Countdown to War

![]() “Major War… Very Soon”

“Major War… Very Soon”

Crude is up 4.4% — over $65 a barrel — as the war drums beat louder in the Middle East.

Crude is up 4.4% — over $65 a barrel — as the war drums beat louder in the Middle East.

“The Trump administration is closer to a major war in the Middle East than most Americans realize. It could begin very soon,” says an Axios article by Barak Ravid.

“A U.S. military operation in Iran would likely be a massive, weeks-long campaign that would look more like full-fledged war than last month's pinpoint operation in Venezuela, sources say.”

Ravid’s byline carries the authority of someone who served in Unit 8200 — Israel’s version of the National Security Agency.

Seeing the latest developments this morning, my mind rewound to Paradigm’s exclusive event yesterday with Mason Sexton, The Prophecy 2026

There, he said the stock market looks “extremely fragile” with the potential for many familiar names to tumble 30–40%.

And then it hit me — something Mr. Sexton said during an event we convened with him almost a year ago.

And then it hit me — something Mr. Sexton said during an event we convened with him almost a year ago.

Last March he was expecting a steep downdraft in the market — which is exactly what happened in early April.

The catalyst turned out to be the president’s “Liberation Day” tariff announcement. But as Mason explained at the time, the market was primed for a fall and the catalyst could have been anything. One day I mused over the myriad possibilities. One of those possibilities was…

… Donald Trump unleashing the U.S. military on Iran.

I cited the independent journalist Ken Klippenstein: “President Trump’s menu of options for dealing with Tehran now includes one he didn’t have in his first term,” he wrote: “full-scale war…

“While a range of military options are often provided to presidents in a passive-aggressive attempt on the part of the Pentagon to steer them to the one favored by the brass, Trump already has shown his proclivity to select the most provocative option.”

Klippenstein said even nuclear weapons are on the table — according to “a retired senior military officer who has been briefed on the planning.”

Escalation to nukes would happen one of two ways: “One, with the CENTCOM commander ‘requesting’ the use of nuclear weapons, mostly to stave off Iranian conventional military success; and two, in a ‘top down’ order, that is, by the president, mostly as a ‘demonstration’ to ‘signal’ to Iran.”

And here we are, almost a year later.

Whatever the catalyst, Mason says the window for the coming market downdraft opens this Friday. Anytime between now and Tuesday, March 3 is when he expects something will throw the market for a loop.

If you want to see why he’s so certain, you owe it to yourself to watch a replay of The Prophecy 2026. Click here to start watching immediately.

More about Iran in Bullet No. 2…

![]() So Much for Negotiations

So Much for Negotiations

Really, you don’t need Axios to see which way the winds are blowing.

Really, you don’t need Axios to see which way the winds are blowing.

When we left you yesterday, U.S.-Iran talks in Geneva, Switzerland ended with Iran’s foreign minister saying there was a “clear path” to a deal. But we were awaiting word from the U.S. side.

Then Vice President Vance piped up. “It was very clear that the president has set some red lines that the Iranians are not yet willing to actually acknowledge and work through.”

Exactly what those red lines are, he didn’t say. Zero uranium enrichment? Surrender all medium-range missiles? Those are Israel’s red lines — and they’re non-negotiable from Tehran’s viewpoint.

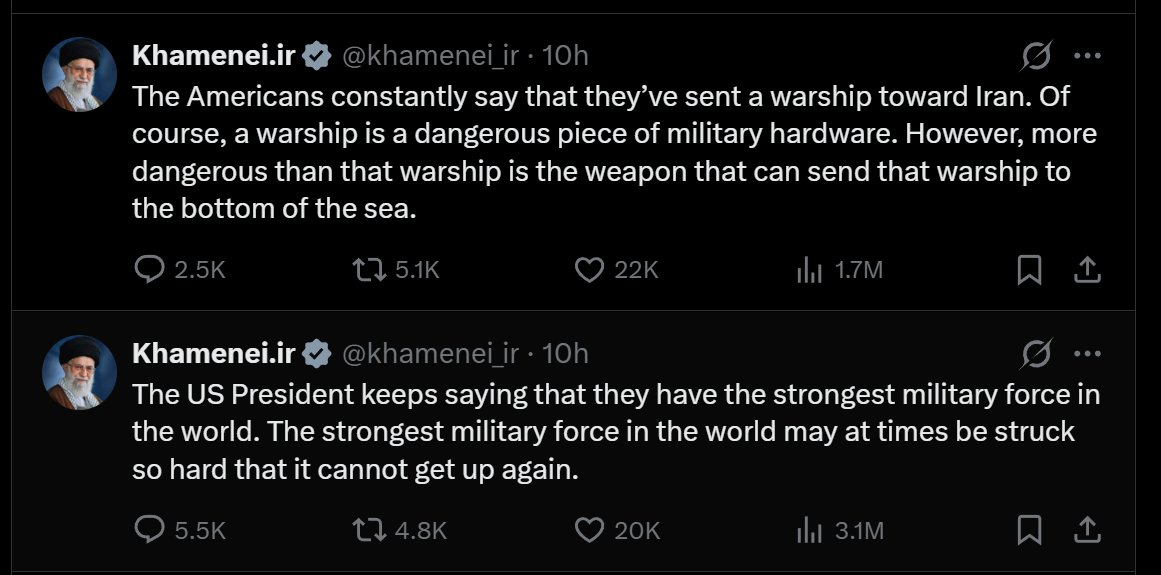

Speaking of Tehran’s viewpoint, the English-language social media feed of Iran’s Supreme Leader Ayatollah Ali Khamenei is on fire…

It will be several days before a second U.S. aircraft carrier arrives in the region — but war might well start before then.

It will be several days before a second U.S. aircraft carrier arrives in the region — but war might well start before then.

Even with only one U.S. carrier battle group in place, “the U.S. has now positioned in the Middle East a formidable array of assets to prosecute an air campaign against Iran,” tweets the military analyst Will Schryver.

As Schryver sees it, Israeli Prime Minister Benjamin Netanyahu will likely force the issue: “the magnitude of the force the U.S. has now concentrated to the region will not be seen again within Netanyahu's lifetime — and probably never.

“Therefore the Israelis have to make this happen NOW. And I doubt there are any limitations to what they might do to ensure they get the war they're looking for.

[Recall also that Israel launched its attack on Iran last year even while U.S.-Iranian talks were underway.]

“So Trump has backed himself into a corner from which there is no escape. He has congregated all the air and naval power the U.S. can assemble without perilously denuding its force posture elsewhere on the planet.

“And, short of the Iranians prostrating themselves and bathing his feet with tears and kisses, there is simply no way Trump cannot USE the large force he has gathered to make war against Iran.”

That’s even if he loses the substantial portion of the MAGA base that’s wary of U.S. intervention overseas…

Exactly what Washington’s objective is, we still don’t know. Ravid’s article sheds no light.

But Schryver says air power alone won’t be enough to disarm the Islamic Republic. To be continued…

![]() Software Insider Buy

Software Insider Buy

“After months of watching beaten-down software stocks get hammered, insiders are finally stepping in to buy their own shares,” says Davis Wilson of our sister e-letter The Million Mission.

“After months of watching beaten-down software stocks get hammered, insiders are finally stepping in to buy their own shares,” says Davis Wilson of our sister e-letter The Million Mission.

The collapse in software stocks this month has been one for the ages. The Salesforces, ServiceNows and Intuits of the world have been smoked on the narrative that AI is going to render many of their products obsolete.

Earlier in February, Paradigm trading pro Enrique Abeyta said many of these names were so beaten down that they’re worth “aggressively buying.”

Which brings us to this week: “Yesterday,” writes Davis Wilson, “a filing revealed that ServiceNow (NOW) CEO Bill McDermott entered into an agreement to purchase $3 million worth of company stock on Feb. 27.

“At the same time, he and several other top executives, including CFO Gina Mastantuono, terminated their 10b5-1 trading plans, which typically allow insiders to automatically sell stock over time.”

It brings to mind a saying attributed to Peter Lynch, the legendary manager of the Fideilty Magellan Fund: Insiders sell their shares for any number of reasons but there’s only one reason they buy — they expect the price will go up.

“Academic research consistently shows insider buying is one of the most reliable signals investors can follow,” says Davis. “Insider purchases tend to predict future outperformance, especially when multiple executives buy shares around the same time…

“I view this as a signal that it’s time to start nibbling at ServiceNow and other beaten-down software names.”

[“But what about Mason Sexton’s forecast?” you wonder. We’ll address that in today’s mailbag section…]

For whatever it’s worth, the software names are rallying today — leading the broad market higher.

For whatever it’s worth, the software names are rallying today — leading the broad market higher.

The iShares Expanded Tech-Software Sector ETF (IGV) is up 1.75% — and that’s helped give the Nasdaq a 1.1% boost. The S&P 500 is up three-quarters of a percent, back within spitting distance of 6,900. The Dow is the laggard, up a half percent.

Gold is back within $12 of the $5,000 mark while silver is up 5.5% to $77.48. But crypto is moving the other direction, Bitcoin now under $67,000 and Ethereum still under $2,000.

![]() Comic Relief

Comic Relief

The best humor has a foundation in the truth…

The best humor has a foundation in the truth…

![]() Mailbag: About Mason Sexton’s Prophecy…

Mailbag: About Mason Sexton’s Prophecy…

We got a couple of similar inquiries after yesterday’s edition — specifically about Mason Sexton’s The Prophecy 2026 event…

We got a couple of similar inquiries after yesterday’s edition — specifically about Mason Sexton’s The Prophecy 2026 event…

“The information presented this afternoon is likely to adversely affect many of the stocks that you have recommended to your customers. Will you be alerting your customers in a timely manner?”

Another: “Since the edge of the cliff begins to be in view in three days on Feb. 20, what should we expect for changes to Paradigm's stock recommendations?”

Dave responds: This is an important question — especially if you’re a newer reader of Paradigm Press publications.

The short answer: We don’t enforce a “company line” among our team.

True to our name, we ask only that our editors bring a rigorous paradigm to their work — a model of how the markets and the economy operate.

The last thing we want is for them to censor or second-guess themselves. You’ve paid good money for your subscription(s) and you deserve the editors’ unvarnished, no-holds-barred opinions.

On those occasions when their opinions diverge, we respect your intelligence enough to weigh those opinions and come to your own conclusions.

At times, we’ve even leaned into these divergences — as with our “gold vs. Bitcoin” debates pitting Jim Rickards against James Altucher in 2018 and again last year at the Paradigm Shift Summit in Nashville.

Now, specifically as it pertains to Mason Sexton’s outlook: Perhaps this won’t surprise you, but none of our other editors uses his one-of-a-kind methodology.

Now, specifically as it pertains to Mason Sexton’s outlook: Perhaps this won’t surprise you, but none of our other editors uses his one-of-a-kind methodology.

That said… all of our other editors are on alert — at all times — for events and hazards and black swans that might alter the thesis behind their buy recommendations.

After all, they know it’s your money on the line. Often it’s their money too.

Continue to follow the guidance of the publication(s) you subscribe to, as long as the ideas of the editor(s) continue to ring true for you. Their research is thorough and well-considered. They wouldn’t be on our team if they weren’t.

Thanks for the inquiries — and the reminder not only that we must earn our readers’ trust, but that we must earn that trust anew every day.