Extortion Racket

![]() Mafia Tactics?

Mafia Tactics?

“This is literally just the U.S. government extorting private businesses. Capitalism is dead. The free market is dead,” says a random comment on X.

“This is literally just the U.S. government extorting private businesses. Capitalism is dead. The free market is dead,” says a random comment on X.

The big business story of the day broke over the weekend: The Trump administration has granted export licenses to chipmakers Nvidia and AMD so they can sell their semiconductors in China — as long as they fork over 15% of the proceeds from those Chinese sales to the U.S. government.

“The quid pro quo arrangement is unprecedented,” says the Financial Times, which broke the story. “According to export control experts, no U.S. company has ever agreed to pay a portion of their revenues to obtain export licenses.”

“It is unusual for companies to essentially pay for export licenses,” adds The Wall Street Journal.

The criticism isn’t coming just from free-market conservatives like the one we cited up top.

➢ The market reaction so far? NVDA and AMD shares opened the day flat compared with Friday’s close. The big moves higher came in mid-July — when Trump first signaled he was open to letting the companies resume chip sales to China. No wonder: Global sales for both companies are now on track to jump at least 20%.

The news comes only days after Donald Trump opined on his Truth Social site that the CEO of another chipmaker should resign.

The news comes only days after Donald Trump opined on his Truth Social site that the CEO of another chipmaker should resign.

Trump said Intel chief Lip-Bu Tan is “highly conflicted” on account of his previous business ties in China. (Tan is Malaysian-born, and a U.S. citizen who’s spent the entirety of his business career in America.)

The problem for Tan is that he’s been on the job only since March. He inherited a major decision by his predecessor — to accept nearly $8 billion in subsidies from the Biden administration under the CHIPS and Science Act of 2022.

Intel is the biggest single recipient of these subsidies. You take the government’s money, you dance to the government’s tune.

According to The Wall Street Journal, Tan is paying a call on the White House today. What sort of deal might come out of that meeting?

You might or might not approve of these tactics on the part of the president. But whatever your opinion…

You might or might not approve of these tactics on the part of the president. But whatever your opinion…

… it comes back to a point we try to emphasize whenever politics intrudes on commerce.

Politicians make decisions every day that alter the flows of billions of dollars.

Whether it’s backroom deals on Capitol Hill or executive orders coming from the White House, successful investing means positioning yourself so you can capture some of those flows, whatever you might think about government’s role in the economy.

Really, that was the entire subtext to the Paradigm All-in Summit we held last Thursday — bringing together Jim Rickards, James Altucher and Enrique Abeyta. If you’re a Paradigm Mastermind Group member, you already have an idea what we’re talking about.

These three frequently have differing worldviews and differing investment approaches. But right now they’re all in on a single idea — one that will be propelled by a White House announcement likely coming either today or tomorrow.

Little wonder that Paradigm publisher Matt Insley sent you an email yesterday saying he believes “you’ll look back on this moment years from now as the most critical turning point of your wealth-building journey.”

If you haven’t watched our all-in event, this is the time. Click here now so you’ll still have “first mover” advantage before this imminent announcement.

![]() Profitable “Misinformation”

Profitable “Misinformation”

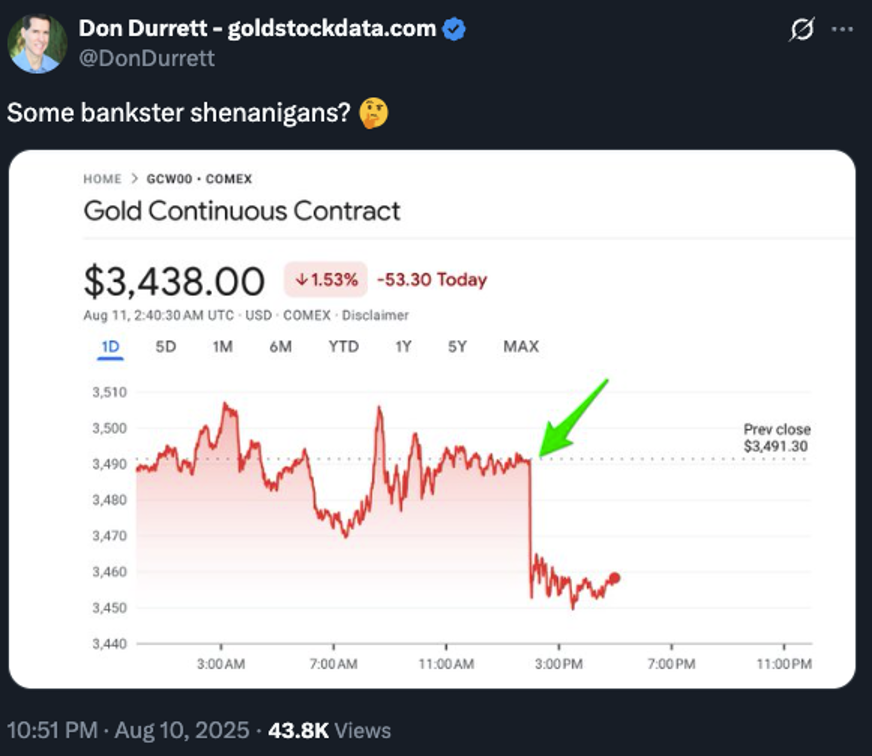

Speaking of decisions in Washington that alter money flows… the spot price of gold has tumbled over $50 to $3,344, its lowest level since the start of the month.

Speaking of decisions in Washington that alter money flows… the spot price of gold has tumbled over $50 to $3,344, its lowest level since the start of the month.

When we left you on Friday, the Financial Times had a scoop about the Trump administration planning to impose tariffs on imports of one-kilo and 100-ounce gold bars — a historic first. Gold futures soared to record highs.

But while the markets were closed over the weekend, anonymous administration officials told Reuters and Bloomberg that Trump would soon issue an executive order that would clarify “misinformation” about these gold tariffs.

It’s hard to shake the thought that somebody had inside knowledge of these leaks… and acted on it.

Last month, similar hinky activity showed up in other asset classes: heavy selling of Tesla shares began minutes before Trump announced tariffs on batteries from China… a rally in the dollar minutes before Trump said he doesn’t intend to fire Fed chair Jerome Powell… a plunge in Nasdaq futures minutes before Trump declared new tariffs on Canada and Europe…

No, there’s no smoking gun that administration insiders are front-running these announcements. But someone’s making a lot of money off them.

Anyway, silver got whacked alongside gold — the bid down 60 cents to $37.67.

Crypto is faring much better than the precious metals — Bitcoin rallying big yesterday and bigger earlier today, getting oh-so-close to last month’s record over $122,000. It’s since pulled back to $120,220.

Ethereum, meanwhile, finally broke through the $4,000 barrier and now rests over $4,300 — the highest since late 2021.

As for stocks, it’s a mixed bag to start the week.

As for stocks, it’s a mixed bag to start the week.

At last check the S&P 500 has inched into record territory, four points shy of 6,400. The Nasdaq is posting a slightly stronger gain, while the Dow is slightly in the red.

“The S&P has erased the majority of its early August losses,” Greg Guenthner writes his Trading Desk readers. “But fresh inflation data will test the bulls' conviction later this week. A more pronounced pullback this month remains likely.”

Here, Greg is eyeing SPY, the giant S&P 500 ETF — trading at $637.47 as we check our screens. “The likelihood of a flush lower increases on a weekly close below 625.50,” he says.

“Regardless, we must respect this stubborn ‘stocks only go up’ rally until cracks appear in the averages. Let’s see how stocks stand up against this week’s consumer price index and a handful of earnings reports.

“The S&P 500 could just as easily print a new all-time high as a two-week low by Friday.”

![]() A Clean 10x in One Year

A Clean 10x in One Year

Decisions from D.C. figure into today’s Bullet No. 3 as well: For the second time this year, a White House announcement has propelled shares of Fannie Mae higher.

Decisions from D.C. figure into today’s Bullet No. 3 as well: For the second time this year, a White House announcement has propelled shares of Fannie Mae higher.

In May, the president said he was giving “very serious consideration” to taking the mortgage giant private; it’s been under government control since the 2008 financial crisis.

After we hit “send” on Friday’s edition, The Wall Street Journal reported the administration is preparing to sell stock in both Fannie Mae and Freddie Mac. FNMA shares soared 20% on the news — and they’re up another 10% this morning.

Several Paradigm analysts have been pounding the table on FNMA over the last year…

- A year ago at this time, Dan Amoss recommended FNMA in Jim Rickards’ Situation Report; as of today, readers are sitting on a 1,000% gain

- Chris Cimorelli talked up FNMA last October during our “America’s Next Move” gathering in Baltimore

- Davis Wilson told readers of The Million Mission in February that FNMA is an “extremely rare 5x return opportunity.” He picked up 2,500 shares of FNMA at $7.25. As we write this morning, it’s a penny shy of $11.

Still, Davis is leery of the market reaction to Friday’s announcement: “Is this based on fundamentals, or just headline hype? Right now, it’s clearly the latter.

“The real value here depends on what the IPO structure looks like, how much equity is actually released to public shareholders, and whether the government keeps a heavy hand on operations.”

That’s a lot of ifs. But Davis is holding on tight — while advising readers, “Don’t be surprised if this continues whipsawing higher and lower.”

![]() Not So Natural

Not So Natural

France’s purest mineral water might not be as pure as it claims to be? Sacre bleu!

France’s purest mineral water might not be as pure as it claims to be? Sacre bleu!

A year ago, the newspaper Le Monde and Radio France revealed that at least a third of “mineral water” sold in the country had in fact been treated — whether by ultraviolet light, carbon filtering or mesh material.

The problem is that under European Union law, anything marketed as “natural mineral water” should have nothing coming between the spring and the bottle.

And yes, the most popular names including Perrier and Evian are implicated in this scandal.

Reports the BBC: “Complicating matters for Perrier and its parent company Nestlé — as well as President Emmanuel Macron's government — is the charge that executives and ministers conspired to keep the affair quiet, covered up reports of contamination and re-wrote the rules so that Perrier could continue using micro-filtration.”

Legacy media outlets are trying to spin this story as a global-warming thing: Several years of drought have brought on fears of contamination — thus, the producers of mineral water resort to filtering or other treatment.

"The commercial model of the big producers has worked very well,” hydrologist Emma Haziza tells the BBC. “But it is absolutely not sustainable at a time of global climate change,:”

For its part, Perrier denies that contaminants are entering the deep-water aquifers.

In any event, the upshot is that within a few months, EU authorities might forbid Perrier to market itself as natural mineral water.

Little wonder that over the last year or so, the company has pivoted to a brand of energy drinks and flavored water called “Maison Perrier.” No issues with these products being filtered…

![]() Finding Courage

Finding Courage

High praise in the mailbag for Paradigm trading pro Enrique Abeyta, after his guest column on Saturday.

High praise in the mailbag for Paradigm trading pro Enrique Abeyta, after his guest column on Saturday.

“Hello Enrique — people have always told me that stock options are the best way to lose everything you have. Because of that, I have avoided learning more.

“Your article this morning makes so much sense. The big boys don’t want other people playing in their lane. I have downloaded the e-book you recommended. Thank you for giving me the courage to start looking into stock options Investing.”

Dave responds: We made sure Enrique saw your note, and he conveys his thanks for your kind words.

For anyone else looking to dip their toe into options, we publish The Ultimate Beginner’s Guide to Stock Options.

And for the investment idea that Enrique is most enthusiastic about right now… we direct your attention once more to the recent Paradigm All-In Summit. He, Jim Rickards and James Altucher have all rallied around one company that’s poised to soar after an announcement from the White House either today or tomorrow. Once more, check it out right here while there’s still time.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets