James Altucher: Back on the Bitcoin Train

![]() Altucher: Back on the Bitcoin Train

Altucher: Back on the Bitcoin Train

Wait, what?

Wait, what?

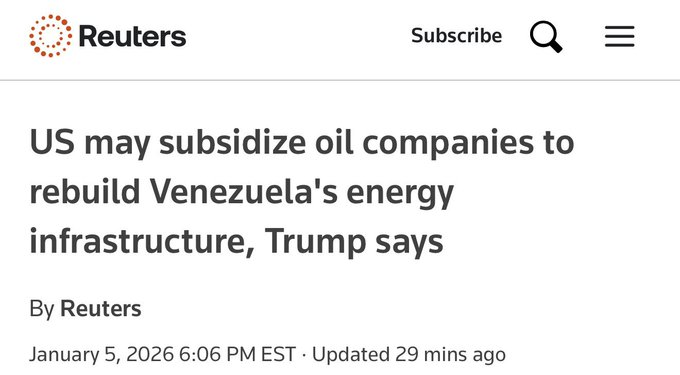

From the Reuters newswire: “The United States may subsidize oil companies to enable them to rebuild Venezuela's energy infrastructure, President Donald Trump said in an interview with NBC News on Monday.”

Trump told NBC that reviving the Venezuelan oil industry will require “a lot of money.

“A tremendous amount of money will have to be spent and the oil companies will spend it, and then they’ll get reimbursed by us or through revenue.”

Well, I guess that answers the question we were pondering yesterday: What incentive do U.S. oil firms have to sink prodigious amounts of capital into rebuilding Venezuela’s oil industry when oil prices sit near five-year lows?

Well, I guess that answers the question we were pondering yesterday: What incentive do U.S. oil firms have to sink prodigious amounts of capital into rebuilding Venezuela’s oil industry when oil prices sit near five-year lows?

I confess to a lack of imagination. My limited mind did not allow for the possibility that the administration might resort to soaking the U.S. taxpayer — handing their hard-earned dollars to Exxon, Chevron et al.

And so, on further reflection, I take back what I said yesterday — about how investing in post-Maduro Venezuela would be like investing in post-Saddam Iraq in 2003 or post-Gaddafi Libya in 2011.

There will be plenty of moneymaking opportunities coming out of this regime-change op — even if Venezuela sinks into chaos, with leftist paramilitaries sabotaging the pipelines to ensure the Yanquis are deprived of the country’s oil wealth.

Yesterday, our James Altucher convened an urgent “all-hands” strategy session with his analysts to discuss the post-Maduro landscape. Out of respect for his paying subscribers, I won’t say too much about the recommendations that came out of this livestream…

…but I can reveal this much: Venezuela has put James back on the Bitcoin train.

…but I can reveal this much: Venezuela has put James back on the Bitcoin train.

If you’ve been with us for a while, you’ll recall James sold all his Bitcoin in early 2022 — having first recommended it in 2013 at a mere $114.

His rationale for selling? “When I make an investment, the one thing I want to make sure of is managing my risk,” he said at the time. “With crypto now, I need to see it being used by people [because] it makes their lives better. But nobody really needs to use Bitcoin…”

In other words, he saw more potential in Ethereum and a select few alt-coins that are actually used to conduct commerce. Bitcoin, in contrast, was evolving into digital gold — a reserve asset that you accumulate as a hedge against geopolitical or societal or currency turmoil.

Which is exactly what Venezuela is experiencing now, right?

“When countries go through moments like this,” says James this week, “people don’t wait around to see what happens to their currency or their savings. They move into assets that sit outside the system.

“When a local currency fails, people don't wait for a new government— they move to the only asset the state can’t seize or inflate.

“This could be a large adoption event, and one more catalyst for mass crypto adoption.”

To be sure, the crypto space enjoyed a big pop after Maduro’s capture on Saturday — and those gains are sticking more than 72 hours later, with Bitcoin approaching $94,000 and Ethereum a shade below $3,300.

More insight from James follows immediately…

![]() Hyundai’s Humanoid Robot

Hyundai’s Humanoid Robot

The big highlight so far this week at the Consumer Electronics Show in Las Vegas fulfills a prediction James Altucher made in this space on New Year’s Day…

The big highlight so far this week at the Consumer Electronics Show in Las Vegas fulfills a prediction James Altucher made in this space on New Year’s Day…

“Hyundai Motor Group says it will roll out human-like robots in its factories from 2028,” reports the BBC, “as major companies race to use the new technology.”

The company’s robot, named Atlas, showed its stuff on the convention floor yesterday — including the capacity to lift 110 pounds. Hyundai says it “plans to integrate Atlas across its global network.”

Time was that James Altucher wasn’t sold on humanoid robots. Then it dawned on him, as he explained in our New Year’s Day special edition: “The entire world has been constructed to fit 8,000,000,000 5’8”, two-armed, two-legged humans.

“If you want a robot that can vacuum, make a bed, cook, pack goods, stack shelves, move objects down hallways, climb stairs, open doors and work inside spaces already optimized for people… you don’t redesign the world.

“You redesign the worker. That worker is humanoid.”

James points out there were fewer than 1,000 humanoid robots worldwide in 2023 — a number that grew to 25,000 by last year.

He expects that number to swell to 100,000 this year… and a million next year. Critical mass.

“Humanoid robots solve a problem governments, corporations and societies cannot solve any other way,” he says. “And that’s before we account for use cases we haven’t even imagined yet.”

![]() The Floor Under Silver

The Floor Under Silver

Silver is back within sight of $80 an ounce — with two big drivers behind it here in early January.

Silver is back within sight of $80 an ounce — with two big drivers behind it here in early January.

On New Year’s Day, the Chinese government implemented a new export-licensing scheme for silver.

“That means 60–70% of the globally traded refined supply will require Beijing’s permission to leave the country,” writes money manager Charlie Garcia. China needs that silver to build out its solar-panel and electric-vehicle capacity.

And it’s not as if the rest of the world can wave a magic wand to spin up new production.

Garcia reminds us there’s very little “primary” silver mining. Most silver production is a byproduct from gold mining, copper mining and so on. “This means you can’t just ‘mine more silver’ because silver prices went up,” Garcia writes for MarketWatch. “You’d have to mine more copper first.”

Meanwhile… Bloomberg will steadily recalibrate its Bloomberg Commodity Index starting on Thursday and continuing into next week. Because silver soared 147% during 2025, its weight in the index will rise from 4% to around 9%. There’s a lot of institutional money tied to this index, and it is moving into silver ahead of this shift.

Yes, both of these developments are known quantities and have been for weeks. They’re not anything actionable. But they do have the effect of keeping a floor under the silver price.

Even the most pessimistic observers we follow think the floor on silver is now $50 — which we’ll remind you is where silver was trading only three months ago before this furious rally.

Checking our screens, silver is now back over $80 for the first time since last week — up $3.73 today alone.

And gold is up $29 to $4,477 — the highest since a steep sell-off a week ago Monday.

It’s going to be a nail-biter, but today might be the day the S&P 500 sets a record close.

It’s going to be a nail-biter, but today might be the day the S&P 500 sets a record close.

The last one came at the end of the abbreviated Christmas Eve trading session — 6,932. At last check, the index rests at 6,933 — up a half-percent on the day. The Dow is also firmly in the green at 49,179 — on track to top yesterday’s record. The Nasdaq is also staging a modest rally, but it has work to do before exceeding its late-October highs.

The Venezuela-fueled burst of enthusiasm for energy stocks we saw in yesterday’s trading is cooling off: Chevron is down nearly 3%, Exxon down 1.2% and the XLE ETF down 1.4%.

Crude, meanwhile, is little changed at $58.15.

![]() Comic Relief

Comic Relief

Wow, and people call me a cynic…

Wow, and people call me a cynic…

And speaking of Venezuela…

![]() Mailbag: Venezuela, Kimmel

Mailbag: Venezuela, Kimmel

“A most excellent single-issue piece you did there on that boneheaded gangsta move on Venezuela. Spot-on!!” a longtime reader writes after yesterday’s edition.

“A most excellent single-issue piece you did there on that boneheaded gangsta move on Venezuela. Spot-on!!” a longtime reader writes after yesterday’s edition.

“You and I have been around long enough to know that funny things can and will happen on the way to the forum. In other words, look out for the myriad of unintended consequences.”

“I thought this was an investment publication not let’s-kick-Trump’s-ass publication,” counters a critic.

“I thought this was an investment publication not let’s-kick-Trump’s-ass publication,” counters a critic.

“Yes, oil is important and several oil companies are owed billions of dollars by Venezuela and this has been adjudicated.”

Another critical email, more measured: “The idea of ousting Maduro wasn't just a Trump idea. Biden thought about it but didn't have the control of his administration or the backbone.

“Ousting Maduro seems to be because of a myriad of reasons, probably even more deeper than you even know. The players including China, Russia, Iran/Hezbollah at least. It has to be agreed that these players in our backyard have to be corrected!

“The USA has been involved in so many conflicts far away. It's about time we keep our hemisphere safe from these bad actors.”

Dave responds: To the first point, American companies do business overseas and get hosed by foreign governments all the time. It’s a risk that comes with the territory of operating in countries where the rule of law isn’t followed in the way you and I typically think of it.

Do you seriously propose that U.S. special forces be deployed every time some tinhorn dictator gives the shaft to a Fortune 500 company?

Meanwhile… to whatever extent China, Russia and Iran are meddling in the Western Hemisphere, it’s a response to many decades of U.S. meddling in those nations’ backyards.

And that U.S. meddling is nowhere near over: Trump continues to arm Ukraine. He’s threatening once more to bomb Iran. He continues to station nearly 80,000 troops in Japan and South Korea that China sees as a direct threat. (There is no remotely comparable Chinese presence on our doorstep.)

One more thought…

“Great article, Dave. I struggle with the freedom of speech/censorship debate. In the end, I just want the truth! I can handle the truth!” a reader writes after we revisited the Jimmy Kimmel kerfuffle over the holidays.

“Great article, Dave. I struggle with the freedom of speech/censorship debate. In the end, I just want the truth! I can handle the truth!” a reader writes after we revisited the Jimmy Kimmel kerfuffle over the holidays.

“Maybe we shouldn’t have censorship and strong-arm tactics as both the Republicans and Democrats have demonstrated they’re not afraid to use, but there may be a better way to do this:

- Require news outlets to double-source with names in published reports

- Eliminate anonymous sources as a means to establish legitimacy for whatever is in the article. If a news outlet won’t subject themselves to those two requirements, then they have become an opinion outlet and a banner should run above them with the following quote during their broadcast: ‘This segment does not follow proper journalistic practices and should be considered opinion and LIKELY UNTRUE’

- If something that is reported and double-sourced is not true, the Justice Department can go after the sources and not the news outlet.

“Maybe that will clean up the disinformation and propaganda being sold as truthful news.”

Dave: In effect, you’re proposing every news outlet register with the feds — and that they’d be licensed to practice their trade.

Your intentions are noble — but you’re putting even more power in the hands of Washington, D.C. bureaucrats than they already have!