An “Extremely Fragile” Market

![]() An “Extremely Fragile” Market

An “Extremely Fragile” Market

It was a little unnerving watching Paradigm’s latest livestream event this afternoon. It wrapped up only moments ago.

It was a little unnerving watching Paradigm’s latest livestream event this afternoon. It wrapped up only moments ago.

“The market is extremely fragile right now,” said Mason Sexton, a market veteran of nearly 50 years experience with a history of uncannily accurate calls.

“And it would not surprise me at all if stocks were to fall 30–40%.”

The process could begin as early as this Friday. At the very latest, you’ll want to position yourself for a jolt before Tuesday March 3.

If that’s enough to grab your attention, you can watch the replay of our event called The Prophecy 2026 right here.

If you’re skeptical, that’s understandable. After all, the S&P 500 is only 2% off its all-time high — a lofty level that’s barely a month in the rearview.

But you could have said the same thing in the spring of last year — right before the S&P collapsed nearly 19%.

But you could have said the same thing in the spring of last year — right before the S&P collapsed nearly 19%.

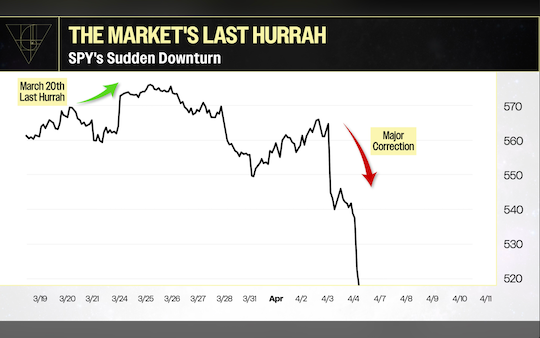

Here’s a chart I pulled straight from Mason’s presentation…

Maybe you recognize that big tumble as the reaction to Donald Trump’s “Liberation Day” tariffs.

Mr. Sexton warned his readers that the period from March 20–24 would act as a “last hurrah” for the market before a “surprise shock.” Then on March 31, he warned the market would enter a “death zone” during the first week of April.

Then came the tariff announcement on April 2. The bottom fell out. In two trading days, the S&P 500 lost $5 trillion in market value — the sharpest drop since COVID.

How did he see it coming? His methodology is unique — but he’s used it to successfully call major turning points in the market for many decades. COVID… the financial crisis… the dot-com bust… the crash of 1987.

You get the idea; you dismiss his warnings at your own risk.

Again, time is limited in which to act. The danger window opens this Friday, Feb. 20. The last possible opportunity to take protective measures is Tuesday, March 3 — and by then it could be too late. So take the time to check out The Prophecy 2026 right away.

![]() Missing the Point Much?

Missing the Point Much?

Leave it to CNBC to miss the real news from one of its own exclusive interviews.

Leave it to CNBC to miss the real news from one of its own exclusive interviews.

Last week the network spoke with David Einhorn, founder of Greenlight Capital — who rose to fame betting against Lehman Bros. before it went bankrupt during the 2008 financial crisis.

CNBC’s article about the interview began with Einhorn’s expectation that the Federal Reserve will cut interest rates this year more than most experts expect — which gives him confidence in his gold bets. “I think by the time we get to the end of the year, it’s going to be substantially more than two cuts.”

But the real news is that Einhorn thinks gold is on its way to eclipsing U.S. Treasuries as a global reserve asset.

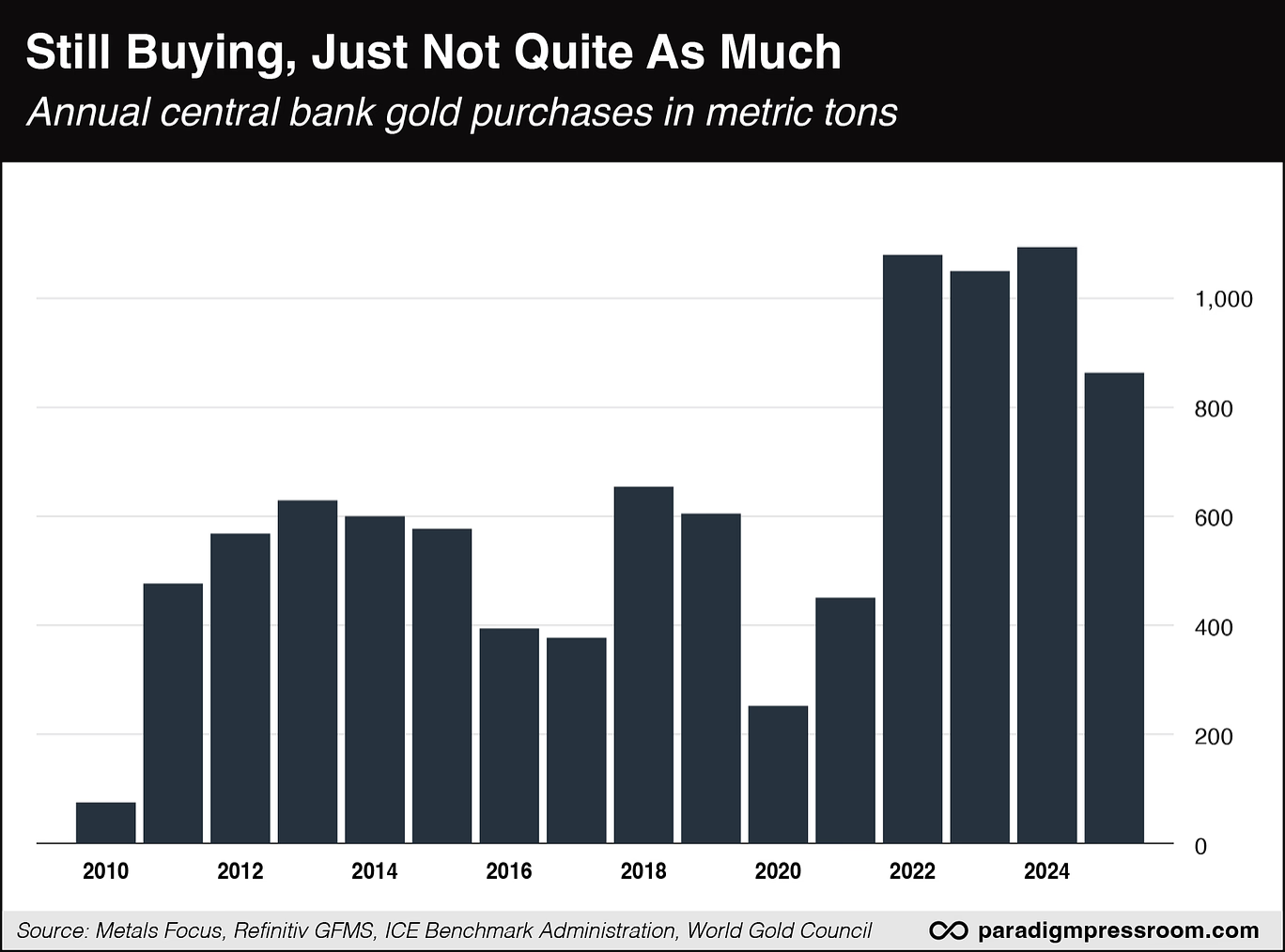

He cites the massive accumulation of gold by central banks since 2022 — something we’ve cited ourselves regularly. Here’s one of those charts we can’t show often enough…

"The Chinese have decided they want to, sort of want to compete on a currency basis,” said Einhorn. “The central banks around the world are buying gold. Gold is becoming the reserve asset as opposed to Treasuries, or it's kind of mostly even at this point.”

In addition, Einhorn said U.S. trade policy is “very unstable” and that Uncle Sam’s debt load is becoming unmanageable.

Einhorn’s firm has had gold positions for the better part of a decade — ever since the Midas metal bottomed around $1,050 an ounce in late 2015.

As for the immediate action in precious metals, it’s another down day.

As for the immediate action in precious metals, it’s another down day.

No one noticed amid the recent volatility, but on Friday gold notched its first weekly close over $5,000 an ounce. But selling hit hard yesterday in electronic holiday trading and it’s continued with the resumption of COMEX trading today.

At last check, the bid is down to $4,861. And silver is under $73, testing its lows at the start of this month.

The choppy action in crypto continues — Bitcoin a little over $67,000, Ethereum under $2,000.

As for the major U.S. stock indexes, not much to say: The Dow is flat, the S&P is down about a quarter-percent and the Nasdaq down about a third of a percent.

Oil prices are easing on reports of progress in U.S.-Iran talks.

Oil prices are easing on reports of progress in U.S.-Iran talks.

After a meeting in Geneva, Switzerland, Iran’s foreign minister Abbas Araghchi said the two sides came to terms on “guiding principles” for future negotiations. “The path for a deal has started,” he said.

So far, no comment from the U.S. side. And Araghchi didn’t get into details about whether Washington is insisting that Tehran give up its medium-range ballistic missiles — something Tehran will never do because it would amount to unilateral disarmament.

Amid that backdrop, a barrel of West Texas Intermediate is down nearly 1.5%, barely over $62. That’s at the bottom end of its trading range for the last three weeks or so.

![]() Racing Toward Trump’s Nuclear Deadline

Racing Toward Trump’s Nuclear Deadline

This is a performative stunt — bringing in the military seems like gilding the lily — but it does underscore the White House’s commitment to nuclear power.

This is a performative stunt — bringing in the military seems like gilding the lily — but it does underscore the White House’s commitment to nuclear power.

“The U.S. military airlifted a miniature nuclear reactor for the first time, part of President Trump’s push to deploy nuclear power across the United States,” says The Wall Street Journal.

“Three C-17 transport planes flew components of the Valar Atomics Ward 250 unfueled nuclear reactor from March Air Reserve Base, Calif., to Hill Air Force Base, Utah, on Sunday.”

The privately held Valar Atomics is one of the companies hoping to make hay with “small modular reactors” that can be built at their own factory and transported anywhere to produce electricity — in contrast with the 94 mega-reactors currently in operation around the United States.

No taxpayer funds were involved in this stunt; Valar picked up the cost of the flight. The firm plans to test the reactor at a site near the air force base. If all goes well, it could generate up to five megawatts — enough to power 5,000 homes.

A likely first customer would be the military. Pentagon official Michael Duffey says the reactors could provide power to a military base without relying on the grid — while overseas, the reactors “would mean U.S. forces could operate without concern that an enemy might cut fuel supplies.”

Donald Trump will be watching the progress of the testing closely. He’s set a goal of getting three small reactors “critical” — that is, running all its nuclear systems smoothly — by July 4.

![]() About Epstein and Fort Knox…

About Epstein and Fort Knox…

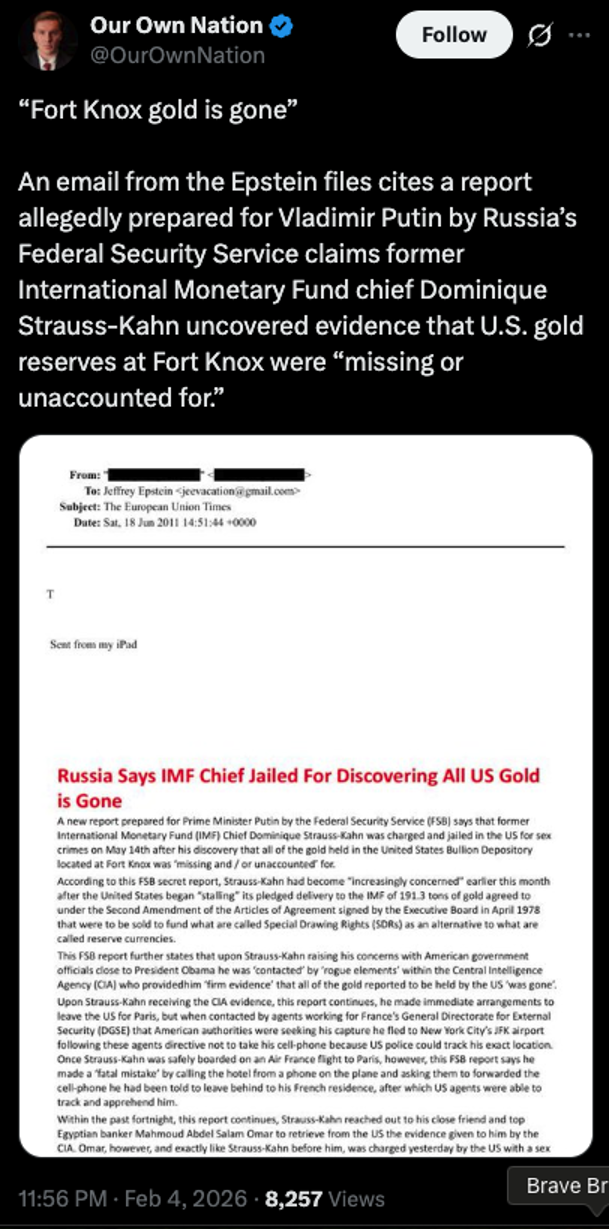

We’re seeing a lot of people on social media making way more out of this 2011 email to Jeffrey Epstein than they should…

We’re seeing a lot of people on social media making way more out of this 2011 email to Jeffrey Epstein than they should…

So, let’s back up a bit. It is true that a month before this email, Dominique Strauss-Kahn resigned as chief of the International Monetary Fund amid allegations he sexually assaulted a hotel maid in New York.

Later that summer (after this email) the charges were dismissed amid questions about the accuser’s credibility. But the scandal was enough to derail Strauss-Kahn’s ambitions to run for president of France in 2012.

In no way, however, does this email constitute smoking-gun evidence that “the gold in Fort Knox is gone.”

In no way, however, does this email constitute smoking-gun evidence that “the gold in Fort Knox is gone.”

The cut-and-pasted article came from The European Union Times — a website that 15 years ago was notorious for articles that were either clickbait or outright fabrications. I remember it well.

The fabrications that got the most circulation were republished from a site called “What Does It Mean.” Most of them were bylined “Sorcha Faal, as reported to her Western Subscribers.” And while that byline doesn’t appear in the email, the article follows a familiar pattern — “shocking” information attributed to one or another Russian intelligence service that’s never confirmed by another news outlet.

As the Grok AI engine summarizes, “they are classic hoax-style pieces blending real news snippets with wild, unsubstantiated claims about secret Russian intelligence, impending global catastrophes, anti-Western conspiracies, etc.” (It’s a poorly kept secret online that “Sorcha Faal” is a pseudonym for someone named David Booth.)

Still, the question remains: Who forwarded this fabricated article to Epstein and why?

Still, the question remains: Who forwarded this fabricated article to Epstein and why?

The sender’s name is redacted. The only text above the forwarded article is the letter “T” — which might be the sender’s signoff or perhaps it means something else.

Was the sender gullible enough to think the article was legit and worth Epstein’s attention? Did the sender think the article was bogus and sent it to Epstein for a good laugh? Or was the email validation of Look, this article is proof that our diabolical disinformation campaign is working!

(I mean, you can’t rule out that last one completely…)

Anyway… the question isn’t whether the gold in Fort Knox is “gone.” It’s whether the U.S. Treasury still has legal possession.

We explored that matter in depth last year once it was evident that nothing would come of the Trump-Musk chatter about an audit of Fort Knox.

![]() Mailbag: The 144-Year Cycle

Mailbag: The 144-Year Cycle

We heard from a couple of readers for whom our guest essay yesterday resonated: Mason Sexton unpacked a recurring 144-year cycle in financial history.

We heard from a couple of readers for whom our guest essay yesterday resonated: Mason Sexton unpacked a recurring 144-year cycle in financial history.

“Brilliant!” says one. “An eloquent presentation and detailed explanation of what is going on. Looking forward to Tuesday to find out how to ride the wave in this major transition.

Thank you so very much for including me.”

“Impressive and thought-provoking,” says another. “It gave structure and understanding to the seeming chaos and uncertainty of our time. This long-term overview of the patterns seen in society, economics, innovation, power and governance give a valuable framework for making one’s own long-term financial decisions.

“One can look at Warren Buffett’s recent restructuring of his vast wealth with greater understanding and appreciation. Thank you for this valuable input.”

Dave responds: You mean the fact Berkshire Hathaway was sitting on a record amount of cash at the time Buffett retired as CEO a few weeks ago?

On the one hand, that might be a function of Berkshire’s sheer size nowadays: An acquisition target would need to be worth tens of billions of dollars to make a difference. Few companies that size are reasonably priced and willing to sell.

On the other hand, the famous “Buffett indicator” — the total value of the U.S. stock market divided by GDP — sits at record levels.

Buffett once called this indicator "the best single measure of where valuations stand at any given moment." And at the current given moment, the stock market has never been more richly valued relative to America’s economic output.

So yes, that’s important context for Mason Sexton’s The Prophecy 2026 event — which, again, wrapped up just a short time ago. Time is short, given his outlook for an ominous market window that opens this Friday.