2025 Report Card

![]() 2025 Report Card

2025 Report Card

It was perhaps our team’s most out-there forecast for 2025 — and it was a banger.

It was perhaps our team’s most out-there forecast for 2025 — and it was a banger.

Welcome to the Paradigm Press 2025 report card. We’ll evaluate some of our team’s top forecasts — the ones that panned out, and the ones that fell short.

During a gathering at our firm’s Baltimore headquarters a year ago, the newest addition to our team — trading pro Enrique Abeyta — turned heads when he said AI darling Nvidia would shed $1 trillion in market cap sometime during 2025. Or at the latest, the first half of 2026.

His forecast came with 150 years of history and data behind it, and a dozen market cycles. The best analogy, he said, was that of Amazon during the dot-com bust from 2000–2002.

It didn’t take long for Enrique’s forecast to start coming to fruition. First, CEO Jensen Huang gave an underwhelming presentation at the Consumer Electronics Show in Las Vegas. Then came the bombshell of DeepSeek, the Chinese AI engine that achieved stupendous results at little cost.

NVDA’s market cap sank from a peak of $3.7 trillion on January 3 to $2.7 trillion by early March — ultimately sinking to $2.3 trillion in early April.

Enrique also forecast that NVDA shares would bounce back from those losses. Sure enough, from those April lows NVDA more than doubled to a $5 trillion market cap by the end of October. (Today? It’s more like $4.25 trillion, up 28.8% year-to-date.)

“Trump will immediately open up federal lands to new permits for oil and natural gas exploration,” Jim Rickards forecast in this space on the first business day of 2025.

“Trump will immediately open up federal lands to new permits for oil and natural gas exploration,” Jim Rickards forecast in this space on the first business day of 2025.

The move was key to what Jim saw as a three-pronged energy plan — “the implementation of ‘drill, baby, drill’ energy policies, the end of the Green New Deal programs and changes in the current climate agenda.”

Within a few weeks, Jim’s forecast evolved into his “American Birthright” thesis — an aggressive plan by the Trump White House to unlock the energy and mineral bounty beneath federal lands, valued as high as $150 trillion.

In time, the Trump administration’s strategy developed into one in which the federal government took ownership stakes in mining companies. Several Paradigm editors followed Jim’s “Birthright” cue with a recommendation of the rare-earth firm MP Materials. Members of Altucher’s True Alpha profited the most — $918% playing MP call options.

This is one trend where there will be many more profit opportunities during 2026. Stay tuned…

Along the same lines as Jim’s American Birthright thesis, Ray Blanco anticipated the Trump administration’s launch of a “National Strategic Computing Reserve” — not unlike the government’s Strategic Petroleum Reserve.

Along the same lines as Jim’s American Birthright thesis, Ray Blanco anticipated the Trump administration’s launch of a “National Strategic Computing Reserve” — not unlike the government’s Strategic Petroleum Reserve.

Ray said it would aim to ensure the United States is the world leader not only in AI but in the next generation of digital technology — quantum computing.

Further, he said the guts of a National Strategic Computing Reserve are already in place, thanks to a Biden administration initiative in 2021 that aimed to harness computer power to track the progress of COVID and other viruses.

And with figures like Elon Musk, David Sacks and Marc Andreessen in Trump’s circle, Ray believed it would become a newsmaking force in 2025 comparable to the space program in the 1960s.

It didn’t pan out exactly that way. But the administration has made clear it seeks to “win the AI race” with China. Among the steps it’s taken in that regard is Uncle Sam acquiring a 10% stake in Intel.

INTC is a company that conventional wisdom had left for dead — but that Ray and several other Paradigm editors championed going into 2025. Sure enough, it’s up 79.6% year-to-date.

Our 2025 report card continues in Bullet No. 2…

![]() 2025 Report Card, Continued

2025 Report Card, Continued

“We're witnessing something truly historic — the birth of machines that can actually think and reason,” said James Altucher in this space on the second business day of 2025.

“We're witnessing something truly historic — the birth of machines that can actually think and reason,” said James Altucher in this space on the second business day of 2025.

“This isn't just about computers getting faster or smarter. This is about machines developing real problem-solving abilities.”

No, that’s not the same thing as AI becoming self-aware and bossing you around. “Think of it like teaching a child to solve 247 + 385,” said James. “Instead of just guessing, they learn to add the ones column first, then the tens, then the hundreds.

“Previous AI models often struggled with complex problems because they tried to solve everything at once. These new models are different. They take their time, think things through and explain their reasoning along the way.”

James said the companies successfully harnessing this technology could “create generational wealth for their shareholders.”

That includes the aforementioned NVDA — a core holding in the Altucher’s Investment Network portfolio, up 288% from the newsletter’s initial recommendation in September 2023.

Paradigm chart hound Greg Guenthner entered 2025 conscious of the fact the typical bull market runs about 5½ years — and the current one began in October 2022.

Paradigm chart hound Greg Guenthner entered 2025 conscious of the fact the typical bull market runs about 5½ years — and the current one began in October 2022.

That’s based on market data going back to 1950. Using that rule of thumb, the bull could run until early 2028.

Sure enough, the S&P 500 is on track to register three straight years of double-digit percentage gains.

That said, Greg warned at the start of the year that we were overdue for a 10% pullback. “Be on the lookout, even in the first half of 2025, for the S&P 500 to drop 10%.”

Bingo. From a high of 6,144 in mid-February, the S&P slid throughout March — then plunged in April after the president’s “Liberation Day” tariff announcement. The index bottomed on April 8 at 4,982 — a swoon of 18.9%.

Alas, Greg will be the first to admit he whiffed on his projected Bitcoin price of $279,000. Can’t win ‘em all.

We’d be remiss if we didn’t subject one of your editor’s own forecasts for scrutiny. That’s next…

![]() Progress Report on 3-3-3

Progress Report on 3-3-3

Ahead of Trump’s inauguration in January, the financial media were playing up the “3-3-3” agenda of incoming Treasury Secretary Scott Bessent.

Ahead of Trump’s inauguration in January, the financial media were playing up the “3-3-3” agenda of incoming Treasury Secretary Scott Bessent.

Bessent set the following goals…

- Cutting the federal budget deficit to an amount that’s 3% of GDP

- 3% GDP growth by the final year of Trump’s term

- Growth in energy production equivalent to 3 million barrels of oil per day.

Those goals sound rather wonkish — but the broad idea is to juice economic growth to a point that it generates sufficient tax revenue so Uncle Sam’s gargantuan debt load becomes more manageable.

With the proviso that we’re not even 12 months into the Trump 47 presidency, let’s see where things stand on each plank of the 3-3-3 plan…

- As Trump prepared to take office a second time, the budget deficit as a percentage of GDP stood at shockingly high levels outside of wartime, a financial crisis or a pandemic — 6.3% in fiscal year 2024. For fiscal year 2025, that figure was trimmed slightly to 6.0%. Still high by historical standards, and there’s a lot of work to do to get to 3%

- As it happens, the Commerce Department reported third-quarter GDP this morning, behind schedule because of the government shutdown. “The data show the economy growing at an average annual rate of 2.5% since Trump returned to office,” says The Wall Street Journal, “even after a first-quarter contraction as companies ramped up imports to get ahead of new tariffs.” Going forward, 3% is achievable — but a lot has to go right. (And even if it does, GDP is a statistical abstraction that has little to do with your own prosperity)

- Measuring the growth in energy production is a challenge because Bessent’s yardstick is “barrels of oil equivalent” including both oil and natural gas. But oil production alone did grow almost half a million barrels a day in 2025. From the get-go, this was the most achievable of Bessent’s goals.

On Jan. 15, I wrote that 3-3-3 is “a variation on the same old playbook that’s never worked.”

Without a plan to slash federal spending — and I was already on record skeptical that DOGE would accomplish anything — the plan was doomed to failure.

I didn’t outright forecast that 3-3-3 would be a bust in calendar year 2025 — especially since Bessent’s goals were for the duration of the Trump 47 administration.

But everything hinges on the first element of the plan. The budget deficit as a percentage of the economy has to get out of crisis-era levels and back to something approximating “normal.”

We’re nowhere near there yet. And we’ll never get there unless the White House and Congress take a chainsaw to federal spending.

And how likely is that?

![]() Silver $70

Silver $70

Silver is making a run for $70 — only two weeks after breaking above $60 for the first time.

Silver is making a run for $70 — only two weeks after breaking above $60 for the first time.

Actually the white metal broke above $70 as the sun rose over the East Coast — only to take a tumble after the release of the aforementioned GDP numbers.

(Apparently the theory is that because the numbers are “better than expected” the Federal Reserve is less likely to cut short-term interest rates during its next meeting at the end of January. Literally no one is going to remember this by the time we get to the end of January.)

But at last check the bid has poked its nose over $70 again. Overbought markets can stay overbought longer than you expect.

Gold is also in record territory at $4,459. But the HUI index of mining stocks is in the red — down nearly half a percent at 737.

Meanwhile, copper is also setting records today — over $12,000 per metric ton. It’s up 37% year-to-date. Congratulations are in order for Rickards’ Insider Intel readers who collected 50% gains yesterday playing options on the big copper producer Freeport-McMoRan.

At the same time, the S&P 500 is inching its way back toward a record.

At the same time, the S&P 500 is inching its way back toward a record.

At last check, the index is up a quarter percent on the day, resting at 6,895 — only five points away from its Dec. 11 record. The Dow and the Nasdaq are likewise registering modest gains.

Crude sits a little under $58… Bitcoin just under $88,000… Ethereum at $2,954.

![]() Gold Myth-Busting

Gold Myth-Busting

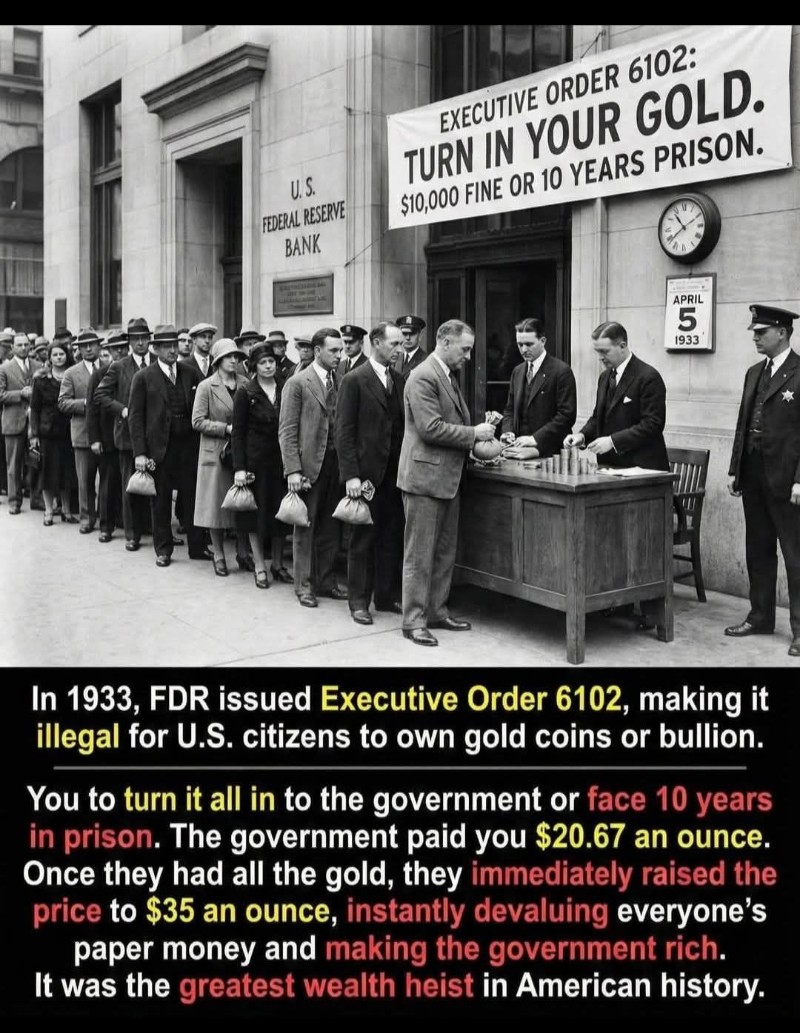

The following meme is catching fire on social media…

The following meme is catching fire on social media…

The caption is mostly accurate. Individuals could still retain up to five ounces of gold bullion in their personal possession. But yes, the dollar was instantly devalued relative to gold by 45%.

The photo itself looks… too perfect. Probably AI generated. An image search on Google for “‘turn in your gold’ photo 1933” turns up only one result and it’s accompanied by the same caption and it was posted to the web only yesterday.

(Granted, Google search is nigh-useless anymore — but it’s probably reliable in this instance.)

The faux photo belies this reality: Most Americans voluntarily surrendered their gold years before FDR’s order in 1933.

The faux photo belies this reality: Most Americans voluntarily surrendered their gold years before FDR’s order in 1933.

People didn’t have to line up at the bank — and FDR did not send G-men door-to-door.

Instead, people had been conditioned over the previous couple of decades to use convenient “gold certificates” instead of gold coins.

As Jim Rickards explained it here in 2016, “Banks slowly took the coins out of circulation (the way cash is going out of circulation today), melted them down and recast them into 400-ounce bars. Nobody is going to walk around with a 400-ounce bar in her pocket.

“Then they said to people, in effect, ‘OK. You can own gold, but it’s not going to be in the form of coins anymore. It’s going to be in the form of these bars. By the way, these bars are very expensive.’ That meant you needed a lot of money to have even one bar, and you weren’t going to take it anywhere. You were going to leave it in a bank vault.”

Americans were lured down the garden path with the promise of convenience. Why lug around those $5, $10 and $20 gold coins when you had those handy paper “gold certificates”?

Now you know.

The “photo” is certainly eye-catching. But it has nothing to do with the reality of how FDR executed his fiendish scheme…