Blackout Nation: An Update

![]() Blackout Nation: An Update

Blackout Nation: An Update

At the risk of sounding like a broken record, you need to start preparing for the likelihood of regular electric blackouts before the end of this decade.

At the risk of sounding like a broken record, you need to start preparing for the likelihood of regular electric blackouts before the end of this decade.

We began sounding the alarm about the fragility of the power grid in the summer of 2022. In many regions — particularly the Upper Midwest — too many coal and nuclear plants were being shuttered… and there wasn’t nearly enough solar and wind capacity coming online to replace it.

(Your editor, based in the Upper Midwest, bought a generator that summer — just in case.)

And this was before AI burst into popular consciousness when ChatGPT 3.5 was released later in 2022. By 2024 we were regularly warning that AI could become “the monster that ate the power grid.” Only last year did the mainstream start picking up on the story.

It was down to the wire last month during the big winter storm that blasted everywhere from Texas to the Northeast.

It was down to the wire last month during the big winter storm that blasted everywhere from Texas to the Northeast.

On Monday Jan. 26, the biggest grid operator in the country — serving 67 million customers in 13 states — said 24% of its deliverable power that day came from coal.

Old-economy, dirty coal — without it, 20% of the demand in its territory that day would have gone unfilled — resulting in blackouts.

The situation won’t get better and will likely get worse between now and 2030.

The situation won’t get better and will likely get worse between now and 2030.

That’s according to the North American Electric Reliability Corporation — which a few days ago issued its annual “Long Term Reliability Assessment.”

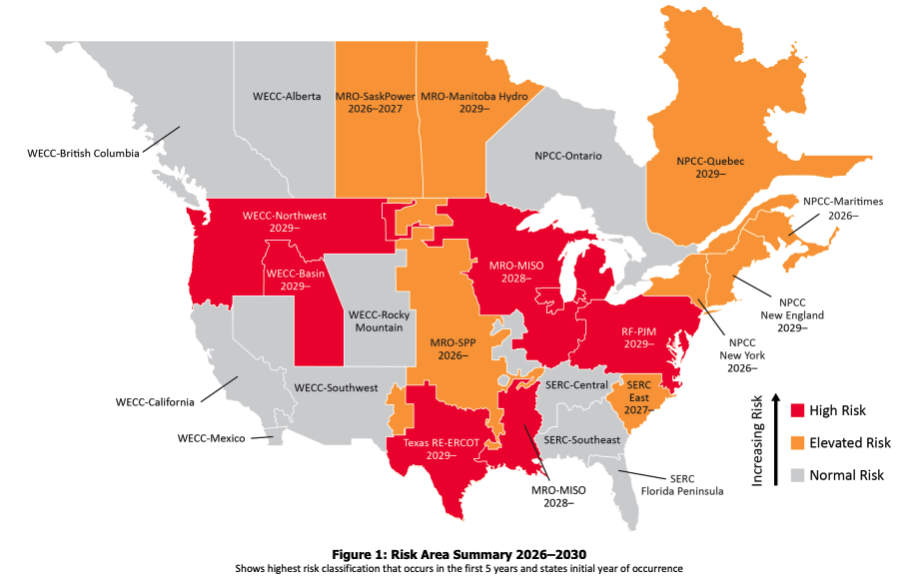

The one-sentence takeaway: If you live anywhere in the red areas on this map, you’re at “high risk.”

Let’s dig into a few details, region-by-region…

- PJM, a 13-state territory stretching from New Jersey west to Illinois: This is a region that includes “Data Center Alley” in northern Virginia — the highest concentration of data centers in the world. PJM is already at “elevated risk,” which flips to “high risk” by 2029. From the report: “Current projections for resource additions do not keep pace with escalating demand forecasts and expected generator retirement”

- MISO, a 15-state territory stretching from Minnesota to Louisiana: “Elevated risk” next year, “high risk” in 2028. From the report: “Projected resource additions do not keep pace with escalating demand forecasts and announced generator retirements”

- ERCOT, the Texas grid: Currently “elevated risk,” also slipping into “high risk” come 2029 like PJM. The report warns that “continued rapid load growth outpaces projected resource additions in later years.”

Do you detect a pattern here? None of the issues we began warning about in 2022 have been addressed in any meaningful way.

Do you detect a pattern here? None of the issues we began warning about in 2022 have been addressed in any meaningful way.

The three regions listed above aren’t the only ones that will slip into the red “high risk” category before the end of the decade. You can review NERC’s report for yourself right here.

And the report might be underselling the risks: NERC says California is at a “normal” level of risk… but Paradigm energy authority Byron King says “on any given day, about one-third of California’s non-solar electricity is wheeled in from outside — either the Pacific Northwest or the Rocky Mountains.”

Both of those regions, you’ll note, are in the red.

What to do? You can attack this issue from a couple of angles:

- First, there’s personal preparedness. If you don’t have the funds for one of those Generac “whole house” generators, garden-variety gasoline-fired generators are much more affordable and can keep essential loads running. Do it right: Have an electrician install a transfer switch and breaker interlock. Then test your backup system at least three times a year so you’ll know what to do step-by-step once the lights go out for real

- As for how to invest… Last year, Paradigm readers started reaping the profits from this phenomenon as share prices of “independent power producers” that aren’t regulated utilities began to soar. On May 7, we offered a rare free pick in 5 Bullets — Constellation Energy — which rose 34% by year-end. Meanwhile, Enrique Abeyta pinpointed a special trade for his paid readers, garnering 177% on Talen Energy.

Shares of the independent power producers have pulled back in early 2026 — potentially serving up an attractive new entry point. Keep an eye out in your paid publication(s) for ways to play the trend as the year goes on.

Unfortunately there are no ETFs comprising only independent power producers — but those companies do make up a meaningful slice of the State Street Utilities Select Sector SPDR ETF (XLU).

![]() The Rules Are Changing (Climate Regs)

The Rules Are Changing (Climate Regs)

On the margins, action by the White House might help alleviate the electricity crunch described in today’s Bullet No. 1.

On the margins, action by the White House might help alleviate the electricity crunch described in today’s Bullet No. 1.

Today’s Wall Street Journal has a front-page story telling us the Trump administration plans to junk the Obama administration’s “endangerment finding” — which asserted that so-called climate change poses a threat to public health and welfare.

The finding, which dates to 2009, has been a key facet of what our Jim Rickards has long called the “Green New Scam.”

“Expert climate change predictions have been wrong for 50 years,” Jim wrote his Strategic Intelligence readers in December. “Every year, the science experts claim the world will be flooded in 10 years and 10 years later they’re wrong every time.”

Ever since that 2009 finding, the EPA has exercised sweeping new powers beyond just keeping the air and water clean. Carbon dioxide came under its purview, and thus the agency has been tightening fuel-economy standards for vehicles and — relevant to our discussion today — capping carbon emissions from power plants. It’s one reason why so many functional coal-fired plants are shutting down.

The final revised rule will be made public later this week. “This amounts to the largest act of deregulation in the history of the United States,” EPA Administrator Lee Zeldin tells the Journal.

From the vantage point of early 2026 it’s hard to say exactly what the impact will be. And it’s likely that the climate-change crowd will take the Trump administration to court.

But we figured it’s worth putting on the record today…

![]() Party Like It’s 1999

Party Like It’s 1999

“When you strip away the fear and compare today’s conditions to those in early 2000, it’s clear the market is NOT at a top like the one before the dot-com collapse,” says Paradigm trading pro Enrique Abeyta.

“When you strip away the fear and compare today’s conditions to those in early 2000, it’s clear the market is NOT at a top like the one before the dot-com collapse,” says Paradigm trading pro Enrique Abeyta.

As we noted last week, a sell-off in software stocks like Salesforce has revived fears of an “AI bubble” — and chatter that we’re in for a rerun of the dot-com bust, in which the Nasdaq crumbled by 78% starting in early 2000.

But “the market is behaving very differently today,” says Enrique — “and many of the signals that defined that era are notably absent.”

For one thing, the Nasdaq has not experienced the hyperbolic rise that it did at the end of the dot-com bust — an 80% surge in only five months.

Indeed the Nasdaq has been consolidating since mid-2025. “Blow-off tops don’t happen in markets that are correcting internally,” Enrique says. “They happen when everything rises together, relentlessly, regardless of earnings, growth or balance sheet strength.”

For another thing, the Federal Reserve is not raising interest rates — which it was throughout 1999 and early 2000. Assuming Kevin Warsh is confirmed by the Senate as the new Fed chair, rate cuts are in the offing later in 2026.

“Markets typically do not experience catastrophic tops when monetary policy is easing,” Enrique says. “Liquidity acts as a cushion. It supports risk assets, absorbs shocks and extends cycles longer than many expect.”

And there’s a third difference, perhaps the most important, he points out: The most notorious-dot coms “were burning cash at staggering rates and financing growth almost entirely through debt issuance and equity dilution. When capital markets closed, those business models collapsed overnight.

“Fast-forward to 2026 and the picture could not be more different. The companies committing the largest capital expenditures today are among the healthiest and most profitable enterprises on the planet.”

That includes the four biggest hyperscalers — Microsoft, Alphabet, Meta and Amazon. “The major technology leaders funding AI infrastructure are generating massive free cash flow, posting strong margins and operating with fortress-like balance sheets.”

Bottom line: “Against this backdrop, I feel more bullish than I’ve been in years… This environment feels far more like 1999 than 2000.”

Maybe today is the day the S&P 500 will notch its first close over 7,000.

Maybe today is the day the S&P 500 will notch its first close over 7,000.

At last check, the index is up a little less than a quarter percent to 6,980. The Nasdaq’s gain is similar. The Dow is powering still higher into record territory, up a half percent and approaching 50,400.

Precious metals look positively sleepy by recent standards — gold down about $50 but still holding the line on $5,000 and silver down about two bucks to $81.30.

The major cryptos are little moved from this time 24 hours ago — Bitcoin a little under $70,000, Ethereum a little over $2,000.

Crude is inching higher at $64.54.

Steady as she goes for the nation’s small-business sector.

Steady as she goes for the nation’s small-business sector.

The National Federation of Independent Business is out with its monthly Small Business Optimism Index. The headline number for January is 99.3, down slightly from December’s 99.5. But it’s still above the long-term average of this survey, which goes back more than 50 years.

On the portion of the survey where respondents are asked to identify their single-most important problem, taxes are in first place — cited by 18%.

“Taxes ranking as the top issue is typically a sign that other, less consistent issues (labor quality, inflation, poor sales, etc.) are not currently in a bad state,” says the NFIB’s report.

But good help is still hard to find in many places: “Quality of labor” was cited by 16%. The cost and availability of insurance comes in third at 13% — the highest that category has registered in over seven years. Inflation was cited by 12%.

![]() Copper: Still Attractive

Copper: Still Attractive

“Without a significant reduction in demand or a massive increase in supply, we will see a big squeeze in copper,” says Real Wealth Insider editor Matt Badiali.

“Without a significant reduction in demand or a massive increase in supply, we will see a big squeeze in copper,” says Real Wealth Insider editor Matt Badiali.

Last month, as copper crossed $6 a pound for the first time, Matt helped us spotlight the red metal’s investment potential in the context of sturdy global demand for electric vehicles.

Since then, the price spiked over $6.50 at the same time gold and silver reached their manic highs — only to fall back.

But copper is hanging tough, still a little under $6, because the long-term story remains so compelling.

“As we enter the age of AI and massive data center buildouts,” says Matt, “copper is more important than ever. And the supply/demand curve points to even higher prices.”

Analysts at S&P Global expect over the next 14 years, global copper supply will fall 23.8% short of demand. According to their recent report, “The widening disconnect highlights copper's dual role as both enabler and potential bottleneck for the energy transition and digital transformation.”

“In other words,” says Matt, “if you’re a tech bull, you’re also a copper bull. The limited copper supply creates a ‘systemic risk’ for AI.”

As before, Matt says the simplest way to play it is with a basket of copper mining stocks — the Global X Copper Miners ETF (COPX).

But he’s keeping an eye out for juicier opportunities: “The setup in copper is so good today that we can move further down the food chain in this sector. We can take more risks and make larger gains without the fear of a price collapse.”

If you’re one of Matt’s paid readers, keep an eye out for a recommendation or two along those lines. If you’re not among them, Real Wealth Insider is currently closed to new subscribers — but we’ll let you know when it reopens.

![]() Paper Money as Floral Arrangements

Paper Money as Floral Arrangements

From the central bank of Kenya comes a warning to stop using the country’s banknotes as faux flowers for Valentine’s Day.

From the central bank of Kenya comes a warning to stop using the country’s banknotes as faux flowers for Valentine’s Day.

Apparently it’s become something of a Valentine tradition there — “popularized by celebrities and online influencers, who share videos of themselves presenting such bouquets during celebrations,” reports the BBC.

The Central Bank of Kenya does not approve — issuing a notice on social media last week reminding citizens that defacing the paper currency comes with a penalty as steep as seven years in prison.

The news coverage we see of this story begs the question: Is the purchasing power of the Kenyan shilling so pitiful that it’s useful mostly for fake floral arrangements?

The news coverage we see of this story begs the question: Is the purchasing power of the Kenyan shilling so pitiful that it’s useful mostly for fake floral arrangements?

We’re pretty sure the blue banknotes used in the picture above are 200 shillings each — about $1.56 U.S. at the current exchange rate. And that exchange rate has been very stable since mid-2024.

So they’re not worthless by any stretch. We’re not in Zimbabwe-dollar territory here.

Indeed, the central bank says the problem comes when the paper currency is put back into use after being folded, rolled, glued, stapled and otherwise altered: Apparently it gums up ATMs and cash-counting machines.

Meanwhile, a website called The Punch tells us that “Kenya is one of the world’s leading producers of flowers, and the announcement has been welcomed by some who argue that fresh floral bouquets are more appropriate Valentine’s Day gifts.”

See guys, here’s your subtle reminder that Saturday’s the day. Get your flower order in early. You’re welcome.