Power to the People (Trump’s Energy Agenda)

![]() Trump’s Energy Agenda

Trump’s Energy Agenda

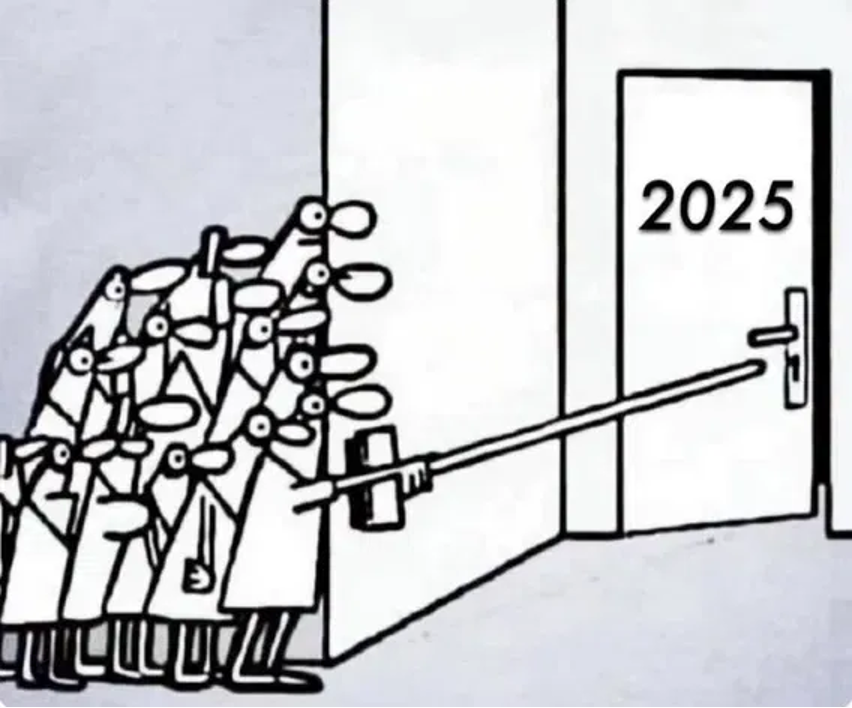

Someone created this meme in late 2024. We figured it would be prescient — but maybe not so soon in light of the New Year’s Day headlines?

Someone created this meme in late 2024. We figured it would be prescient — but maybe not so soon in light of the New Year’s Day headlines?

In any event, let’s dive headlong into the Paradigm Press editors’ predictions for 2025 — starting with the outlook for energy once Donald Trump takes office in 18 days.

(Yes, for our purposes this morning we’ll assume he takes office in 18 days…)

“The needed executive orders have already been drafted and will be awaiting Trump’s signature on day one,” Jim says.

“The needed executive orders have already been drafted and will be awaiting Trump’s signature on day one,” Jim says.

“In some cases, legislation will be needed to implement Trump’s policies in these areas but that legislation is also being drafted behind the scenes.”

Jim describes three main elements to the Trump energy agenda — “the implementation of ‘drill, baby, drill’ energy policies, the end of the Green New Deal programs and changes in the current climate agenda.”

Naturally, there’s some overlap — but let’s take them on one-by-one.

“On energy production, Trump will immediately open up federal lands to new permits for oil and natural gas exploration,” Jim says.

“On energy production, Trump will immediately open up federal lands to new permits for oil and natural gas exploration,” Jim says.

“These permits for new drilling will also apply to offshore drilling in the Gulf of Mexico and both the Atlantic and Pacific coasts as well as Alaska.”

Meanwhile, “Trump will permit more fracking in places like Pennsylvania and New York, which will result in production of far more natural gas.

“At the same time, Trump will order the Environmental Protection Agency (EPA) to stop shutting down coal-fired plants using bogus environmental concerns.

“On the Green New Deal, Trump will end subsidies to electric vehicles and impose high tariffs on EV imports from China and Mexico,” Jim continues.

“On the Green New Deal, Trump will end subsidies to electric vehicles and impose high tariffs on EV imports from China and Mexico,” Jim continues.

“Trump will also end subsidies to solar panels and windmills and will stop the installation of offshore wind farms, which are killing whales due to sonic booms and also killing rare birds with their turbines.

“Trump is not opposed to EVs and solar and wind energy. He is opposed to green subsidies and EV mandates that are killing jobs in existing manufacturing facilities making internal-combustion engine vehicles and jobs in coal and natural gas-fired energy plants.”

As for climate change, Jim says Trump will — once again — withdraw the United States from the 2015 Paris Agreement adopted by the UN Climate Change Conference.

As for climate change, Jim says Trump will — once again — withdraw the United States from the 2015 Paris Agreement adopted by the UN Climate Change Conference.

“He will also repudiate any wealth transfers from the U.S. to developing economies agreed at the 29th Conference of the Parties (COP29) recently held in Azerbaijan (a major oil producer, by the way).

“Trump will also reject the false science and flawed models produced by the United Nations Intergovernmental Panel on Climate Change (IPCC). These models have been used to justify the most extreme climate change mandates but they have been shown to be based on false assumptions and populated with manipulated data.”

Add it all up and what do you get?

Add it all up and what do you get?

“The combination of all of these policy changes,” says Jim, “will result in increased energy output, lower energy prices, a more reliable power grid and a strong dollar as the U.S. becomes a net exporter instead of a net importer of energy.”

And contrary to what you might think, Jim says lower energy prices won’t necessarily be bad news for Big Oil. As he sees it, what they lose from lower prices they’ll more than make up for with higher production — which translates to higher profits and higher market share relative to the rest of the world.

The biggest of the Big Oil players are Exxon Mobil (XOM) and Chevron (CVX). Buy now and while you wait for the share price to rise you’ll collect a respectable 3.7% dividend from XOM and 4.5% from CVX. At the moment, Chevron’s yield is better than you can get from Treasury bills.

So that’s Jim’s prediction for 2024. Come back tomorrow when it’s James Altucher’s turn — and you’ll learn about the next generation of AI.

In the meantime, we have other matters to attend to…

![]() Supply Chain Alert: 13 Days Till Dockworkers Walk

Supply Chain Alert: 13 Days Till Dockworkers Walk

While it’s 18 days till Inauguration Day, it’s 13 days until East Coast and Gulf Coast dockworkers go on strike.

While it’s 18 days till Inauguration Day, it’s 13 days until East Coast and Gulf Coast dockworkers go on strike.

Contract talks between the International Longshoremen’s Association and the U.S. Maritime Alliance will resume next Tuesday. The two sides came to terms last year on pay — but automation remains a huge sticking point. Donald Trump spoke up last month in support of the union.

Between the threat of a strike and uncertainty over Trump’s tariff plans, companies are loading up on inventory from overseas while they can: The logistics company Wabtec says imports through the Port of Los Angeles last week were up 73% from a year earlier.

Mr. Market has some heavy lifting to do if there’s going to be a Santa Claus rally.

Mr. Market has some heavy lifting to do if there’s going to be a Santa Claus rally.

“Many investors are often confused about how the Santa Claus rally works, and when it actually takes place,” says Paradigm chart hound Greg Guenthner.

A Santa Claus rally covers the last five trading days of the year, and the first two of the following year. So this time around, the window started on Christmas Eve and ends tomorrow.

“The Santa Claus rally has averaged a 1.6% gain since 1928, according to Oppenheimer, with one-month, three-month and six-month forward returns averaging 1.7%, 2.6% and 5.3%, respectively,” Greg tells us. “Not bad!”

➢ That said, even when a Santa Claus rally doesn’t materialize, the market posts an average 0.4% gain by the time Independence Day rolls around.

Among the big movers today are Tesla — down 5.5% after reporting its first year-over-year drop in annual vehicle sales in more than a decade.

Also in the spotlight is IAC Inc. (IAC) — a holding company chaired by the octogenarian media mogul Barry Diller. Among IAC’s holdings is a car-sharing app called Turo. Investigators believe Turo was used to rent the vehicles used in both the New Orleans car-ramming incident and the Las Vegas Cybertruck explosion yesterday. But for the moment, IAC shares are flat on the day.

Crude is starting the year with a big rally — up 2.5% to $73.52, the highest since mid-October. Oilprice.com chalks it up to “expectations of stronger economic and oil demand growth.” Whatever the case, it comes despite a rally in the dollar relative to other currencies. Rude Awakening editor Sean Ring tells us crude now is moving toward an upside target of $76.70.

Precious metals are also on the rally tracks — gold up $30 to $2,655 and silver up 60 cents to $29.46. Bitcoin can’t get any traction though, currently $96,428.

![]() Loose Ends

Loose Ends

We have a couple of loose ends from the period between Christmas and New Year’s to tie up today…

We have a couple of loose ends from the period between Christmas and New Year’s to tie up today…

First, Donald Trump filed a friend-of-the-court brief at the Supreme Court — urging the justices to pause the law that would ban TikTok come Jan. 19, the day before his inauguration.

Trump “takes no position on the underlying merits of this dispute,” says the brief. Rather he’s asking the court to take its time deliberating the case so that once he takes office his administration can “pursue a political resolution of the questions at issue in this case.”

Presumably the “political resolution” entails a sale of TikTok’s U.S. assets to an American buyer. That’s the one condition under which the ban would not take effect.

But TikTok’s Chinese owners have had nearly nine months since the law’s passage to line up a U.S. buyer — and no one has stepped forward yet with a credible offer.

The Supreme Court will hear arguments in the case a week from tomorrow.

Small-business owners have gotten a last-minute reprieve from onerous new regulations.

Small-business owners have gotten a last-minute reprieve from onerous new regulations.

Under the Corporate Transparency Act of 2021, up to 32 million small businesses were under the gun to file a new form about their “beneficial ownership” with an agency many business owners had probably never heard of — FinCEN. That’s a unit of the Treasury Department formally known as the Financial Crimes Enforcement Network.

The law is yet another attempt by the feds to stop “money laundering” via anonymous shell companies — and yet another thorn in the side of small businesses.

The deadline to comply was yesterday. But as of Dec. 2, only 10 million businesses — fewer than a third of those affected by the law — had gotten around to submitting the paperwork.

Fortunately, a week ago today a federal appeals court put the reporting requirements on indefinite hold while the court reviews the law’s constitutionality.

![]() Olympic Medals Ain’t What They Used to Be

Olympic Medals Ain’t What They Used to Be

If you thought the Paris Olympics were a train wreck… well, this won’t alter your perception…

If you thought the Paris Olympics were a train wreck… well, this won’t alter your perception…

“French bronze medal-winning Olympic swimmer Yohann Ndoye-Brouard wondered over the weekend whether a medal he captured is from this summer or 100 years ago,” says an NBC News article. “That's because the bronze he won in the 4x100-meter medley relay at the Paris 2024 Games seems to be deteriorating faster than a Leon Marchand lap.”

Nor is Ndoye-Brouard alone. Several bronze medalists report similar decay.

Fortunately there are no similar reports about the silver and gold medals. But as we mentioned once again last year, the “gold” medals haven’t had much gold content since 1912. The 2024 edition weighed 18.66 ounces and consisted of 95.4% silver and a smattering of iron scraped from the Eiffel Tower — and gold-plated. At current prices it’s worth roughly $1,020.

![]() The First Mailbag of 2025

The First Mailbag of 2025

We got plenty of positive feedback to last Saturday’s edition — which featured our occasional foray into who we are and what we’re all about.

We got plenty of positive feedback to last Saturday’s edition — which featured our occasional foray into who we are and what we’re all about.

“Thanks for the candid, succinct, no-BS description of your business model and services. It helped to confirm my own observations and feelings during the last five months, during which I have done exactly what you described, starting small and then signing on to some of your premium services.

“One of those is already very profitable, and I have high hopes for the others. Looking forward to 2025!!”

From a longer-term reader: “What a thorough, sensible and sensitive revelation of what Paradigm Press and 5 Bullets [I still call it ‘The 5’] are all about and how it all works.

“I learned things I never knew about Paradigm and how that concept unites and propels the many [sometimes disparate] minds and voices that power the successful services you provide. Thanks for your independence and freedom of thought.

“Good on you! Also, special kudos to Doug, Matt, Dustin, Emily and any others keeping the team running. Happy New Year!”

Another longtimer: “Been a Paradigm Press subscriber for something like 10 years. Wouldn't be without it.”

“Even though I fall into the category of entry-level subscriber,” says a newbie, ”I look forward to receiving your correspondence, as well as Sean Ring, Byron and Rickards’ Strategic Intelligence. I am working toward the premium subscriptions.

“Thank you for what you do and more importantly how you do it.”

One more: “Last week I sent in a rant email. I rarely do that but I didn’t understand the Altucher and Paradigm connection.

One more: “Last week I sent in a rant email. I rarely do that but I didn’t understand the Altucher and Paradigm connection.

“Thank you for your patient explanation in your ‘Who We Are and What We’re All About’ email on Dec. 28.

“I appreciate you hearing me and responding, it was very helpful. I wish you all goodness in the new year!”

On the subject of our unconventional inflation-fighting advice, a reader takes issue with razor blades as an asset class.

On the subject of our unconventional inflation-fighting advice, a reader takes issue with razor blades as an asset class.

“Maybe a few could come in handy to do emergency surgery with, but for shaving the answer is very simple: Why do you bother shaving?

“Having a childlike, or ladylike, smooth face by shaving off your whiskers might please your overlords to help keep you looking suitably childlike and therefore submissive and non-threatening to them.

“Be thankful if razor blades become scarce. You can then have a good excuse to explain to your masters why you quit emasculating yourself with them.”

Dave laments: I hear ya. But when rolling in the genetic dice game for bountiful facial hair… some of us came up snake eyes!

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets