Gold Breaks the Rules

![]() Gold Breaks the Rules

Gold Breaks the Rules

Gold begins a new week making up for lost time — up nearly 2% and in record territory over $4,400.

Gold begins a new week making up for lost time — up nearly 2% and in record territory over $4,400.

No, there’s no obvious catalyst. It’s just what happens when any asset class is in a bull market. It acquires a momentum all its own.

In recent weeks it’s been silver stealing all the precious-metals thunder. But gold is the foundation and the framework.

Silver, platinum, palladium and the mining stocks can deliver life-changing wealth when they get on the rally tracks — but that doesn’t happen without a movement into gold.

What’s behind gold’s 70% year-to-date appreciation? And where does it go from here?

Some insight comes from economic historian Edward Chancellor in a recent opinion piece published by the Reuters newswire…

“By the turn of this decade it had become received wisdom that gold moves inversely with long-term real interest rates,” Chancellor writes.

“By the turn of this decade it had become received wisdom that gold moves inversely with long-term real interest rates,” Chancellor writes.

In other words, gold rises when real (or after-inflation) interest rates fall. And by the same token, gold falls as real rates rise.

“Thus its value swooned in 2022,” Chancellor explains, “when central banks tightened the cost of borrowing and bond yields climbed.

“Then something unexpected happened: Gold started to rise exponentially even as inflation turned down and inflation-adjusted bond yields rose.”

“Then something unexpected happened: Gold started to rise exponentially even as inflation turned down and inflation-adjusted bond yields rose.”

Gold slid from $2,000 to nearly $1,600 in 2022 — only to begin an ascent that’s still underway, even as long-term bond yields adjusted for inflation are also rising.

In other words, gold is breaking the rules.

Paradigm macro maven Jim Rickards says this is a huge development: “This decoupling of gold prices and real yields means gold can continue to go up in diverse interest rate environments.”

What changed?

Maybe you’ve already guessed if you’ve been keeping up with these daily missives: Russia invaded Ukraine in 2022 and Washington responded with unprecedented sanctions — freezing the dollar-based assets of Russia’s central bank, some $300 billion worth.

“The seizure of U.S. Treasury securities owned by Russia has caused large reserve holders like China, Japan and Saudi Arabia to ask if the same thing could happen to them,” Jim goes on. “The simple solution is to buy physical gold since it is not a currency and is not easy to freeze or seize.

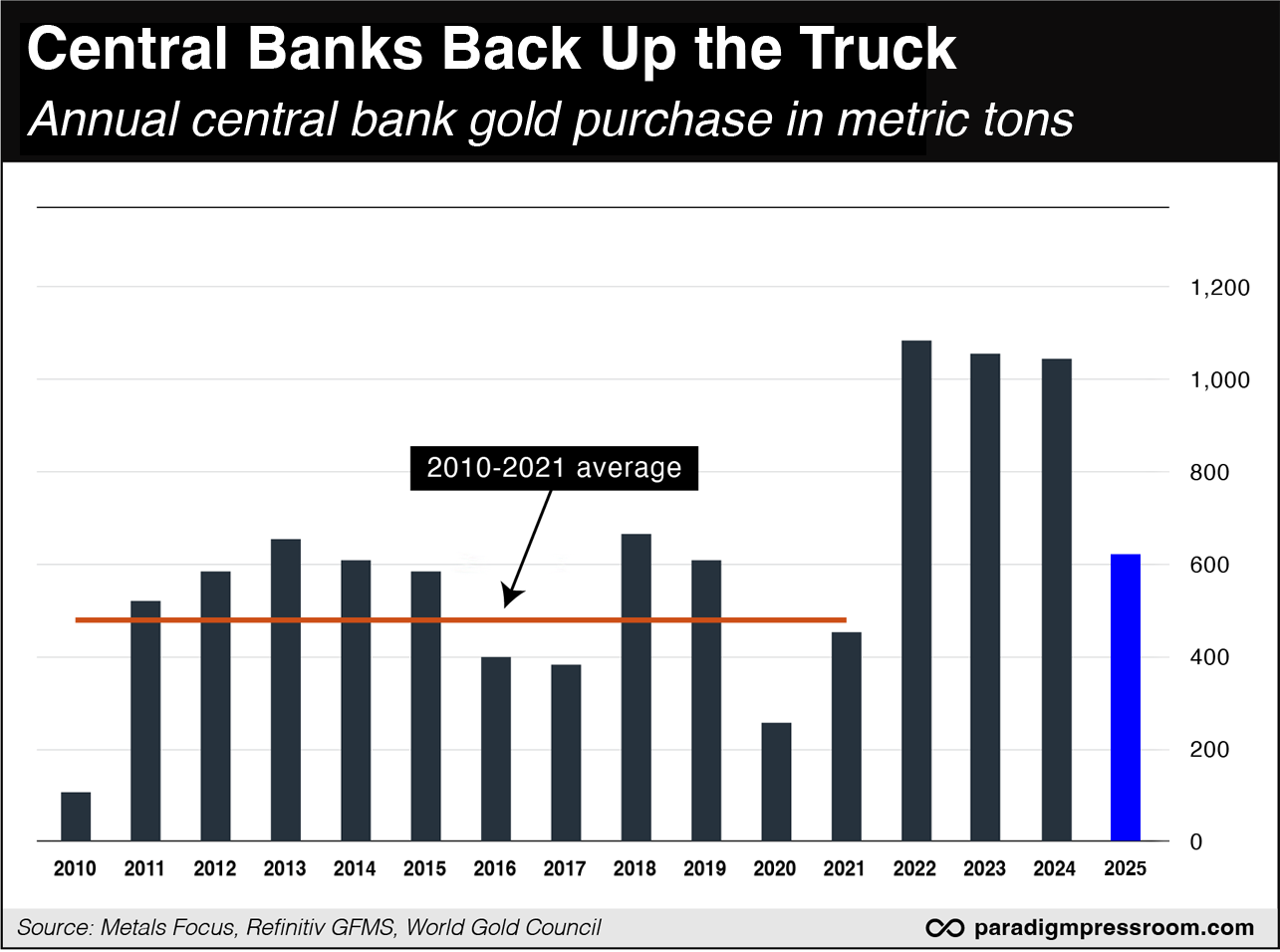

“Central banks moved from being net sellers to net buyers in 2010. That buying trend is continuing and getting larger.”

Here again is a chart we can’t show you often enough. Look how everything changed in 2022. And the 2025 number is for only the first three quarters of the year…

This phenomenon “puts a de facto floor under the price of gold,” says Jim — “because central banks will buy the dips to keep expanding their positions.”

But central bank buying isn’t the only factor propelling gold higher.

But central bank buying isn’t the only factor propelling gold higher.

“Holdings of gold by ETFs, a kind of proxy for retail interest, have been lagging the price action,” Jim goes on. “This means the ETFs are poised to expand their share issuance and gold purchases in the near future.

“Above all, private institutional investors have gold allocations of below 2.0% of total assets. If that expanded to a mere 4.0% allocation, there’s not enough gold in the world at today’s prices to fill those orders.

“That dynamic alone could send gold prices above $10,000 per ounce in the year ahead.”

Understand, that’s not a forecast per se. It’s an extrapolation of current trends — and a recognition that nothing is getting in the way of those trends. If $10,000 doesn’t happen in 2026… it won’t be much beyond 2026.

Meanwhile, silver powered another $2 higher overnight — surpassing $69 before pulling back a bit.

Meanwhile, silver powered another $2 higher overnight — surpassing $69 before pulling back a bit.

Yes, silver has gotten ahead of itself. But assets that get ahead of themselves frequently rally much higher before taking a rest. “Its next target is $78.50,” comments Sean Ring in today’s Rude Awakening — “and it may get there sooner rather than later.”

![]() About the Santa Claus Rally…

About the Santa Claus Rally…

The stock market begins the new week where the old one left off — with a rally. But don’t call it a “Santa Claus rally” yet.

The stock market begins the new week where the old one left off — with a rally. But don’t call it a “Santa Claus rally” yet.

“Many investors are often confused about how the Santa Claus rally works, and when it actually takes place,” says Paradigm chart hound Greg Guenthner.

It’s not just a general year-end uptrend. The term was coined in 1972 by Yale Hirsch, longtime editor of the Stock Trader’s Almanac — and he gave it a very specific definition. A Santa Claus rally covers the last five trading days of the year, and the first two of the following year.

With that in mind, “The Santa Claus rally officially kicks off this Wednesday and runs through Monday, Jan. 5,” Greg says.

“So far, stocks are holding their gains today. A fitting end to 2025 and the past two months of choppy conditions starts now.”

Checking our screens, the S&P 500 is up nearly two-thirds of a percent to 6,876 — about 25 points off the index’s record close back on Dec. 11. Curiously the S&P’s gains are a bit stronger than both the Dow and the Nasdaq — which are both in the green by a little over a half percent.

As for crypto, “Bitcoin and Ethereum have been dead trades for the better part of the past two months,” says Greg. But we’re beginning to see signs of life following a nice Friday rally.

“Bitcoin is moving toward $90K and is up more than 1.5% today while Ethereum is solidly above $3K.

“Yes, there’s still a ton of work left to do for the big coins. But every rally has to start somewhere. We’ll see if they can continue their comeback moves into the short trading week.”

![]() Tanker Wars

Tanker Wars

Intentionally or not, the Trump administration is picking a fight with the Chinese government over the U.S. seizure of Venezuelan-linked oil tankers.

Intentionally or not, the Trump administration is picking a fight with the Chinese government over the U.S. seizure of Venezuelan-linked oil tankers.

It started on Dec. 10 when U.S. forces seized a tanker off the Venezuelan coast and escorted it to Houston.

Then last Tuesday night, Donald Trump declared “a total and complete blockade” of all “sanctioned oil tankers” entering or leaving Venezuela.

As we chronicled on Wednesday, Moscow immediately called Trump’s bluff — when a sanctioned Russian-owned vessel, the Hyperion, began approaching Venezuela with a cargo of oil-processing chemicals.

According to ship-tracking data, the Hyperion arrived yesterday at the Venezuelan port of Amuay.

But while the Russian-owned vessel went on its way unmolested, U.S. forces seized a Chinese-owned vessel on Saturday.

But while the Russian-owned vessel went on its way unmolested, U.S. forces seized a Chinese-owned vessel on Saturday.

This is an oil tanker called the Centuries. The ship itself is not under U.S. sanctions but apparently the cargo is. The New York Times reports the ship was carrying Venezuelan oil en route to Chinese refineries. Further, unlike the first seizure earlier this month, this time there was no seizure warrant from the Justice Department to take possession of the ship.

And with that, Chinese state media unleashed its full fury on Washington.

“The U.S. now faces another major strategic choice,” says an article in the Global Times — drawing on a Chinese proverb.

“History has repeatedly demonstrated that ‘a just cause rallies abundant support while an unjust one finds little.’ Only mutual respect and equality can bring lasting peace and development, which aligns with the common interests of all countries, including the long-term well-being of the American people."

Yes, Global Times is a Communist Party mouthpiece — but it’s not wrong.

In fact, on second thought maybe the second ship seizure this weekend is what’s propelling the gold price higher.

That is, it’s another no-confidence vote in Washington’s efforts to be — as France’s finance minister put it a few years back — “the economic policeman of the planet.”

For sure, the oil price popped big-time as markets reopened Sunday night. At last check a barrel of West Texas Intermediate is up over 2% to $57.77.

For sure, the oil price popped big-time as markets reopened Sunday night. At last check a barrel of West Texas Intermediate is up over 2% to $57.77.

As the day wears on, it appears U.S. forces tried to seize a third vessel but then gave up the pursuit. The Bella 1 was on its way to Venezuela to load a shipment of crude before turning tail back into the Atlantic.

![]() Bud for Boomers

Bud for Boomers

Volatility in cannabis stocks notwithstanding, cannabis use among older Americans is on the rise.

Volatility in cannabis stocks notwithstanding, cannabis use among older Americans is on the rise.

In our Saturday edition, Emily told you about Donald Trump’s executive order downgrading marijuana from a Schedule I drug (on par with LSD and heroin) to Schedule III (comparable to codeine and ketamine).

In anticipation of the order, cannabis stocks rallied hard last week — only to collapse once it was apparent that the cannabis industry still would not get access to the banking system.

Still, the long-term growth trajectory is intact. Figures from the National Survey on Drug Use and Health in 2024 find 10% of Americans 65 and older reported using the herb at least once a year. That’s up from only 0.3% in the early 2000s.

Which makes sense when you think about it. “In the early 2000s, the 65-plus age bracket was comprised of the GI and Silent generations. These two groups were never known for their drug use,” write demographers Neil Howe and Christian Ford at their Demography Unplugged Substack.

“But over the last 25 years, the 65-plus bracket has become mostly comprised of boomers. And this Deadhead cohort has brought their weed habits with them into older age brackets.

“Expanded access has also played an important role. Recreational marijuana is now legal in 24 states, while medical marijuana is legal in 40. As a result, just over half of Americans live in a county with at least one marijuana dispensary.”

Paradigm tech-and-biotech specialist Ray Blanco guided readers to some of the earliest profits to be had in publicly traded canna-businesses in 2016–17.

He has his eye out for the next wave in the aftermath of Trump’s order. Stay tuned…

![]() Mailbag: Free Pass for Big Pharma

Mailbag: Free Pass for Big Pharma

Friday’s edition about Abbott Laboratories’ threat to pull baby formula off the market unless Congress gives it liability protection prompted a couple of responses…

Friday’s edition about Abbott Laboratories’ threat to pull baby formula off the market unless Congress gives it liability protection prompted a couple of responses…

“Re your comment, ‘If the studies and authorities say there’s nothing to back up a link between the formula and necrotizing enterocolitis, rely on those studies and authorities in court and let the chips fall where they may. You shouldn’t need special favors from Washington.’

“If only it were that simple! Shopping for the right judge and the right venue doesn’t happen just in politics. Evidence allowed to be presented in court may bear little resemblance to what a typical person would perceive as facts, especially when scientific or technical data are involved.

“In the absence of tort reform needed for product liability, how can you blame a company like Abbott from seeking alternate ways to level the playing field? Shouldn't they be making the best business decisions they can for their shareholders?”

“The real problem is when someone can get a $500 million judgement against a provider for a bad outcome because the product designed to cure that fatal disease failed to do so,” writes a reader who evidently is a medical professional.

“The real problem is when someone can get a $500 million judgement against a provider for a bad outcome because the product designed to cure that fatal disease failed to do so,” writes a reader who evidently is a medical professional.

“Most preemies die without intense medical intervention. The logical business solution is to quit trying to save them and stop making the product. If the help-to-harm ratio is high, as your data suggests, every effort to keep helping is reasonable.

“I look for NEC on every preemie X-ray that is taken. It is hard to identify early. I am not in a position to know what the treatment is and how often it is successful.

“I have been sued twice because of bad outcomes. First one there was no payment. It was clear the patient was responsible for his own demise. Second was extremely sad. Pulled at your heartstrings. Full-term baby on formula got severe complications of NEC. Pediatrician and neonatologist took big monetary hits. NO ONE DID ANYTHING WRONG!”

Dave responds: To be sure, my critique didn’t make allowances for the America-as-a-litigious-society problem.

But I don’t think the answer to that problem is to give Big Pharma free passes of the sort it got for the COVID jabs…

The mailbag thread about the Vietnam War is carrying into a new week…

The mailbag thread about the Vietnam War is carrying into a new week…

“So my girlfriend is a refugee from this country,” a reader writes. “She was caught trying to escape multiple times by the communists and some of her family were killed by them.

“A friend of mine who fought in the war also said we were indeed winning and could have won the war. He had many crazy stories like being shoved into the luggage space of a Huey gunship to get airlifted out and the hatch would not completely shut. He said the number of political grifters such as LBJ owning stock in Sea-Land etc. was common.

“The people in this country must make laws such as it being mandatory for the families of all politicians to fight in these wars, that they cannot trade stocks during their tenure and any evidence of familial inside trading will result in prison time, etc.

“Until things like this are enacted and enforced the U.S. is doomed to die.”

Dave: The timing of your note’s arrival couldn’t be more pitch-perfect…