Flying Cars (Sooner Than You Think)

![]() Flying Cars (Sooner Than You Think)

Flying Cars (Sooner Than You Think)

For the better part of 15 years, it’s been the most damning indictment of the digital age: “We wanted flying cars, instead we got 140 characters.”

For the better part of 15 years, it’s been the most damning indictment of the digital age: “We wanted flying cars, instead we got 140 characters.”

So read the subtitle of a 2011 report from Founders Fund — a venture capital firm co-founded by Peter Thiel.

(Recall this was a time when X was still called Twitter and tweets were limited to 140 characters.)

The report’s thesis? Computers were getting faster, cheaper, better. But in the realm of “real stuff,” human progress was nearing a standstill.

As Thiel summed it up to an audience at Stanford University in 2012, “Whether we look at transportation, energy, commodity production, food production, agro-tech, nanotechnology — that with the exception of computers, we’ve had tremendous slowdown…

“I believe we are in a world where innovation in stuff was outlawed. It was basically outlawed in the last 40 years — part of it was environmentalism, part of it was risk aversion. And all the engineering disciplines that had to do with stuff have basically been outlawed one by one.”

Thiel was not alone in the early 2010s…

“I’m not denying that the changes in digital IT over the last three decades have been breathtaking,” wrote the demographer Neil Howe, also in 2012. “They have been.”

“I’m not denying that the changes in digital IT over the last three decades have been breathtaking,” wrote the demographer Neil Howe, also in 2012. “They have been.”

But progress otherwise during his boomer lifetime, he suggested, was much slower than during the life of, say, Dwight Eisenhower, born in 1890.

“When he was a child... you needed to know Morse code to communicate faster than a horse could run, and (in fact) horses were the only mode of ordinary street transport. Children routinely died from bacterial infections. And Lord Kelvin, one of the greatest scientists of that age, declared that ‘aeronautical travel’ was impossible.”

By the time Ike was president in the late ’50s, “he was inside in a Boeing 707... dictating memos on the deployment of hydrogen bombs, sugar-cube vaccines for polio and plans to put a ‘man on the moon’ while flying at 35,000 feet over a nation whose vast, affluent, homeowning, car-driving, union card-holding middle class would have been utterly inconceivable in the presidency of William McKinley.

“Meanwhile I get up every morning and drive basically the same silly internal-combustion car that people drove 50 years ago through the same suburbs on the same interstates to the same buildings powered by the same nuclear plants and hydroelectric dams that Eisenhower’s peers saw fit to build.”

That was then. This is now. People privy to Thiel’s thinking say he’s changed his tune.

That was then. This is now. People privy to Thiel’s thinking say he’s changed his tune.

As recently as last summer, Thiel gave an interview to The New York Times in which he continued to lament the lack of progress outside the digital realm.

But during a recent edition of the Provoked podcast, co-host Darryl Cooper said he attended a private talk given by Thiel. Apparently Thiel now believes AI has the potential to bring about a transformation in all the realms where there’s been middling progress for the last 50 years — energy, transportation, agriculture…

Cooper did not specify what brought about Thiel’s change of heart. A couple of different web searches on your editor’s part come up dry. Whatever Thiel is saying, he’s saying to a limited audience.

But perhaps what he’s saying is along the lines of what Paradigm’s top editors were saying during our All-In Summit held last Thursday.

But perhaps what he’s saying is along the lines of what Paradigm’s top editors were saying during our All-In Summit held last Thursday.

To recap, it was all about “aAI” — or autonomous AI.

Jim Rickards, James Altucher, Enrique Abeyta… They all see AI melding with advanced robotics and a revived U.S. manufacturing base. The sort of combination that could bring about flying cars sooner than you think.

And to be clear, this convergence is not something they see coming in the 2030s. They see three catalysts building here in the first quarter of 2026…

- Donald Trump is set to sign an executive order accelerating the development of aAI. Target date: Any day now

- Elon Musk is preparing a one-of-a-kind aAI product rollout — an autonomous robot called Optimus that will re-shape every industry you can think of. Target date: No later than March 30

- Jensen Huang, CEO of Nvidia, is set to unveil the company’s newest superchip that will power aAI — and he’ll name the tiny software company Nvidia is partnering with to make it all happen: Target date: Nvidia’s annual GTC event, also known as the “Super Bowl of AI,” on March 16.

If you’re a Paradigm Mastermind Group member, you’re already hip to the changes that are coming and how to profit. Still, you won’t want to miss a follow-up live session featuring the Mastermind team tomorrow at 1:00 p.m. EST. At that time they’ll walk you through all the special reports they issued last week and even take your questions. Watch your inbox for a link.

![]() Chop on the Surface, Calm Underneath

Chop on the Surface, Calm Underneath

Beneath the choppy action in the major U.S. stock indexes, a different picture emerges.

Beneath the choppy action in the major U.S. stock indexes, a different picture emerges.

“We are witnessing a clear rotation out of the highflying mega-cap tech names and into a much broader area of the market,” says Paradigm analyst Zach Scheidt — who works on several publications including Altucher’s True Alpha and Rickards’ Insider Intel.

“We’ve seen stocks like the Mag 7 absolutely tear higher over the past several months. It makes sense that these names need a break. And the fact that capital is rotating rather than disappearing means that the overall bull trend is still intact.

“If anything, the market is becoming healthier as participation expands. As noted in the recent research from Bespoke regarding market broadening, the rally is no longer relying on just a handful of names to do the heavy lifting.”

Consider the following stats:

- 57% of S&P 500 stocks are currently outperforming the broad market index

- 4 of the S&P sectors closed at 52-week highs at the end of January

- 91 stocks are already up 10% or more year-to-date.

“While the Mag 7 names take a breather, small-cap stocks are holding up remarkably well,” Zach continues. “The Russell 2000 (IWM) remains firmly above its 50-day moving average, signaling that risk appetite isn’t vanishing, it’s simply moving to other areas of the market that haven’t gotten the same excitement as the Mags.”

In addition, Zach concurs with trading pro Enrique Abeyta’s remarks here last week: The software stocks are deeply oversold after last week’s bloodbath and liable to bounce big.

➢ Congratulations are in order for Altucher’s True Alpha readers, where Zach and James Altucher recommended an up-and-coming tech name on Jan. 6. Today they urged readers to sell for 220% gains.

In the meantime, Friday’s bounce in the major indexes is extending into a new week.

In the meantime, Friday’s bounce in the major indexes is extending into a new week.

At last check the S&P 500 is up nearly two-thirds of a percent and less than 25 points away from 7,000. The Nasdaq is up nearly 1.2%. The Dow, which breached the 50,000 level for the first time on Friday, is also in the green today — but just barely.

Gold has roared over $100 higher to $5,074. Silver is up a blistering 7.2% to $83.25. Bitcoin has recovered the $70,000 mark and Ethereum is approaching $2,100.

Two big economic numbers are coming later this week — the January jobs report on Wednesday (delayed a few days by the latest “partial government shutdown” and the official inflation rate Friday.

The oil price is drifting higher even though a U.S. attack on Iran did not transpire over the weekend.

The oil price is drifting higher even though a U.S. attack on Iran did not transpire over the weekend.

When we left you on Friday, traders were once again positioning themselves for that possibility — bidding crude up in the event of a weekend attack when markets were closed.

Ordinarily we’d see a pullback as a new week begins. Instead, a barrel of West Texas Intermediate is up over three-quarters of a percent, back over $64.

Perhaps that’s because of something that did transpire over the weekend — an announcement that Israeli Prime Minister Benjamin Netanyahu will pay a call on the White House Wednesday.

For the record, this will be the seventh time he’s visited Trump in the United States since Trump’s return to office just over a year ago.

His demands are already clear: In a statement, Netanyahu’s office said any U.S. negotiations with Iran “must include limitations on ballistic missiles and a halting of the support for the Iranian axis.”

That’s a nonstarter for Tehran: “Missiles are never negotiable because they are a defense issue,” Iranian Foreign Minister Abbas Araghchi told Al Jazeera on Saturday.

SpaceX IPO Plans

![]() SpaceX IPO Plans

SpaceX IPO Plans

The SpaceX IPO is still on track for late spring or early summer after Elon Musk’s announcement that SpaceX is acquiring xAI.

The SpaceX IPO is still on track for late spring or early summer after Elon Musk’s announcement that SpaceX is acquiring xAI.

Musk made it official a week ago today — although users of the Paradigm Press mobile app got the scoop days earlier from our Ray Blanco, in attendance at the SpaceCom event in Orlando.

As we mentioned last week, combining the company will make it easier for Musk to pursue his goal of orbiting data centers — using 24/7 solar power that doesn’t compete with homeowners and businesses for scarce electricity back on Earth.

“xAI was burning about $1 billion per month,” Ray tells us. “They need SpaceX for orbital infrastructure. SpaceX needs guaranteed launch revenue. Space data centers solve both problems.

“There will be other players doing the exact same thing — moving compute to space, with Google and Amazon as potential competitors from within the U.S.”

As for the timing of the merger — the combined firm could be valued at $1.25 trillion — Ray says one possibility is June 8-9, which marks the conjunction of Jupiter and Venus.

“It might sound like a weird reason to pick a date,” Ray allows, “but this is classic Elon Musk style. Remember in 2018 when he tweeted about taking Tesla private at $420 per share (a classic cannabis reference)?

“Since SpaceX is a space company, Elon might like a date that occurs during a rare planetary alignment.

“Another option is that Elon does it as a birthday gift to himself, on June 28 (Musk's 55th birthday). Either way, the IPO could raise up to $50 billion, which would smash Saudi Aramco's $29 billion record IPO raise.”

In the pages of Altucher’s Investment Network, Ray and James Altucher have pinpointed several ways to profit from SpaceX’s IPO before it ever happens.

![]() Bread and Circuses

Bread and Circuses

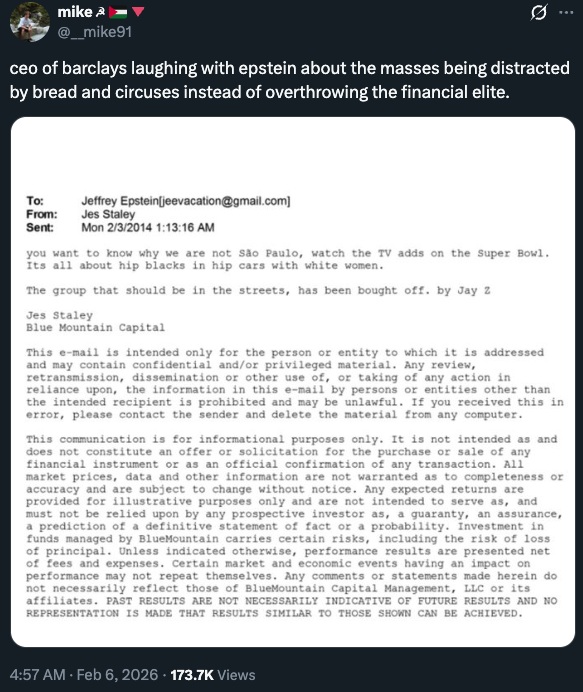

The latest Jeffrey Epstein revelations opened an ugly window into what the power elite really thinks of the plebes.

The latest Jeffrey Epstein revelations opened an ugly window into what the power elite really thinks of the plebes.

It has to do with the already-disgraced Jes Staley — a 34-year veteran of JPMorgan Chase who moved on to become CEO of Barclays in 2015. He resigned in 2021 amid ongoing disclosures about his cozy relationship with Epstein.

The most recent Epstein document dump includes a jaw-dropping email Staley sent to Epstein ahead of the 2014 Super Bowl.

The context is that a few days earlier, protesters fought with military police in Brazil’s most populous city, Sao Paolo. They were upset with the government’s lavish spending on stadiums to host the 2014 World Cup.

Aside from that, the three-sentence email speaks for itself.

Brings to mind the late George Carlin’s rant about how “It’s a big club, and you ain’t in it.”

And in light of how last night’s Super Bowl halftime show became another touchstone in the culture wars, this part of his routine seems especially relevant…

That’s all you ever hear about in this country is our differences. That’s all the media and the politicians are ever talking about: the things that separate us, things that make us different from one another.

That’s the way the ruling class operates in any society: They try to divide the rest of the people; they keep the lower and the middle classes fighting with each other so that they, the rich, can run off with all the ****ing money.

Fairly simple thing… happens to work.

And he said that in 1992!

![]() Mailbag: Silver, MAMA Stocks

Mailbag: Silver, MAMA Stocks

A new week’s mailbag begins with a one-sentence inquiry…

A new week’s mailbag begins with a one-sentence inquiry…

“Do you believe confidence exists that silver can go higher than its recent high price and above in the near term of six months?”

Of course confidence exists. The question is among whom?

In all seriousness, many smart observers of the precious metals space, both inside and outside Paradigm, believe silver could easily reach $150 by year-end — certainly next year.

Six months is a tighter timeframe, though. We’re talking Aug. 9. Expecting silver to reclaim $121 by that time? It’s certainly possible, but I wouldn’t want to bet on it.

But I’m nonetheless hanging on to my Sprott Physical Silver Trust (PSLV). I’m playing for the long haul and I’m willing to exercise patience. But that’s just me. If you’re sitting on hefty silver profits even after the recent whacking and you need to meet current expenses… you might well come to a different conclusion.

After last week’s mention of how our label of the “MAMA” stocks never got traction last year — Microsoft, Alphabet, Meta, Amazon — a reader weighed in…

After last week’s mention of how our label of the “MAMA” stocks never got traction last year — Microsoft, Alphabet, Meta, Amazon — a reader weighed in…

“Since your MAMA acronym didn’t catch on, how about adding a couple of hyperscaler-related companies, Nvidia and Oracle, and going with the Al Bundy-inspired acronym of NO MA’AM?”

Dave responds: And I thought my mind went off on weird tangents!