Feeling Smug

- “Investors think they’re bulletproof”

- Fitch snitch: What took so long?

- Coinbase, just destroy your entire business model

- Japan proposes curbs on seniors’ ATM access (Huh?!)

- What happened to the dog days of summer?

![]() “Investors Think They’re Bulletproof”

“Investors Think They’re Bulletproof”

“Just how cocky are investors right now?” asks Paradigm chart hound Greg Guenthner.

“Just how cocky are investors right now?” asks Paradigm chart hound Greg Guenthner.

Seven months of 2023 are in the books. The S&P 500 is up nearly 20% year-to-date — not enough to offset 2022’s losses, but enough to make those losses feel like a distant memory.

If it doesn’t make sense to you, if it doesn’t square with what you’re reading about the economy, or what you see with your own eyes wherever you live… well, it comes back to my dictum about how the most dangerous word in all of investing is should.

That’s why it’s so valuable to have Greg’s input. He sees many of the same things you see, thinks many of the same thoughts you think.

And then he sets them aside.

So with that backdrop, Greg answers his own question: “Investors think they’re bulletproof. They’ve erased 2022 from their minds and now believe stocks have nowhere to go but up.”

So with that backdrop, Greg answers his own question: “Investors think they’re bulletproof. They’ve erased 2022 from their minds and now believe stocks have nowhere to go but up.”

As evidence, he submits the following: “Virtually no one is hedging their bets. Snagging puts has never been cheaper than it is now, according to Bloomberg, with the cost of buying protection against a 5% dip over the next year falling to historically low levels. When hedging is dirt-cheap, you’ll have trouble finding anyone who isn’t setting up their portfolio with higher prices in mind.

“Even a routine 5% pullback isn’t top of mind right now. I say ‘routine’ here because a 5% dip is downright guaranteed to come knocking sooner rather than later. The major averages will typically post a 5% drop an average of about four times per year.

“To think a perfectly normal pullback isn’t lurking around the corner is nothing short of delusional.”

[It might have even started today. More about that shortly…]

All the same, “I’m not attempting to call a top or bet on a serious market crash at the moment,” says Greg.

All the same, “I’m not attempting to call a top or bet on a serious market crash at the moment,” says Greg.

Why not? Because that’s a great way to get destroyed.

Far better is to take the approach Greg took going into last month: “When the calendar flipped to July, I wasn’t expecting this wild rally. I had a suspicion that the market would flatline for the dog days of summer — or even correct through a broad consolidation following the big push higher in June. The Nasdaq — specifically mega-cap tech — was hitting overbought territory. A pause or move lower felt like a sensible prediction.

“Obviously, this isn’t what happened. Not even close! But I did not allow my expectations for a move lower to affect the outcome of my trading.

“As the rally continued to broaden and breakouts extended into July, I had no trouble following the trading signals and hopping on board some strong momentum plays. I call it trading the disconnect.

“Instead of driving myself crazy by trading what I think should be happening in the markets, I open my eyes and trade what I’m seeing on my screen.”

There’s that word again — should.

There’s that word again — should.

Perhaps you’ve heard the old saw about how the stock market is not the economy. “An extended take on this adage,” says Greg, “is that the market will go through extended periods where it appears to be disconnected from reality.

“Sometimes that’s true. Other times, it’s simply a case of the financial media remaining stuck on an old narrative. That’s usually the case in and around market turning points. The investing public’s core feelings about the stock market take time to reverse and move in the opposite direction.

“If we apply this idea to the market’s performance so far this year, we can assume the herd was extremely bearish in January, and the narrative was slow to flip bullish until the end of the second quarter.

“Now, we find ourselves in a situation where investors are chasing stocks following a historic first-half run.”

Greg was able to put aside his expectations about what should happen at the start of July — and guided his readers of The Trading Desk through five options trades during the month. All five were winners — and the smallest gain was 82% playing Palantir Inc.

Looking ahead, “I’m more than willing to ride this rally until it starts to sputter. But I’m also aggressively taking gains where I can — and carefully watching for signs of weakness.”

The Trading Desk is currently closed to new subscribers. But we’re scheming on a way to give Paradigm readers expanded access to Greg’s trades. Watch this space in the weeks to come…

![]() Fitch Snitch: What Took So Long?

Fitch Snitch: What Took So Long?

Gee, compared with 12 years ago, Mr. Market seems nonplussed about the Major Rating Agency Downgrades U.S. Debt! headlines.

Gee, compared with 12 years ago, Mr. Market seems nonplussed about the Major Rating Agency Downgrades U.S. Debt! headlines.

At the conclusion of the debt-ceiling drama in 2011, Standard & Poor’s downgraded the bonds issued by the U.S. government from a pristine AAA to a slightly less-pristine AA+. The stock market freaked out, all the major indexes tumbling 5% or more in a day.

It took 12 years for S&P’s competitor Fitch to follow suit.

“In Fitch's view,” said a statement it issued after the market close yesterday, “there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025.”

Gee, ya don’t say…

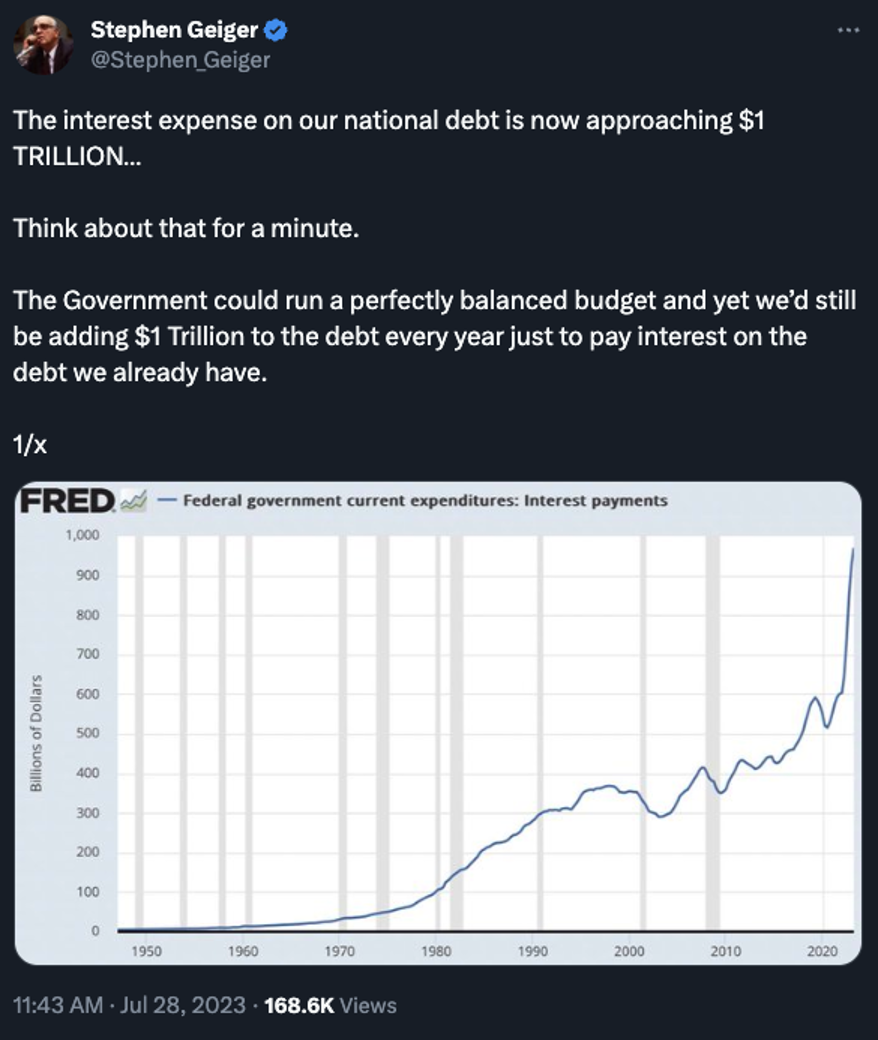

The huge rise on that chart is a function of two things…

- Interest rates couldn’t stay at rock-bottom forever

- Federal spending has not — and never will — return to pre-COVID levels. The last pre-COVID federal budget in 2019 had $4.5 trillion in spending. While the spending peak came in 2021 at $7.2 trillion, 2023 is still shaping up to be $6 trillion — one-third higher than four years ago.

So yes, the U.S. stock market is down today — but nothing like the downgrade reaction in 2011.

So yes, the U.S. stock market is down today — but nothing like the downgrade reaction in 2011.

At last check, the Dow is holding up best, down three-quarters of a percent at 35,369. The S&P 500 is down 1.2% to 4,521. The Nasdaq is taking it worst, down nearly 2% and clinging to 14,000.

Really, that’s a garden-variety one-day sell-off. After several weeks with precious few hiccups in the market, something was bound to happen. If it wasn’t Fitch it would be something else. Even with today’s losses, the S&P is no lower now than it was on… July 17.

Bond prices are also falling, sending yields higher: The yield on a 10-year Treasury note is up to 4.11%, approaching the highs of last October.

With fixed income delivering higher yields, no-yield precious metals are selling off: Gold is down $8 to $1936 and silver’s gotten slammed, down 55 cents to $23.71. Crude is off nearly two bucks and back below $80.

Maybe, just maybe, this knee-jerk market reaction has less to do with Fitch’s downgrade and more to do with the unhinged reaction of the Biden administration? Treasury Secretary Janet Yellen labeled the decision “arbitrary.”

Methinks she doth protest too much…

![]() “What We’d Like You to Do Is Destroy Your Entire Business Model”

“What We’d Like You to Do Is Destroy Your Entire Business Model”

Well, no wonder Coinbase couldn’t escape getting sued by the Securities and Exchange Commission.

Well, no wonder Coinbase couldn’t escape getting sued by the Securities and Exchange Commission.

The SEC went after Coinbase in June, accusing it of trading in at least 13 crypto assets the agency considers “securities” and thus under the SEC’s purview.

This week, Coinbase CEO Brian Armstrong told the Financial Times that before filing suit, the SEC asked the company to halt trading in all cryptos apart from Bitcoin.

“They came back to us and they said… we believe every asset other than Bitcoin is a security,” Armstrong said. “And we said, well, how are you coming to that conclusion, because that’s not our interpretation of the law. And they said, we’re not going to explain it to you, you need to delist every asset other than Bitcoin.”

That sounds very much in keeping with SEC chair Gary Gensler’s approach to crypto: He wants oversight over crypto, but he never orders his staff to draw up crypto regulations.

“It kind of made it an easy choice,” says Armstrong. “Let’s go to court and find out what the court says.”

And let’s hope the court has no patience for Gensler’s game-playing.

In the meantime, Bitcoin remains stuck under $30,000.

![]() Japan Proposes Curbs on Seniors’ ATM Access (Huh?!)

Japan Proposes Curbs on Seniors’ ATM Access (Huh?!)

How berserk is this? There’s a proposal in Japan to limit senior citizens’ access to ATMs.

How berserk is this? There’s a proposal in Japan to limit senior citizens’ access to ATMs.

Apparently it’s a common scam in Japan to call an older person’s mobile phone, posing as a relative who desperately needs cash quickly. Often, the scammer will stay on the line with the victim, walking the victim through the process of making the ATM withdrawal.

“In the first half of this year alone,” reports SoraNews24, “there have been over 15 billion yen ($107 million) in damages from these kinds of scams.”

With that in mind, the National Police Agency has proposed, as the news site reports, “locking ATM use for any bank account held by someone over 65 years of age that hasn’t had a transaction in over one year.”

For their own good, of course.

“Elderly people, naturally, were not thrilled about the news, telling reporters that setting limits on only seniors wasn’t fair and that setting the cut-off age at 65 seemed especially arbitrary. It’s been reported that the banking industry isn’t crazy about the idea either since it requires them to restrict their own customers and involves costly upgrades.”

The social media reaction has been interesting — especially this comment: “This sounds like yokinfusa to me.”

The social media reaction has been interesting — especially this comment: “This sounds like yokinfusa to me.”

The news site explains: “Yokinfusa (meaning ‘account lockdown’) is a Japanese term that describes a blanket freezing of citizens’ assets by the government, either by imposing withdrawal limits or imposing incredibly high taxes on any bank transaction.

“It was done in postwar Japan to curb hyperinflation and the idea tends to pop up now and again as a possible solution to the country’s ongoing economic malaise.”

Fascinating. In 2016, when Japan was experimenting with negative interest rates, we took note of an explosion in sales of home safes. Physical cash kept at home literally retained its value better than bank deposits.

But based on this account it sounds as if the Japanese affinity for physical cash has deeper roots, going back further in history. One wonders how a central bank digital currency would be received in the Land of the Rising Sun…

![]() What Happened to Plain Ol’ Hot Weather?

What Happened to Plain Ol’ Hot Weather?

We got a snarky one-liner from a reader after our Bullet No. 3 yesterday.

We got a snarky one-liner from a reader after our Bullet No. 3 yesterday.

As a refresher, four U.S. senators are urging the Justice Department to sue Big Oil for “climate change denial” in much the same way Big Tobacco was sued for covering up the harm caused by smoking. I mused about how scientists who challenge the conventional climate-change wisdom might testify for the defendants.

Which brought this reaction: “I wonder how many of your scientists denying climate change live in Phoenix?”

Dave responds: You know, it’s a funny thing. During a wintertime deep freeze, right-wingers often make snide social media comments about “Oh gee, what happened to all that global warming?”

Of course, that’s dumb. A deep freeze doesn’t disprove conventional wisdom about climate change. A single weather event is not indicative of any long-term trend. And the climate change hustlers are always quick to point that out.

But it cuts the other way too. You don’t get to claim that a month of 110-plus degree days in Phoenix is definitive proof of climate change, much less climate change caused by human activity.

The founder of our parent company, Bill Bonner, is in France right now. “It is cooler than usual,” he observes. We wear sweaters… and put a quilt on the bed at night.

“But that is just a ‘fact’… an eyewitness observation. Turn on the news media, and we discover that we must be on a different planet. The seas are no longer hot; they are ‘boiling.’ The desert no longer suffers the summer heat; it is an ‘inferno.’ We have no more hot spells, no more heat waves, no more ‘hazy, hot and humid’ forecasts. Now we have the fires of hell, fanned by five generations of fossil fuel sinners… ready to roast us all to cinders.

“Yes, our goose is not just cooked… it is scorched.”

Summer is not yet over… but it wouldn’t surprise us that once it is, 2023 will have turned out to be no hotter than the notoriously hot year of 1936 — when, presumably, carbon emissions weren’t nearly what they are now.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets