Mother of All Tariffs

![]() The Mother of All Tariffs

The Mother of All Tariffs

The big tariff headline today is the president slapping a 35% levy on Canada effective Aug. 1. But that’s peanuts compared with what’s coming as early as Monday.

The big tariff headline today is the president slapping a 35% levy on Canada effective Aug. 1. But that’s peanuts compared with what’s coming as early as Monday.

For whatever reason the mainstream didn’t notice… but on Tuesday of this week, Donald Trump suggested he’d throw his support behind a bill in Congress that would impose a 500% tariff on imports from any country that buys Russian energy.

We told you about this bill in early June. Sponsored by the warmongering Senate duo of Lindsey Graham (R-South Carolina) and Richard Blumenthal (D-Connecticut), the measure has 83 co-sponsors — way more than a veto-proof majority. Presumably support in the House would be nearly as lopsided.

The president’s remarks about this mother of all tariffs came at the same time he committed to sending more weapons to Ukraine — and said he was “disappointed” in Russia’s Vladimir Putin for continuing to wage war. Evidently Trump thinks this bill might give him negotiating leverage.

“I’m looking. It’s totally at my option. They pass it totally at my option, and to terminate totally at my option. And I’m looking at it very strongly.”

(If this is so, why do we even bother having a legislative branch anymore? But I digress…)

Among the Senate dissidents is Rand Paul (R-Kentucky) — who warns the bill’s passage “would cause an economic calamity on a scale never before seen in our country.”

Among the Senate dissidents is Rand Paul (R-Kentucky) — who warns the bill’s passage “would cause an economic calamity on a scale never before seen in our country.”

It’s not just that China buys energy from Russia and thus all American imports from China would be subject to a 500% duty.

As Paul points out, “Dozens of countries continue to trade with Russia directly and indirectly including key strategic allies…”

Europe still can’t wean itself off Russian energy; imports of Russian liquefied natural gas into the European Union grew 19% between 2023–2024. All American imports from the EU would be subject to 500% tariffs.

Japan also relies on Russian LNG. All American imports from Japan would be subject to 500% tariffs.

Trump’s remarks this week got more attention in India’s press than in the United States. “India will be hit hard as it has benefited greatly from buying cheaper Russian oil since the Russia-Ukraine war broke out,” explains The Economic Times.

As we’ve chronicled now and then, India’s oil imports from Russia have skyrocketed since 2022. India’s been happy to buy the Russian crude that Americans and Europeans have sanctioned.

Before 2022, less than 1% of India’s oil imports came from Russia. This summer it’s at least 40%. Russia is far and away India’s biggest crude supplier.

India is America’s No. 7 trading partner — sending us everything from electrical equipment to pharmaceuticals to textiles. And all of it would be subject to a 500% tariff under this bill.

As Sen. Paul warns, “these tariffs would make U.S. trade with most of the world untenable, raise prices for American consumers and risk further weakening the dollar.”

After Trump’s remarks Tuesday, he gave a birthday shout-out on Wednesday to the bill’s lead sponsor, Sen. Graham…

After Trump’s remarks Tuesday, he gave a birthday shout-out on Wednesday to the bill’s lead sponsor, Sen. Graham…

The following day, yesterday, he said this to Kristen Welker of NBC News: “I think I’ll have a major statement to make on Russia on Monday.” He offered no detail.

That’s where it stands with the mother of all tariffs going into this weekend. Check back with us next week…

![]() BTC ATH

BTC ATH

The big market story today is Bitcoin — blasting to all-time highs over $118,000 this morning, now hovering around $117k.

The big market story today is Bitcoin — blasting to all-time highs over $118,000 this morning, now hovering around $117k.

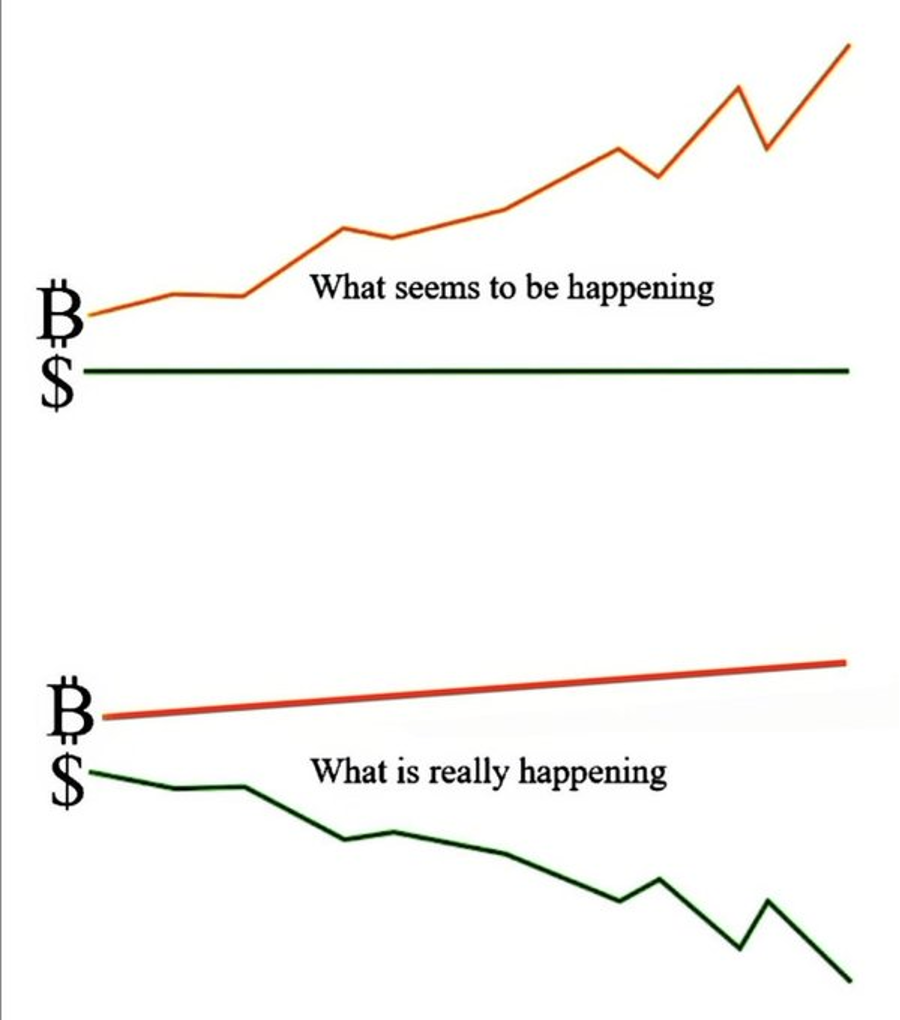

Although as some wags are quick to point out, it’s not so much that Bitcoin is strong as it’s a vote of no-confidence in the U.S. dollar.

Same goes for precious metals: Gold is up $34 on the day to $3,356 — and silver is on track to end the day (and the week) over $38 for the first time since 2011.

“Bitcoin has nothing but blue skies above,” Greg Guenthner tells his Trading Desk subscribers. “I know it sounds crazy, but I think the high $200ks is a decent year-end target.” Meanwhile at the Rude Awakening, Sean Ring says it’s not too soon to start thinking about silver recovering its $50 record high — which would “almost certainly be the beginning of a new surge, not the end of the bull market.”

That’s how it goes when the purchasing power of your dollars is being relentlessly trashed.

Even crude is seeing a big bounce today — up nearly two bucks to $68.53, another high-water mark since the big slide on June 23.

The stock market is slightly in the red as the weekend approaches — the S&P 500 pulling back from yesterday’s record close of 6,280.

The stock market is slightly in the red as the weekend approaches — the S&P 500 pulling back from yesterday’s record close of 6,280.

The aforementioned Greg Guenthner points out the best performers of late have been the most crazy-speculative names — like the hydrogen fuel-cell maker Plug Power Inc. “If PLUG is on the move, you know you’re in a frothy, speculative market.

“Unfortunately, it also usually means we’re closer to the end of a big run than the beginning of one. This ‘dash for trash’ is likely the last leg of this thrust before the market will need to cool off and reset. No guarantees, of course. But that’s usually how these situations play out.”

Don’t get the wrong idea: That doesn’t necessarily mean a big plunge is around the corner.

Don’t get the wrong idea: That doesn’t necessarily mean a big plunge is around the corner.

As Paradigm’s Zach Scheidt points out this week for readers of Rickards’ Insider Intel, corrections come in two flavors — corrections in price and corrections in time.

Corrections in time mean that “stocks simply trade sideways for a period of time [as] investors gradually become accustomed to the higher prices and set a new baseline.”

We had such an episode of sideways chop late last year and early this — the S&P 500 oscillating between 5,800 and 6,100 for the better part of four months. It’s the old truism about nothing goes up in a straight line…

![]() Here We Go Again

Here We Go Again

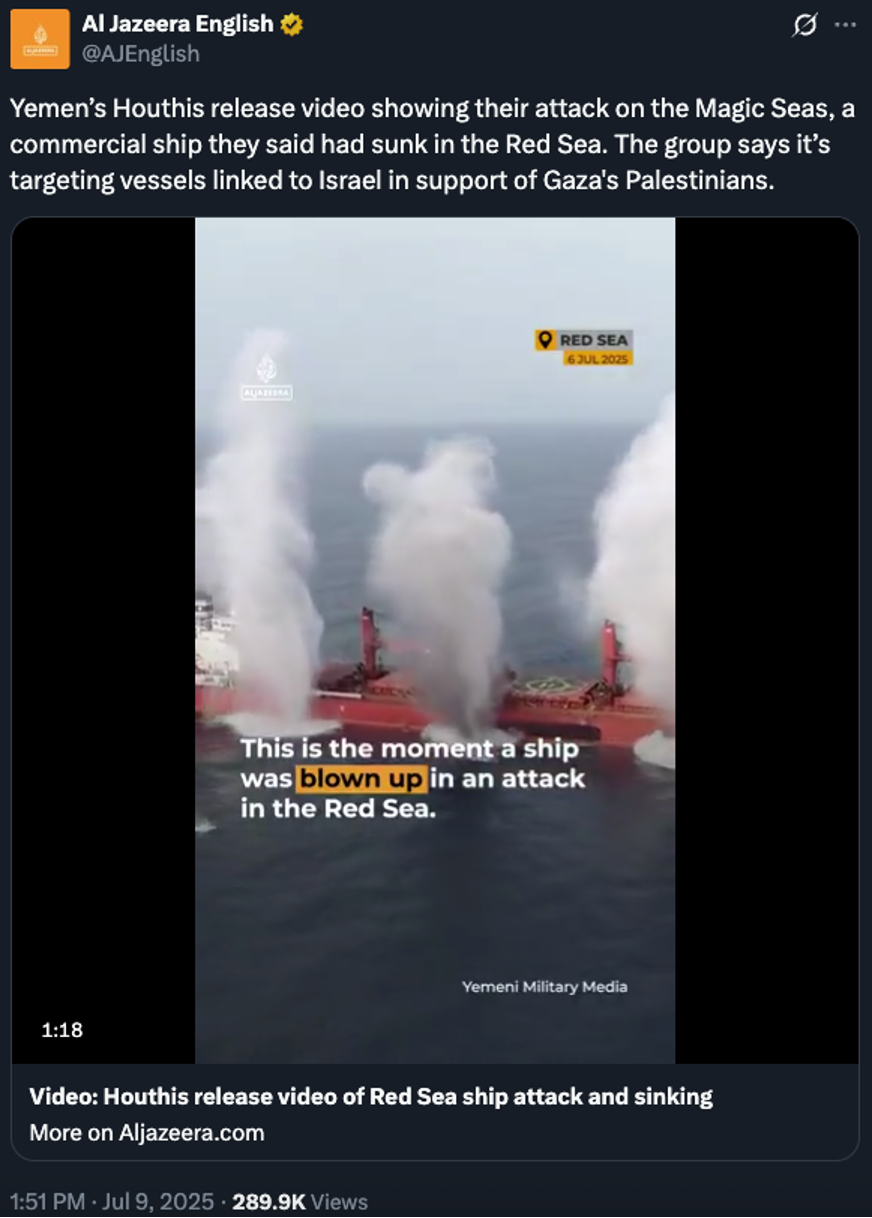

This is one of your periodic reminders that global shipping through the Red Sea and the Suez Canal is still balled up.

This is one of your periodic reminders that global shipping through the Red Sea and the Suez Canal is still balled up.

In early 2024, the Houthi faction that rules most of Yemen started harassing Israel- and U.S.-linked ships transiting the slender Bab-al-Mandeb waterway at the south end of the Red Sea — an act of solidarity with the Palestinians in the Gaza Strip.

As a result, much of Western shipping that once transited the Suez Canal is taking the long way around Africa — as it did before the canal was completed in 1869.

Earlier this year after an Israel-Hamas cease-fire fell apart, U.S. forces started a major bombing campaign in Yemen. The Houthis responded to considerable effect. They downed several MQ-9 Reaper drones costing over $30 million each. Meanwhile, evasive maneuvers by U.S. aircraft carriers resulted in two fighter jets sliding off the deck and into the drink.

Then the Trump administration negotiated a separate peace with the Houthis: The Israelis were not a party to it.

Fast-forward to this week and for the first time this year, the Houthis started attacking commercial ships bound for Israeli ports…

And so the State Department is suggesting that Washington might start bombing the Houthis again “to protect freedom of navigation,” as spokeswoman Tammy Bruce put it. Israeli officials are egging on the Trump administration, saying it “can no longer remain solely an Israeli problem.”

As I said when Joe Biden was still president, it would be easy to end all of this with one phone call like Ronald Reagan made in 1982. But Biden didn’t have it in him and neither does Trump…

![]()

Lemonade Bait Stand Tyranny

It wouldn’t be summer if we didn’t have a 5 Bullets story about lemonade-stand law enforcement.

It wouldn’t be summer if we didn’t have a 5 Bullets story about lemonade-stand law enforcement.

It’s been a staple of ours for years — youngsters getting their first taste of entrepreneurship, only to be stymied by snitches and busybodies and Karens who notify the zoning board or the health department or whatever. (It even happened to Jerry Seinfeld’s son 10 years ago in the Hamptons!)

Now an alert reader has tipped us off to a variation on the theme…

“A teenage boy’s fishing bait stand, stocked with worms, sodas and candy, is a threat to government order,” says a report by the farm-oriented TV newscast AgDay.

(Love how they can barely conceal their contempt for the bureaucrats!)

“Max McKinney’s home-built, 6’x15’ shed perched at the end of his farm driveway in Spooner, Wis., has been deemed a zoning violation and shut down by county officials.”

McKinney is in an ideal location for such a venture — a touristy spot in the northwest of the Badger State.

Alas, Washburn County zoning authorities have issued a cease-and-desist order — complete with a threat of daily fines if he fails to comply.

“It’s hard to believe,” says the 15-year-old McKinney — who hoped to squirrel away the proceeds and put them toward medical school. “I’m angry and sad at the same time. I thought I was working hard and doing the right thing. Instead, they say I broke their regulations.”

The regulations in question govern the presence of a “general merchandise store” in an area zoned “Residential Recreation.”

McKinney’s grandfather Tom Foss owns the property — and he’s disgusted.. “There’s no way this type of bureaucratic crackdown on a kid selling bait would have happened when I was a teen in the 1970s,” he tells AgDay.

“My grandson, Max, is the kind of kid this country needs more of.”

Amen. Whatever Max decides to do next, we wish him well…

![]() Mailbag: Socialism, Bias, Cynicism

Mailbag: Socialism, Bias, Cynicism

“Is it just me, or should all citizens be concerned when the Pentagon starts investing in privately held or publicly traded companies?” a reader writes after yesterday’s edition spotlighting the news about MP Materials.

“Is it just me, or should all citizens be concerned when the Pentagon starts investing in privately held or publicly traded companies?” a reader writes after yesterday’s edition spotlighting the news about MP Materials.

“This is how China, Russia and Venezuela operate. We've stooped that low? Please, 5 Bullets team, explain to me how this is not far overstepping the bounds of ‘free marketing capitalism’ and entering us into very disconcerting times.”

Dave responds: I share your concern. I raised that concern when I first broached the Trump administration’s plans in late April. Kinda blurs the line between crony capitalism and fascism, no? (Or is it the strict definition of socialism — state ownership of the means of production? Strange times these are…)

But there’s literally nothing you can do about it. (Write your congressman? Please.)

As I also wrote at the time, you can’t let your politics affect your investing decisions. Like it or not, politicians and bureaucrats make decisions every day that alter the flows of billions of dollars. Successful investing means positioning yourself so you can capture some of those flows, whatever you might think about government’s role in the economy…

“Your analysis always appears biased against what the administration is doing,” a reader writes.

“Your analysis always appears biased against what the administration is doing,” a reader writes.

That’s literally all the email said.

Another reader wrote a few days earlier that with my take on the Big Beautiful Bill, I was effectively “spewing propaganda like CNN and MSDNC!”

Perhaps this individual wasn’t around last year when people thought I was in the tank for Trump.

Oh, well. It’s an occupational hazard. Generally speaking, whoever’s in charge, I’m agin’ ‘em.

Although I’ve gotten saltier about it since the 2008 and 2012 campaign cycles…

Which brings us to one more email from a longtimer about “the cynicism issue”...

“I’ve read with great interest Dave’s self-bio and him addressing his “cynical” side 😊

“I’ve read with great interest Dave’s self-bio and him addressing his “cynical” side 😊

“I’ve always enjoyed Dave’s brief glimpses into his personal life. As I read about your background in your career, I conjured up this image of Dave.

“Knowing he is an ELP (Emerson, Lake & Palmer) fan, your (his) emoji should be the Tarkus album cover of a tank-like armadillo.

“But come on, you REALLY need a fantasy football team. Now, there’s where that cynicism would really come in handy! LOL”

Dave: Hmmm…

Sorry, I’m much too casual of a football fan to ever take up fantasy leagues. I’d have to immerse myself in stats, highlights, etc. if I wanted to do it right. Go big or go home!

Have a good weekend,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets