Shortcut to a Miracle

![]() Medicine’s Holy Grail

Medicine’s Holy Grail

Sometimes the best investment opportunities reward those who are patient.

Sometimes the best investment opportunities reward those who are patient.

It was a year ago at this time when Paradigm’s tech-and-biotech specialist Ray Blanco forecast that AI would start to transform the biotech sector during 2024.

During an online event we convened for readers called the 7 Predictions Summit, Ray made a powerful case for AI’s power in the biotech space.

As a sector, biotech runs extremely hot and cold: For every winner there are at least a half dozen busts.

No wonder: Up until now, 90% of clinical trials end in failure. And the average cost of such a trial runs $2.6 billion across the space of 10 years.

That’s $2.6 billion in costs and a decade of time before a penny of revenue materializes — and in 90% of those cases, the revenue never materializes.

“It’s hard to find the right therapeutic targets to treat disease, and to understand the complex biology of disease,” says Ray. “Researchers are unable to efficiently explore a huge universe of potential drug structures. It takes a long time to optimize potential drug candidates so they have the desired properties.”

But AI can slash those costs, slash that development time — and dramatically raise the odds of success.

But AI can slash those costs, slash that development time — and dramatically raise the odds of success.

Makes sense, right? If scientists can use a well-trained AI to rule out formulations that won’t work before going to the time and expense of a clinical trial… suddenly they won’t be pouring hundreds of millions of dollars into a black hole year after year.

That’s the theory, anyway. The practice has been more of a challenge. That’s why Ray has been cautious about recommending AI-driven biotechs during 2024.

Until now. And he says it’s worth the wait.

All this year, Ray has been charting the progress of scientists using AI to develop the holy grail of disease treatment.

All this year, Ray has been charting the progress of scientists using AI to develop the holy grail of disease treatment.

It’s a single breakthrough that could lead to solutions for everything from Alzheimer’s to cancer to diabetes to heart disease to arthritis.

“The pain and suffering of disease, along with the fear caused by it, may one day be a thing of the past,” says Ray.

That’s a big promise. But Ray says the promise will be made real during an announcement set for this Thursday — two days from now — in New York at 9:00 a.m. EST.

Yes, the profit potential is enormous. The most recent analogue that comes to mind for Ray is many years in the past now. A company called Medivation developed a prostate cancer treatment in 2006. By the time Pfizer acquired the firm a decade later, investors were sitting on a gain of 11,534%.

Now’s the time to position yourself ahead of what Ray anticipates will be a world-changing announcement.

It might not be instant riches — but it could well be the start of something even better — generational wealth. Click here, let Ray make his case and decide for yourself.

![]() Bitcoin Barrier (It’s Temporary)

Bitcoin Barrier (It’s Temporary)

Try as it might, Bitcoin is having trouble leaving $100,000 behind.

Try as it might, Bitcoin is having trouble leaving $100,000 behind.

The flagship crypto broke the $100K barrier last Wednesday — but the move didn’t stick. Checking our screens this morning, it’s below $96,000.

But Paradigm’s trading pros are unperturbed. The move to date has been “too damn orderly,” Greg Guenthner tells his Trading Desk readers. “A little chaos goes a long way in setting up these breakouts. The market needs to squeeze out the weak hands to set up the next leg higher.”

History shows that next leg higher is coming — and it will be substantial, says Enrique Abeyta.

Ordinarily when the relative strength index or RSI on a chart shows a stock or other asset is “overbought”... that’s a sign it’s due for a pullback.

But not in Bitcoin’s case. When Bitcoin’s RSI 83.5 or greater — an enormously overbought level — it rises an average 45% over the next 90 days.

“One of the core drivers of our successful trading strategies is to avoid overbought stocks and buy oversold ones,” says Enrique. “This isn’t driven by opinions — it is driven by the data.

Here the data is telling us something VERY different and we want to respect it.”

Elsewhere, the major U.S. stock averages are shaking off their Nvidia-driven doldrums from yesterday. The Dow, S&P 500 and Nasdaq are all in the green — if just barely.

And now for the least surprising economic number of the year.

And now for the least surprising economic number of the year.

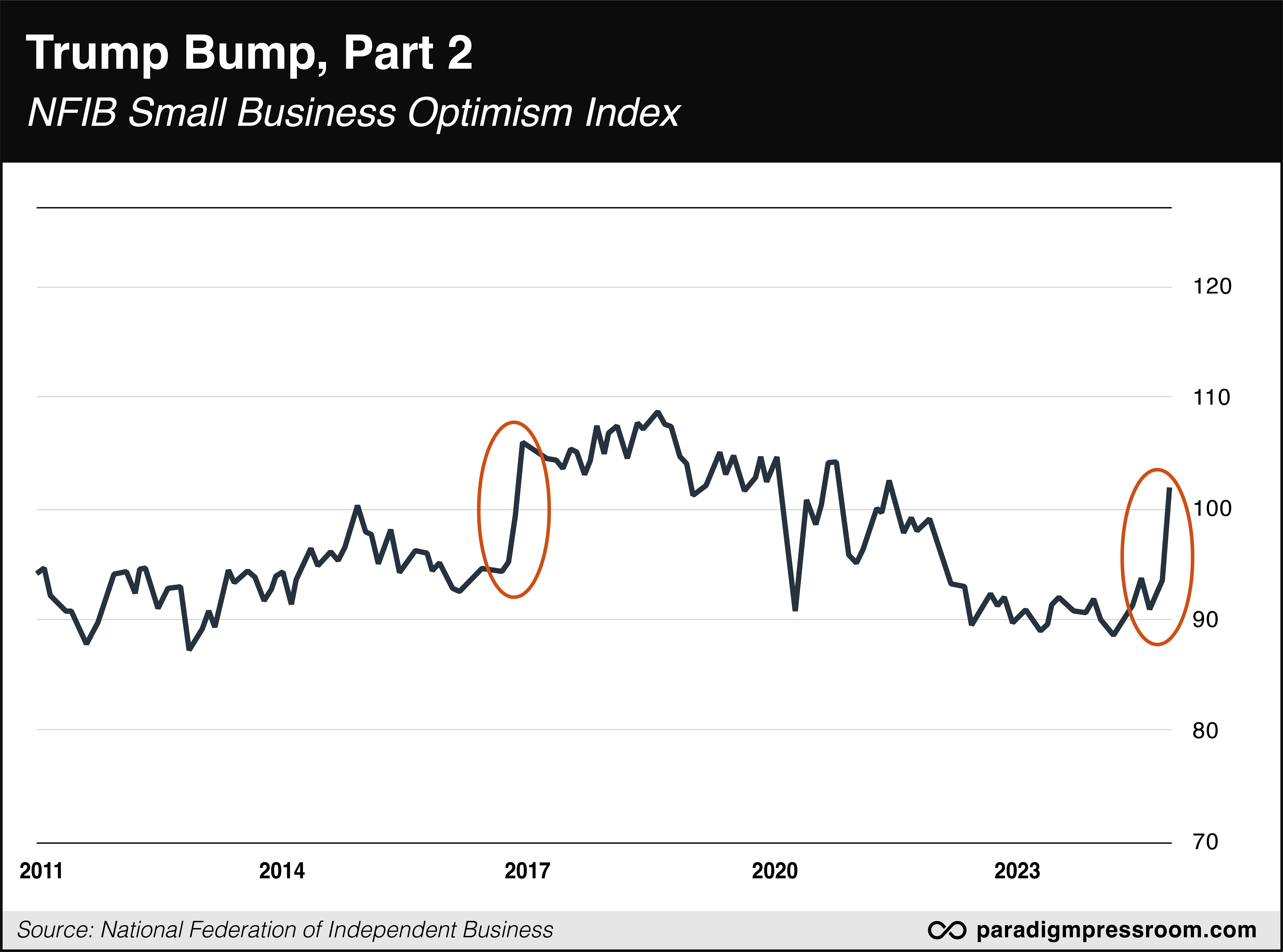

The National Federation of Independent Business is out with its monthly Small Business Optimism Index.

The previous survey was conducted before Election Day. As mentioned a month ago, the NFIB’s membership skews Republican. Thus we anticipated a big jump in the next survey with Trump’s victory — as happened in 2016.

Sure enough…

The headline number leaped eight points to 101.7, the highest reading since June 2021. After nearly three years, this figure is once again higher than its long-term average. And we do mean long-term; this survey’s been conducted for 50 years.

The internals of the survey are equally sunny: Expectations for the economy to improve are the highest since late 2020. Expectations for higher sales are the best since late 2021.

“Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures,” says NFIB chief economist Bill Dunkelberg.

![]() Gold, Syria, Silver

Gold, Syria, Silver

Gold is inching back toward the $2,700 level — again performing its risk-hedging role as we await the next shoe to drop in the Middle East.

Gold is inching back toward the $2,700 level — again performing its risk-hedging role as we await the next shoe to drop in the Middle East.

Really there isn’t that much that’s changed about Syria since we wrote you 24 hours ago. The United States, Israel and Turkey are all bombing their respective spheres of influence inside the country — which isn’t that different a state of affairs than before the overthrow of Bashar al-Assad.

Our own Jim Rickards ran down a list of the likely winners and losers for his Strategic Intelligence readers yesterday — good for Israel, bad for Iran and so on.

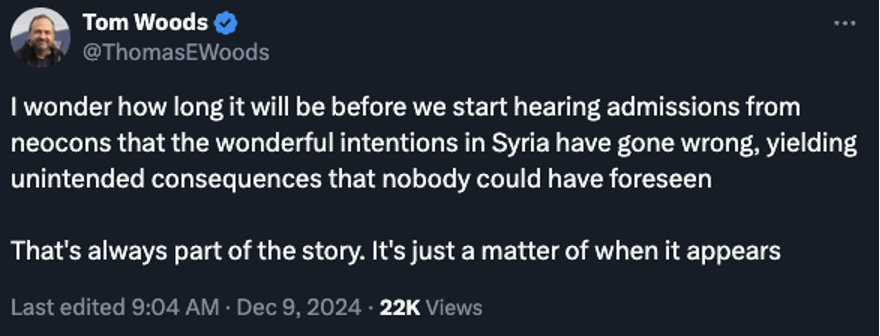

But he added an enormous caveat you won’t hear from corporate media: “Every early assessment of winners and losers may completely reverse in a year. The U.S. may find it has empowered a new Taliban. U.S. regime change operations in Libya, Iraq, Afghanistan and Ukraine have all failed badly and left chaos or war in their wake. Syria may be no different.”

Indeed, “The problem now in Syria is the same as that in Iraq in 2003 after the defeat of Saddam Hussein and his largely Sunni regime,” writes the London Independent’s veteran Middle East correspondent Patrick Cockburn.

“Removing the old elite and purging the old Saddam appointees from the state apparatus may have been democratic in one sense, but it also meant replacing Sunni with Shia which provoked a sectarian bloodbath in Iraq....”

Back in the markets, it’s a familiar story of late: Gold’s strength is not being reflected in either silver or the mining stocks — silver is back below $32 — and that’s a sign gold will continue to struggle in the short term.

![]() Countdown to TikTok Ban

Countdown to TikTok Ban

With any luck, the TikTok ban will go before the Supreme Court soon.

With any luck, the TikTok ban will go before the Supreme Court soon.

Last week, a federal appeals court upheld the law passed by Congress and signed by President Biden: TikTok will be banned in the United States unless its Chinese parent firm can sell its U.S. operations by Jan. 19 — less than six weeks from now.

The judges bought the Justice Department’s arguments that TikTok somehow poses a threat to U.S. national security. That’s an assertion relying largely on secret evidence — hidden not just from you and me but also from TikTok’s attorneys.

TikTok is used by 170 million Americans to exercise their First Amendment rights. And contrary to what you might think, fully 75% of them are of voting age. In addition, 7 million small online businesses rely on TikTok for their livelihoods.

Despite the enormous size of this constituency, Congress passed the ban last spring on the grounds that TikTok spies on its U.S. customers and feeds them propaganda. Again, there’s no evidence to support those claims — other than secret evidence congresscritters say they were presented by the “intelligence community” behind closed doors.

As we’ve said much of this year, the real reason TikTok is in the feds’ crosshairs is that it’s one of the few platforms that’s not under the thumb of the FBI, CIA, DHS, etc.

Yesterday, TikTok asked a federal appeals court to temporarily halt the law’s enforcement, pending an appeal to the Supreme Court.

"The Supreme Court has an established historical record of protecting Americans' right to free speech,” says a TikTok statement, “and we expect they will do just that on this important constitutional issue.”

Yeah, based on the justices’ ruling this summer in Murthy v. Missouri, we don’t share the confidence that TikTok’s lawyers are expressing here…

![]() Was It Something About the CEO Shooting?

Was It Something About the CEO Shooting?

After a reader’s vigorous denunciation yesterday for “disgusting, offensive” and “one-sided” views, we got a short note from one of our regulars.

After a reader’s vigorous denunciation yesterday for “disgusting, offensive” and “one-sided” views, we got a short note from one of our regulars.

“This comes from a reader on the extreme left. I can tell because it is long on opinion, indignation, rhetoric, disinformation and... devoid of facts.”

You may well be right, sir, but I still wonder what set her off.

Her note came in after last Thursday’s edition. There were a handful of against-the-grain insights, but nothing particularly over-the-top — unless it was my defense of the casual verbiage I used to describe the circumstances surrounding the murder of UnitedHealthcare CEO Brain Thompson.

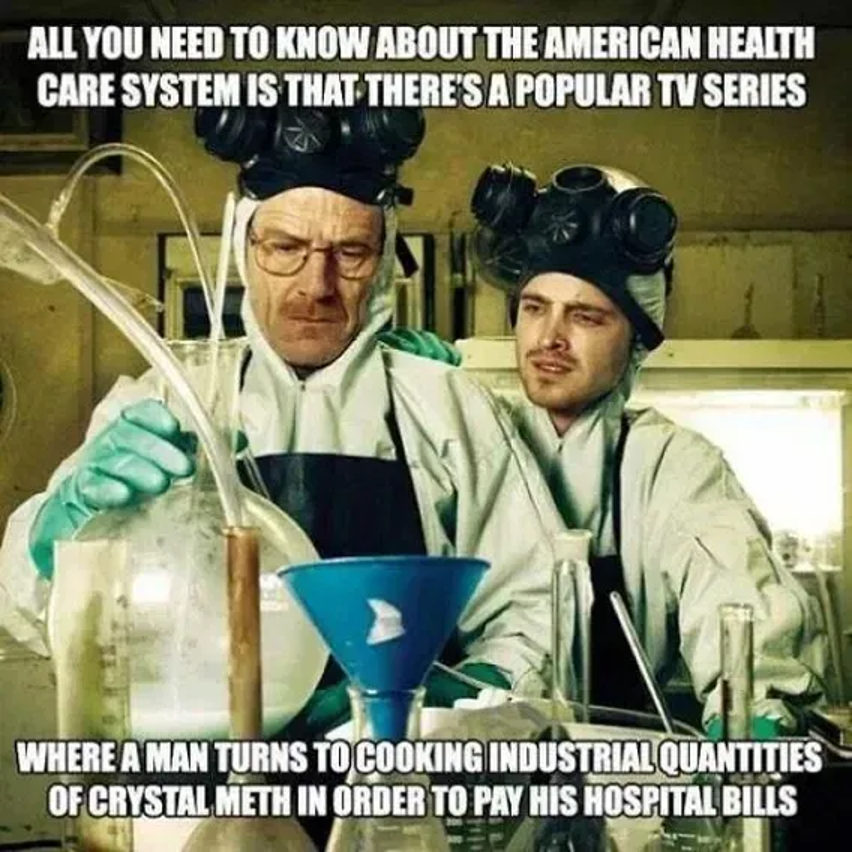

From the beginning, I’ve been floored by the power elite’s hectoring tone toward the social media vibe — you know, everyday people’s jokes about “I’m sorry, prior authorization is required for thoughts and prayers,” and the shooter being dubbed “the adjuster.”

After the arrest of a suspect in Pennsylvania yesterday, we got more tut-tutting from Gov. Josh Shapiro: “He’s no hero.”

Well, no. But the Establishment seems to be in deep denial about the outrage currently directed against America’s ruinously expensive crony-capitalist health care system — also a point I tried to make on Thursday. Maybe that’s what set the reader off?

The fact is that millions of people are victims of financial extraction by this industry — no, not in the way the leftist “free health care for all” crowd portrays it, but so what?

We don’t know exactly what beef the suspect had with the system — and my former colleagues in the media better get on the stick releasing his manifesto in full so we the people can judge it for ourselves — but whatever his grievance, it obviously wasn’t addressed through either legislation or litigation.

So it comes back to that old truism: When injustices aren’t remedied via the soap box, the ballot box or the jury box… it should be no surprise when someone decides to resort to the cartridge box.

That’s not an endorsement of Thompson’s murder. It’s just a recognition of reality — which is more than you’ll get from the likes of Gov. Shapiro.

Here’s one more recognition of reality as seen in the meme-o-sphere. And with that, we’ll call it a day…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets