The Most Important Chart You’ll See All Year

![]() The Most Important Chart You’ll See All Year

The Most Important Chart You’ll See All Year

“It's faster than the internet, it's faster than the iPhone,” says the White House’s AI-and-crypto czar David Sacks.

“It's faster than the internet, it's faster than the iPhone,” says the White House’s AI-and-crypto czar David Sacks.

“It” is the adoption rate of AI. “The adoption is faster than any previous technology.” And even so, “roughly half the public hasn’t tried it yet.”

Sacks is nobody’s fool. A generation ago he was part of the “PayPal mafia” along with more famous figures like Peter Thiel and Elon Musk.

Now he’s in the forefront of addressing a matter so important that shortly after taking office last winter, the president declared a national emergency.

The emergency is the stress that AI is putting on the power grid.

The emergency is the stress that AI is putting on the power grid.

Three years ago in these digital pages, we were already sounding the alarm about the grid’s fragility.

The regional grid operator serving the Upper Midwest and Mississippi valley warned that in the event of extra-hot summer weather, it might have to resort to rolling blackouts. On a personal level, your editor took the warning seriously enough to get a generator.

And that was before ChatGPT 3.5 burst on the scene in late 2022.

“Running all of these computational resources that modern AI needs requires an awful lot of electricity,” says Gregory Allen with the Center for Strategic and International Studies.

The biggest AI algorithms will require at least one gigawatt of electricity to function. "One gigawatt,” Allen tells Fox News, “is about one Hoover Dam's worth of electricity.”

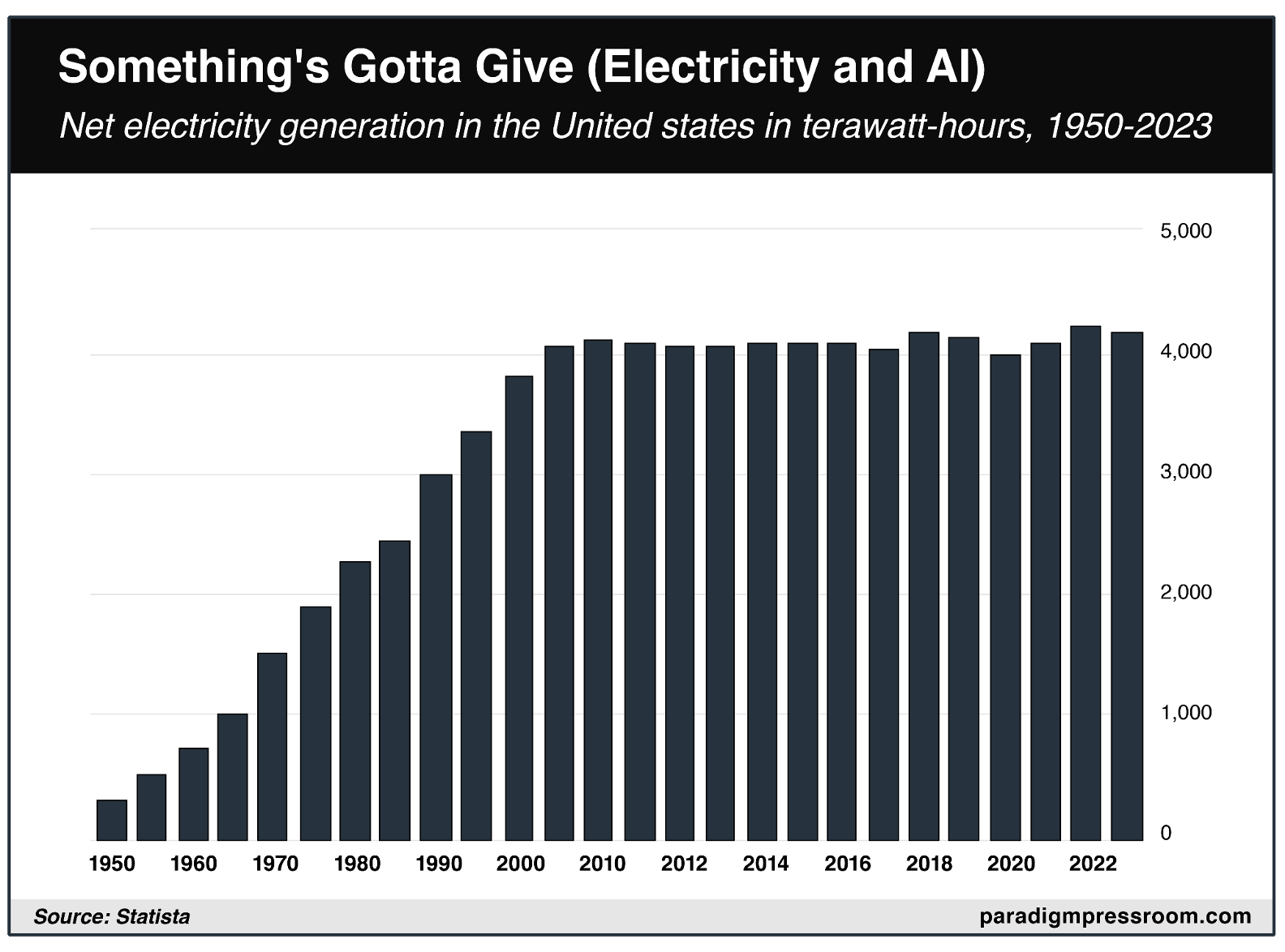

By early 2024 it was apparent to everyone at Paradigm: The AI adoption curve was so steep that it would inevitably collide with the reality on this chart. We first showed it a year ago. Give it a good look, even if you’ve seen it before. We can’t show it often enough.

Notice the steady growth in the power grid’s capacity during the latter half of the 20th century. And then see how that capacity has essentially flatlined since 2010. Coal-fired and nuclear power plants were being shuttered faster than solar and wind capacity was coming online to replace them.

Meanwhile, as Emily mentioned in Tuesday’s edition, data centers sucked up 4.4% of all electricity consumption in 2023. With AI’s stupendous growth, that share is projected to swell to 12% by 2028.

Something’s gotta give — and hopefully it’s not the first-world lifestyle to which we’ve become accustomed.

Something’s gotta give — and hopefully it’s not the first-world lifestyle to which we’ve become accustomed.

In 2023 we chronicled how 15 years of mismanagement have wrecked the grid in South Africa — leading to rolling blackouts lasting as long as 15 hours a day.

That reality is coming to a country near you without urgent action to expand the grid’s capacity.

Which brings us back to the national emergency declared by Donald Trump last winter.

"The executive orders are now cutting through a lot of the red tape, and effectively we're not required to do things that we were required to in the past," says Joe Dominguez, CEO of Constellation Energy.

"The executive orders are now cutting through a lot of the red tape, and effectively we're not required to do things that we were required to in the past," says Joe Dominguez, CEO of Constellation Energy.

Example: Operators like Constellation no longer need to obtain an early site permit when looking to expand an existing nuclear power plant.

"It makes sense if you've never built a nuclear reactor in that place before,” Dominguez tells Fox. “But in our case, we have existing reactors that have operated in these communities for decades.

"Currently the NRC [Nuclear Regulatory Commission] regulations require us to go through a laborious exercise that costs about $35 million a pop to verify what we already know and that is that nuclear could go there.

“As a result of the president's executive orders, that's no longer going to be required."

Another big step in the right direction is coming next Tuesday — five days from now.

Another big step in the right direction is coming next Tuesday — five days from now.

Paradigm’s Jim Rickards says everything is lining up for “an explosive opportunity” involving a company that’s right in Jim’s “American Birthright” wheelhouse.

“Last July,” says Jim, “this same event sent shares of this company booming — with one trade eventually showing a peak gain of 1,161% in a span of three months.”

Jim says there’s every reason to believe the same setup will take place next Tuesday.

We’ve spent a year and half at Paradigm sounding the alarm about AI and electricity. And we’ve spent months scoping out the ideal opportunity to trade off this ongoing theme — and now it’s arrived. Click here to check out Jim’s urgent briefing right away.

![]() An Overheated Market

An Overheated Market

“Quite simply, the market is overheated and seems due for a pullback,” says Paradigm trading pro Enrique Abeyta.

“Quite simply, the market is overheated and seems due for a pullback,” says Paradigm trading pro Enrique Abeyta.

In light of that assessment, Enrique laid out a plan yesterday for readers of The Maverick — and while we’re withholding his recommendation out of respect for his paying subscribers, we can share his outlook for the next 30–60 days.

He sees three reasons to be cautious…

“First,” he says, “the market recovery out of April's tariff-related sell-off was nothing short of historic. Very few times in history have we witnessed a V-shaped recovery of this magnitude.

“Second, sentiment has been extremely positive for an extended period. Everything, other than bonds, has been going up at the same time.

“Stocks, precious metals, Bitcoin and even major indexes like the S&P 500 have all been going straight up and setting all-time highs. Market history teaches us that this can't continue forever, at least not without a significant pullback or two.”

The third reason is the calendar. “We’re headed into a period of the year known for seasonal volatility,” says Enrique.

The third reason is the calendar. “We’re headed into a period of the year known for seasonal volatility,” says Enrique.

“August through September is often a bumpy time for the stock market. These months have a long history of being more volatile, with September ranking as the worst-performing month.”

That’s the case going back the last 50 years and even the last 100.

“This happens partly because many big investors take vacations in August, leading to fewer trades and bigger price swings. Then in September, trading picks up again as funds rebalance their portfolios and prepare for the year's final quarter.

“Add economic updates and surprise news events,” Enrique says — “and you get a mix that can shake up the market.”

But not today here in mid-July. The S&P 500 is on track for a record close.

But not today here in mid-July. The S&P 500 is on track for a record close.

The index is up a half-percent on the day and only six points away from the 6,300 mark. The Nasdaq is likewise in record territory and five points away from 20,900. The Dow is the laggard, beneath both its highs from earlier this month as well as its February record.

The big economic number of the day is retail sales — up 0.6% in June. That’s way more than expected, but not enough to offset May’s decline. For once the number is not skewed by auto and gasoline sales: Strip those out and you still get a 0.6% jump.

Bitcoin is hanging tough at $119,354. Crude is up nearly a buck to $67.27

As for the precious metals complex, gold is pulling back a bit to $3,335 but silver has once again crested the $38 level. More about gold next…

![]() Gold: Taking a Needed Breather

Gold: Taking a Needed Breather

“Gold is behaving exactly like an asset that just ran a marathon,” says Paradigm’s recovering investment banker Sean Ring.

“Gold is behaving exactly like an asset that just ran a marathon,” says Paradigm’s recovering investment banker Sean Ring.

“After climbing over 28% year-to-date and approaching $3,500 in April, the yellow metal has been trading within a tight $3,250–3,450 range for the past few months.

“This is a bullish consolidation, not bearish exhaustion.”

There’s any number of factors holding gold back right now, says Sean: “Although the dollar has declined significantly year-to-date, it has rallied since July 1. Yields remain stubbornly high. And while geopolitical tensions simmer, they haven’t boiled over.

“The result? Gold rallies on fear and then gives it back when markets calm down.”

In today’s Rude Awakening, Sean lays out six things that could spark the next rally in gold — and bring along the rest of the precious metals complex for the ride. Worth a look…

This much is for certain: “The rising price for gold and silver over the past two years is not due to retail coin buyers in America,” says Paradigm mining-and-energy authority Byron King.

This much is for certain: “The rising price for gold and silver over the past two years is not due to retail coin buyers in America,” says Paradigm mining-and-energy authority Byron King.

Byron spent last week in Boca Raton, Florida at the annual Rule Investment Conference — helmed by resource investing legend Rick Rule. Byron talked with plenty of mining execs, for sure, but he also spent time with several veteran precious metals dealers.

His takeaway? “They said that more and more Americans are selling coins and other precious metals just to raise cash and pay bills.

“In this sense, metal flows through U.S. dealers offer powerful evidence of growing financial problems across the nation’s middle and upper middle classes, even among households that were buying gold and silver just a few years ago.”

Said one dealer to Byron: “Inflation has robbed perhaps 30% and more of household purchasing power in the past five years. Even people and households that you think would be well-off are struggling. When people sell coins we ask why, and they tell us.”

(Which sort of lines up with our item a week ago today about New Yorkers selling their gold jewelry at this time to precious metals dealers in the Diamond District.)

And who’s buying? “Typically, we buy small lots from sellers who need the cash,” explained one dealer to Byron. “And then I’ll contact a long-time client who might come in and buy 300 or 400 ounces at a time.”

“In other words,” Byron concludes, “retail-level gold is moving into the hands of large accumulators.”

Gold is moving from the proverbial weak hands to stronger hands. Take heed…

![]() Good Reminder

Good Reminder

In light of the Senate voting for a piddly $9 billion in budget cuts — in other words, DOGE has been good for a mere 13 cents out of every $100 in federal spending — here’s a timeless reminder…

In light of the Senate voting for a piddly $9 billion in budget cuts — in other words, DOGE has been good for a mere 13 cents out of every $100 in federal spending — here’s a timeless reminder…

![]() Mailbag: AI and Electricity

Mailbag: AI and Electricity

Yesterday’s edition touching on this week’s developments in AI and electricity prompted a couple of reader responses.

Yesterday’s edition touching on this week’s developments in AI and electricity prompted a couple of reader responses.

One chose to paraphrase President Dwight Eisenhower’s “Cross of Iron” speech from 1953.

“With a fixed grid capacity, every AI data center that is built or proposed, every gigawatt they consume, signifies in the final sense a power theft from those citizens who are subjected to rolling blackouts, subsisting without heat or air conditioning in times of extreme weather.

“Is AI really as crucial to the average American as keeping their refrigerators running?”

Another reader peers into the future: “The big push to upgrade the grid will happen, although it will take years and is a good idea, period.

Another reader peers into the future: “The big push to upgrade the grid will happen, although it will take years and is a good idea, period.

“The bigger push for legacy data centers will be squashed by quantum computing, which runs on 1,000 watts that is not legacy based, and can do the same work in 15 minutes that takes legacy an entire week to do.

“Why aren't all the geniuses recognizing that this is a big problem for AI right now?

“Legacy-based data centers will lose this battle, and it will happen very quickly. That will turn data centers into vacant warehouses, not to mention the destruction of huge swaths of farming and forested lands. What an atrocity!”

Dave: Hmmm… There’s still an awful lot to figure out to make quantum computing feasible for mass data center deployment. Cooling them, isolating them from electromagnetic interference and so on.

Presumably the long-term planners at Microsoft, Google, Meta and Amazon have taken these factors into consideration and have decided to steam ahead with their aggressive buildout anyway because quantum computing still isn’t ready for prime time.

But if you’re convinced they’re wrong? Might want to consider some long-dated put options on Big Tech!