Elon’s Warning Shot

![]() Elon’s Warning Shot

Elon’s Warning Shot

Sam Altman and OpenAI are scared… uh, well, I was about to use a crude term describing an empty colon, but this is a PG e-letter.

Sam Altman and OpenAI are scared… uh, well, I was about to use a crude term describing an empty colon, but this is a PG e-letter.

“OpenAI is asking the U.S. government to make it easier for AI companies to learn from copyrighted material, citing a need to ‘strengthen America’s lead’ globally in advancing the technology,” reports NBC News.

The company issued a 15-page plea to the Trump administration yesterday. The gist is that copyright law is making it inconvenient for OpenAI to continue sucking up the entire contents of the internet to train its large language models.

Thus, OpenAI says the U.S. government must clear various and sundry copyright barriers or else the People’s Republic of China will eat OpenAI’s lunch.

OK, OpenAI tries to put it in more altruistic and patriotic terms than I just did: “If the PRC’s developers have unfettered access to data and American companies are left without fair use access, the race for AI is effectively over.”

OK, OpenAI tries to put it in more altruistic and patriotic terms than I just did: “If the PRC’s developers have unfettered access to data and American companies are left without fair use access, the race for AI is effectively over.”

“Fair use” is the doctrine in U.S. law that allows journalists and writers to cite snippets of other people’s work without running afoul of copyright — for example, my brief excerpt of an NBC News web article above.

The doctrine would not apply if I were to copy and paste the entire article — even if I gave NBC proper attribution.

And yet OpenAI insists on unfettered access to the entire article with no attribution — and if it doesn’t get that access, it says China will strangle the American AI industry.

“Applying the fair use doctrine to AI,” says the OpenAI document, “is not only a matter of American competitiveness — it’s a matter of national security.”

Oh, so China will drain us of our precious bodily fluids, too!

OpenAI’s plea is absurd. “In order to compete with China, OpenAI needs to steal all our content,” tweets Jason Calacanis — the angel investor and co-host of the All In podcast.

“Give me a ****ing break. Just pay us a license. Your nonprofit is worth $350 billion and you’re making $10 billion a year!”

This latest development puts a new spin on the news about Elon Musk’s bid for OpenAI.

This latest development puts a new spin on the news about Elon Musk’s bid for OpenAI.

As you might recall, Musk led a consortium of investors last month in offering to buy the nonprofit that controls OpenAI for $97.4 billion.

OpenAI and Sam Altman turned down the offer instantly. As we said at the time, the offer made no sense — OpenAI is surely worth more than what Musk and crew were offering.

But Paradigm AI authority James Altucher says it wasn’t a serious offer as much as it was a “warning shot.”

Essentially, Musk gave OpenAI one friendly offer to cash out — before he disrupts the AI industry with the most powerful AI ever.

James calls this new venture “Elon’s Endgame” — because once it goes online, it will pose a huge threat to OpenAI as well as Microsoft and Google. “According to my sources,” James tells us, “this groundbreaking technology could finally go online on March 18.”

That’s next Tuesday. And in a fascinating twist to the story, James believes Elon’s Endgame could propel one small AI firm to a 50X return by next year. For sure, you’ll want to watch James’ new video before then — here’s the link.

![]() Gold $3K

Gold $3K

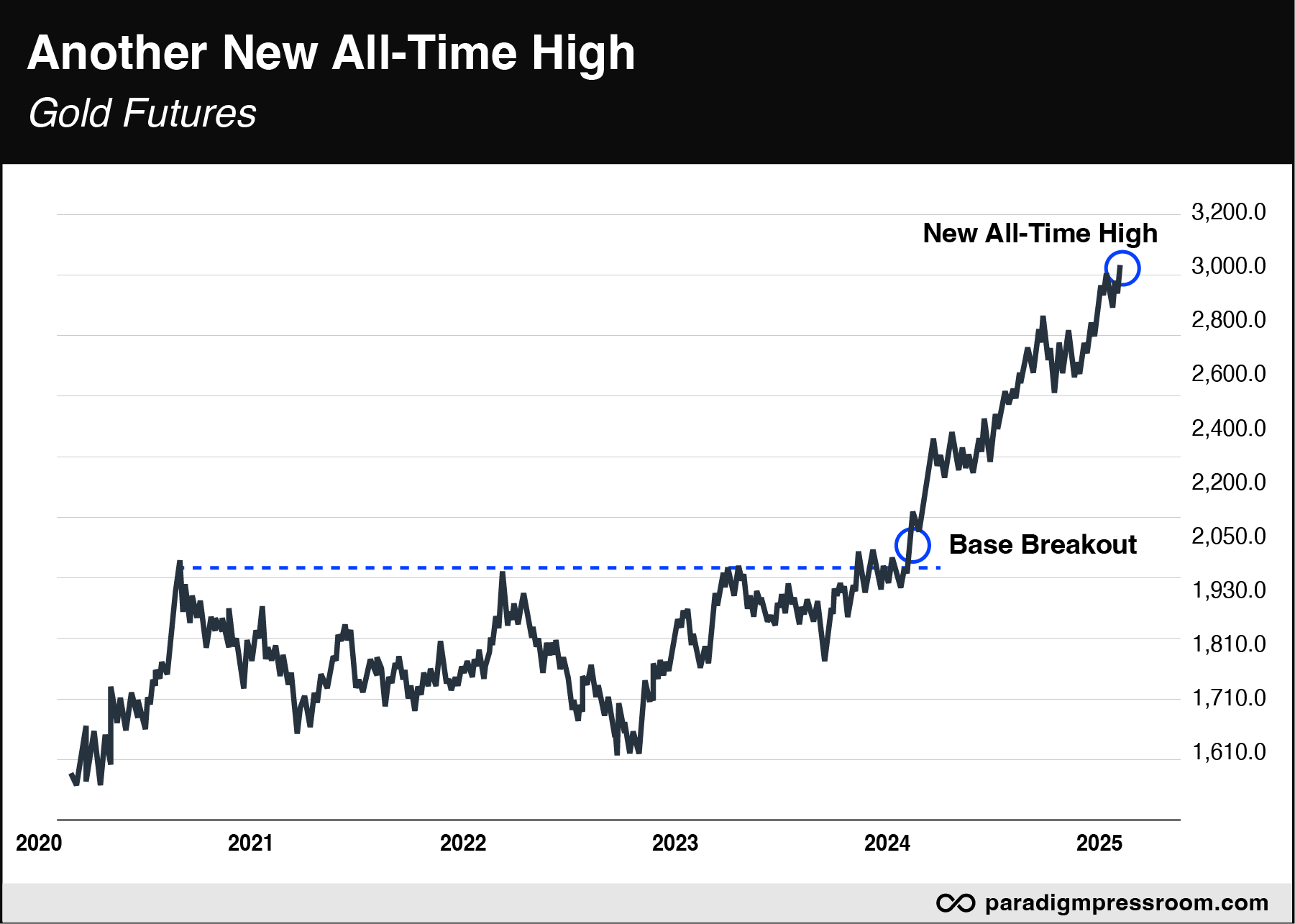

While the U.S. stock market has sunk 10% in three weeks… gold has surpassed $3,000 for the first time.

While the U.S. stock market has sunk 10% in three weeks… gold has surpassed $3,000 for the first time.

It didn’t last long — checking our screens the bid is back to $2,983 — but a milestone is a milestone.

Credit where it’s due: At the start of 2024, when gold was going for $2,064, Paradigm’s income-and-value maven Zach Scheidt stuck his neck out and forecast $3,000 gold — a nearly 50% increase — by year-end. Zach was off by less than three months. Not bad!

If you wish to explore the whys and wherefores of how gold rose so far so fast, our recovering investment banker Sean Ring unpacked it nicely in today’s Rude Awakening. Meanwhile, our chart hound Greg Guenthner puts the rise in dramatically visual form.

“Perhaps most investors will consider gold a missed opportunity now that it’s trading above $3K. I don’t,” says Greg.

“Perhaps most investors will consider gold a missed opportunity now that it’s trading above $3K. I don’t,” says Greg.

“History teaches us not to underestimate gold’s upside potential. The yellow rock climbed roughly 650% during the last commodity boom. A comparable rally this time around would see the shiny rock dancing to the tune of $8K.” His near-term target is $3,300.

Silver sits at $33.51 this morning — still about a buck below its 2024 high. “A break above last year's high will likely send silver screaming to $40,” says Greg.

The stock market is set to end this week the way it ended last week — up on the day, but down on a Monday–Friday basis.

The stock market is set to end this week the way it ended last week — up on the day, but down on a Monday–Friday basis.

All the major indexes are solidly in the green — the S&P 500 up 1.75% to 5,618 after sinking into 10% “correction” territory at yesterday’s close. The Dow’s gains are a little weaker, the Nasdaq’s a little stronger.

➢ For the record: There will be no “partial government shutdown” at midnight tonight; Senate Minority Leader Chuck Schumer figures Democrats lack the political capital to put up a fight at the moment.

The lone economic number of the day is a huge downside surprise: The University of Michigan consumer sentiment survey stunk up the joint with a reading of 57.9, in contrast with Wall Street expectations of 64.0. The number hasn’t been this low since late 2022.

The lone economic number of the day is a huge downside surprise: The University of Michigan consumer sentiment survey stunk up the joint with a reading of 57.9, in contrast with Wall Street expectations of 64.0. The number hasn’t been this low since late 2022.

Ordinarily we don’t mention this report because often it’s just a reflection of whether the stock market is up or down — and of course it’s been down lately. But a “miss” of this scale is worth noting.

We also give this survey the side-eye because frequently it’s a political Rorschach test — Republicans happy when Republicans are in charge and so on. But in this instance the keepers of the survey report that across the board, Republicans, Democrats and independents “are in agreement that the outlook has weakened since February.”

![]() The War on Cash, Border Edition

The War on Cash, Border Edition

Suddenly it’s a lot harder to transact with cash near the U.S. border with Mexico.

Suddenly it’s a lot harder to transact with cash near the U.S. border with Mexico.

As perhaps you’re aware, federal law has long required banks to report all cash transactions over $10,000, in an effort to crack down on drug dealing, “money laundering,” etc.

It’s a huge burden for many small businesses that rely on cash-paying customers — especially since small-business insurance policies typically limit coverage for theft or other loss of cash to $10,000.

Now comes word from the Treasury Department that in 30 ZIP codes along the U.S.-Mexico border, that $10,000 threshold has been lowered to… $200.

The new requirement “underscores our deep concern with the significant risk to the U.S. financial system of the cartels, drug traffickers and other criminal actors along the Southwest border,” says a statement from Treasury Secretary Scott Bessent.

Looking closely at the press release from FinCEN — the Treasury’s Financial Crimes Enforcement Network — it seems the order applies primarily to “money services businesses.”

According to the IRS, “An MSB is generally any person offering check cashing; foreign currency exchange services; or selling money orders, travelers' checks or pre-paid access (formerly stored value) products; for an amount greater than $1,000 per person, per day, in one or more transactions.”

Well, let’s hope it doesn’t apply to banks anytime a customer just wants to take out $200 from an ATM, right?

Prediction: This requirement is starting at the border… but it won’t stay there. Consider yourself warned.

![]() Treehouse of (Bureaucratic) Horrors

Treehouse of (Bureaucratic) Horrors

Because the city of Los Angeles has solved all its other problems…

Because the city of Los Angeles has solved all its other problems…

An elaborate treehouse that’s been part of the landscape in the Sherman Oaks neighborhood for 24 years is no more.

“‘The Simpsons’ producer Rick Polizzi built the treehouse, dubbed Boney Island, in his front yard as a playhouse for his daughters,” reports the Los Angeles Times. “He says it’s become a quirky local landmark loved by the neighborhood children and visited by celebrities such as Halle Berry, Christina Aguilera and Will Ferrell.”

You know where this is all going, right?

The trouble began in 2017 when a neighbor snitched to the city, upset with the way the treehouse was decorated for Halloween and drawing spectators. Yeah, once a year.

“For the last eight years, Polizzi has fought to keep the three-story structure standing, spending more than $50,000 on legal fees and zoning permits.”

And to no avail. Demolition began last Saturday.

“After all this treehouse stuff, I’m just totally burned out on the city, and politics,” Polizzi tells the New York Post. “I’m just getting tired of the rat race here. The rats are winning, so I want to get out.” He’s looking to sell and move back to his native New Orleans.

He hopes the victims of the LA wildfires looking to rebuild have better luck with the bureaucracy than he did: “If the fire victims have to go through one-tenth of what we dealt with, they’re going to be in a world of trouble, so I hope the city can get it together, because fire victims have been through enough.”

![]() Mailbag: DOGE and DST

Mailbag: DOGE and DST

“A one-month federal expenditure metric is hardly a valid scoring sheet for the effectiveness of DOGE,” a reader writes after yesterday’s edition. “Eventually it might be.

“A one-month federal expenditure metric is hardly a valid scoring sheet for the effectiveness of DOGE,” a reader writes after yesterday’s edition. “Eventually it might be.

“Most of what DOGE has really done so far is initiate some layoffs, which don't take effect for three–seven months and may include bonuses, or identify fraud, waste and abuse contracts. Many of the identified contracts have already been executed with payments and obligations that are difficult to stop overnight. The next or follow-on contract can certainly be killed off, but federal contracts are subject to many enforceable regulations including the FAR, or federal acquisition regulation.

“Assigning a ‘grade’ to DOGE's effectiveness yet is like blaming Trump for current inflation or grocery prices. We all know that economic changes including Fed actions take months or years to fully show themselves in the economy. Yes, there are some short-term indicators, but the final grade will be months in developing.

“There may well be some short-term pain for long-term gain. The problem for Trump is that if his policies do include a recession, or close to it, he better hope that the improvements are evident before the midterm elections in 2026.

“Still love the 5 Bullets!”

Dave responds: I didn’t assign a grade; I just said DOGE’s impact hasn’t shown up yet in the monthly Treasury statement. If and when that impact shows up, I’ll chronicle it here.

Now riddle me this: With Congress set to pass another “continuing resolution” instead of an honest-to-God budget… the U.S. Agency for International Development will get its full Biden-era appropriation even though the Trump administration is shutting down the joint. What will happen to that money?

“I’ve lived in Asia for the last 25 years where we don’t have that daylight saving time crap. People just get on with their lives,” writes our final correspondent.

“I’ve lived in Asia for the last 25 years where we don’t have that daylight saving time crap. People just get on with their lives,” writes our final correspondent.

“It’s as simple as: Summer has longer days, shorter nights. Winter longer nights, shorter days.

“None of this panicking about losing an hour in March, running late for work and the opposite in October.

“Keep up the wonderful work you do. I enjoy my dose of Dave Gonigam’s sense of humor and cynicism each day.”

Dave: I’m glad someone does.

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets