Power Struggle in PA

![]() Tight Supplies, Surging Prices

Tight Supplies, Surging Prices

We begin the week with a sense of foreboding…

We begin the week with a sense of foreboding…

This much we know: Even before his “Epstein crashout” on Saturday, the president was promising he’d have “a major statement to make on Russia” today.

In the meantime, while we await whatever that might be, we turn our attention back to an ongoing theme in these virtual pages for the last 18 months. At long last the mainstream is catching on…

“America's largest power grid is under strain as data centers and AI chatbots consume power faster than new plants can be built,” says the Reuters newswire.

“America's largest power grid is under strain as data centers and AI chatbots consume power faster than new plants can be built,” says the Reuters newswire.

Summertime electric bills are set to surge 20% or more in at least part of the area served by PJM.

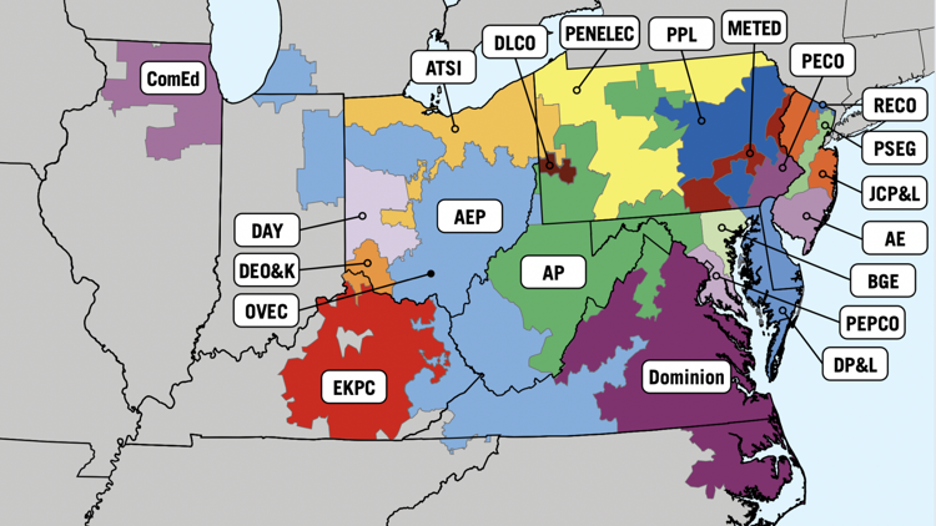

PJM is the biggest “interconnection” or regional grid operator in the country — serving 67 million customers from New Jersey west to Illinois. Here’s a map from PJM showing all the power companies that rely on it…

More than any other interconnection, PJM is feeling the squeeze from the explosion in use of AI engines like ChatGPT. PJM’s service area includes much of Virginia — including Loudoun County, home to what’s now known as “Data Center Alley.”

Nearly a year ago we told you about PJM’s annual power market auction — an event aimed at averting blackouts by setting a rate at which power suppliers agree to generate the juice on the hottest and coldest days, when the grid is most under stress.

The result of that auction was that as of six weeks ago — June 1, 2025 — prices for power plants leaped to $269.92 per megawatt day.

Compared with 2024 levels, that’s an 800% increase.

As we said a year ago, an 800% increase in auction rates does not translate to 800% higher electric bills; state regulators impose caps on rate increases. But 20% will definitely take a bite out of many household budgets.

As you might expect, there’s a lot of finger-pointing.

As you might expect, there’s a lot of finger-pointing.

Back to the Reuters article…

PJM has made the situation worse by delaying auctions and pausing the application process for new plants, according to more than a dozen power developers, regulators, energy attorneys and other experts interviewed by Reuters.

“We need speed from PJM, we need transparency from PJM and we need to keep consumer costs down with PJM,” Pennsylvania Gov. Josh Shapiro told Reuters in an interview.

For its part, PJM says much of the problem lies outside its control: State regulators shut down power plants fueled by coal and natural gas, the better to fight “climate change” — at the very moment that power-hungry data centers have been growing like weeds.

“Prices will remain high as long as demand growth is outstripping supply,” says PJM spokesman Jeffrey Shields. More from the article…

PJM has lost more than 5.6 net gigawatts in the last decade as power plants shut faster than new ones enter service, according to a PJM presentation filed with regulators this year. PJM added about 5 gigawatts of power-generating capacity in 2024, fewer than smaller grids in California and Texas.

Meanwhile, data center demand is surging. By 2030, PJM expects 32 gigawatts of increased demand on its system, with all but two of those gigawatts coming from data centers.

Key point: PJM’s next auction is Wednesday. Auction rates could leap again — worsening the rate spiral for consumers next year.

Key point: PJM’s next auction is Wednesday. Auction rates could leap again — worsening the rate spiral for consumers next year.

And the risk of blackouts remains — a risk that’s on the radar of the White House. In May the Trump administration ordered two fossil-fuel power plants in Pennsylvania to remain open past their scheduled retirement date.

We’ll follow up as the week progresses. In the meantime, on to other matters…

![]() Tariff Roundup: Russia, Gold

Tariff Roundup: Russia, Gold

As the day wears on, it seems the big Russia announcement is a variant on the Senate bill we mentioned in Friday’s edition.

As the day wears on, it seems the big Russia announcement is a variant on the Senate bill we mentioned in Friday’s edition.

The president says if there’s no Russia-Ukraine cease-fire in 50 days, he’ll apply “secondary tariffs” of 100% to Russia.

Presumably, that means the 100% tariff would be applied against countries that do business with Russia — which is a lot of countries.

China, yes — but as we mentioned on Friday both the European Union and Japan still buy liquefied natural gas from Russia.

For that matter, the United States still buys uranium from Russia — which once more raises the strange prospect of whether America will tariff itself.

Anyway, it seems the takeaway here is that we’re looking at 100% tariffs and not the 500% proposed in a bipartisan Senate bill. Last week, the president said he was giving the bill serious consideration.

Will the legislation be rewritten? Congress goes on its summer break in less than two weeks. And 50 days from now is the day after Labor Day.

With that, you know what we know.

By the way, on Saturday the president said the tariffs against the European Union and Mexico — who together supply a third of U.S. imports — will be 30%. Presumably that’s effective Aug. 1. Then again, stay tuned.

If you’re still accumulating your precious metals stash, you should know there isn’t any clarity about tariffs there, either.

If you’re still accumulating your precious metals stash, you should know there isn’t any clarity about tariffs there, either.

When the president made his initial tariff declarations, it seemed gold and silver imports would be exempt.

But according to Josh Phair, CEO of Scottsdale Mint, it’s not that simple.

“They said that bullion is exempted,” Phair tells Kitco News. “But if we start looking at a lot of the tariff codes, everyone's going to need to know exactly what is considered bullion, because in our industry we call coins bullion, like from Perth Mint, for example, but that actually is legal tender. It's a monetary bullion product.”

That’s an issue if, for instance, you find the premiums on U.S. Gold Eagles to be too steep and you opt instead for a less-costly government-issued coin like Canadian Maple Leafs, Austrian Philharmonics or South African Krugerrands. They won’t be less costly if they’re subject to tariffs.

On the wholesale level, “What nobody wants is to bring in a $10 million shipment of something and get slapped with $1 million-plus in taxes,” says Phair. “It feels like the whole world is waiting for clarity.”

Trump is “changing his view two, three times a day,” adds Jeff Christian, managing partner at CPM Group. “He's throwing things in, and he is taking things out. So you really can't say definitively what the tariffs will apply to, or if there even will be tariffs.”

![]() New Crypto Highs, Overstretched Stocks

New Crypto Highs, Overstretched Stocks

As was the case Friday, the big market story is all-time highs in Bitcoin.

As was the case Friday, the big market story is all-time highs in Bitcoin.

The flagship crypto surpassed $120,000 overnight, although it’s pulled back ever so slightly this morning. Excitement is building amid hype over what the corporate media are labeling “crypto week.”

The U.S. House begins debate today on a series of crypto bills. Among them is the GENIUS Act already passed by the Senate — setting rules of the road for stablecoins.

Conservative estimates have Bitcoin rising to $130,000 from here. Outliers including Paradigm chart hound Greg Guenthner see the distinct possibility of “high $200ks” before year-end.

But Greg is less sanguine about the stock market at this stage…

“Any way you slice it, this market is stretched,” Greg says of U.S. stocks.

“Any way you slice it, this market is stretched,” Greg says of U.S. stocks.

“The S&P 500 would have to fall nearly 7% just to get back to its 200-day moving average, which is about how extended it was when printing new highs way back in February. That was before the late-month stumble that led up to the Liberation Day shenanigans.

“The most recent leg of this melt-up rally has been so damn persistent, you would think we cured every disease and achieved world peace. The rally has been so strong, in fact, that the S&P last recorded a 1% down day on June 12.

“The last one before that? May 21. You have to go all the way back to April to find another. That’s a whopping 55 trading days with just two significant drops!”

Conditions like these don’t last forever. All the same, a crash is not inevitable.

Conditions like these don’t last forever. All the same, a crash is not inevitable.

Greg reminds us of something colleague Zach Scheidt said in this space on Friday. “Markets correct in two ways: through price and through time.

“While it’s possible we could see a drop similar to what we experienced back in February, the averages could just as easily run out of steam and chop along for weeks (or longer!) until they catch down to longer-term moving averages.”

For the moment, watching the major U.S. stock averages is like watching paint dry.

For the moment, watching the major U.S. stock averages is like watching paint dry.

None of the major U.S. averages has moved more than a quarter-percent. The S&P 500 is up a mere four points to 6,264 — about 16 points below Thursday’s record close.

Not much movement in precious metals either — gold at $3,346 and silver still comfortably above $38. Crude is down just over a buck to $67.38.

![]() Uncle Sam’s Surplus (Don’t Celebrate)

Uncle Sam’s Surplus (Don’t Celebrate)

The federal government recorded a budget surplus for the month of June — but don’t break out the Champagne yet.

The federal government recorded a budget surplus for the month of June — but don’t break out the Champagne yet.

On Friday afternoon, the U.S. Treasury issued its monthly statement of income and outflows.

The month of June logged receipts of $526.4 billion, while spending totaled $499.4 billion — yielding a modest surplus of $27 billion.

Arguably, tariffs made the difference: Tariff revenue totaled $26.6 billion in June. In a typical month last year, tariffs brought in $7.2 billion.

Still, the long-term picture is ugly. From February through June — the first five full calendar months of the Trump 47 presidency — Uncle Sam ran a deficit of $667 billion. That’s 18% higher than the same period last year.

The problem is that while revenue grew 2%... spending grew 7%.

DOGE might be having an impact on the federal payroll — down 2.8% since January — but it’s having zero impact on spending. No wonder Elon Musk is so bitter…

![]() Mailbag: Brazil Tariffs, Pentagon’s Stock Stake

Mailbag: Brazil Tariffs, Pentagon’s Stock Stake

On the subject of the president’s proposed 50% tariff on Brazil — mentioned in Thursday’s edition — a reader writes…

On the subject of the president’s proposed 50% tariff on Brazil — mentioned in Thursday’s edition — a reader writes…

“My neighbor is an engineer at a large company that caters to the potato industry here in east Idaho. Mostly design/build. One piece they install is made of a type of stainless steel made only in Brazil.

“It is a huge piece; the packing crate is made of 1" steel in order to withstand the ocean and land trip to Idaho. I'm curious how much it will cost now.”

“I get that government investment in private companies is a concern — but at least they got preferred shares yielding a dividend,” a reader writes about the Pentagon’s 15% stake in MP Materials.

“I get that government investment in private companies is a concern — but at least they got preferred shares yielding a dividend,” a reader writes about the Pentagon’s 15% stake in MP Materials.

“When they bailed out the banks in 2008, they got nothing. When they bailed out the airlines during COVID, they got nothing. Seems an investment with a yield is better than nothing.

“And lest we forget Obama's expensive foray into the car business in Biden's Delaware. What did we piss away there? $500 mill?”

“The comments about the Pentagon investing in a private company gave me a flashback to 1994 when I was at HQ Marine Corps,” writes our final correspondent.

“The comments about the Pentagon investing in a private company gave me a flashback to 1994 when I was at HQ Marine Corps,” writes our final correspondent.

“During this time many defense contractors were merging, and Lockheed had just merged with Martin Marietta. In a time before memes were circulated a hard-copy note was passed around with the headline ‘U.S. Air Force to Merge With Lockheed/Martin.’ It was all tongue-in-cheek of course showing that military officers do have a sense of humor. A couple of excerpts:

The plans for the new company, to be called Air Lockietta, are somewhat sketchy but sources say that the former contractors will move into military housing at already closed military bases around the country. Air Lockietta believes that forcing their employees into government housing will save the company billions of dollars each year.

“And:

The merger has left the other services scrambling to help themselves by looking into mergers of their own. The Navy is interested in a deal with Carnival Cruise Line, but Kathie Lee Gifford has said that she and Richard Simmons opposed a government takeover. The Army is saying it is keeping its options open but that it expects to close a deal with the Marines sometime in the near future. The Marines, upset at not being included in the Navy negotiations with Carnival, say they want to be affiliated with another organization.

Many say that the Air Lockietta merger will take a while to ‘fit’ the people, though. 'We know how to spend money but we don't know a damn thing about making it,' said an unidentified USAF Lt. Col.

“Still enjoy The 5 even with the cynicism.”

Dave: Ah yes, pre-internet humor circulated by fax machine.

Still remember the one about the 1990s wars in the Balkans and how there was a desperate need for vowels. (At least one version seems to have been taken from The Onion? Back when it was funny, of course…)

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets