104%

![]() Tariff Threat Escalates U.S.-China Trade War

Tariff Threat Escalates U.S.-China Trade War

President Trump has doubled down on his trade war with China, threatening to impose an additional 50% tariff on Chinese imports… if Beijing does not withdraw its retaliatory 34% tariff on U.S. goods.

President Trump has doubled down on his trade war with China, threatening to impose an additional 50% tariff on Chinese imports… if Beijing does not withdraw its retaliatory 34% tariff on U.S. goods.

If implemented, these new tariffs would bring the total tax on Chinese goods entering the U.S. to an astonishing 104%, marking one of the most aggressive escalations in the trade war yet.

[This just in: The White House now says that, barring China’s recapitulation, the 104% tariff will go into effect at midnight.]

China has responded with defiance, pledging to “fight to the end” and rejecting what it describes as U.S. “blackmail.” Beijing insists its countermeasures are necessary to protect its sovereignty and interests, signaling no intention of backing down.

For now, President Trump is equally resolute in his tariff strategy, emphasizing that his administration is committed to achieving “fair deals” for the United States. “Countries from all over the world are reaching out to us,” he remarked on Monday, highlighting the surge in foreign leaders contacting the White House since “Liberation Day” last week.

Trump notes that nations are offering concessions that “we wouldn’t have even thought to ask for,” underscoring his belief in the effectiveness of his hard-line approach.

Notably, Trump denies reports suggesting a possible 90-day pause on tariffs. Nevertheless, when asked if tariffs are permanent or open for negotiation, Trump said coyly: “They can both be true.”

As for the duration — and multifaceted strategies — of trade wars, Paradigm’s macro expert Jim Rickards offers an historical perspective…

“If a country raises tariffs on another country, you might say that the trade war continues as long as the higher tariffs are in place,” Jim says.

“If a country raises tariffs on another country, you might say that the trade war continues as long as the higher tariffs are in place,” Jim says.

“But trade wars easily morph into currency wars,” he notes. “If a country is the target of tariffs, they can retaliate [by] cheapening their currency.

“The cheaper local currency offsets the costs of higher tariffs and keeps the prices of exported goods unchanged in terms of the importing nation’s currency.

“Other ways of fighting trade wars include non-tariff barriers such as local subsidies, tax breaks and prohibitions,” Jim notes.

“For example, Australia has no tariffs on U.S. imports, but it has an outright ban on imports of U.S. beef. That’s a non-tariff barrier that’s worse than a tariff.

“Trade wars can also morph into financial sanctions,” he says, “which are a form of financial warfare — or even morph into a shooting war, such as the Royal Navy blockade of goods for Europe during the Napoleonic Wars.

“One of the longest trade wars was during the Great Depression and beyond, beginning in 1925 with currency devaluations, then escalating in 1930 with the Smoot-Hawley tariffs and continuing throughout the 1930s with a major contraction in world trade, which segued into World War II.

“That trade war wasn’t really over until the early 1950s with the rise of the General Agreement on Tariffs and Trade (GATT), one of the Bretton Woods institutions.

“You could perceive that as a 25-year trade war (1925–1950) fought with currencies, tariffs, embargos and bullets,” Jim says, concluding: “Trade wars involve many factors other than tariffs and can last a long time.”

[From Paradigm Publisher Matt Insley’s iPhone: Just moments ago, Matt recorded an urgent tariff warning for our readers.

“Because these tariffs are set to go into effect hours from now on April 9,” says Matt, “one thing has become extremely clear: People are confused.

“Which is a dangerous thing to be in a market like this.”

So eliminate all distractions, pay close attention and click here as Matt explains how tariffs could impact your investments now… and for the decade to come.]

![]() Pessimism AND Optimism Dip

Pessimism AND Optimism Dip

The CBOE Volatility Index (VIX) — the “fear gauge" — approached 60 points on “Liberation Day.” Today? The VIX is hovering around 40 points…

The CBOE Volatility Index (VIX) — the “fear gauge" — approached 60 points on “Liberation Day.” Today? The VIX is hovering around 40 points…

With that, stocks are settling down too — the three major U.S. stock indexes are all in the green today, in fact. At the time of writing, the tech-heavy Nasdaq has rebounded the most, up 3.20% to 16,100. Meanwhile, the Dow is up about 2.60%, just under 39,000, and the S&P 500 is up 2.70% to 5,200.

Crude is slightly rallying likewise: A barrel of West Texas Intermediate is up 0.40% to $61. And precious metals are getting some love. Gold is up 1.65% to $3,022.70 per ounce, and the price of silver is up 1.75%, just over $30.

Crypto, however, is of two minds. Although Bitcoin is up 0.25% to $78,420, Ethereum is down 1.35% to $1,525.

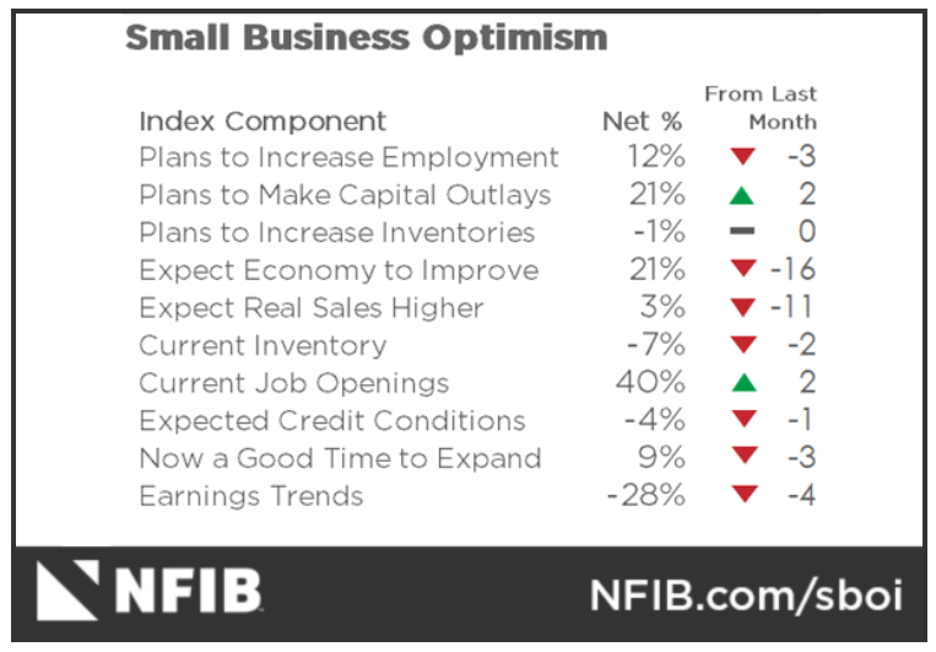

Per the major economic number of the day, the National Federation of Independent Business (NFIB) is out with its monthly Small Business Optimism Index. The headline number is 97.4 for March — marking the biggest month-over-month decline since June 2022.

Per the major economic number of the day, the National Federation of Independent Business (NFIB) is out with its monthly Small Business Optimism Index. The headline number is 97.4 for March — marking the biggest month-over-month decline since June 2022.

This drop has pushed the index below its 51-year average of 98, just three months after it reached a near-record high of 105.1 in December.

“The implementation of new policy priorities has heightened the level of uncertainty among small-business owners over the past few months,” says NFIB chief economist Bill Dunkelberg. Referring to tariffs as ‘policy priorities’ is a creative choice…

“Uncertainty is high and rising on Main Street and for many reasons,” Mr. Dunkelberg continues.

“Those small-business owners expecting better business conditions in the next six months dropped and the percent viewing the current period as a good time to expand fell, but remains well above where it was in the fall.”

Labor continues to be a significant hurdle, as 40% of business owners report having unfilled job openings, a two-point increase compared to February. At the same time, just 12% of owners intend to add new jobs within the next three months — a three-point decline from February and the lowest figure since April 2024.

Obviously, the survey was taken before “Liberation Day.” Next month’s survey should get really interesting.

![]() It’s All Good in the Hood

It’s All Good in the Hood

“Five years from now, what’s the one stock everyone will wish they bought today?” That’s the million-dollar question Paradigm’s publisher Matt Insley asked our trading guru Greg Guenthner mere days ago.

“Five years from now, what’s the one stock everyone will wish they bought today?” That’s the million-dollar question Paradigm’s publisher Matt Insley asked our trading guru Greg Guenthner mere days ago.

“Without hesitation, I gave him a point-blank answer,” says Greg. “That’s how confident I am about one innovative company — Robinhood Markets Inc. (HOOD).

“My reasoning: The Robinhood platform is maturing into an incredible one-stop shop for everything markets.” Aside from a sleek new interface for both mobile and desktop users, there’s also…

- Robinhood Gold: A subscription program offering deposit bonuses and a 5% yield on cash

- 24-Hour Trading: Round-the-clock trading on major stocks and ETFs

- Crypto Wallet & DeFi Expansion: A crypto wallet with plans to delve deeper into decentralized finance.

“Robinhood’s laundry list of new features is growing so fast that I’m having trouble keeping up,” says Greg.

Is HOOD the market’s next amazing success story?

Is HOOD the market’s next amazing success story?

“I began to build my HOOD position in late 2022 when the stock was still trading in the $10 range,” Greg says.

“It wasn’t a perfect entry,” he admits. “HOOD was hit especially hard because it was one of the later IPOs of the COVID era, launching in mid-2021.

“The stock quickly cooled following some rabid buying during its first week on the market. By the time the dust cleared in 2022, HOOD had fallen as much as 90% off its IPO highs.

“HOOD spent 2023 building its big base,” he recalls. “Since 2024, the stock has been on an absolute tear.”

Greg’s verdict? “HOOD is a sleeping giant.

“Not only do I think the stock could rally toward $100 by the end of this year,” he says, “it’s also the type of play that has that magic mix of growth and disruption that could propel it to market royalty.”

“And just like that, Robinhood isn’t just a trading app anymore,” agrees Paradigm’s DeFi expert Chris Campbell.

“And just like that, Robinhood isn’t just a trading app anymore,” agrees Paradigm’s DeFi expert Chris Campbell.

“While banks are busy charging overdraft fees, giving you 0.01% interest in your savings account and upgrading their fax machines, Robinhood is building…

- “A prediction market so you can bet on the Fed rate or the next president

- A Cortex AI assistant — that’s like ChatGPT if it went to Wharton and got jacked on Bloomberg data

- A tokenized securities exchange that makes private equity look like public stocks.

“Imagine,” Chris continues, “a marketplace where you don’t just trade Bitcoin or Dogecoin, but where you buy tiny slices of private companies like Anthropic, SpaceX or the next world-changing company.”

According to Chris? “Robinhood’s CEO Vladimir Tenev [understands] what 99% of Wall Street doesn’t: The next trillion-dollar companies won’t IPO.

“The public markets are a bloated dinosaur,” he says. “Compliance costs are sky-high. IPOs are down. Liquidity is trapped. But tokenization? That’s the loophole.”

In short: “Robinhood is building prediction markets. They’re turning AI into your personal wealth adviser. And they’re working on tokenizing SpaceX.

“Robinhood,” Chris concludes, “is the most forward-thinking fintech company in the world.”

![]() Flipper… or Flop?

Flipper… or Flop?

Heineken’s idea is simple: Stop doomscrolling on nights out with friends… and start interacting with actual humans.

Heineken’s idea is simple: Stop doomscrolling on nights out with friends… and start interacting with actual humans.

To that end, a prototype phone case — The Flipper — uses AI and a robotic arm to flip your phone face down when it hears the word “cheers.”

Courtesy: Heineken

Heineken, in fact, isn’t new to this anti-tech crusade; previous stunts include The Closer, a bottle opener that disables work apps.

On the flip side (couldn’t resist), instead of The Flipper case for your smartphone, why not get an actual FLIP phone?

Problem solved… Cheers!

![]() Mailbag: No Good Deed Goes Unpunished

Mailbag: No Good Deed Goes Unpunished

“As far back as 2005 when my husband was receiving Avastin infusions for prostate cancer treatment, I realized that Medicare Parts B and D were not in sync,” writes a regular reader and retired nurse, commenting on Dave’s single-issue denunciation of U.S. health care.

“As far back as 2005 when my husband was receiving Avastin infusions for prostate cancer treatment, I realized that Medicare Parts B and D were not in sync,” writes a regular reader and retired nurse, commenting on Dave’s single-issue denunciation of U.S. health care.

“An infusion with Avastin administered in a medical provider’s office cost $5,220. Instead, I was able to get a prescription for two treatments of Avastin filled at the pharmacy for $240 per treatment through Part D and take it to the physician’s office. Since it was administered in a physician’s office, it should not have even been covered under Part D.

“I brought this to the attention of the only three members of the federal government with whom I had any influence. My information asking for such an error to be addressed fell on deaf ears. So much for trying to right a wrong!”

“One of the many problems with U.S. health care is that providers are required by law to care for everyone (i.e. all possible medical treatments regardless of ability to pay),” says another health care professional.

“One of the many problems with U.S. health care is that providers are required by law to care for everyone (i.e. all possible medical treatments regardless of ability to pay),” says another health care professional.

“I would guess that a bunch of costs are related to ‘Hail Mary’ procedures. Hail Marys include at least four categories: non-standard treatments, procedures/treatments shown to have a low likelihood of success, treatment to delay the moment of death or treatments on people permanently incognizant.

“I once was forced to do imaging procedures on a 90-plus-year-old lady with bleeding from her colon who had not known who she was or where she was for over five years and was not in any pain until I violated her peace. (That's the other side of RIGHT TO LIFE.)

“These costs should not be dumped on you and me.”

Emily: To our contributor’s point, end-of-life care consistently accounts for about 25% of total Medicare spending, a figure that has remained stable for decades.

Perhaps that’s because, according to one study, almost 32% of Medicare beneficiaries who died in 2008, for instance, underwent surgery in their last year of life. And about one in five had surgery in their final month.

It’s my opinion, U.S. health care would benefit from a dose of reality: Death is not always a medical failure. In fact, given time for compassionate communication, physician and patient might better align when it comes to end-of-life decisions.

Just my two cents…

Take care, and thanks to our contributors today!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets