Bigger Than Israel-Iran

![]() The Fate of Vladimir Putin

The Fate of Vladimir Putin

Putin will die soon. That’s a fact.

Putin will die soon. That’s a fact.

“That chilling statement” — circa late March — “came from Ukrainian President Volodymyr Zelenskyy,” writes Paradigm’s Mason Sexton. “But it didn’t sound like a simple threat… It sounded like a diagnosis.”

Having momentarily turned our attention away from events in the Middle East, we instead brace for the possibility of an unforeseen event — one that could deliver a momentous shock to the global system.

Back in January, Mason himself made a daring prediction: Vladimir Putin would not survive 2025. “We weren’t speaking metaphorically,” says Mason. “Our forecast pointed to a real, tangible inflection point in which Putin’s grip on power would be challenged from all sides — militarily, politically, economically… and physically.”

Right on cue, the cracks are showing. Russia’s economy is overheating, inflation is surging and the ruble is in free fall. On the battlefield, Soviet-era tanks are nearly depleted. Even Putin’s inner circle is growing restless, as the Kremlin turns its sights on once-loyal technocrats in a desperate bid to shift blame.

But the most telling sign of all may be Putin himself…

Once relegated to the tabloids, rumors of Putin’s failing health have now captured the world’s attention. And for a leader obsessed with control, every sign of weakness is a threat. “If his health truly is deteriorating, it creates a dangerous feedback loop… physical vulnerability begets political vulnerability,” Mason notes.

Once relegated to the tabloids, rumors of Putin’s failing health have now captured the world’s attention. And for a leader obsessed with control, every sign of weakness is a threat. “If his health truly is deteriorating, it creates a dangerous feedback loop… physical vulnerability begets political vulnerability,” Mason notes.

Rumors about Vladimir Putin’s health have circulated for years, but in recent months, observers have noted several instances where Putin appeared unsteady in public — gripping tables for support, walking with a noticeable limp and occasionally seeming uncomfortable during lengthy meetings.

Reports from outlets, including The Washington Post and Reuters, have cited Western intelligence and Kremlin insiders suggesting Putin may be facing serious health challenges. Allegations range from advanced-stage cancer to Parkinson’s disease, with sources claiming he is surrounded by a rotating team of doctors.

While the Kremlin has consistently denied these reports, the persistence and specificity of the rumors have deepened Russia’s divide, as once-loyal elites grow restless and public patience wears increasingly thin.

Putin’s hesitation to accept a ceasefire in Ukraine, even as his health is questioned and his inner circle shows signs of dissent, reveals the precariousness of his position. In Russia’s history, leaders who lose their aura of invincibility rarely recover it.

And Mason cautions, the result is often upheaval and collapse. He notes, in fact, an uncanny 36-year pattern in Russian history — the end of the czars in 1917, the end of the Stalin era in 1953, the fall of the Berlin Wall in 1989 (presaging the end of the Soviet Union) and now, here we are, 36 years later.

The pattern is clear: economic turmoil, political fragmentation and, inevitably, regime change.

Whatever your take on the future of Russia… or the fate of Vladimir Putin… Mason believes we are living through events that will reshape the global order — and markets — for a generation.

What does the end of the Putin era mean for investors, for markets, for the world?

In over 40 years as a market strategist, accurately calling major turning points over and over, Mason has been keenly attuned to recurring patterns in markets and in global affairs.

And he believes we’re on the brink of another turning point within the next few days. That’s why he’s hosting a new edition of his acclaimed briefing, The Prophecy, on Wednesday at 1:27 p.m. EDT.

This time, he’s delivering what publisher Matt Insley calls a “terrifyingly specific prediction.”

Don’t dismiss it as hyperbole. Mason’s track record speaks for itself. If you want to understand what’s coming — and how to prepare — you need to be in the virtual room.

Sign up now to reserve your spot. We’ll send you everything you need to join Mason live and discover what the future holds. Don’t miss it.

![]() Central Banks, Gold and De-dollarization

Central Banks, Gold and De-dollarization

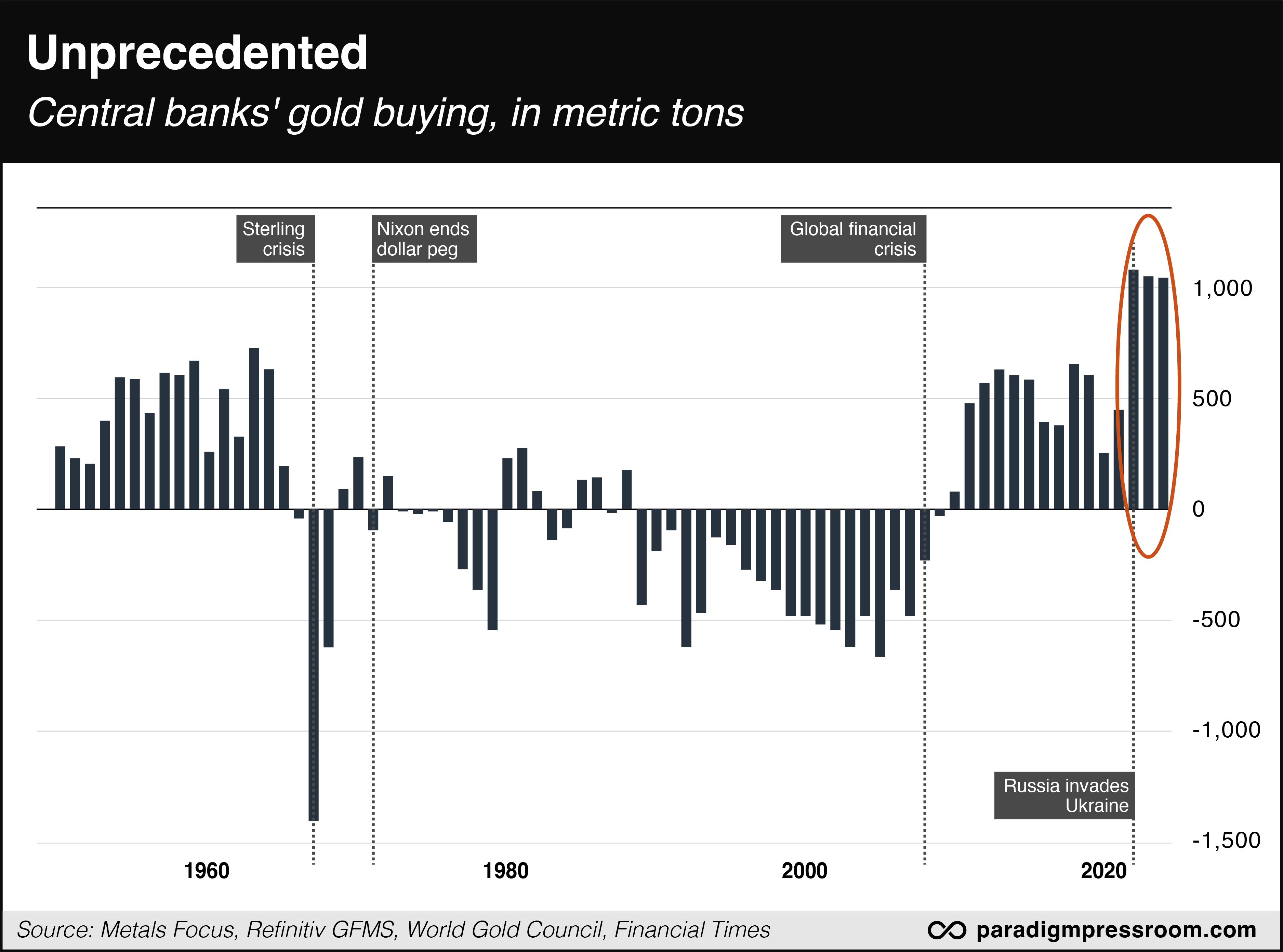

Central banks around the world are piling into gold at record rates, driven by mounting geopolitical tensions, fears over the reliability of the U.S. dollar and a desire to safeguard their reserves from sanctions or political interference.

Central banks around the world are piling into gold at record rates, driven by mounting geopolitical tensions, fears over the reliability of the U.S. dollar and a desire to safeguard their reserves from sanctions or political interference.

According to the World Gold Council’s latest survey — answered by more than 70 central banks — a record 95% of respondents expect global central bank gold holdings to increase over the next 12 months, the highest proportion since the survey began in 2018.

At the same time, three-quarters of those surveyed anticipate a decline in their USD holdings over the next five years.

As we reported last week, this trend has propelled gold to become the world’s second-largest reserve asset, overtaking the euro and sitting just behind the U.S. dollar. Gold prices, meanwhile, have surged around 30% since January and doubled over the past two years, reflecting both heightened global uncertainty and robust demand from central banks and investors.

“The sentiment is very strong. Certainly there’s more confidence among central banks that the entire universe of central banks is going to buy,” says Shaokai Fan of the World Gold Council.

“The sentiment is very strong. Certainly there’s more confidence among central banks that the entire universe of central banks is going to buy,” says Shaokai Fan of the World Gold Council.

Geopolitical concerns are not only influencing buying patterns but also storage strategies. Some central banks, worried about access to their gold during crises or sanctions, are opting to store more bullion domestically rather than in the traditional repositories of London and New York.

About 7% of survey respondents said they planned to increase domestic storage, the highest level since the COVID-19 pandemic. Recent examples include India repatriating over 100 tonnes of gold from the Bank of England and Nigeria also bringing some of its holdings home.

The rationale for holding gold is clear: Central banks cite its performance during “times of crisis,” its lack of default risk and its role as an inflation hedge as the top reasons for their bullish stance.

As one anonymous survey respondent notes: “Recent market developments around tariffs have raised questions on the safe-haven status of U.S. dollars but have bolstered that of gold,” underscoring the metal’s enduring and multifaceted appeal.

U.S. retail salesposted their largest drop in four months, falling by 0.9% in May compared to April, according to data released by the Commerce Department.

U.S. retail salesposted their largest drop in four months, falling by 0.9% in May compared to April, according to data released by the Commerce Department.

The decline was sharper than economists expected and was led by a significant drop in automobile purchases, as consumers pulled back after a spring rush to beat anticipated tariff-related price increases. While some sectors, including online retail and furniture stores, saw modest gains, overall spending was dampened by falling gasoline prices and cautious consumer sentiment.

- U.S. industrial production unexpectedly slipped in May, declining by 0.2% compared to April, according to Federal Reserve data. This contraction marks the second drop in three months and reflects weaker utility output and only marginal gains in manufacturing, which managed a slight 0.1% increase for the month. Capacity utilization, a key measure of industrial efficiency, also edged lower to 77.4% from 77.7% in April.

Taking a look at my screen, it’s silver that’s really shining today: up 2.30% to $37.28. Gold, on the other hand, is down 0.55% to $3,397.70.

As for stocks, they’re all flailing in the red. The S&P 500 and tech-heavy Nasdaq are both down about 0.25% to 6,015 and 19,650 respectively. The DJIA is down just 0.10% to 42,470.

The crypto market? Is getting taken to the cleaners. At the time of writing, flagship crypto Bitcoin is down 4.10% to $104,200 while Ethereum’s down, oof, 6.30% to $2,485.

![]() James Altucher: Cybersecurity’s Moment

James Altucher: Cybersecurity’s Moment

“There is an opportunity too big to ignore. And it might be only weeks away,” says Paradigm’s iconoclast investor James Altucher.

“There is an opportunity too big to ignore. And it might be only weeks away,” says Paradigm’s iconoclast investor James Altucher.

James isn’t one to shy away from bold predictions — or candid admissions. “In 2008,” he confesses, “I published a book called The Forever Portfolio. It was horrible. Not because the content was bad, but because nobody was interested in buying it.

“When my publisher saw the numbers, he wanted to throw me out of the window. If he had read the book and waited a few years, he might have felt differently.”

James continues: “The book describes a group of stocks you can buy and hold forever. It predicted the success of companies like Eli Lilly (which has since returned 24x), Mastercard (which has since returned 39x) and Taser (which has since returned 197x).

“Chapter 3 actually predicted a global pandemic… 12 years before COVID-19,” he adds.

“Which brings me to Chapter 2 of the Forever Portfolio: cybersecurity. As I said in the book, it's only a matter of time before we see a large internet attack,” says James. “When that time comes, cybersecurity companies are going to skyrocket by 2x, 5x, even 10x.”

“Which brings me to Chapter 2 of the Forever Portfolio: cybersecurity. As I said in the book, it's only a matter of time before we see a large internet attack,” says James. “When that time comes, cybersecurity companies are going to skyrocket by 2x, 5x, even 10x.”

Recent skirmishes between Israel and Iran have put the spotlight back on cyberthreats. “Overnight, Israel launched an attack on Iranian military officials and nuclear facilities,” James says. “In response, Iran launched a drone attack on Israel which was largely unsuccessful.”

But he warns: “This raises the possibility of an escalation to a full-out war with the potential for cyberattacks.” To wit, James points out this critical tool in Israel’s defense strategy:

- In 2010, Israel is believed to have used a virus to target and remotely destroy Iran’s nuclear arsenal — the Stuxnet worm, which caused significant setbacks for Iran’s nuclear program

- Israel is also believed to have used a virus to cause a small explosion at the Natanz nuclear facility in Iran in 2021

- Then, of course, there was the operation in 2024 when Israel remotely detonated bombs inside Hezbollah’s pagers ahead of a ground invasion into Lebanon.

For investors, James notes: “Highly visible cyberattacks are the best possible advertising that cybersecurity companies can ask for.” With the world watching, James believes investors who act now could be poised for significant gains.

“I would not be surprised if we see a similar trend play out in the coming days or weeks,” he concludes, “should the conflict between Israel and Iran continue to escalate.”

![]() Idaho’s Role in America’s Mineral Future

Idaho’s Role in America’s Mineral Future

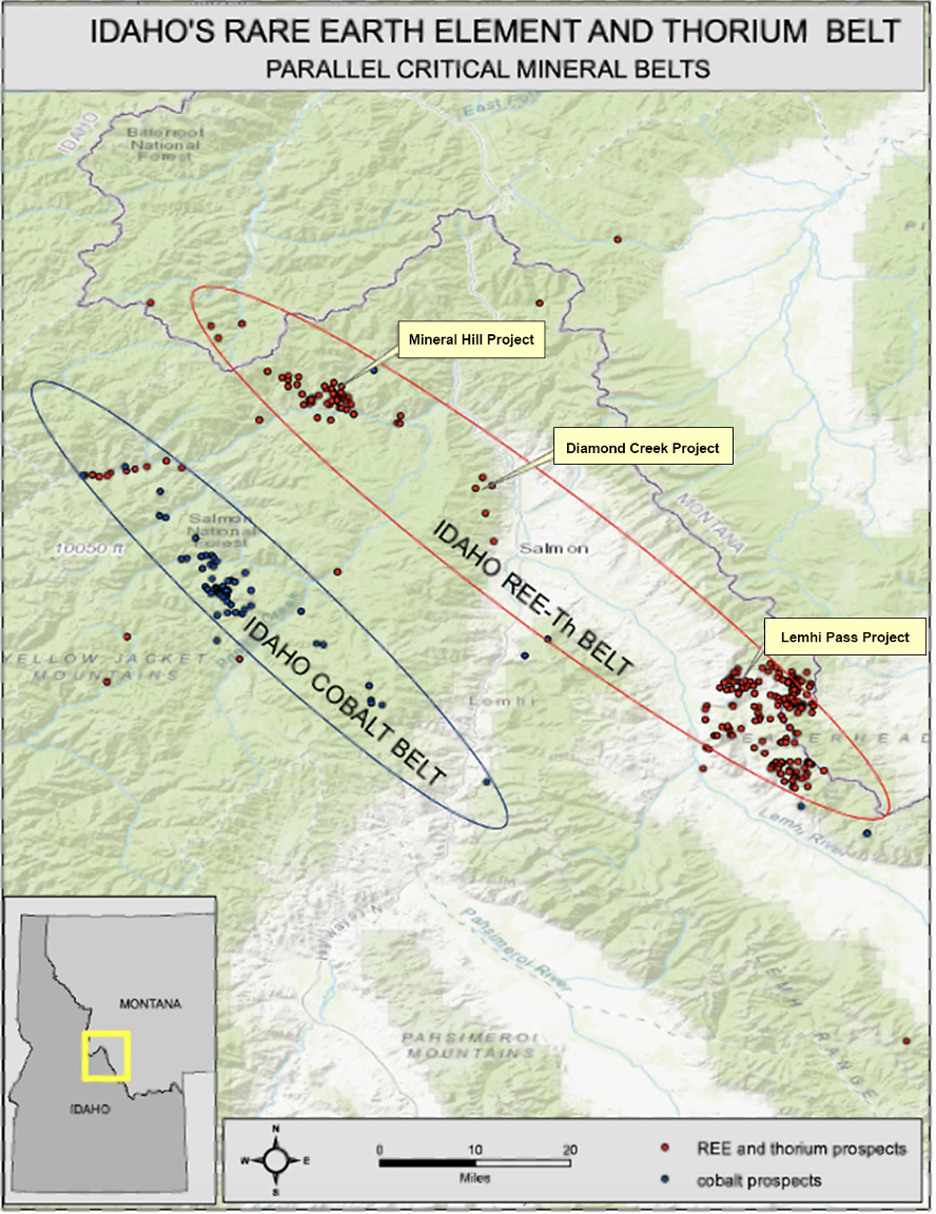

Recent legal and political changes have put Idaho at the forefront of efforts to unlock America’s mineral resources.

Recent legal and political changes have put Idaho at the forefront of efforts to unlock America’s mineral resources.

The Supreme Court’s 2024 reversal of the Chevron Doctrine has reduced federal regulatory barriers, making it easier for companies to pursue mining projects on federally controlled lands. This shift is especially significant for Idaho, home to some of the country’s most promising rare earth element (REE) deposits.

Idaho Strategic Resources (IDR) is leading rare earth exploration in the state. In 2025, the company launched its largest exploration season to date, focusing on three major projects within Idaho’s 70-mile REE-Thorium Belt: Lemhi Pass, Mineral Hill and Diamond Creek.

Source: Idaho Strategic Resources

These sites are included in the U.S. National REE Inventory, underscoring their strategic importance:

- Lemhi Pass: Planned radiometric surveys and soil sampling will help identify new drill targets. Previous work at Lemhi Pass has found high concentrations of valuable magnet rare earths, with some samples exceeding 5% total rare earth oxides and over 70% magnet REEs.

- Mineral Hill: Drone-assisted mapping and surface sampling have revealed areas with up to 34% total rare earth oxides, prompting further exploration.

- Diamond Creek: Follow-up trenching and potential drilling are planned to expand on earlier findings.

In addition, President Trump’s executive order to accelerate domestic mineral production has provided additional momentum for these projects by streamlining permitting processes. Idaho Strategic’s approach — targeting high-value magnet REEs and leveraging faster regulatory approvals — demonstrates how private companies can respond quickly to changing policy landscapes.

As Idaho’s mining sector grows, it’s positioned to play a key role in strengthening domestic supply chains and reducing America’s reliance on foreign resources.

![]() Nanny State Bans Chocolate-Fueled Fun

Nanny State Bans Chocolate-Fueled Fun

A Twix commercial was banned in the U.K. for allegedly encouraging “unsafe driving” practices.

A Twix commercial was banned in the U.K. for allegedly encouraging “unsafe driving” practices.

“The advert shows a man with flowing hair involved in a car chase and crash that results in his and an identical, caramel-colored car sandwiched on top of each other,” BBC describes, “like a Twix.”

Source: Twix, YouTube

Viewer discretion advised? Watch the banned commercial for yourself…

After five U.K. viewers (presumably “Karens” with too much time on their hands) complained that the ad was irresponsible, Mars Wrigley, Twix’s parent company, defended the spot as “absurd, fantastical and removed from reality.” Even Clearcast, the U.K.’s ad approval body, agreed it was all in good fun.

But the Advertising Standards Authority (ASA) wasn’t having it. Despite the ad’s physics-defying finale, the “emphasis on speed,” “skid marks” and “fast-paced music” in the car chase were just too much titillation for British viewers.

(Plus? The late model American-made muscle car used in production is, gasp, a gas guzzler!)

The verdict: the ad “must not appear again” in its current form on U.K. telly. Lest someone tries to recreate a Twix sandwich… with actual cars… on British roadways.

Given that it’s your editor’s favorite, enjoy a Twix today — responsibly, of course. Or not, it’s your call. Either way, enjoy the absurdity of it all! Take care…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets