AI Is Ancient History

- AI is ancient history

- Two economic indicators: What will the Fed do next?

- “The world’s mandate is to become greener”

- EV adoption underwhelms

- Cruel to Be Krugman

![]() AI Is Ancient History

AI Is Ancient History

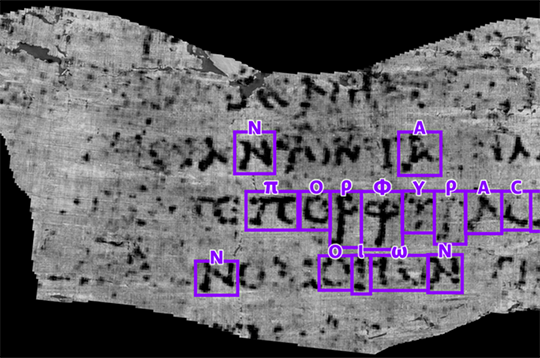

“A computer science student has won $40,000 for deciphering the first word on an ancient Roman scroll carbonized by Mount Vesuvius’ eruption in 79 C.E.,” says Smithsonian Magazine.

“A computer science student has won $40,000 for deciphering the first word on an ancient Roman scroll carbonized by Mount Vesuvius’ eruption in 79 C.E.,” says Smithsonian Magazine.

Twenty-one-year-old Luke Farritor, who attends the University of Nebraska, developed a machine-learning algorithm (AI) to detect Greek letters on a charred scroll — too fragile to unfurl.

Courtesy: Vesuvius Challenge

“Farritor used subtle, small-scale differences in surface texture to train his neural network and highlight the ink,” says Nature. The text revealed the Greek word porphyras, meaning “purple.”

“When I saw the first image, I was shocked,” says Federica Nicolardi of the University of Naples. “I can actually see something from the inside of a scroll.”

Using AI, Farritor won the “first letters” prize as part of the Vesuvius Challenge, culminating in a grand prize of $700,000 “for reading four or more passages from a rolled-up scroll,” Nature says.

But what’s good for ancient history… is bad for finance?

SEC chair Gary Gensler warns “a financial crisis caused by artificial intelligence (AI) is ‘nearly unavoidable’ in the next decade without further regulation of the rapidly advancing technology,” The Hill says

SEC chair Gary Gensler warns “a financial crisis caused by artificial intelligence (AI) is ‘nearly unavoidable’ in the next decade without further regulation of the rapidly advancing technology,” The Hill says

“It’s frankly a hard challenge,” Gensler says. “This is about a horizontal [matter whereby] many institutions might be relying on the same underlying base model or underlying data aggregator.”

The Financial Times notes: “Wall Street has already adopted AI in a number of ways, from robo-advising to account-opening processes and in brokerage apps.”

The “robo-advising” trend is a thread our firm has been following for several years…

In 2020, for example, Paradigm’s macro expert Jim Rickards said: “In reality, 90% of stock trading today is done by robots and algorithms. This has created efficiencies, lowering costs and enabling faster execution of trades… However, it has come at a high cost.”

To wit? “Gensler is concerned that parties basing decisions on the same data model may lead to herd behavior that would undermine financial stability and unleash the next crisis,” FT says.

“Might this lead to more concentration of market makers?” Gensler wonders. (And if you have to ask the question, we think you have your answer.)

When it comes to the world of finance, AI has been operating in plain sight for many years; one could say it’s ancient history. And now that publicly traded companies in all sectors have their AI marching orders — “do AI” — it’s going to be difficult for regulators like Gensler to put a lid on Pandora’s box.

[Note: The AI genie isn’t going back in the bottle. On the contrary, investors can profit from a little-known supplier that just received a massive order from Nvidia.

This supplier is planning to manufacture what we’re calling “The AI Crown Jewel.” It’s one of the biggest production runs in technology history, and it’s one reason Barron’s says this supplier could see $100 BILLION in sales by 2025.

Learn how to get in front of this fortune-building AI wave now.]

![]() Two Economic Indicators: What Will the Fed Do Next?

Two Economic Indicators: What Will the Fed Do Next?

For the day’s major economic numbers, Paradigm’s editor Sean Ring digs deep into the data.

For the day’s major economic numbers, Paradigm’s editor Sean Ring digs deep into the data.

“The cadence of monthly reporting isn’t arbitrarily chosen,” Sean notes. “It provides a near real-time snapshot, enabling a timely response from policymakers and the market. This frequency allows for a more agile approach to assessing the economic trajectory.”

Thus, Sean takes a closer look today at the “anatomy of industrial production data”:

- “Manufacturing: The largest component, encompassing the production of goods ranging from the behemoth machines that grace our skies to the minuscule silicon chips that power our modern lives

- Mining: My friend and colleague Byron King’s specialty, this sector includes the extraction of minerals and resources essential for many industries

- Utilities: The lifeblood of modern civilization, utilities cover the generation and distribution of electricity, gas and water.

“Alongside the raw production data, [capacity utilization] highlights how effectively the existing infrastructure capacities are employed in manufacturing, mining and utilities,” Sean continues.

“Alongside the raw production data, [capacity utilization] highlights how effectively the existing infrastructure capacities are employed in manufacturing, mining and utilities,” Sean continues.

“As such, a deeper understanding of ‘cap ute’ can offer a window into a nation's economic vigor and potential future trajectory. If cap ute numbers are too hot, that could indicate a recession.

“The market is looking for an unchanged number this month (79.7%)” — which jibes exactly with today’s number, in fact.

As for the headline industrial production number, Sean notes: “The market is looking for a slight 0.1% increase in industrial production for September.” The reading is better than anticipated: 0.3%.

Retail sales are also reported today: “Economists are looking for a flat number of around 0.2%,” Sean says. Instead, that number rose to 0.7% last month.

“Surprises to the upside,” he adds, and “Jay Powell may reconsider his rate-hiking position.”

At the time of writing, the three major U.S. stock indexes are taking a breather. The tech-heavy Nasdaq is down 0.35% to 13,500 while the Dow is just this side of green, a few points under 34,000. Somewhere in the middle, the S&P 500 is down 0.10% to 4,370.

At the time of writing, the three major U.S. stock indexes are taking a breather. The tech-heavy Nasdaq is down 0.35% to 13,500 while the Dow is just this side of green, a few points under 34,000. Somewhere in the middle, the S&P 500 is down 0.10% to 4,370.

As for the commodities complex, the price of crude is up 0.30% to $86.91 for a barrel of West Texas Intermediate. Turning to precious metals, gold is positive: up 0.20% to $1,923.80 per ounce, according to Kitco. Silver is rebounding too — up 1%, over $23.

But it’s a bifurcated crypto market: Bitcoin is up 0.20% to $28,500 while Ethereum is down almost 1% to $1,575.

![]() “The World’s Mandate Is to Become Greener”

“The World’s Mandate Is to Become Greener”

“You just cannot reindustrialize the world without basic materials, so one major theme [today] is mining critical minerals,” says Paradigm’s energy-and-mining expert Byron King… And one of those critical minerals for the “green transition” is copper.

“You just cannot reindustrialize the world without basic materials, so one major theme [today] is mining critical minerals,” says Paradigm’s energy-and-mining expert Byron King… And one of those critical minerals for the “green transition” is copper.

“Copper demand is growing,” Byron notes. “Certainly in the developing world, from Paraguay to Pakistan, when people get some new money they buy a microwave oven, refrigerator, air conditioner... which all rely on copper.

Copper concentrate fills a railcar in Peru

“In the developed world, the EV story is pretty misunderstood,” he says. “For example, my gasoline-powered Buick has about 50 pounds of copper in it. But if I trade my Buick in for a Tesla or other EV, I'm sitting on top of at least 250 pounds of copper.

“Now, multiply that by millions of cars over the next 10, 15, 20 years. Meanwhile, I also must rewire my garage to install an EV charging system, like another major appliance in many ways. Times millions, across the landscape.”

Meanwhile?

“The Earth is a big place filled with energy and mineral resources — but getting resources out of the ground is a long, complex, expensive process,” Byron said on stage two weeks ago at our Paradigm Shift Summit in Las Vegas.

“The Earth is a big place filled with energy and mineral resources — but getting resources out of the ground is a long, complex, expensive process,” Byron said on stage two weeks ago at our Paradigm Shift Summit in Las Vegas.

A reality the mainstream financial media is finally waking up to: “The world’s largest copper producers have warned that there is a lack of mines under development to deliver enough of the metal to keep pace with the clean energy transition,” says a Financial Times article.

Head of mining and metals at RBC Capital Markets Farid Dadashev explains: “When you add further complexity from longer permitting timelines, higher inflation and generally declining ore body grades, this perhaps explains why we’re finding ourselves in the situation where it’s likely there won’t be enough copper to meet decarbonization goals in the next few decades.”

Byron says: “I could go on, but you get the point: Copper demand is increasing.” Conversely, he adds: “Fossil fuels are here to stay.”

And automakers are surrendering to this reality too (however reluctantly).

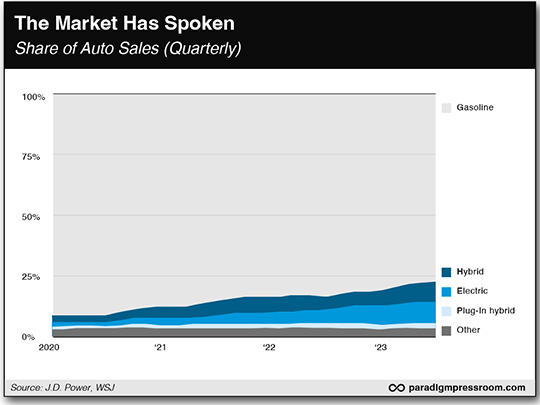

![]() EV Adoption Underwhelms

EV Adoption Underwhelms

“The [EV adoption] curve isn’t accelerating as quickly as I think a lot of people expected. We’re seeing it flatten a bit,” says Ford’s CFO John Lawler.

“The [EV adoption] curve isn’t accelerating as quickly as I think a lot of people expected. We’re seeing it flatten a bit,” says Ford’s CFO John Lawler.

According to The Wall Street Journal: “While EV sales continue to grow — rising 51% this year through September — the rate has slowed from a year earlier and unsold inventory is starting to pile up for some brands”... including for Tesla, despite the automaker slashing prices across the board.

In fact, for all the hoopla associated with the EV market, sales of EVs account for less than 10% of the global retail market.

For one thing, sticker shock is real: Although the average price of an EV has drifted down from $65,000 in 2022 to $50,683 in September, it’s still a bitter pill for consumers used to spending $40,000 or less on a new car.

“Some [automakers] are resetting ambitious forecasts,” WSJ says. “Ford pushed back a plan to produce 600,000 EVs annually to late 2024 instead of the end of this year… Hyundai Motor, which has been aggressive in adding new EVs to its lineup, is offering a free charger to attract buyers, along with a discount to install it, a promotion worth about $1,100.”

WSJ concludes: “The first wave of buyers willing to pay a premium for a battery-powered car has already made the purchase… and automakers are now dealing with a more hesitant group.”

![]() Cruel to Be Krugman

Cruel to Be Krugman

“Why does anybody listen to Krugman?” a longtime reader asks (rhetorically).

“Why does anybody listen to Krugman?” a longtime reader asks (rhetorically).

“He’s a classic ‘I'm not always wrong, but I'm never right’ guy. After all, like all good elitists, he has not pumped his own gas, been to the grocery store or, heaven forbid, mowed his own grass in years.”

Emily: Paul Krugman is infamous for his 1998 prediction: “By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.”

So to our reader’s point, hmm, we wonder if Mr. Krugman sends his own faxes?

“I teach in a parochial school, and I teach cursive handwriting as part of each day,” a new contributor writes on the decline of cursive. “Sometimes I have students (or parents) who ask why? There is a multitude of information out there, all addressing teaching cursive writing.

“I teach in a parochial school, and I teach cursive handwriting as part of each day,” a new contributor writes on the decline of cursive. “Sometimes I have students (or parents) who ask why? There is a multitude of information out there, all addressing teaching cursive writing.

“But…

“My favorite story comes from one of my former students. When he was in fifth grade, he and some friends helped with a local search party group. Afterward, they were given a handwritten ‘thank you’ note. He bragged to me that he was the only one of his group who could read the note.”

Emily: I might be a member of the last generation, Gen X, widely taught cursive handwriting — in public school, no less. However, I never mastered this style of penmanship. For me, it’s print only. (But I do write legibly, and I’m assiduous about writing ‘thank you’ notes. Another lost art, one could argue.)

That’s all for today, reader. Join us tomorrow for another round of 5 Bullets. Take care!

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets