Lights Out

![]() The Clock’s Ticking on America’s Energy Future

The Clock’s Ticking on America’s Energy Future

In the autumn of 2021, the world watched as entire cities across China fell dark, under the shroud of sudden, government-mandated power rationing.

In the autumn of 2021, the world watched as entire cities across China fell dark, under the shroud of sudden, government-mandated power rationing.

China experienced abrupt power outages that brought cities to a standstill — traffic lights failed, causing gridlock, and elevators were shut down to save electricity. Some residents, desperate for warmth, burned coal or gas indoors, resulting in dangerous incidents of carbon monoxide poisoning.

At the same time, many factories faced intermittent power cuts. Energy-intensive industries, especially textiles, faced strict rationing, forcing managers and customers to adapt to unpredictable shutdowns.

It was a stark reminder that even one of the most advanced economies in the world was not immune to energy shortages. But few Americans imagine such scenes could unfold here.

Fast-forward to 2025, and the U.S. is now staring down its own energy crisis — one that experts warn could bring unprecedented blackouts and economic disruption.

Fast-forward to 2025, and the U.S. is now staring down its own energy crisis — one that experts warn could bring unprecedented blackouts and economic disruption.

America’s electric grid, once the envy of the world, is now overtaxed and underprepared for the demands of a digital, electrified economy.

The U.S. Department of Energy’s (DOE) latest Resource Adequacy Report paints a sobering picture: “Modeling shows annual outage hours could increase from single digits today to more than 800 hours per year,” the DOE warns. “Such a surge would leave millions of households and businesses vulnerable.”

What’s driving this crisis? The answer is a collision course of factors:

- Exploding demand: Electricity consumption is soaring, fueled by the rapid growth of data centers, artificial intelligence and electric vehicles and a shift away from fossil fuels. The U.S. Energy Information Administration projects power demand will hit record highs, with a 38% jump in peak demand by 2030

- Aging infrastructure: Much of America’s electrical grid dates back to the 1950s and ’60s; these aging wires and substations weren’t built for today’s soaring demand. Breakdowns and maintenance issues are becoming more common, while overloaded transmission lines create bottlenecks across regions. A shortage of skilled workers, many nearing retirement, further slows upgrades and repairs, leaving the system increasingly fragile

- Plant retirements: Older coal, gas and nuclear plants, critical for grid stability, are being retired faster than new, reliable replacements can be built. The DOE estimates 104 gigawatts of baseload generation could be lost by 2030, while 95% of new capacity in progress is renewable, intermittent

Meanwhile, shifting government priorities — supporting fossil fuels versus promoting renewables — make it difficult for utilities to plan long-term projects with any confidence.

Such uncertainty discourages investment and innovation, slowing the modernization of the grid at a time when rapid upgrades are urgently needed.

The DOE warns that “the status quo is unsustainable for the U.S. electric grid.”

The DOE warns that “the status quo is unsustainable for the U.S. electric grid.”

The solution isn’t as simple as choosing between fossil fuels and renewables. The DOE stresses the need for a “balanced transition” — extending the life of existing plants, accelerating infrastructure projects and significantly expanding nuclear energy.

To that last point, recent federal action directs the DOE to facilitate power upgrades at existing reactors, fast-track construction of new nuclear plants and bolster domestic uranium supplies, aiming to quadruple U.S. nuclear capacity by 2050.

But the DOE cautions: “If the U.S. doesn’t act quickly to balance energy supply and demand, power blackouts could increase 100-fold by 2030.”

Conclusion? The clock is ticking. The warning signs — rolling blackouts abroad (and “load shedding” domestically), a maxed-out grid and surging demand — are impossible to ignore.

The consequences of an overtaxed grid go far beyond the inconvenience of flickering lights. Blackouts threaten everything from hospital operations to food supply chains and national security.

Without urgent, coordinated action, the U.S. could soon join the ranks of nations grappling with routine energy shortages. The time to shore up America’s grid is now.

![]() Copper Tariffs = Self-Sabotage

Copper Tariffs = Self-Sabotage

Donald Trump’s 50% copper tariff is a gut punch to America’s infrastructure ambitions.

Donald Trump’s 50% copper tariff is a gut punch to America’s infrastructure ambitions.

Hiking tariffs on this critical metal, as the president did yesterday, is counterintuitive when the nation is desperate to modernize its aging grid.

The administration claims tariffs will boost domestic production, but the reality is stark: America lacks the smelters, refineries and regulatory speed to ramp up supply overnight.

“If you make copper too expensive to import, and it’s already too bureaucratic to produce locally, you’re setting yourself up for a supply shock,” warns Paradigm editor Sean Ring at The Rude Awakening.

Not to mention the U.S. imports almost half its refined copper because as hedge fund manager Spencer Hakimian tweets: “You can tariff copper 10,000% and it still won’t change the fact that most of the copper on Earth is in Chile and Peru… The copper mines in the world are where they are. There’s literally nothing you can do about it.”

Sean adds, “When you tariff the one metal required in every wire, motor, pipe and power line in your society, don’t be surprised when costs explode and your economy shorts out.

“Nothing says ‘Let’s build new infrastructure’ like tripling the cost of the stuff that wires, powers and plumbs the entire economy.”

This isn’t just a blow to manufacturing — literally every industry will feel the pain. Tariffing copper is an act of self-sabotage, risking higher inflation and stalling the very progress America needs.

The market’s verdict was swift: U.S. copper futures surged 13% to record highs yesterday. Today, the price of copper’s pulled back about 3.5%.

The market’s verdict was swift: U.S. copper futures surged 13% to record highs yesterday. Today, the price of copper’s pulled back about 3.5%.

As for other commodities in the spotlight, WTI crude oil is up 0.35%, trading at $68.60 a barrel. Gold is up 0.15% to $3,322 per ounce, but silver is down about 0.10% to $36.70.

U.S. stocks have ticked higher midday: the Dow Jones Industrial Average is up 0.15% to 44,300, the S&P 500 has gained 0.25% to 5,240 and the Nasdaq Composite is up 0.60% at 20,540.

Notably, Nvidia (NVDA) is dominating headlines, surging over 2% today to $163.33 per share and pushing its market cap to a record $4 trillion — making it the most valuable company in history. The AI chip giant’s meteoric rise has left other tech titans in the dust, cementing its status as the new heavyweight champ of Wall Street.

![]() Inside the Rick Rule Symposium 2025

Inside the Rick Rule Symposium 2025

“This week, I’m in Boca Raton, Florida, attending Rick Rule’s annual investment conference alongside Jim Rickards and Byron King,” says Paradigm’s editor Adam Sharp at The Daily Reckoning.

“This week, I’m in Boca Raton, Florida, attending Rick Rule’s annual investment conference alongside Jim Rickards and Byron King,” says Paradigm’s editor Adam Sharp at The Daily Reckoning.

“Rick is a legend in the natural resource investing space,” Adam continues. “This conference is a bit like Mecca for gold, silver and hard asset investors.”

Rick kicked things off with a keynote that was “one for the record books.” He laid out the stark reality: “America’s financial math isn’t adding up.”

With Americans holding about $141 trillion in net worth, we’re also facing $36.6 trillion in outstanding debt — 123% of GDP — and nearly $100 trillion in unfunded liabilities. These are costs like Medicare, Medicaid, federal pensions, Social Security and the like.

“These unfunded liabilities are money we have promised, but not paid for. They will come due over the coming years and decades,” says Adam.

“So we are already almost at a 1:1 ratio in terms of net worth and liabilities. $141 trillion in net worth and $136.6 billion in liabilities. In other words, we can’t tax our way out of this one.”

Debt is rising by at least $2 trillion a year, and unfunded liabilities are ballooning just as fast. “Entitlement spending has grown completely out of control.

“We’re approaching the tipping point. And Rick Rule says we’re destined to print money and devalue the dollar to make up the difference,” Adam notes.

“We’re approaching the tipping point. And Rick Rule says we’re destined to print money and devalue the dollar to make up the difference,” Adam notes.

Rick draws parallels to the 1970s, when the dollar’s purchasing power fell by around 75% and inflation soared about 15%.

“In real terms (after inflation) the S&P 500 index lost money over the decade. The broad stock market offered no shelter,” adds Adam.

“However, some investors thrived during the ‘70s. They did so by buying gold, silver, miners, oil and other natural resources. This is how Jim Rogers and George Soros made their fortunes.

“Rick strongly believes that this is the best path to preserving and even growing wealth during this tumultuous period.

“Gold and silver miners. Base metals like iron and copper, too. Oil and gas companies. These are sectors that stand to benefit from sustained inflation,” Adam emphasizes. “Silver miners, in particular, are cheap. Both Rick and I love ‘poor man’s gold,’ and the companies that produce it.

“Platinum has been on fire over the past few months. Since [May], the price has risen from $982 to $1,386 per ounce. This unique precious metal has often traded at par or even a premium to gold, so it could still have a lot of catching up to do.”

The message from Boca Raton is loud and clear: “Rick Rule strongly believes that investing in hard assets will be key to thriving over the next decade,” says Adam. “So do we.”

![]() For the Record

For the Record

“Got gold?” asks editor Sean Ring at our internal Slack channel, captioning this tweet…

“Got gold?” asks editor Sean Ring at our internal Slack channel, captioning this tweet…

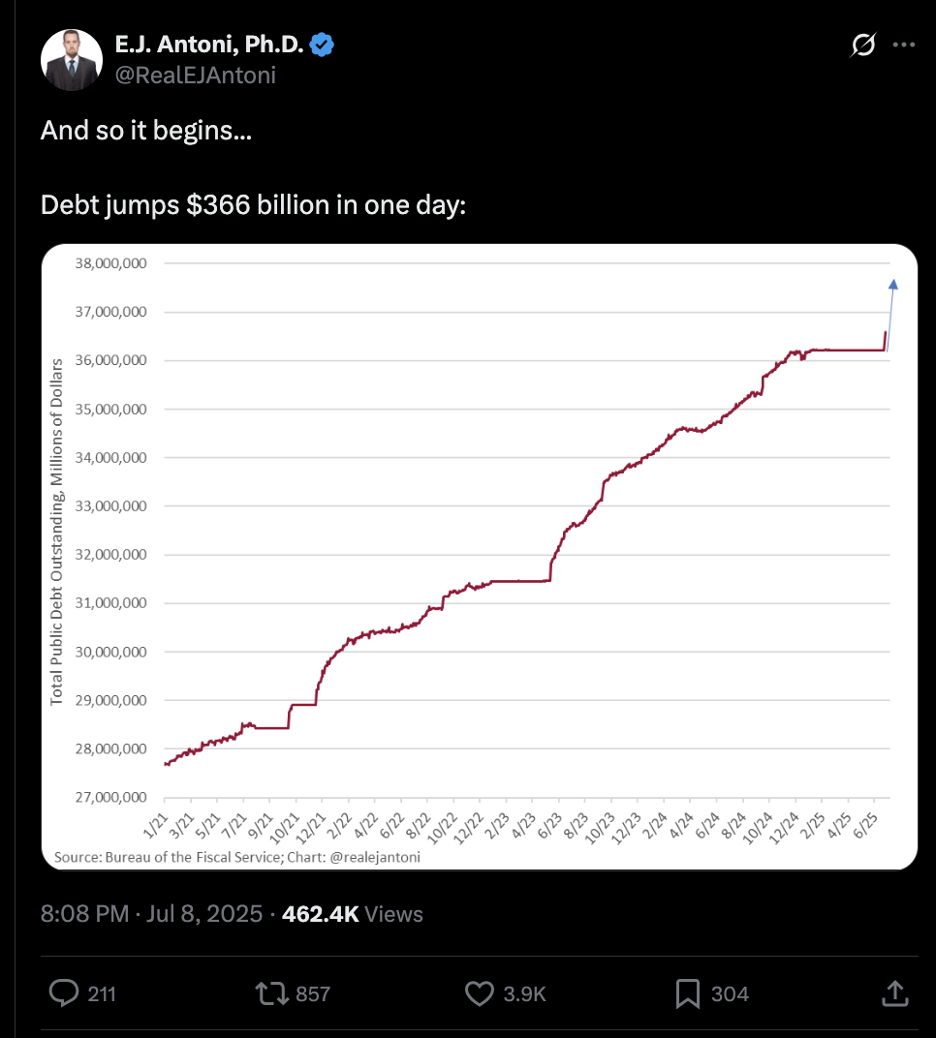

This chart tracks the total U.S. public debt since the start of the Biden administration in January 2021. The periods where the line flattens out represent times when the debt ceiling was in effect, preventing the government from borrowing more money.

Each time the debt ceiling is suspended or raised, the line jumps upward as the Treasury catches up on borrowing. Most recently, with the debt ceiling no longer in force, there’s a sudden $366 billion spike in the national debt. How quickly government borrowing rises once those limits are lifted!

![]() Brie Prepared: More Than Meets the Eye

Brie Prepared: More Than Meets the Eye

Fancy a slice of French countryside for the price of a croissant? The village of Ambert, famous for its fourme d'Ambert cheese, is offering two homes for just one euro each. But before you start packing your beret and dreaming of baguettes, there’s a twist.

Fancy a slice of French countryside for the price of a croissant? The village of Ambert, famous for its fourme d'Ambert cheese, is offering two homes for just one euro each. But before you start packing your beret and dreaming of baguettes, there’s a twist.

These aren’t move-in ready chateaux; think more DIY adventure than turnkey retreat. The catch? Buyers must commit to renovating these crumbling beauties within a year — no letting your fixer-upper gather more dust — and then living in the residence full-time for three years minimum.

Courtesy: Daniel C., Tripadvisor

Ambert, France

Why the bargain? The small village in southeast France, with about 6,500 residents, has launched this initiative as part of a five-year plan to reverse population decline and inject new life into its sleepy streets.

(With property vacancy rates in some parts of Ambert reaching up to 60%, local authorities should probably put more than just two homes on the market!)

It’s a clever strategy: lure dreamers — especially young dreamers — with a price tag that’s practically pocket change, then challenge them to roll up their sleeves and get to work. The local council hopes this will attract a new wave of residents, ideally those with a fondness for rustic charm and a knack for plastering walls (a dying art, I’m told).

So if your Pinterest board is overflowing with “cottage core” inspiration and you don’t mind a few cobwebs, Ambert might be your next great adventure.

Just remember, in Europe, even a one-euro house comes with its own archaic blueprint of bureaucracy.

Enjoy your day! We’ll catch up with you tomorrow…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets