Gold & Silver: What Changed

![]() OK, time to take a deep breath…

OK, time to take a deep breath…

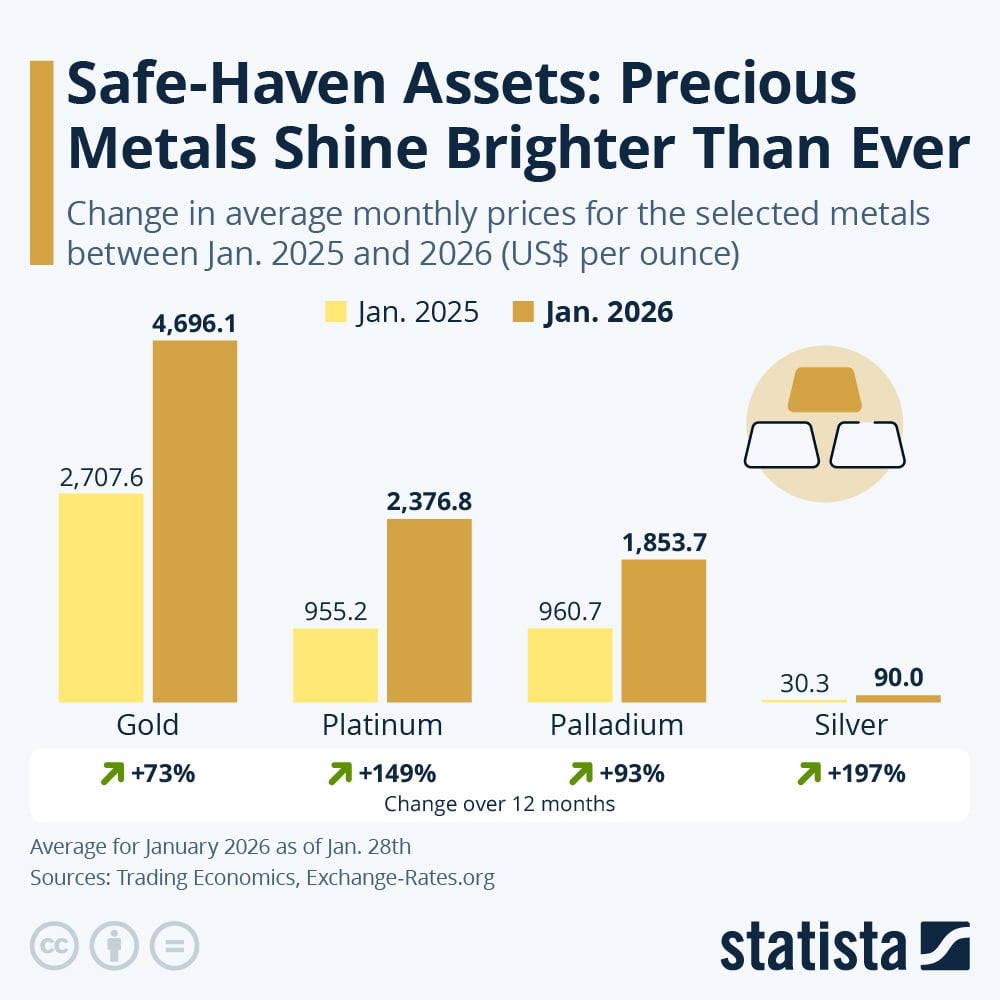

Yes, precious metals got whacked on Friday. They’re getting whacked some more today.

Let’s try to get some perspective as we look at our screens this morning. Gold is just under $4,700. That level was a record high way back on… Jan. 19. Two weeks ago.

Silver is a little over $80. That was a record high way back on… Dec. 28. Barely a month ago.

Meanwhile on X, author Lawrence McDonald reminds us that Microsoft’s share price is no higher today than it was in… March 2024.

Netflix shares trade today for the same price they did in November 2024. And by the same token you’d be at breakeven on Tesla shares held since [gulp] November 2021.

The metals had gone up too far, too fast. A reset was inevitable.

The metals had gone up too far, too fast. A reset was inevitable.

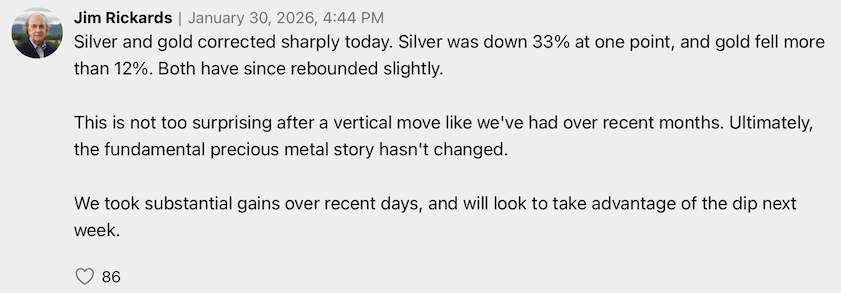

What do Paradigm’s top experts have to say now? Macro maven Jim Rickards weighed in Friday evening on the Paradigm mobile app…

Trading pro Enrique Abeyta is in broad agreement: “Despite the dramatic move last week and the volatility, we are likely to see in coming weeks, the multiyear bull market in silver is not at all over,” he writes in our Truth & Trends e-letter, set for publication later today.

“In fact, it may still be in its early innings.”

None of the factors that drove silver over $50 last year has changed: Supply is tight. Demand is growing. Confidence in fiat currencies both here and abroad is eroding.

The factors that drove silver from $50 to $120? Those did change. The first wave of price appreciation attracted the “momentum” crowd — people who don’t care about supply or demand or other factors.

“These investors do NOT care about the long-term reasons to be bullish silver,” Enrique says. “They only care that the price is going up.

“… and when the price stops going up? They sell.”

Simple as that. If you’re into silver for the long term, Jim and Enrique say hold on tight. Your patience will be further rewarded.

![]() Markets Today: Rare Earths and Oil

Markets Today: Rare Earths and Oil

As a new week begins, the momentum crowd that’s ditching silver is suddenly discovering rare earths.

As a new week begins, the momentum crowd that’s ditching silver is suddenly discovering rare earths.

“President Donald Trump is set to launch a strategic critical-minerals stockpile with $12 billion in seed money,” reports Bloomberg — “a bid to insulate manufacturers from supply shocks as the U.S. works to slash its reliance on Chinese rare earths and other metals.

“The venture — dubbed Project Vault — is set to marry $1.67 billion in private capital with a $10 billion loan from the U.S. Export-Import Bank to procure and store the minerals for automakers, tech firms and other manufacturers.”

As always in situations like these, the details are fuzzy. How much of this is new and how much of it is a continuation of Trump administration initiatives from last year? (We chronicled many of these initiatives here in 5 Bullets — and many Paradigm readers profited from plays on MP Materials and similar names.)

In any event, investors are bidding up many of the big rare earth names today. USA Rare Earth, for instance, is up 11.5%.

The broader stock market is starting the week in the green.

The broader stock market is starting the week in the green.

At last check the S&P 500 is up over half a percent to 6,980 — challenging last week’s peak. The Nasdaq’s gain is a bit stronger, the Dow’s stronger still.

The big economic number of the day is the ISM Manufacturing Index — which roared higher in January from 47.9 to 52.6.

Numbers over 50 suggest the factory sector is growing — under 50, shrinking. This figure has spent most of the last three years under that 50 watermark, so we’ll be on the lookout for a sustainable rebound.

Speaking of economic data, the Labor Department says there will be no January jobs report this Friday, owing to the “partial government shutdown” that began over the weekend.

Crypto is in a world of hurt — Bitcoin a little over $79,000 and that’s up from the weekend lows. Ethereum sits under $2,400.

Oil prices have cratered nearly three bucks to $62.23 because U.S. forces did not attack Iran over the weekend.

Oil prices have cratered nearly three bucks to $62.23 because U.S. forces did not attack Iran over the weekend.

When we left you on Friday, the price action suggested traders were positioning themselves for some sort of renewed conflict.

But no attack took place: U.S. media report that the Pentagon wants to get more air defenses into place first, while Iranian media report that President Masoud Pezeshkian has ordered new negotiations with Washington about Iran’s civilian nuclear program.

Back stateside… there’s a merger to report in the energy sector, creating a major player in shale oil: Devon Energy is combining with Coterra Energy in a $58 billion all-stock deal. DVN shares are up more than a half-percent as we write while CTRA is down over 2%.

![]() Space Is Vast… But This Is Bigger

Space Is Vast… But This Is Bigger

“I’m thinking about how major shifts happen. The world transforms quietly while we're looking elsewhere. By the time most people notice, the change is already complete,” muses Paradigm tech-investing pro Ray Blanco.

“I’m thinking about how major shifts happen. The world transforms quietly while we're looking elsewhere. By the time most people notice, the change is already complete,” muses Paradigm tech-investing pro Ray Blanco.

“I think we're in one of those moments right now — and it's not just AI or the breakthroughs happening on the ground.”

Ray couldn’t help being awed in this way attending the SpaceCom event in Orlando — which wrapped up on Friday.

Our man in Orlando…

Our man in Orlando…

“Something bigger is taking shape overhead,” he says. “A new layer of infrastructure beyond our planet — intelligence, connectivity and industrial capability that's already reshaping how the economy works.

“We call it ‘space,’ but that word feels too small for what I've been witnessing here. It's infrastructure that will be as fundamental as railroads were when they were built or the internet.

“Most investors will recognize this shift years from now after it's already happened. You're learning about it today while the foundation is still being poured.

“Generational wealth is made by those who see the trend before it becomes obvious. That's the difference between watching wealth being created and creating it yourself.

“This has been an incredible three days not only for my current research, but for my understanding of where breakthrough tech is headed next.”

Ray will share more of his takeaways with his readers in the days and weeks ahead, so keep an eye out.

![]() Aliens and Markets

Aliens and Markets

Here’s a problem we hadn’t started thinking about yet — disruptions to the markets caused by disclosure about aliens.

Here’s a problem we hadn’t started thinking about yet — disruptions to the markets caused by disclosure about aliens.

But a former analyst for the United Kingdom’s central bank is thinking about it.

Helen McCaw is her name and she’s dashed off a letter to Bank of England chief Andrew Bailey. The Times of London got its hands on the letter.

“The United States government,” she wrote, “appears to be partway through a multiyear process to declassify and disclose information on the existence of a technologically advanced nonhuman intelligence responsible for unidentified anomalous phenomena (UAPs).

“If the UAP proves to be of nonhuman origin, we may have to acknowledge the existence of a power or intelligence greater than any government and with potentially unknown intentions.”

Hmmm… McCaw attributes far greater “intelligence” to government than is deserved.

Be that as it may, she speculates that disclosure might spur a rush toward safe-haven assets including bonds and gold.

On the other hand, she said precious metals might lose their luster if all of a sudden there would be an influx of metal arriving from outer space.

Beyond that, she speculates “there might be extreme price volatility in financial markets due to catastrophising or euphoria, and a collapse in confidence if market participants feel uncertain on how to price assets using any of the familiar methods.”

She left out the part about government insiders trading on inside information — which seems like the surest outcome of all!

![]() What Goes Into the Mailbag?

What Goes Into the Mailbag?

“Hi, I’m quite disappointed you didn’t feature my reply about 9/11,” a reader writes.

“Hi, I’m quite disappointed you didn’t feature my reply about 9/11,” a reader writes.

“You guys should consider incorporating a few more reader responses in your daily 5 Bullets.”

Dave responds: Sorry to disappoint in this instance — although we’re heartened to see that you follow our scribblings so closely!

There are many variables that go into deciding which reader emails we include in the issues, and which don’t make the cut.

If there’s a lot going on in the news and the markets — which has been the case lately — we’ll tend to showcase less reader mail unless there’s a truly hot topic.

Other variables include informational value, entertainment value and whether the reader’s musings inspire a tangent on my part.

In your own case, I didn’t want to get too far afield from our financial beat. We had a longtimer write in response to my issue-length exploration of the military-industrial complex. He had a handful of interesting points and then proceeded to assert that 9/11 was an inside job.

I wasn’t about to suppress that portion of his email but neither was I going to open up a days-long debate about it. So I briefly said my piece and dropped the matter.

The exclusion of your email had nothing to do with whether you had something worthwhile to say — and I encourage you to keep writing!