Gold Clears Huge Hurdle

![]() A Golden Milestone

A Golden Milestone

OK, gold finally ended a calendar month over $2,000 an ounce. Where from here?

OK, gold finally ended a calendar month over $2,000 an ounce. Where from here?

As we mentioned much of this week — and as we mentioned a month earlier — gold at $2K is a crucial line in the sand.

A monthly close over $2K is a signal from the powerful forces who tamper with the price of precious metals that they’re willing to let gold prices sail higher — beyond the $2,060 record set in the summer of 2020.

Or, alternatively… the massive buying of gold by central banks in China and other developing nations is a force that’s starting to overwhelm the powers that be in New York and London.

“The upshot,” colleague Sean Ring writes in this morning’s Rude Awakening, “is that TPTB will still monkeyhammer gold whenever they can. ‘They’ just can’t hold the $2,000 line anymore.”

Looking ahead, Sean counts himself as “cautiously optimistic. The new upside target in gold is $2,340.”

As we write, the spot price is up another $14 today to $2,049. That’s an impressive rise from $1,930 in only three weeks — and from $1,818 less than two months ago.

By and large, gold’s autumn rally has been a “stealth” rally — the very best kind, says Paradigm trading maven Greg Guenthner.

By and large, gold’s autumn rally has been a “stealth” rally — the very best kind, says Paradigm trading maven Greg Guenthner.

“I don’t think anyone else is really paying attention. Not yet!” he wrote his Trading Desk readers this morning.

“I just swung by the ol’ CNBC homepage and didn’t see a single story on gold. So I performed a quick ‘Gold $2,000’ news search and came up mostly empty-handed, except for a few technical posts. This tells me we’re probably still very early in the breakout phase.”

What’s Greg’s upside target for gold?

Well, I should preface the answer with a little history.

Well, I should preface the answer with a little history.

As someone with a trader’s mindset, Greg is completely agnostic when it comes to asset classes. He has no particular love for gold, or for anything else. He examines the price action and makes a candid assessment for the short and medium terms.

This approach profoundly offended a subset of my readers a decade ago — the folks who wear the term “goldbug” as a badge of honor.

They rode gold’s price down from a then-record $1,900 in September 2011 to $1,650 in early 2013. At that point, Greg declared gold was in a bear market.

For his candor, goldbug readers wouldn’t let him hear the end of it. One labeled him “the Antichrist.”

But Greg’s call was, to use an industry term, dead-on balls accurate: Gold spent nearly three more years sinking from $1,650 to $1,050 toward the end of 2015.

So with that backstory in mind… I invite you to watch Greg’s interview on Tuesday with Paradigm Press executive publisher Matt Insley — or, if you prefer, read the transcript.

It’s only the second weekly installment in a new and totally FREE series of trading briefings we’re offering.

“Sometimes I’ll share a big-picture view,” Greg says. “Other times, I might share a chart I like.

“But no matter what, you’ll have a better grasp on what the market might throw your way.

It’s useful, actionable information and knowledge based on my up-to-the-minute market commentary.”

If you like what you see, you should absolutely sign up for email links to these briefings — they’re live on Zoom every Tuesday at 11:00 a.m. Eastern.

We shouldn’t forget about silver.

We shouldn’t forget about silver.

Checking our screens, the spot price is up three cents to $25.29. A weekly close over $25 wouldn’t be a first — but given silver’s rally from under $21 in less than two months, it could be another significant milestone.

![]() Elsewhere in the Markets Today…

Elsewhere in the Markets Today…

As for stocks, the major U.S. indexes are marching higher — adding to their big November gains.

As for stocks, the major U.S. indexes are marching higher — adding to their big November gains.

At last check, the S&P 500 was up just under a half percent to 4,588 — this close to the year-to-date high posted on July 31. Volatility as measured by the VIX rests at 12.5 — exceptionally low. Mr. Market is feeling nice-n-mellow — which means the November rally could easily stretch into year-end and maybe beyond.

“Stocks have shot up fast, up 10% in less than a month,” says Alan Knuckman — Paradigm’s eyes and ears at the Chicago options exchanges. “If the S&P can take out this 4,600 level,” he tells readers of The Profit Wire, “that targets a 400-point move from that previous range on top, 5,000 — which is interesting, another 10% higher.” [Shout-out to Alan’s readers who booked 50% gains this morning playing call options on Lyft and AT&T.]

And if the dollar continues its fall, that’s even more fuel for the rally. The U.S. dollar index sits at 103.3 — up from this week’s lows, but down huge from 106.5 a month ago.

Elsewhere, crude is up a quarter to $76.20. Bitcoin is at $38,744 — the highest since the crypto meltdown in the spring of last year.

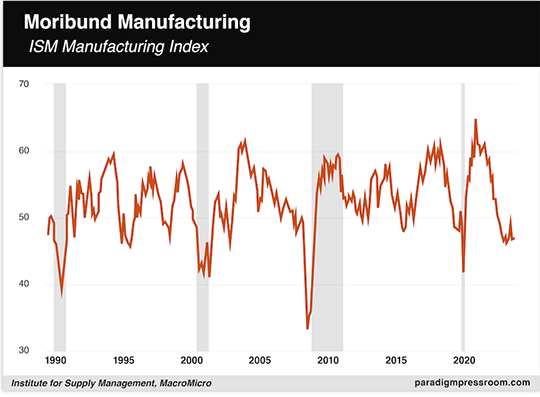

One economic number of note, and it’s a stinker: The ISM Manufacturing Index logged another sub-50 reading at 46.7 — suggesting the U.S. factory sector has been contracting for 13 months now.

One economic number of note, and it’s a stinker: The ISM Manufacturing Index logged another sub-50 reading at 46.7 — suggesting the U.S. factory sector has been contracting for 13 months now.

The last time the index spent this much time below 50 without the economy sinking into recession was the mid-1990s…

![]() Peak Green, Continued

Peak Green, Continued

For a second day running, we have a revealing item that suggests we’re at “Peak Green” — the beginning of the end of the renewable-energy frenzy.

For a second day running, we have a revealing item that suggests we’re at “Peak Green” — the beginning of the end of the renewable-energy frenzy.

Four months ago, Connecticut Gov. Ned Lamont proposed a ban on the sale of vehicles with internal-combustion engines after 2035. Tuesday, Lamont’s office quietly withdrew the proposal. Even with a large Democratic majority in the legislature, the proposal was dead on arrival.

A Fox News headline calls the decision “a stunning blow to environmentalists” — although it’s not the end of the story.

Democratic lawmakers plan to meet next week to draw up a revised proposal for next year’s legislative session. House Speaker Matt Ritter says, “We have to demonstrate to Connecticut residents that this switch will not only save the environment, save lives and save our planet — but not leave you in a position where you can no longer afford a vehicle.”

Yeah, good luck with that. But at least there’s a recognition that the most extreme green proposals will effectively deprive large numbers of people of the first-world lifestyle they’re accustomed to.

This news comes on the heels of our item yesterday about General Motors taking some of the cash it previously intended to plow into EVs and instead using it to buy back shares. Promising, no?

Meanwhile, auto dealers from all 50 states have fired off a letter to the White House — calling on the Biden administration to slow its roll toward EVs.

Meanwhile, auto dealers from all 50 states have fired off a letter to the White House — calling on the Biden administration to slow its roll toward EVs.

As we mentioned over the summer, the National Highway Traffic Safety Administration wants to jack up fuel economy standards for model years 2027–32.

As it is, automakers are required to achieve an average 49 miles a gallon across their fleet of light-duty cars and trucks by 2026. Beyond 2026, the number ramps up to 58.

The only way the industry can get there is with a sharp increase in sales of electric vehicles. As it happens, separate regulations from the EPA governing tailpipe emissions would effectively require two-thirds of all new vehicles be electric by 2032.

The problem is that “electric vehicle demand today is not keeping up with the large influx of BEVs [battery electric vehicles] arriving at our dealerships prompted by the current regulations,” says the letter — signed by representatives from 3,800 dealerships.

“BEVs are stacking up on our lots… even with deep price cuts, manufacturer incentives and generous government incentives.”

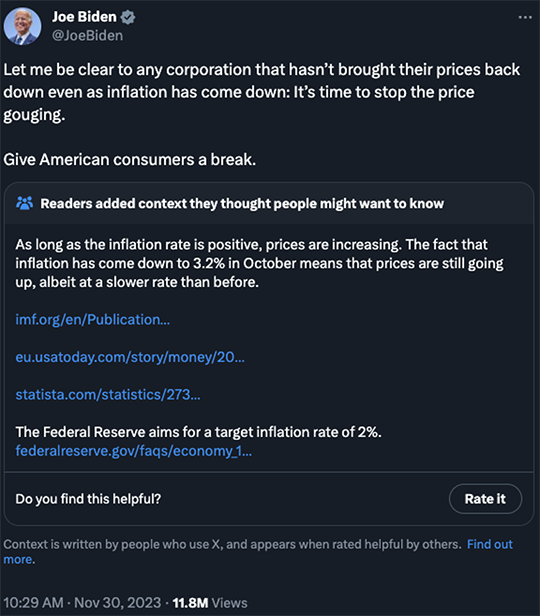

No reply yet from the White House — although we’re guessing whenever it comes, it will be as clueless and tone-deaf as the approach it’s taking with complaints about inflation…

![]() Peak Higher Ed

Peak Higher Ed

The equation “college degree = good-paying job” is breaking down — and not a moment too soon. Maybe we’ve reached “Peak Higher Ed.”

The equation “college degree = good-paying job” is breaking down — and not a moment too soon. Maybe we’ve reached “Peak Higher Ed.”

“Nearly half of U.S. companies intend to eliminate bachelor's degree requirements for some job positions next year,” reports the Daily Mail. “And 55% said they'd already eliminated degree requirements this year, according to an Intelligent.com survey of 800 U.S. employers, carried out in November.”

The numbers aren’t surprising in light of similar numbers we passed along last February. But since then, several big-name employers have made eye-opening announcements…

- Walmart eliminated bachelor’s degree requirements for hundreds of corporate positions last October — calling them “unnecessary barriers” for people who already have the required skills

- Accenture, the corporate consulting giant, has expanded an apprenticeship program launched in 2016 — hoping it will fill 20% of its entry-level positions in the U.S. To date, the program has produced 1,200 hires — 80% of whom lack a four-year degree.

To be sure, the process of eliminating degree requirements is moving at glacial speed — but the trajectory is unmistakable.

To be sure, the process of eliminating degree requirements is moving at glacial speed — but the trajectory is unmistakable.

The Axios website cites these figures from the labor analytics firm Lightcast: “About 78.4% of job postings in ‘college-level occupations’ in 2023 specifically called for a degree, down from 82.5% in 2017 and 85% in 2010.

“Jobs like insurance sales agent, e-commerce analyst, property appraiser and call center manager are among the positions that increasingly do not require a degree.”

Axios concludes its article with a “thought bubble” that goes like this: “In a capitalistic system, employers have no incentive to stick to their traditional hiring practices if they identify a better route.

“That means this trend is a serious threat to colleges and universities, which must prove their relevance to prospective enrollees who have real-world job opportunities and fear taking on student debt.” [Emphasis ours]

Maybe that’s obvious to you… but to see these sentences on the website of an elite outlet like Axios (it was launched in 2017 by a handful of Politico veterans) is something of a watershed moment.

The Intelligent survey from earlier this year found that the industries where a degree is valued least now include IT, retail, construction, health care and social services.

Friday rant: Sadly, your editor’s former profession of journalism is not on the list — and I think we’re all worse off as a consequence.

Friday rant: Sadly, your editor’s former profession of journalism is not on the list — and I think we’re all worse off as a consequence.

According to the Pew Research Center, newsroom employment plunged 26% between 2008–2020. That’s a lot fewer people covering our city councils and county commissions and school boards and especially our state capitals — which are now appallingly under-covered for the amount of influence they wield over our lives.

It’s a simple story: Unless you work at the most elite level, the pay sucks (and the hours frequently suck worse). That’s always been the case — journalism is a labor of love. But no amount of love can overcome the burden of a five-figure student debt.

Once that’s grafted onto the bargain, the whole thing becomes untenable.

By one estimate, more than half the reporters in the country back in the 1950s had (at most) a high-school degree. They learned their skills on the job, mentored by veterans who understood that a tutoring role came with the territory.

There’s no reason it can’t be done that way again. Take it from someone who’s been there: There’s nothing about the work that demands the “rigors” of a four-year degree.

![]() A Golden Mailbag

A Golden Mailbag

“We did it!” a reader writes triumphantly of gold’s monthly close over $2,000.

“We did it!” a reader writes triumphantly of gold’s monthly close over $2,000.

Referring to the gold-positive remarks from Goldman and Citi that we mentioned on Tuesday, he adds, “I thought for sure the Wall Street giants’ ‘clues’ were a set-up — and they were plotting to smash the dollar price of gold yet again to cover their short positions.

“Not that they like to sucker us or profit at our expense. But they’re very good at head fakes and manipulations. Maybe that’s still their plan?

“Hopefully not. We shall see.

“If gold’s dollar price breaks through the triple top (dating back to 2020) and that serves as subsequent support, it will be a great sign. If it breaks away from the cup and handle (dating from 2011), that would be even greater.

“I’m no chartist/technician, but even an amateur like me can see those formations.

“BTW Rick Rule makes a great point about the set of conditions that could be occurring whenever gold’s dollar price goes much higher. To paraphrase: It does well in bad times, and would signal the collapse of the dollar.

“Buckle up the headgear! Things might get sporty.”

Dave responds: All true — with the proviso that inevitable events aren’t necessarily imminent.

Say the stock market reclaims its early-2022 highs toward year-end — 4,800 on the S&P 500 — or goes even higher.

And then say it tumbles into a 15% sell-off in the space of six weeks.

Gold could easily sell off hard under those circumstances. When big-money players need to raise cash to cover their losses, they sell whatever’s liquid. Gold is about as liquid as it gets.

It’s happened time and again — most memorably during the 2008 financial crisis, from a peak of $1,020 in March to a trough below $700 in late October. Many of the proverbial “weak hands” were shaken out by that downdraft.

Of course, strong hands were rewarded with a rally to over $1,900 by Labor Day 2011.

And yes, the odds are good that history would rhyme in our little scenario. Keep stacking!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets