdings is a U.S. sovereign wealth fund (SWF), modeled on Norway or Abu Dhabi’s trillion-dollar funds. It would consolidate federal equity stakes, royalties, license fees and crypto assets.

Jim believes the natural destination for these holdings is a U.S. sovereign wealth fund (SWF), modeled on Norway or Abu Dhabi’s trillion-dollar funds. It would consolidate federal equity stakes, royalties, license fees and crypto assets.

“If Trump is successful in creating his SWF,” Jim says, “the future of American wealth may no longer rely on debt and money printing but could be based on income-producing assets and hard assets held safely in trust and out of the hands of corrupt politicians.

“The U.S. investments are strategic but are still relatively few compared with the market capitalization of all private companies,” he notes. “The U.S. percentage ownership in each case is in the 5–10 % range, which is a far cry from a socialist-style takeover.”

Jim concludes: “Trump is using some government resources to prime the pump for private wealth creation. This is in keeping with the Homestead Act, the transcontinental railroad and the Tennessee Valley Authority.

“The boundaries between the public and private sectors have never been impermeable,” Jim adds, “but they do exist and most of us have a sense of which side of the line we’re on.

“Not anymore.”

The Trump administration is taking ownership stakes in major corporations while selling or leasing public assets back to private hands. Some call it chaos. Jim calls it an opportunity.

“Smart investors will put ideology aside,” he says, “and make the most of it while the opportunity lasts.”

![]() The Penny Drops

The Penny Drops

The U.S. Mint quietly ended penny production on Nov. 12, 2025 — a footnote to most people, but a reminder of how far the dollar has fallen.

The U.S. Mint quietly ended penny production on Nov. 12, 2025 — a footnote to most people, but a reminder of how far the dollar has fallen.

For years, critics fixated on the Mint spending roughly 3.7 cents to make a one-cent coin. But that’s just the symptom. The real story is the century-long erosion of the currency itself.

Gold was pulled from U.S. money in 1933. Silver followed in 1965. And the penny stopped being a true copper coin in 1982, when rising metal prices forced the Mint to switch from 95% copper to a 97.5% zinc slug coated in copper. By then, the metal in a “copper” cent was worth more than a cent.

Source: Reddit

When a nation can no longer afford to mint its smallest denomination, it’s not the coin that’s been debased — it’s the currency behind it.

If the raw metal in a low-value coin becomes too expensive relative to the currency’s face value, that is a sign of falling purchasing power. The progressive removal of precious and semiprecious metals from U.S. coins reflects the declining real value of the dollar over time.

Ending penny production is, in part, an acknowledgment that the dollar can no longer support what used to be a trivial unit of account.

After 43 days, the federal government shutdown is officially over. Late Wednesday night, President Trump signed a stopgap funding bill to keep agencies operating through Jan. 30, 2026.

After 43 days, the federal government shutdown is officially over. Late Wednesday night, President Trump signed a stopgap funding bill to keep agencies operating through Jan. 30, 2026.

The measure already cleared the Senate earlier in the week, and it passed the House on Wednesday evening by a tight 222–209 vote — ending what became the longest shutdown in modern U.S. history.

This morning, the government began its slow restart. The Office of Management and Budget directed agencies to reopen and ordered furloughed federal workers back to their posts.

But the effects won’t disappear overnight. Millions of Americans are awaiting food stamp benefits, though the USDA says most SNAP payments should resume within 24 hours of reopening. And federal workers are still waiting on back pay.

Here’s how Wall Street is responding…

The DJIA did get a relief bounce yesterday, closing above 48,000 for the first time. But that enthusiasm is fizzling today.

The DJIA did get a relief bounce yesterday, closing above 48,000 for the first time. But that enthusiasm is fizzling today.

The Dow’s pulled back 0.85% to 47,835; at the same time, the S&P 500 is down 1.10% to 6,775. It’s the tech-heavy Nasdaq that’s really getting clobbered: down 1.70% to 23,000.

Crude, meanwhile, is the only commodity we report that’s getting a boost. A barrel of WTI is up 0.60%, but still historically low at $58.85. Precious metals, you wonder? Silver’s getting crushed — down 1% to $52.85, and gold is down 0.35% to $4,200 per ounce.

Likewise, crypto is in the red. Bitcoin’s down 1.35% to $100,265 while Ethereum’s down 3.40% to $3,300.

![]() Bridging the Gap

Bridging the Gap

Last week, we introduced readers to Bittensor— a decentralized AI network James Altucher believes solves the “permission problem” in modern AI.

Last week, we introduced readers to Bittensor— a decentralized AI network James Altucher believes solves the “permission problem” in modern AI.

According to James, AI today is trapped in its own walled garden: “I need permission from Nvidia for chips, permission from VCs for funding and permission from governments for licenses,” he says.

Bittensor works differently. Instead of one big centralized AI system, Bittensor is made up of many smaller networks, each called a subnet.

A subnet is essentially a mini-startup inside the Bittensor ecosystem. Anyone — independent developers, researchers, small teams — can create one. You don’t need a big company or venture capital backing. You just launch a subnet that performs a specific task.

Some subnets detect deep fakes, for instance. Some train AI models. Others build cybersecurity tools or trading algorithms. Every subnet is its own competitive marketplace where people around the world “compete to do the work,” James says.

Subnet tokens are used to reward participants — miners, stakers or contributors — based on the work they perform inside that subnet. They’re like shares in that mini-startup.

Subnet tokens are used to reward participants — miners, stakers or contributors — based on the work they perform inside that subnet. They’re like shares in that mini-startup.

But here’s the critical design choice: You can’t buy a subnet token directly. “To get a subnet token, you ALWAYS need TAO,” James explains.

TAO is the reserve asset of the entire system. It is the currency that everything flows through:

- Using a digital TAO wallet, you buy TAO (your entry ticket)

- You deposit TAO into the subnet (your investment)

- You earn subnet tokens (your reward — like getting shares).

“Everything routes through TAO — every incentive, every [reward], every subnet entry,” says James.

“Up to now, the process has been too technical for most people,” he adds. “Bridges change that.”

A bridge is a piece of software that plugs Bittensor into regular crypto exchanges. When you want to buy a subnet token through a bridge, the system quietly buys TAO in the background to complete the transaction.

A bridge is a piece of software that plugs Bittensor into regular crypto exchanges. When you want to buy a subnet token through a bridge, the system quietly buys TAO in the background to complete the transaction.

You never see it happen — but TAO’s bought every single time, which creates constant built-in demand for TAO.

TAO isn’t just a regular crypto coin: It’s the core currency of a whole new economic system. As more subnets are created, TAO becomes more valuable.

And once bridges make those subnets easy for anyone to access, the entire ecosystem can grow much faster — with TAO benefiting at every step.

“That’s why,” James says, “I haven’t been this excited about an investment ecosystem in decades.”

![]() Tether: Stablecoin or SWF?

Tether: Stablecoin or SWF?

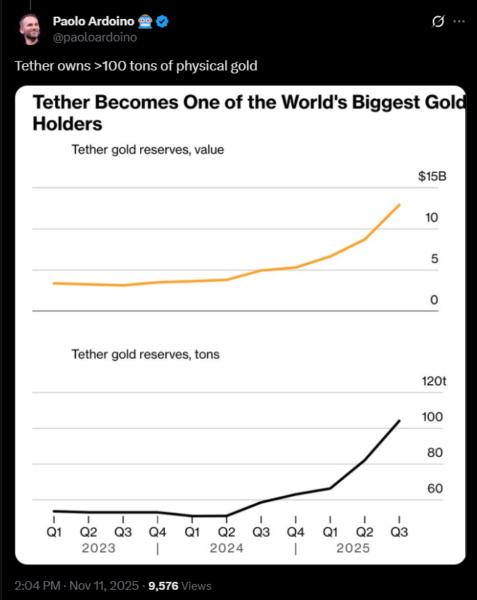

Tether is hiring two of HSBC’s most senior precious-metals executives to support its growing gold reserve.

Tether is hiring two of HSBC’s most senior precious-metals executives to support its growing gold reserve.

Both hires — HSBC’s global head of metals trading Vincent Domien and Mathew O’Neill, head of precious-metals origination for Europe, the Middle East and Africa — mark a major coup.

Domien sits on the board of the London Bullion Market Association (LBMA) and became HSBC’s global metals chief in 2022. O’Neill has been with the bank since 2008.

Their departure comes as the gold market is more competitive than it has been in decades, with bullion heading for its best annual performance since 1979.

Tether is the company behind USDT, the world’s largest stablecoin — a digital token designed to hold a constant one-to-one value with the U.S. dollar.

The company has quietly accumulated one of the world’s largest non-sovereign gold hoards, holding more than $12 billion in bullion as of September.

According to Bloomberg’s calculations, in the year leading up to September 2025, the firm added gold at an average rate of one metric ton per week.

This expansion signals a deeper shift…

Tether is positioning itself less like a payments firm and more like an analogue to a central bank… Or a sovereign wealth fund (SWF)?

Tether is positioning itself less like a payments firm and more like an analogue to a central bank… Or a sovereign wealth fund (SWF)?

Tether’s reserves span U.S. Treasuries, gold and other assets — totalling $180 billion. Last year, those reserves generated $13 billion in profit; this year, the company expects roughly $15 billion.

The timing aligns with global monetary behavior. The World Gold Council reported more than 1,000 tonnes of central-bank gold purchases in 2024, making it one of the strongest years on record.

As emerging economies hedge against dollar-linked volatility, Tether appears to be making the same calculation. Its growing bullion footprint, now reinforced by HSBC veterans, suggests a long-term strategy built on hard assets rather than dollar dependency.

“Tether’s bullion buildup could alter the perception of stablecoins from digital cash to privately managed reserve assets,” says an article at BeInCrypto.

“In effect, Tether is acting less like a payment processor and more like a sovereign wealth fund.”

![]() Worst Stocking Stuffer Ever

Worst Stocking Stuffer Ever

Apple unveiled an extra pocket for your iPhone: a pouch — priced around $150–$230 — that looks suspiciously like a repurposed sock. Just in time for the holidays!

Apple unveiled an extra pocket for your iPhone: a pouch — priced around $150–$230 — that looks suspiciously like a repurposed sock. Just in time for the holidays!

It’s a limited-time collaboration with Miyake Design Studio — the brand behind Steve Jobs’ iconic black turtlenecks.

The accessory is already being lampooned. Deservedly so.

Courtesy: Apple

Form: 0. Function: 0. Consumer: – $150–$230.

One imagines Jobs, wherever he is, observing this knitted phone holster and reconsidering his life’s work — and the late Issey Miyake taking similar inventory.

Apple, meanwhile, seems to be floating a social experiment to determine just how far brand loyalty can stretch… before it unravels completely.

Have a great day! We’ll be back tomorrow…