Trump’s New Tariff Deadline

![]() Trump’s New Tariff Deadline

Trump’s New Tariff Deadline

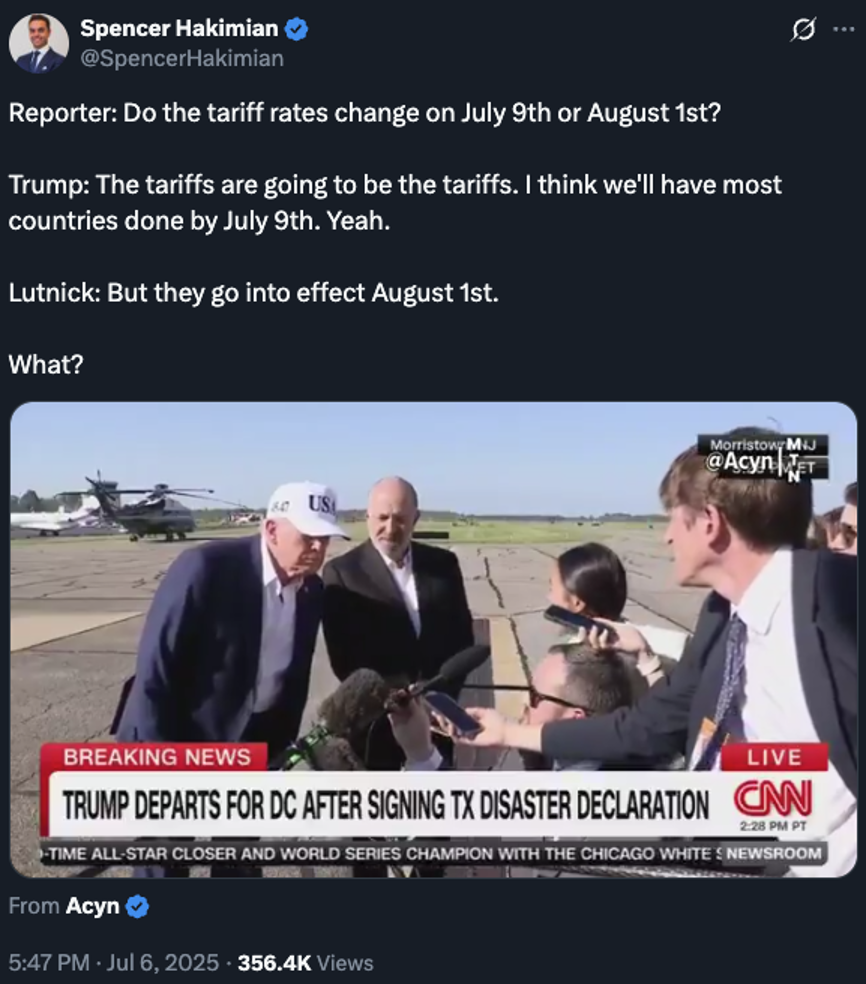

So Aug. 1 is the new July 9. But not really.

So Aug. 1 is the new July 9. But not really.

The Trump administration’s tariff clock that was set to run out on Wednesday has been reset by another 23 days. Kinda-sorta.

The administration’s messaging has been a bit muddled.

Let’s do what we can to make sense of what’s going on.

When we left you before the holiday weekend, the 90-day pause on “reciprocal tariffs” was set to end this Wednesday July 9.

Then on Friday, Independence Day, Bloomberg reported the following: “U.S. President Donald Trump said his administration will probably start notifying trading partners Friday of the new U.S. tariff on their exports effective Aug. 1, while reiterating a preference for simplicity over complicated negotiations five days before his deadline for deals.”

Yesterday, Treasury Secretary Scott Bessent clarified on CNN: “President Trump is going to send letters to some of our trading partners saying that ‘if you don’t move things along, then on Aug. 1, you will boomerang back to your April 2 tariff level.’”

Supposedly these letters will start going out at midday today — and all of them will be issued by Wednesday. So in that sense, the July 9 deadline is still in effect — but there’s still, potentially, room for negotiations before Aug. 1.

Amid that backdrop, Paradigm’s macro maven Jim Rickards expects more surprises come Wednesday — what he describes as “an economic ‘kill shot’ on 194 countries around the world.”

How will markets react? “Ultimately, investors who are positioned ahead of time could make a fortune,” says Paradigm publisher Matt Insley. “The ones who don’t are almost sure to suffer.”

Matt recorded a 62-second message to walk you through what you need to do to prepare: Click here to watch it right away.

The first of those tariff letters just went out on schedule — and it’s not going over well in the stock market.

The first of those tariff letters just went out on schedule — and it’s not going over well in the stock market.

Japan and South Korea will be hit with 25% tariffs effective Aug. 1. And with that, the S&P 500 has slid more than three-quarters of a percent from last Thursday’s record close — 6,228 at last check. The Nasdaq’s losses are about the same; the Dow’s are a bit steeper.

Precious metals are selling off, but not much — gold at $3,326 and silver at $36.63. Crude is up to $67.63, the highest since the big slide two weeks ago today. Bitcoin is hanging tough at $108,215.

There are some additional cross-currents on the tariff front we’re watching…

- The White House is threatening the European Union with an additional 17% tariff on farm exports — in addition to the 20% tariffs threatened on all EU goods if no deal can be reached by Aug. 1

- On social media the president threatened an additional 10% tariff on countries aligning with the BRICS constellation of countries — an announcement timed for Day 1 of a BRICS leaders summit in Rio de Janeiro. (This year’s gathering is shaping up to be a nothingburger; neither Chinese President Xi nor Russian President Putin is there.)

- Before the president announced 25% tariffs on Japan, Prime Minister Shigeru Ishiba said, “We will not easily compromise” on trade. As we mentioned on Thursday, Japan was widely expected to be among the first countries to cut a deal with Washington last spring — but it hasn’t worked out that way.

We’ll leave it there for today. We need to move on to the fallout from passage of the “Big Beautiful Bill” in Washington…

![]() Debt Binge

Debt Binge

Against what seemed like overwhelming odds,the president’s gargantuan tax-and-spend bill is now law. And on his timetable.

Against what seemed like overwhelming odds,the president’s gargantuan tax-and-spend bill is now law. And on his timetable.

Shortly after we hit “send” on last Thursday’s edition ahead of the holiday weekend, the House passed the Senate version of the “Big Beautiful Bill” with no changes.

There was no messy conference committee hashing out a compromise between the House and Senate versions of the bill, necessitating a new floor vote in both chambers that could have quickly gone off the rails. Instead, the president got the Fourth of July signing ceremony he wanted.

How did it happen?

Answer: The House’s “fiscal conservatives” folded like the proverbial lawn chair. It was a true profile in cowardice.

Answer: The House’s “fiscal conservatives” folded like the proverbial lawn chair. It was a true profile in cowardice.

From The Wall Street Journal…

Less than a month ago, 38 House Republicans led by Rep. Lloyd Smucker (R-Pa.) signed a letter saying that they were ‘unequivocal’ in limiting the size of tax cuts by linking them to spending cuts. The House plan, which said that tax cuts couldn’t be $2.5 trillion more than spending cuts, was the ‘minimum standard’ for their support of a Senate-passed bill.

The Senate bill fell more than $500 billion short of that target, and in all it will increase budget deficits by $3.4 trillion through 2034, compared with doing nothing, according to the Congressional Budget Office.

In the end, every single one of those 38 caved — even Chip Roy of Texas, who railed against the Senate bill the day before the vote, promising “to stay here every day until we get it right.”

The only “no” votes on the Republican side came from the heroic Kentuckian Thomas Massie… and Pennsylvania’s Brian Fitzpatrick, who represents a swing district in the suburbs of Philadelphia.

House Speaker Mike Johnson is proving himself even more capable of keeping a fractious caucus in line than Nancy Pelosi.

Either that or the “fiscal conservatives” ditch their principles at the first thought of a mean tweet by Donald Trump…

The passage of this 887-page legislative monstrosity is even more remarkable in light of events just over six months ago.

The passage of this 887-page legislative monstrosity is even more remarkable in light of events just over six months ago.

Last December, one of those “partial-government shutdowns” was looming as the lame-duck session of Congress was winding down its work for the year. With Donald Trump’s blessing, Johnson put forth a 1,547-page kitchen-sink “continuing resolution.”

It was a watershed moment: Everyday folks on social media employed AI to dig out the bill’s most ridiculous provisions. Elon Musk marshaled his followers on X to call Capitol Hill in outrage.

And it worked. The bill was slimmed down to 118 pages.

We dared to wonder if that episode might mark an end to at least one aspect of business-as-usual in Congress.

➢ Just a hunch, but this third party is probably one of Elon’s wild hairs that he’ll forget about in a few weeks. Mr. Market definitely doesn’t approve: Tesla shares are down 7.4% on the day.

Perhaps the biggest outrage of the Senate bill is the lifting of the debt ceiling.

Perhaps the biggest outrage of the Senate bill is the lifting of the debt ceiling.

The ceiling kicked in at the start of this year — effectively freezing the national debt at $36.2 trillion. For the past six months, the Treasury has resorted to various accounting tricks to stay under the ceiling — such as borrowing from government employee pension funds.

The new law lifts the debt ceiling by $5 trillion to $41.2 trillion.

Considering that Uncle Sam has already spent about $800 billion he didn’t have for the last six months… that leaves about $4.2 trillion of wiggle room.

It’s highly likely the debt ceiling will once again kick in before the end of Trump’s term. In the event of a recession or a major war, it’s guaranteed to kick in before the end of Trump’s term.

➢ No surprise, but the bond market is selling off in reaction to the bill’s passage — pushing yields sharply higher. The 10-year Treasury note is up to 4.38% and the 30-year T-bond is up to 4.92%.

![]() Taxing Matters: What the Bill Means to You

Taxing Matters: What the Bill Means to You

The political and debt considerations notwithstanding… what do the tax provisions in the bill mean for you?

The political and debt considerations notwithstanding… what do the tax provisions in the bill mean for you?

The most important thing to know — and an unquestionably good thing — is that the tax brackets that came into effect with the Trump tax cuts of 2017 are now permanent. Or as permanent as anything is in Washington, D.C.

Had those tax cuts expired as scheduled at year-end, folks currently in the 22% tax bracket would have gone back to 25%. That’s just one example; it’s good news for nearly everyone at every income level.

That said, a few things do change. Some highlights…

- The standard deduction for 2025 — previously set at $15,000 for singles and $30,000 for couples — rises to $15,750 for singles and $31,500 for couples. As before, it will continue to rise each year with inflation

- Also this year, the $2,000 child tax credit is reset to $2,200 and will be indexed to inflation

There are also several provisions that have an expiration date — because of the peculiar budget math of Washington, D.C.

- The SALT deduction for state and local taxes rises from $10,000 to $40,000 — but only until tax year 2029

- The “no taxes on tips” and “no taxes on overtime” provisions that the president promised during the campaign last year have income limits and expire at the end of 2028

- Folks over 65 can claim an extra deduction of $6,000 per person per year — on top of the existing standard deduction and senior deduction — through 2028. It starts phasing out at $75,000 for singles, $150,000 for couples. This provision was passed in lieu of the president’s “no taxes on Social Security” promise. (More about that below.)

Those are the broad outlines. As always, consult a tax professional for more details — especially since many of these provisions affect tax year 2025 and the return you’ll file next spring.

Also worth a mention: The estate-tax levels set under the 2017 Trump tax cuts — which were on track to expire at year-end — now remain in effect.

Also worth a mention: The estate-tax levels set under the 2017 Trump tax cuts — which were on track to expire at year-end — now remain in effect.

That means more family-owned businesses can stay in the family after the first generation passes on. Too often over the decades, heirs have had to sell out to corporate behemoths because that’s the only way they could raise the cash to pay the estate tax.

One more thing, not tax related: If you buy health insurance on the Obamacare “exchanges,” expect this bill to jack up your premiums.

One more thing, not tax related: If you buy health insurance on the Obamacare “exchanges,” expect this bill to jack up your premiums.

Obamacare has been brutal for small-business owners and the self-employed — many of whom found themselves paying dramatically higher premiums when the law kicked in a little over a decade ago.

Well, more pain is coming: The Kaiser Family Foundation says premiums on the exchanges are set to rise an average $1,296 per year. And you’ll have to update your personal information every year, including income and immigration status. No more automatic enrollment.

![]() Social Security Stretches the Truth

Social Security Stretches the Truth

And then there was the insult to your intelligence that landed in your inbox on the Fourth if you’re on the Social Security Administration’s mailing list…

And then there was the insult to your intelligence that landed in your inbox on the Fourth if you’re on the Social Security Administration’s mailing list…

Never mind the shamelessly political nature of the email. We’re getting used to that from both parties as America slips ever closer to banana-republic status.

The real outrage is the email’s claim that “the bill ensures that nearly 90% of Social Security beneficiaries will no longer pay federal income taxes on their benefits.”

And this gem: “The new law includes a provision that eliminates federal income taxes on Social Security benefits for most beneficiaries, providing relief to individuals and couples. Additionally, it provides an enhanced deduction for taxpayers aged 65 and older, ensuring that retirees can keep more of what they have earned.”

Folks who can’t keep up with every bit of news related to this bill might be led to believe that, well, federal income taxes on Social Security benefits are being eliminated for most beneficiaries.

➢ Why did Congress write the bill this way? Because when seniors pay income tax on their Social Security benefits, a substantial portion of that money goes into the Social Security trust fund. If Social Security benefits were no longer subject to income tax, the trust fund would be depleted even sooner than the current estimate of 2033.

And of course, the email says nothing about how in 2029 everything goes back to the way it was in 2024…

![]() Comic Relief

Comic Relief

In light of the latest headlines about the financier Jeffrey Epstein…

In light of the latest headlines about the financier Jeffrey Epstein…

On a more serious note, expect a comprehensive 2025 update of our Nov. 21, 2023 edition — titled “From JFK to Jeffrey Epstein” — sometime this month or next.

Sorry, no space for a mailbag today in light of the “Big Beautiful Bill’s” passage.

We did get a boatload of reader feedback to our Independence Day edition — which was a reprise of “the cynicism issue” from earlier this spring. We’ll dive into it tomorrow!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets