Wall Street Buried Intel

![]() From Obit to Opportunity

From Obit to Opportunity

Last year, Intel’s obituary was practically written.

Last year, Intel’s obituary was practically written.

When INTC shares plunged below $20 after disastrous earnings in August 2024, analysts dismissed the onetime king of U.S. semiconductors as “dead money.”

The company had lost its footing in AI, ceded ground to Taiwan Semiconductor (TSMC) and was lugging around a costly foundry business nobody took seriously.

But as Paradigm’s science-and-technology expert Ray Blanco recounts: “Sometimes the most hated stocks become the most essential.”

Over the past few weeks, that shift has come into focus with Washington, Tokyo and Silicon Valley suddenly circling Intel.

Everything changed with one headline on Monday: Bloomberg reported that the Trump administration was in talks to take a 10% stake in Intel.

Everything changed with one headline on Monday: Bloomberg reported that the Trump administration was in talks to take a 10% stake in Intel.

“The mechanism is elegant,” says Ray. “Instead of writing a check, the government would convert Intel's $10.9 billion in CHIPS Act grants into equity.

“Instant ownership without new spending. And instant validation that Intel isn't just another semiconductor company — it's critical infrastructure.”

More than that, it was instant validation of Intel’s role as the only American company capable of manufacturing advanced chips inside U.S. borders.

Within days of the Bloomberg report, SoftBank added fuel to the fire. The Japanese tech giant dropped $2 billion on Intel stock at $23 per share.

“This isn’t charity,” Ray says. “SoftBank already owns Arm Holdings, Intel’s design rival. They understand this ecosystem better than anyone.” If a player of that caliber decides to spend billions, Intel gains credibility fast.

“By the way, [the Trump administration] just negotiated 15% revenue-sharing deals with NVIDIA and AMD for China sales,” says Ray.

“By the way, [the Trump administration] just negotiated 15% revenue-sharing deals with NVIDIA and AMD for China sales,” says Ray.

That’s a stiff penalty on future exports, especially since “these aren’t even Nvidia’s best chips — they’re neutered versions designed to comply with export restrictions.”

Here’s the kicker: “What if Trump uses this penalty as leverage to push AMD and Nvidia to manufacture those China‑bound chips at Intel instead? ‘No penalty if made at Intel.’”

Such a maneuver would do three things at once…

- First, it hands Intel exactly what it lacks: “major customers for its foundry business — what commercial real estate agents call ‘anchor tenants’”

- Second, it gives Nvidia and AMD a way to reduce their financial burden without ceding ground in China

- And third, it brings more advanced semiconductor production back to American soil.

“That would be textbook Trump dealmaking,” Ray says: “Use the stick to create the carrot that solves multiple problems simultaneously.

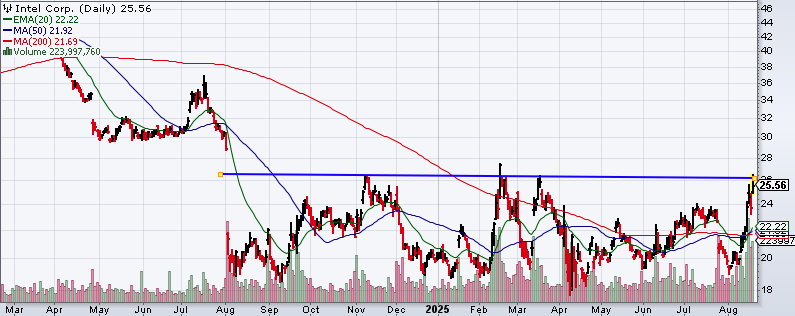

“From a chart perspective, Intel is approaching a critical inflection point,” adds Ray. “The stock is testing resistance around $26 — a level that's been capped multiple times over the past year.

“From a chart perspective, Intel is approaching a critical inflection point,” adds Ray. “The stock is testing resistance around $26 — a level that's been capped multiple times over the past year.

“A clean break above $26 opens the door to $30, filling the gap from last August's crash,” he says.

The blue horizontal line: Intel’s $26 resistance level

“That $30 level isn't arbitrary,” he continues. “It represents a pre-crisis valuation before Intel's AI struggles became apparent.

“With government backing and SoftBank validation, that level looks achievable again.

“Sometimes the most hated stocks become the most essential when the world changes around them,” Ray concludes. “Intel just showed us that it is considered too big to fail.

“That's exactly the kind of transformation that creates massive investment opportunities for those positioned early.”

![]() Mr. Market’s Sugar High

Mr. Market’s Sugar High

During his final Jackson Hole speech as Fed chair, Jerome Powell hinted this morning at a potential policy pivot — if the data cooperate, of course.

During his final Jackson Hole speech as Fed chair, Jerome Powell hinted this morning at a potential policy pivot — if the data cooperate, of course.

He points out the labor market is still (relatively) tight and inflation has cooled from its pandemic peak, albeit *checks notes* inflation remains “somewhat elevated.”

Powell danced around the topic of interest rates, saying the shifting balance of risks “may warrant” changes, subtly planting the seed that rate cuts could be on the table as soon as September.

He insists the Federal Open Market Committee is sticking to its religion of data-driven decisions, not influenced by politics — even though President Trump has been clamoring for rate cuts. But Powell (exasperatedly?) stands behind the Fed’s dual mandate: balancing employment and price stability.

In the end, Powell’s speech was all about keeping options open; no wild rides, just the usual cautious maneuvering. At his final curtain bow in Jackson Hole, it’s clear he wants to be remembered as the guy who tried, at the very least, to soft land the plane.

Does the Fed have Wall Street’s back again? The market certainly seems to think so… Stocks are rallying today with the Dow gaining 2% to 45,700 while the tech-heavy Nasdaq (+1.85%) and S&P 500 (+1.60%) are up to 21,490 and 6,470 respectively.

Does the Fed have Wall Street’s back again? The market certainly seems to think so… Stocks are rallying today with the Dow gaining 2% to 45,700 while the tech-heavy Nasdaq (+1.85%) and S&P 500 (+1.60%) are up to 21,490 and 6,470 respectively.

But it’s a different story for crude; oil’s slightly in the red at $63.50 for a barrel of WTI. Precious metals, on the other hand, are getting some love. The price of gold is up almost 1% to $3,413.10 per ounce, and silver’s gained 2.25%, just under $39 now.

The crypto market, which has been hammered this week, is likewise soaring: At the time of writing, Bitcoin’s up 3.85% to $116,500 while Ethereum’s up an impressive 9.5% to $4,635.

![]() Money on the Move

Money on the Move

For much of the past year, the stock market has been propelled by a familiar group of mega-cap tech giants.

For much of the past year, the stock market has been propelled by a familiar group of mega-cap tech giants.

“Companies like Apple, Microsoft, Nvidia and Tesla captured investor attention,” says Paradigm’s retirement-and-income specialist Zach Scheidt. “Artificial intelligence and cloud computing fueled a wave of enthusiasm, lifting these household names even as economic uncertainty lingered.”

But now that dominance appears to be fading. “The once-untouchable highflyers are showing cracks,” Zach explains. With profit-taking emerging, investors are rotating toward new opportunities.

“This doesn’t spell doom for technology,” he adds, “but it does flash a warning sign. For many investors, now is the time to take some gains off the table.”

Where is that money going? One surprising development is a renewed interest in smaller technology firms.

“Instead of the giants with enormous valuations, attention is turning toward niche companies with unique patents, specialized AI tools or newly commercialized technologies,” Zach notes. These early players may hold more upside than the familiar titans.

But the rotation story doesn’t end with tech…

“Two areas stand out to me in particular: biotech and homebuilders,” Zach says.

“Two areas stand out to me in particular: biotech and homebuilders,” Zach says.

“For years, biotech stocks have been stagnant, weighed down by regulatory uncertainty, high research costs and a lack of enthusiasm compared to flashier tech themes.

“The result has been a buildup of pressure beneath the surface.”

Compressed valuations create “a powerful setup whenever momentum returns.” For broad exposure, Zach points to the iShares Biotechnology ETF (IBB).

Homebuilders are also gaining traction. “Housing affordability looks bleak,” Zach admits, “but markets often price in change early.” If interest rates fall, home demand could rebound sharply. ETFs including ITB and XHB offer straightforward sector access.

“In this environment,” Zach concludes, “flexibility is key. The market is rotating — and recognizing where the money is flowing next is how investors stay ahead.”

![]() A Nord Stream “Saboteur” Is Arrested

A Nord Stream “Saboteur” Is Arrested

The Nord Stream pipeline sabotage will stand as one of the most instrumental events in 21st-century history.

The Nord Stream pipeline sabotage will stand as one of the most instrumental events in 21st-century history.

On Sept. 26, 2022, underwater explosions tore through three of the four Nord Stream natural gas pipelines running beneath the Baltic Sea between Russia and Europe. These pipelines had been a key conduit for Russian natural gas supplies to Germany and much of Western Europe since Nord Stream 1’s launch over a decade ago.

The blasts unleashed massive gas leaks near Denmark’s Bornholm Island; in fact, it was the largest natural gas leak ever recorded. Moreover, the damage pushed an already fraught geopolitical conflict into new territory.

The incident occurred amid rising tensions triggered by Russia’s invasion of Ukraine in early 2022. And though the explosions were unmistakably acts of sabotage — confirmed via explosive residue and seismic data — the saboteur who executed the attacks remains fiercely contested.

Bear in mind, the U.S. long opposed Nord Stream 2’s completion, fearing it would deepen Europe’s energy dependence on Moscow, thereby enhancing Russia’s leverage in the region.

On the record: Former Secretary of State Condoleezza Rice at German channel N24 about U.S. energy aspirations (May 16, 2014).

More specifically, President Joe Biden publicly promised to “bring an end” to the Nord Stream 2 pipeline if Russia were to invade Ukraine.

In February 2023, Pulitzer Prize-winning investigative journalist Seymour Hersh published a report naming the U.S. Navy as the perpetrator, with divers planting explosives during covert NATO operations months before the invasion.

In February 2023, Pulitzer Prize-winning investigative journalist Seymour Hersh published a report naming the U.S. Navy as the perpetrator, with divers planting explosives during covert NATO operations months before the invasion.

Hersh cited secret planning within the Biden administration, a collaboration with Norway and a use of modified submarines — all vehemently denied by U.S. officials. (Despite Hersh’s impressive track record of major scoops, he was branded a “c” word.)

Complicating matters further, Western media and the CIA floated a narrative involving a “pro-Ukrainian” team using a rented yacht, the Andromeda, to deploy explosives. Critics, however, question the plausibility of this theory due to extreme technical challenges.

Just how implausible? A report published in August 2024 details how German news network ARD chartered the Andromeda, discovering the 49-foot yacht was poorly maintained and ill-equipped for the complex task of attaching explosives 260 feet underwater — a mission that would have required a team of expert divers and specialized gear, possibly including a crane and decompression chamber.

Courtesy: NDR

Damage to the Nord Stream pipeline

The Andromeda was so unseaworthy, by the way, that the captain and crew pulled the plug on ARD’s Baltic Sea investigation, hiring a “professional” vessel instead.

Which brings us to Wednesday, Aug. 20, 2025: Italian authorities arrested Serhii K., a former Ukrainian military officer, accused of leading the sabotage team behind the Nord Stream pipeline attacks. German prosecutors allege he commanded a group including two soldiers and four civilian divers, covertly recruited by a Ukrainian military unit, to plant explosives on the pipelines

Ukraine, meanwhile, continues to deny involvement; that said, the arrest this week marks the first legal action implicating a patsy — er, suspect — in the Nord Stream operation. Stay tuned…

![]() Stupid Rebranding Tricks

Stupid Rebranding Tricks

Earlier this year, the cable news network MSNBC decided it was time for a major rebrand.

Earlier this year, the cable news network MSNBC decided it was time for a major rebrand.

For context, MSNBC was formed from a partnership in 1996 between Microsoft and NBC News. This collaboration saw Microsoft investing $220 million for a 50% stake in the cable channel.

The idea was to create a news outlet that could leverage both NBC’s traditional broadcast capabilities and Microsoft’s internet expertise. Its name: a portmanteau, combining “MSN,” Microsoft's internet brand, with the peacock network.

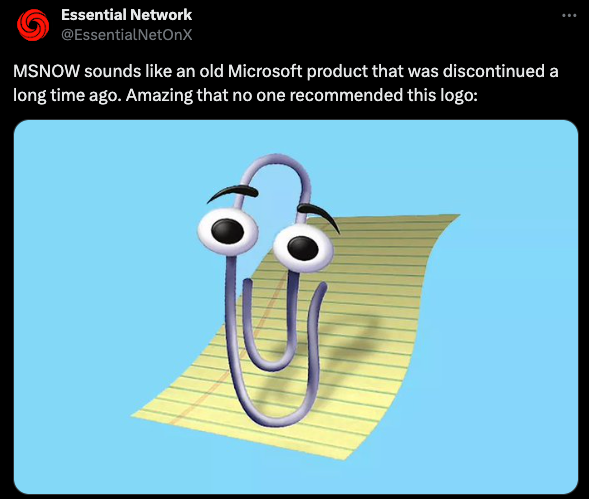

Now, almost three decades later, the move to rebrand as MS NOW — which stands for My Source News Opinion World — marks a break from that original tech-news identity as the network spins off from NBCUniversal, dropping both the original name and the iconic peacock logo.

Sounds very corporate and strategic, right? But the chosen web domain for MS NOW (namely, msnow.com) actually links to a South Korean site explaining… snowmobiles.

Despite MSNBC’s big announcement, the debacle highlights how critical domain checks are. To say nothing of the ill-advised name selection…

Another social media wag quips: “So… is there a Mr. Now?”

On that note, happy Friday! Take care, and enjoy your weekend.