The End of Visa and Mastercard

![]() The End of Visa and Mastercard

The End of Visa and Mastercard

It’s been a good three months for financial stocks — up to a point.

It’s been a good three months for financial stocks — up to a point.

The Vanguard Financials Index Fund ETF Shares (VFH) has rallied 21% since the stock market’s bottom in early April. As we write this morning, the share price has equaled its February record.

That said, VFH has underperformed the broad market in that time frame: The S&P 500 is up 25% from its April bottom.

VFH would be doing a lot better were it not for the ETF’s makeup.

Nothing wrong with the performance of the top two holdings: JPMorgan Chase and Berkshire Hathaway make up a combined 17.4% of the portfolio.

The problem lies with the No. 3 and 4 holdings,

Visa and Mastercard make up a combined 10.6% of the VFH’s portfolio — and they’re stinking up the joint.

Visa and Mastercard make up a combined 10.6% of the VFH’s portfolio — and they’re stinking up the joint.

Both V and MA peaked about June 11–12. Both are down sharply since — close to 5%.

That’s because on June 13, The Wall Street Journal reported the following: “Some of the biggest merchants are exploring how to issue or use stablecoins, potentially shifting the high volumes of cash and card transactions that they handle outside the traditional financial system and saving them billions of dollars in fees.”

We’re talking about the biggest of the big retailers here — Walmart and Amazon.

“A move to launch crypto-based payments by Walmart or Amazon that bypasses the traditional payments system,” said the Journal, “would send shivers through the nation’s banks and card-network giants.”

Stablecoins, as you might already know, are a form of crypto that is pegged to the value of a government-issued currency like the U.S. dollar.

Stablecoins, as you might already know, are a form of crypto that is pegged to the value of a government-issued currency like the U.S. dollar.

Big deal, you might say. What’s the advantage of using stablecoins versus actual dollars?

Answer: Fees.

Every time you swipe your credit card, the merchant forks over an “interchange” fee of 2–3% to Visa or Mastercard. And the transaction takes two or three days to settle, while the merchant waits to get paid.

Stablecoins can overcome both of those drawbacks.

And running a stablecoin can be an enormously lucrative business, as you’ll soon see…

![]() Stablecoins: Better Than a Hedge Fund!

Stablecoins: Better Than a Hedge Fund!

“Stablecoins are like giant hedge funds that keep 100% of their profits and the customers rarely, if ever, want the money back,” says Paradigm’s James Altucher — a hedge fund veteran and our resident crypto evangelist.

“Stablecoins are like giant hedge funds that keep 100% of their profits and the customers rarely, if ever, want the money back,” says Paradigm’s James Altucher — a hedge fund veteran and our resident crypto evangelist.

Hedge funds are a lucrative business, typically collecting “2 and 20” from their customers every year — that is, 2% of all the money the customer entrusts to the fund manager, and 20% of the investment gains.

But stablecoins are an even more lucrative business.

Say you entrust $1,000 to an existing stablecoin operator like Circle (operator of the stablecoin USDC) or Tether (operator of the stablecoin USDT). Circle or Tether takes that $1,000 and buys a U.S. Treasury bill earning about 4.3% at current rates.

And they get to keep almost all of that yield other than what they need to cover their minimal personnel and overhead costs. That’s way better — and easier! — than a hedge fund earning 2 and 20.

Stablecoins just got a huge boost — while Visa and Mastercard got another kick in the teeth — with passage of the GENIUS Act in the U.S. Senate on June 17.

Stablecoins just got a huge boost — while Visa and Mastercard got another kick in the teeth — with passage of the GENIUS Act in the U.S. Senate on June 17.

The GENIUS Act amounts to a “rules of the road” for stablecoins, giving more and more businesses and individuals the confidence to start using them. Industry groups like the Merchants Payments Coalition lobbied hard to ensure passage. (They still have work to do in the House, but Beltway insiders believe passage is near-certain sooner or later.)

“Right now, there are $250 billion worth of stablecoins out there,” says the aforementioned James Altucher. “That’s up from about $120 billion a year ago, and 30x higher than it was in 2021.”

Stablecoins are a win-win for all concerned — the operators because of the near-effortless profits and customers “because they pay 1/100th the fees, they make transactions 1,000x faster and they can send money all over the world.”

It won’t spell the immediate end of Visa and Mastercard — but unless they come up with a new business model, it’s not too soon to wonder if one day they’ll go the way of Circuit City and Blockbuster.

Apart from the stablecoin action on Capitol Hill, James is also eyeing broader crypto developments at the Securities and Exchange Commission.

Apart from the stablecoin action on Capitol Hill, James is also eyeing broader crypto developments at the Securities and Exchange Commission.

James believes the SEC will take action no later than tomorrow — that’s the agency’s self-imposed deadline — that will clear the way for several Wall Street institutions to launch a new crypto venture.

“I believe this will result in a $30 trillion ‘crypto disruption’ that could affect almost every retirement account in America almost instantly,” says James.

The biggest gains, he believes, will come to the holders of five tiny coins. Click here and James will reveal the name and ticker of one of them, FREE.

![]() The Education of Elon Musk

The Education of Elon Musk

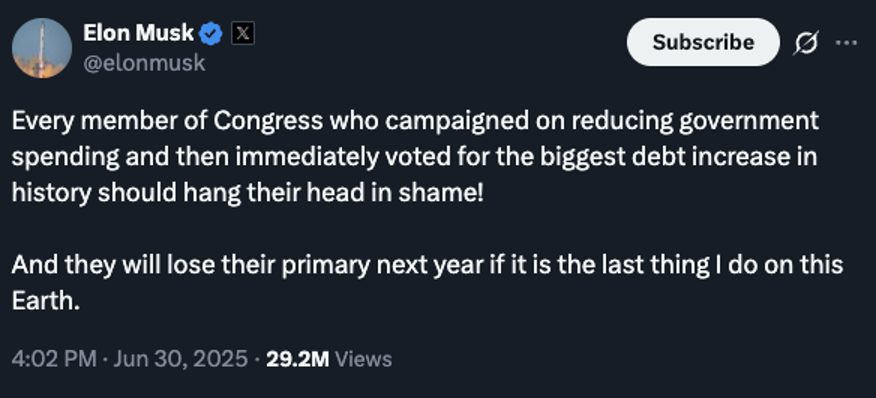

With the “Big Beautiful Bill” approaching passage in the Senate, Elon Musk is upping the ante in opposition.

With the “Big Beautiful Bill” approaching passage in the Senate, Elon Musk is upping the ante in opposition.

Elsewhere, he said, “We live in a one-party country — the PORKY PIG PARTY!!” And he called for the formation of a third-party alternative “that actually cares about the people.”

He also traded online pleasantries with that icon of small government, former Rep. Ron Paul…

… which reminds me that nothing came of Musk’s previous engagement with Paul during the run-up to Election Day 2024. For reasons still unknown, Musk never followed through on including Paul in his DOGE cost-cutting efforts.

Still, Musk’s trajectory reminds me a little bit of my former colleague David Stockman — the Michigan congressman who became Ronald Reagan’s first budget director in 1981.

Still, Musk’s trajectory reminds me a little bit of my former colleague David Stockman — the Michigan congressman who became Ronald Reagan’s first budget director in 1981.

He too learned the hard way how business actually gets done in Washington. After less than a year in office, he aired some of his frustrations to legendary reporter William Greider in the Atlantic Monthly in an epic 18,246-word article called “The Education of David Stockman.”

Unlike Musk, Stockman stuck it out for five years at the White House — watching helplessly as the national debt soared to then-unthinkable levels. (The debt tripled during Reagan’s two terms, a feat unmatched by any president since.)

After his departure, Stockman published a bridge-burning memoir in 1986 called The Triumph of Politics: Why the Reagan Revolution Failed.

Meanwhile, Donald Trump has been channeling the ghost of every other Republican president going back to Reagan.

Meanwhile, Donald Trump has been channeling the ghost of every other Republican president going back to Reagan.

That is, he’s trying to persuade spending-hawk Republicans to see it his way by saying there’s no need to cut spending because, you see, his tax cuts and deregulation will create so much economic growth that Uncle Sam will be awash with revenue…

Sigh… It’s never worked before and there’s no reason to believe it will work now. (I guess I have to say it again: None of this is to let free-spending Democrats off the hook.)

Investment implications? However much gold and Bitcoin you hold as a hedge against the debasement of the U.S. dollar, it’s probably not enough. No one’s coming to save you.

As the day wears on, the bill has passed the Senate with Vice President Vance breaking a 50-50 tie. And amid the D.C. circus, stocks are a mixed bag as the second half of the year begins.

As the day wears on, the bill has passed the Senate with Vice President Vance breaking a 50-50 tie. And amid the D.C. circus, stocks are a mixed bag as the second half of the year begins.

At 6,185, the S&P 500 has pulled back about a third of a percent from yesterday’s record close. And the Nasdaq has shed 1% from yesterday’s close, 20,158 at last check

But the Dow is up over three-quarters of a percent. At 44,479 the Big Board still has work to do to equal its late-January high — but it’s within 1% of that mark.

Gold is trying to stage a recovery from its end-of-the-quarter smackdown — up $38 as we write to $3,339. Silver is holding the line on $36, if barely.

Crude is steady at $65.40. Bitcoin is steady-Eddie over $106,000.

The big economic number of the day is the June ISM Manufacturing index — which registers 49. Since late 2022, this figure has spent all but one month under the 50 level, suggesting the U.S. factory sector has been shrinking almost the entire time.

If you’re curious, there were three dissenting Republican senators on the “Big Beautiful Bill,” necessitating the tiebreaker.

If you’re curious, there were three dissenting Republican senators on the “Big Beautiful Bill,” necessitating the tiebreaker.

Kentucky’s Rand Paul, son of Ron, was a hard no from the beginning. North Carolina’s Thom Tillis objected to the changes to Medicaid. Maine’s Susan Collins is a centrist who often breaks with the party.

An odd “yes” came from Wisconsin’s Ron Johnson. For weeks he squawked about the lack of spending cuts. But during an appearance on NPR yesterday, he said that after meetings with Trump and his staff, “they’ve satisfied my requirement, which was a commitment to a reasonable, pre-pandemic level of spending and a process to achieve and maintain it.”

We’d love to see what that “process” is supposed to look like, seeing as the DOGE savings were such a bust.

In any event, the story still isn’t over: The Senate bill differs in several respects from the House version and those differences now have to be hammered out in conference committee.

![]() Fed Fib

Fed Fib

The president says he won’t fire Fed chair Jerome Powell — but there’s an outside chance Congress might censure him before he steps down next year.

The president says he won’t fire Fed chair Jerome Powell — but there’s an outside chance Congress might censure him before he steps down next year.

In 2021, the Fed undertook a remodeling project at its Washington headquarters, the Marriner Eccles building — cost $2.5 billion.

This past spring, the New York Post reported on some of the lavish amenities: “The plans include rooftop garden terraces, skylights, ornate water features and a new elevator system that allows board members to be dropped off directly in their VIP dining suite.”

Under questioning from senators last week, Powell said the report was “misleading and inaccurate. There’s no VIP dining room, there’s no new marble. There are no special elevators. There are no new water features, there’s no beehives, and there’s no roof terrace gardens.”

The Post now says Powell’s statements “directly contradicted the project’s own planning documents, which were signed off on by government pen pushers in 2021 — and which haven’t been revised since.”

Dartmouth professor and former Fed economist Andrew Levin tells the Post that Powell should be punished for lying to Congress.

“A top Fed official cannot be permitted to make false statements under oath at a congressional hearing. Such statements must be promptly corrected, and in egregious cases, subject to censure by the Senate.”

Yeah, right. Long ago we chronicled two far more serious cases of perjury by former Fed chair Ben Bernanke — for which he never faced even censure, much less handcuffs and leg irons.

![]() Land Grabs for AI?

Land Grabs for AI?

On the subject of AI and electricity use — revisited once more in yesterday’s edition — we heard from one of our regulars living in the Great Plains…

On the subject of AI and electricity use — revisited once more in yesterday’s edition — we heard from one of our regulars living in the Great Plains…

“Dave, I thought of your previous articles on power consumption by data centers and cryptominers when I read this article by a small investigative newspaper in Nebraska that I support.

“Just FYI, Stanton County is in northeast Nebraska and very sparsely populated.”

Dave responds: Fascinating. And disturbing.

The gist of the article by the Flatwater Free Press is this: The Nebraska Public Power District is looking to resort to eminent domain so it can run high-voltage transmission lines across four parcels of private property.

The project will cost electric customers $20 million and the only real beneficiary of the added grid capacity will be… a crypto miner.

“If it’s for one private company, I think eminent domain should be absolutely off the table,” says Justin Kennedy — who hoped to build his retirement house on one of the properties in question. “It feels like a once-in-a-lifetime opportunity is being taken away from me.”

The story reminds us of the carbon-capture saga in nearby South Dakota.

The story reminds us of the carbon-capture saga in nearby South Dakota.

We went into considerable depth on this one two years ago: A private company was looking to build a pipeline for the purpose of transporting carbon dioxide produced by ethanol plants in Iowa, through South Dakota, to an underground storage site in North Dakota — the better to prevent “climate change.”

Here too, the threat of eminent domain was in play — along with extreme strongarm tactics. Surveyors for the company — Summit Carbon Solutions — sometimes arrived unannounced on coveted property with armed security, which one reporter likened to “something out of Blazing Saddles or Yellowstone.”

The story has a happy ending: Earlier this year South Dakota Gov. Larry Rhoden signed legislation forbidding the use of eminent domain to build carbon dioxide pipelines. The project might well be in jeopardy now.

An article published this spring by The Associated Press and the Lee Enterprises newspaper chain reveals even more lengths to which Summit went to secure desired property.

Summit brought 232 lawsuits against landowners across South Dakota, North Dakota and Iowa — including lawsuits seeking access to property for surveys. All 156 of the eminent domain actions were brought in South Dakota. Over the course of two days in late April 2023, the company filed 83 eminent domain lawsuits across the state.

One wonders if we’re going to see the same thing happening with data center operators soon.

We take a back seat to no one in sounding the alarm about the fragility of the power grid: We’ve been doing so regularly in these virtual pages for three years now.

But if the main beneficiaries of a grid buildout turn out to be the likes of Amazon, Microsoft and Meta… well, they’re going to have to tread carefully.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets