“Summer of Hell”

![]() “Summer of Hell”

“Summer of Hell”

As the day winds down, the markets face a pregnant pause — trading closes tomorrow for Juneteenth, reopening Friday. In between, U.S. forces might become fully engaged in a hot war.

As the day winds down, the markets face a pregnant pause — trading closes tomorrow for Juneteenth, reopening Friday. In between, U.S. forces might become fully engaged in a hot war.

We’re coming to you a bit later than usual in the afternoon because Paradigm contributor Mason Sexton just wrapped up the Summer 2025 edition of his presentation called The Prophecy.

A “summer of hell” he’s expecting for the markets. “There’s a chance stocks could drop 10–15% — “in a matter of days!” he says. And up to 30% additional downside after that.

It could all start as early as Friday.

If you want to see his rationale, we encourage you to click here and watch a replay of the event right away.

Here’s what’s sticking in your editor’s mind this afternoon — something that haunts me from when Mr. Sexton did his spring edition of The Prophecy in March.

Here’s what’s sticking in your editor’s mind this afternoon — something that haunts me from when Mr. Sexton did his spring edition of The Prophecy in March.

Then too he was expecting a steep downdraft in the market — which is exactly what happened in early April.

The catalyst turned out to be the president’s “Liberation Day” tariff announcement. But as Mason explained at the time, the market was primed for a fall and the catalyst could have been anything. One day I mused over the myriad possibilities. One of those possibilities was…

… Donald Trump unleashing the U.S. military on Iran.

I cited the independent journalist Ken Klippenstein: “President Trump’s menu of options for dealing with Tehran now includes one he didn’t have in his first term,” he wrote: “full-scale war…

“While a range of military options are often provided to presidents in a passive-aggressive attempt on the part of the Pentagon to steer them to the one favored by the brass, Trump already has shown his proclivity to select the most provocative option.”

Klippenstein said even nuclear weapons are on the table — according to “a retired senior military officer who has been briefed on the planning.”

Escalation to nukes would happen one of two ways: “One, with the CENTCOM commander ‘requesting’ the use of nuclear weapons, mostly to stave off Iranian conventional military success; and two, in a ‘top down’ order, that is, by the president, mostly as a ‘demonstration’ to ‘signal’ to Iran.”

And here we are, three months later.

Again, we’re entering a delicate window with the holiday tomorrow.

Again, we’re entering a delicate window with the holiday tomorrow.

More than once over the last couple of years, major U.S. military action in the Middle East has come while markets are closed. The pattern is too frequent to write off to chance. Last year, U.S. forces launched airstrikes against “Iran-linked” targets in Iraq and Syria literally the instant the market closed at 4:00 p.m. Eastern on a Friday.

Moments ago during The Prophecy, Mason said there’s still time to take protective measures in your portfolio — but not much. By the time the market reopens on Friday morning, it could be too late.

Of course, extraordinary claims require extraordinary evidence. We invite you to watch the replay of The Prophecy right away and decide for yourself.

![]() The Thing About “Unconditional Surrender”

The Thing About “Unconditional Surrender”

And so the markets are on tenterhooks awaiting the next big development — more likely from Washington than from the war zone itself.

And so the markets are on tenterhooks awaiting the next big development — more likely from Washington than from the war zone itself.

“Nobody knows what I’m going to do,” the president told reporters this morning.

Which is not exactly new — on this matter or any other — but the present moment is more serious than whether Lower Slobbovia will be subject to 10% tariffs or 20%.

In retrospect, it’s a fair question whether Donald Trump was goaded into threatening hot war because of all the TACO talk.

In retrospect, it’s a fair question whether Donald Trump was goaded into threatening hot war because of all the TACO talk.

In case you hadn’t heard, over the past few weeks there was increasing chatter on both Wall Street and social media about “TACO” — short for “Trump always chickens out.”

At first, it was applied to the on-again, off-again tariffs. But soon, leading Democrats picked up on it to needle the president about… negotiating with Iran.

Here’s the leader of the Democrats in the Senate, 16 days ago…

➢ Program note: Paradigm Publisher Matt Insley had the lowdown on this MAGA rift in this morning’s edition of The Rundown, and The Daily Reckoning’s Adam Sharp will also take on the topic later this afternoon.

As you’re likely aware, a series of increasingly manic social media posts by the president climaxed yesterday with a demand for “UNCONDITIONAL SURRENDER” from Tehran.

“Unconditional surrenders are so rare they are almost unheard of,” wrote Richard Maybury more than two decades ago

“Unconditional surrenders are so rare they are almost unheard of,” wrote Richard Maybury more than two decades ago

Maybury is one of the graybeards of the financial newsletter biz — and a veteran of Washington’s dirty wars in Central America during the 1960s. The following is gleaned from his 2002 book World War II: The Rest of the Story and How It Affects You Today.

“In an unconditional surrender, the losers are required to lay down their arms with no guarantees at all. They must simply put their fate in the hands of the winners, and the winners can do anything they please, including hang them.”

President Franklin Roosevelt demanded unconditional surrender of Germany on Jan. 24, 1943.

At the time, the Nazis were on their heels — only a week away from getting totally curb-stomped by the Soviets at Stalingrad.

But FDR’s demand steeled the Germans’ resolve.

“The effect of this brutal formula on the German nation, and above all on the army, was great,” German Gen. Heinz Guderian wrote in his 1951 memoir Panzer Leader. “The soldiers, at least, were convinced from now on our enemies had decided on the utter destruction of Germany.”

On the flip side, unconditional surrender devastated the enthusiasm of the German underground: One of its members, Gen. Franz Halder, lamented he could no longer attract new recruits. As he put it, even Hitler’s fiercest opponents understood that “the same frightful fate awaited us with or without Hitler… The only thing to do was hold out until the end.”

The war dragged on for two more years — with more than one million dead per month.

Something to think about at a time the War Party is once again invoking Nazi analogies to whip up public support for a regime-change op. (So far, it’s not working.)

![]() Standing Pat

Standing Pat

Amid a gathering World War III storm, a Federal Reserve meeting seems positively anticlimactic.

Amid a gathering World War III storm, a Federal Reserve meeting seems positively anticlimactic.

To no one’s surprise, the Fed opted to keep the benchmark fed funds rate at 4.5% — where it’s sat for the last six months.

The Fed’s statement characterized unemployment as “low” and inflation as “somewhat elevated” – which suggests Fed’s focus is still more on inflation than on the job market. That’s exactly what Paradigm’s Jim Rickards has been anticipating for weeks now.

As was the case in March, Fed officials still project they’ll cut the fed funds rate twice before year-end — just not yet. Not surprising if the Fed now projects 3% inflation for 2025.

The S&P 500 has been oscillating around the 6,000 level in the aftermath of the Fed decision this afternoon – little higher than yesterday’s close. The gains in the Dow and the Nasdaq are likewise modest.

The S&P 500 has been oscillating around the 6,000 level in the aftermath of the Fed decision this afternoon – little higher than yesterday’s close. The gains in the Dow and the Nasdaq are likewise modest.

Gold is little moved at $3,380. The bigger mover is silver, back below $37 in a much-needed consolidation.

Copper is steady at $4.79 a pound – nowhere near the March highs over $5.30 but attractive enough for copper thieves who pulled some internet fiber cables in Southern California. They knocked out service to big swaths of Los Angeles and Ventura counties last weekend.

Crude’s movement is muted by the standard of recent days – up 48 cents to $75.32. Still, that’s the highest since late February.

The crypto market appears unimpressed by the passage of landmark legislation in the Senate yesterday – perhaps because passage in the House might take a few more weeks. (We’ll have much more on the implications of this crypto legislation in the days ahead.) Bitcoin is back below $104,000 after making a run toward $109k only two days ago.

![]() Comic Relief

Comic Relief

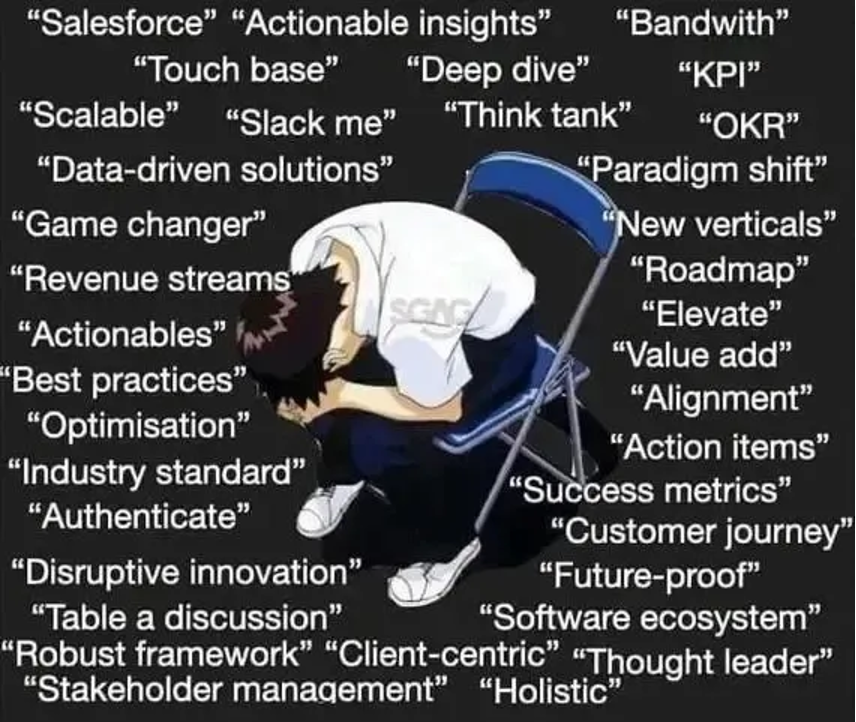

It’s a heavy issue of our 5 Bullets today. We need a respite — if only long enough to behold a meme lamenting dozens of obnoxious business buzzwords…

It’s a heavy issue of our 5 Bullets today. We need a respite — if only long enough to behold a meme lamenting dozens of obnoxious business buzzwords…

The great thing about working for Paradigm Press is that I almost never hear any of them! We’re too busy trying to make happy customers.

Speaking of which, we heard from two in the inbox this morning…

![]() Readers Old and New Sound Off

Readers Old and New Sound Off

“Having lived retired for two decades out of the U.S., 5 Mins. and 5 Bullets was my primary source for US and world economic news,” writes a longtime reader.

“Having lived retired for two decades out of the U.S., 5 Mins. and 5 Bullets was my primary source for US and world economic news,” writes a longtime reader.

“Now that I have returned to live in California for a few years, it continues to be my most reliable and enjoyable news source. As soon as possible I will be moving to Arizona, because of favorable facts that I have learned about taxes, politics, and grid reliability there from reading 5 Bullets. Having once lived in Santurce and worked in Hato Rey [Puerto Rico], I find that I also prefer warm weather and Latin friendliness.”

Addressing Emily after yesterday’s edition, he adds, “I much enjoy the softer style that shows in your articles, contrasting so well with the sharp insights from Dave. I intend to continue reading 5 Bullets for the rest of my days.”

“Hi Dave, thank you for supplying the link to the options information, which I read and understood,” writes a reader we heard from last week looking for beginner’s guidance on options trading.

“Hi Dave, thank you for supplying the link to the options information, which I read and understood,” writes a reader we heard from last week looking for beginner’s guidance on options trading.

(We have just the thing for that — The Ultimate Beginner’s Guide to Stock Options.)

“It was sooo much easier to follow than the article that Schwab insisted I read before applying for options access - my eyes glazed over! But hopefully they will approve me, so that I can get away from merely buying stock.

“Having said that I did want to give feedback that the shares I bought/sold/rebought actually made me a 93% profit. Nowhere near the percentage others were making on options, but hey, I was pleased with the result. I also put $5k into the five cryptos James mentioned, as a long-term investment.”

Dave responds: Great to hear all around!

Altucher’s True Alpha, the trading service to which this individual belongs, has been on a roll lately — registering options gains this month of 604%... 1,078%... and 919%. One of those gains materialized in just over a week.

Alas, this premium advisory is closed to new subscribers at this time. Watch this space for when it reopens…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets