The Monster That Ate the Power Grid (AI)

![]() The Monster That Ate the Power Grid (AI)

The Monster That Ate the Power Grid (AI)

This whole “AI is going to wreck the power grid” thing is getting real.

This whole “AI is going to wreck the power grid” thing is getting real.

Two summers ago — months before ChatGPT took the world by storm — we were already concerned about the grid’s stability.

Regional grid operators were warning of rolling blackouts in the event of exceptionally hot weather. One of those operators was up-front about the reasons: Too many coal and nuclear plants were being mothballed, and newly constructed wind and solar capacity wasn’t nearly enough to make up for it.

Fast-forward to January of this year and Paradigm’s tech-investing pro Ray Blanco said in this space, “The rapid growth in internet traffic and cloud computing has led to skyrocketing energy demands for data centers around the world.

“As more and more data is created, processed and stored, the power needed to operate massive banks of servers and infrastructure keeps increasing. In fact, according to the International Energy Agency, data center electricity requirements are projected to rise from 1% of total electricity demand to 8% by the end of the decade.”

By one estimate, a typical data center’s computing power needs to double every three months just to keep pace with AI’s demands.

Events began moving very quickly this spring…

Events began moving very quickly this spring…

Amazon signed a 10-year deal with Talen Energy, supplying a data center in Pennsylvania with power from the Susquehanna nuclear plant. That was the first deal of its kind, but S&P Global Ratings forecast it would not be the last.

“There simply isn’t enough energy to go around currently to sustain Big Tech’s AI plans,” Ray told us. “Estimates for U.S. electricity demand over the next five years have nearly doubled.”

In addition to the Amazon deal, “Microsoft, normally a tech company, is putting out job listings for hiring nuclear power specialists. It’s also teamed up with Google and Nucor (a steel company) to explore next-generation clean energy projects, including advanced nuclear.”

Which brings us to the front page of today’s Wall Street Journal…

Which brings us to the front page of today’s Wall Street Journal…

“The owners of roughly a third of U.S. nuclear-power plants are in talks with tech companies to provide electricity to new data centers needed to meet the demands of an artificial-intelligence boom,” the paper reports. Amazon is close to cutting a deal with Constellation Energy “for electricity supplied directly from a nuclear plant on the East Coast.”

Most of the activity is concentrated in the Northeast and mid-Atlantic. “Never before could anyone say to a nuclear-power plant, we’ll take all the energy you can give us,” says Patrick Cicero, who holds the post of “consumer advocate” in Pennsylvania’s state government.

The Journal piece, like much mainstream coverage of the issue, is bogged down in concerns about Oh dear, this will slow down the transition to green energy.

But if you read closely enough, you can start to discern what’s really at stake…

![]() AI-Induced Blackouts: They’re Coming

AI-Induced Blackouts: They’re Coming

“Instead of adding new green energy to meet their soaring power needs, tech companies would be effectively diverting existing electricity resources,” the Journal goes on. “That could raise prices for other customers and hold back emission-cutting goals.

“Instead of adding new green energy to meet their soaring power needs, tech companies would be effectively diverting existing electricity resources,” the Journal goes on. “That could raise prices for other customers and hold back emission-cutting goals.

“Even if tech companies were to offset nuclear-power deals by funding the addition of renewable energy, experts say the likely result is more reliance on natural gas to replace diverted nuclear power. Natural gas-fired plants produce carbon emissions but, unlike renewables, can provide round-the-clock power and are cheaper and more practical to build than new nuclear plants.”

Let’s recount a figure the Journal didn’t see fit to include in its article: According to the U.S. Energy Information Administration, 18.6% of U.S. power generation comes from nuclear.

If one-third of nuclear capacity is on track to be diverted to AI, we’re staring down the possibility that at least 6.2% of all U.S. power generation could be sucked up by AI.

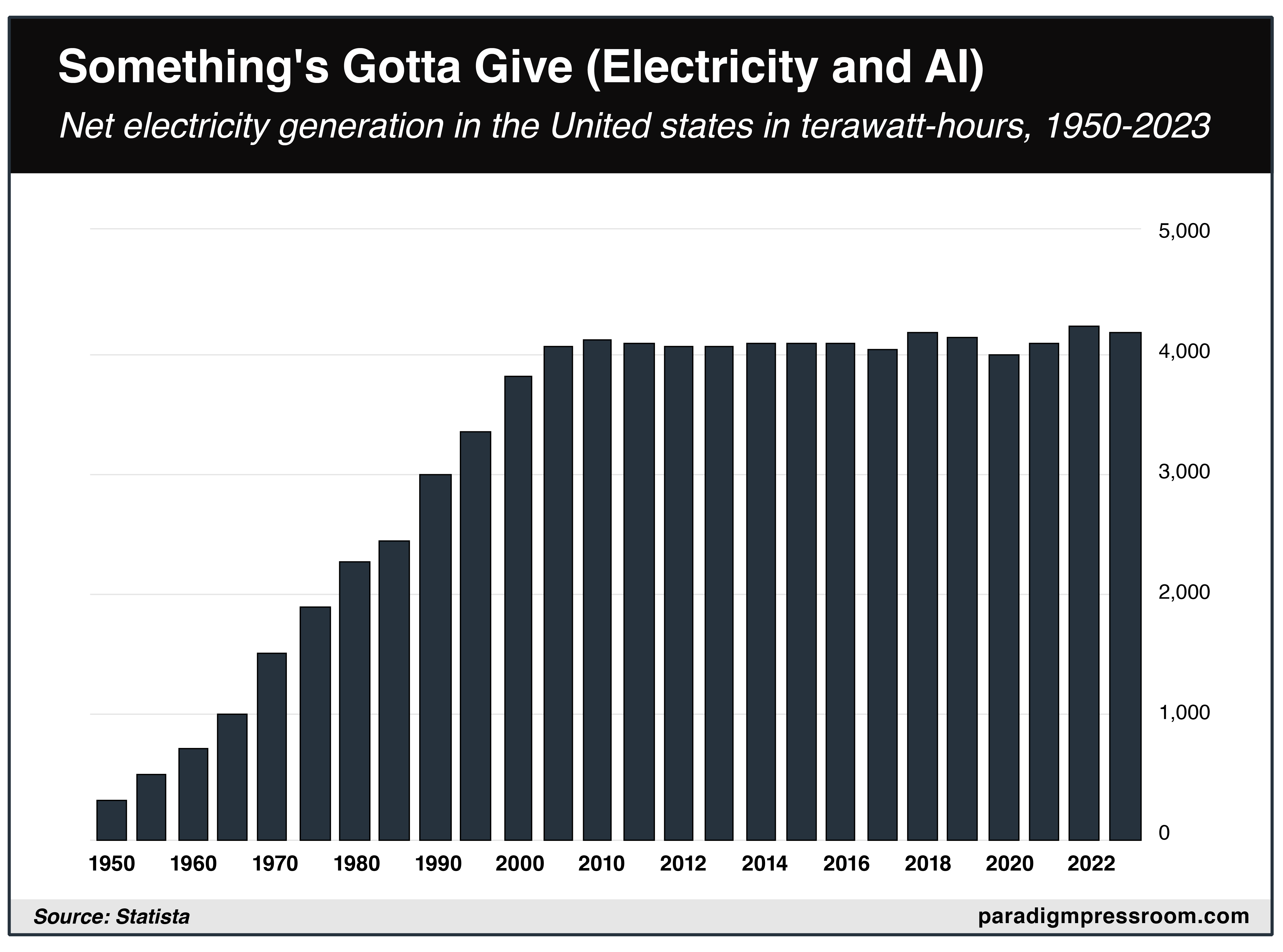

How’s that going to work when the grid is generating no more power now than it was over a decade ago?

How’s that going to work when the grid is generating no more power now than it was over a decade ago?

The Journal article frets about retail electric customers paying higher prices. The real question is whether retail electric customers will have reliable power in the near future at any price.

After all, if the grid’s capacity isn’t growing… and AI is feeding its voracious appetite with “behind-the-meter” deals like Amazon’s… doesn’t it seem inevitable that homeowners and small businesses will be left to fend for themselves if there’s just not enough juice for everyone?

After three decades of nonstop expansion, the vaunted “digital economy” is finally running up against real-world constraints.

After three decades of nonstop expansion, the vaunted “digital economy” is finally running up against real-world constraints.

Until now, all those bits and bytes seemed disconnected from anything as prosaic as limited grid capacity.

Of course the reality was always more complex: Nearly 10 years ago, Digital Power Group CEO Mark Mills briefly went viral when he asserted that an iPhone uses more electricity than your refrigerator. That’s because in the end, the power it consumes is not just from battery charging — it’s also wireless connections and data usage.

But this looming clash only reinforces our confidence at Paradigm Press that a new commodities supercycle is underway.

If AI needs energy, that means it needs not only uranium for nuke plants… but also a host of metals like copper and nickel for renewables… and even that cleanest of “dirty” fossil fuels, natural gas. With that in mind, the commodities supercycle is now the main focus of Alan Knuckman’s trading advisory The Profit Wire.

After a brief window last week, The Profit Wire is once again closed to new readers — but we’ll let you know as soon as it reopens.

![]() Gimme Shelter (and Raid My Retirement)

Gimme Shelter (and Raid My Retirement)

It’s a helluva choice — raid your retirement or lose your home.

It’s a helluva choice — raid your retirement or lose your home.

The fund giant Vanguard is out with new figures revealing that its customers are increasingly making “hardship withdrawals” from their 401(k)s just to keep a roof over their heads.

Hardship withdrawals are how you avoid the 10% early-withdrawal penalty before age 59½. Under the law, you can take them only for limited circumstances such as avoiding eviction or foreclosure or an unexpected medical bill.

Vanguard says a little under 4% of savers took a hardship withdrawal in 2023. The absolute number is still low… but it’s up 40% from 2022 and double the 2021 figure.

The biggest reason? "In 2023, 39% of hardship withdrawals were used to avoid a home foreclosure or eviction,” says Vanguard, “up from 31% of withdrawals two years earlier.”

MarketWatch columnist Brett Arends — one of the few mainstream financial journalists we like — points out there’s both a short-term and long-term problem here.

Short term, “these withdrawals are taking place during an apparent economic boom where the unemployment rate has been below 4% for 2½ years.” What happens in the event the economy turns south?

Longer term, “the cumulative effect of these annual withdrawals will add up over time, and will make worse what looks like a looming divide between those who have enough for retirement and those who don't.”

And even if you have enough, you’ll still be affected as growing numbers of Americans rely on Social Security for a higher percentage of a meager retirement income.

Thus, Arends is on target when he says we’re looking at a future of “sticking it to the middle- and upper-middle-class by capping the growth of their benefits, sticking it to the middle- and upper-middle-class by raising their taxes, or putting the whole thing on the national credit card, along with everything else, and hoping the bond market doesn't notice.”

Or all of the above.

As for your retirement account today…

As for your retirement account today…

The major U.S. stock indexes are little moved from yesterday’s closes; the Nasdaq is creeping higher into record territory, now less than 70 points from the 18,000 mark. Gold continues holding the line on $2,300, silver on $29. Bitcoin’s latest rally didn’t have legs; it’s back below $62,000.

Crude sits at another highest-since-late-April mark of $83.46. The proverbial geopolitical tensions continue to grow: The German newspaper Bild reports that Israel will invade Lebanon during the second half of this month. That comes a few days after the United States deployed an amphibious assault ship to the region as a show of support for Israel.

![]() Gold Sales Tax: Only Four States Left?

Gold Sales Tax: Only Four States Left?

For the record: New Jersey lawmakers are trying once again to repeal the state sales tax on gold and silver.

For the record: New Jersey lawmakers are trying once again to repeal the state sales tax on gold and silver.

Earlier this year, a repeal measure passed the legislature unanimously. But because the vote came in the final 10 days of the session, Gov. Phil Murphy could exercise his authority to veto the bill without it returning to lawmakers for an override.

[Reminder: Before he entered politics, Murphy spent 23 years at Goldman Sachs. Hmmm…]

So lawmakers gave it another go at the end of June. Once again, the vote in favor was unanimous.

Presumably Murphy doesn’t have an out this time… and New Jersey is on track to become the 46th state to end sales taxes on gold and silver.

The remaining holdouts, you ask? Maine, Vermont, New Mexico and Hawaii.

![]() Facebook and the HOLE FOBE

Facebook and the HOLE FOBE

Because your editor gave up his little-used Facebook account a decade ago, I had no idea how badly AI has wrecked Facebook’s algorithm…

Because your editor gave up his little-used Facebook account a decade ago, I had no idea how badly AI has wrecked Facebook’s algorithm…

It seems that 20 years on, Mr. Zuckerberg’s creation is chock-a-block with ridiculous AI-generated images like this one.

“These strange images are published en masse by spammers,” says the Futurism website — “who affix the AI-spun creations with disjointed captions begging for likes and shares.”

Many of them have a religious bent. Others tend to emphasize soldiers and veterans. And then there’s a whole subgenre like the one above — crying police officers hauling oversized Bibles through a flood. (Bonus points for the spine saying “HOLE FOBE.”)

The caption underneath says, “Why don’t pictures like this ever trend” followed by a string of emojis and then “Beautiful cabin crew” and several hashtagged names of celebrities, mostly women.

“Because Facebook is an undead land of bots and synthetic imagery,” says Futurism, “it's hard to tell just how much engagement supposedly garnered by this post — currently over 46,000 likes and nearly 1,000 shares — is genuine.

“Still, that posts like this continue to get picked up by Facebook's algorithm feels like a grim sign of platform erosion for the social media site, which now feels more like an empty, chaotic funhouse for scammers than it does a website for humans.”

Which brings up an interesting question, given how older users took over Facebook long ago and the over-45 crowd is the prime “demo” for the newsletter biz: Are you still on Facebook?

Drop us a line at feedback@paradigmpressroom.com and we’ll share your answers tomorrow in a pre-Independence Day mailbag. Catch you then…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets