Can Robots Get a Suntan?

![]() A Sun-Seeker Visits Vegas

A Sun-Seeker Visits Vegas

The Consumer Electronics Show (CES) in Las Vegas isn’t just about the flashiest gadgets. It’s where early prototypes sit next to finished products and where you occasionally stumble onto something that feels slightly ahead of its time.

The Consumer Electronics Show (CES) in Las Vegas isn’t just about the flashiest gadgets. It’s where early prototypes sit next to finished products and where you occasionally stumble onto something that feels slightly ahead of its time.

That’s exactly the feeling surrounding one of the more subtly ambitious debuts at CES 2026: the Solar Mars Bot from Silicon Valley-based company Jackery.

Jackery is already well known to CES regulars. For more than a decade, it has built a reputation in portable energy, off-grid power and home backup solutions.

This year, Jackery showed off plenty of familiar hardware, from new portable power stations to an eye-catching solar gazebo designed to turn outdoor space into a living room or home office.

But the solar product that’s drawing attention at this year’s CES isn’t fixed in place. Instead, it roams.

But the solar product that’s drawing attention at this year’s CES isn’t fixed in place. Instead, it roams.

Mounted on wheels and paired with auto-retractable 300-watt solar panels, the solar bot can navigate autonomously, reposition itself during the day and adjust its angle to capture more sunlight.

When charging is done, the panels fold back in, making the whole system surprisingly compact for what it does. According to Jackery, the Mars Bot uses AI-enhanced computer vision to avoid obstacles and optimize its placement throughout the day.

The platform can travel at speeds up to 5.9 feet per second, handle modest terrain and tilt its panels up to 60 degrees to improve solar capture as conditions change.

Power is stored in modular LiFePO4 batteries, each rated at 2 kilowatt-hours, with total capacity designed to scale while supporting AC, DC and USB outputs.

The idea is simple: Panels capture optimal solar energy, store power onboard and deliver it wherever electricity is needed. The use cases Jackery highlights range from outdoor recreation to emergency or rescue scenarios.

The idea is simple: Panels capture optimal solar energy, store power onboard and deliver it wherever electricity is needed. The use cases Jackery highlights range from outdoor recreation to emergency or rescue scenarios.

There’s also a more forward-looking thread running through the pitch, potentially powering portable satellite internet, future AI systems and personal robotics — situations where mobile, self-sustaining energy matters as much as raw capacity.

The Solar Mars Bot first appeared as a concept at CES 2024. Seeing it return in 2026 as a working product says something about the next generation of energy capture. Instead of bigger panels or heavier batteries, this is about mobility and autonomy that actively seeks out sunlight rather than passively waiting for it.

CES has always been at its best when it shows how familiar problems can be solved in novel ways. A robot that wanders around looking for sunlight? Feels right at home in Las Vegas or even in your own backyard.

![]() “Prediction Season Is in Full Swing”

“Prediction Season Is in Full Swing”

“It’s the first full trading week of 2026, and prediction season is in full swing,” says Paradigm’s pro trader Enrique Abeyta.

“It’s the first full trading week of 2026, and prediction season is in full swing,” says Paradigm’s pro trader Enrique Abeyta.

“To kick off the new year, I want to share some of my surprise predictions for the next 12 months,” he says. “Like stock picking, predictions are all about probability. There are no guarantees.

“What I’m presenting here are some out-of-consensus views that I think aren’t just possible — they’re probable. Outcomes that, if they happen, are going to surprise a lot of folks.

“And I don’t want you to be caught off guard,” Enrique says. “So here we go!”

Small Caps Finally Outperform

“In the long term, I’m not a fan of small-cap stocks,” he says. “They’re subscale companies with inferior balance sheets and more exposure to variables like inflation, interest rates and commodities.

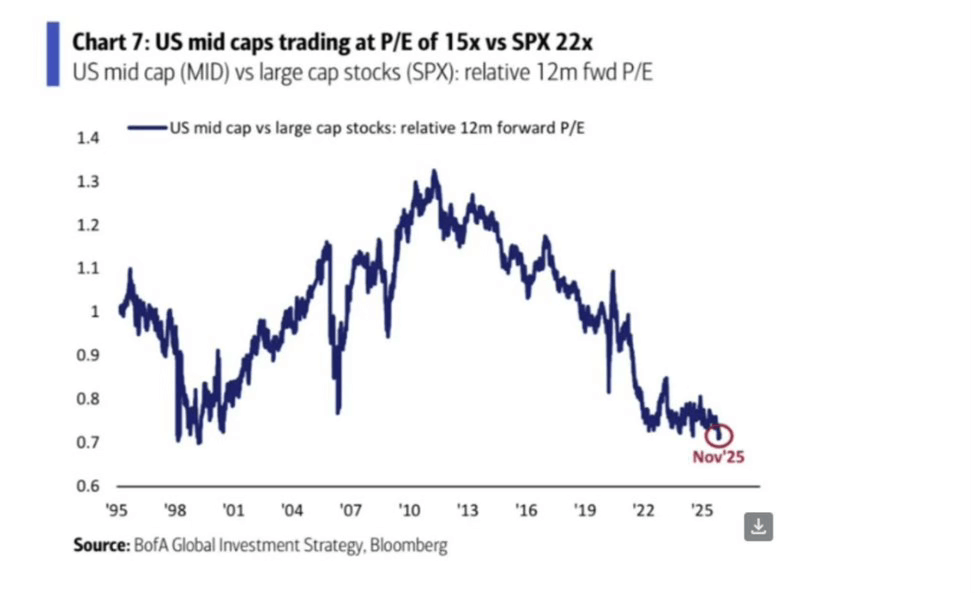

“But right now, they have undemanding valuations. Look at this chart showing the valuation of the midcap stocks over the last few decades…

“Valuations are back down to relative levels last seen in the late 1990s,” Enrique points out.

“Back then, we saw a rotation into technology leaders (think today’s Mag 7), causing increased multiples in those stocks and lower multiples in everything else.

“With an acceleration in non-AI economic growth and lower interest rates, I think the setup for smaller stocks is superb,” he says.

“Remember that in 2000, the S&P 500 was down 9% and the Nasdaq was down 40%. But the Russell 2000 was only down 4%, while the equal-weight S&P 500 was up 12%.

“We don’t think the major indexes will be down as much as they were in 2000,” Enrique says. “But the outperformance of smaller stocks could be just as much.”

On Friday, we’ll be back with four additional 2026 insights from Enrique — predictions investors won’t want to miss.

The S&P 500 and DJIA hit new intraday highs today, extending their strong start to 2026. But the rally appears to be stalling…

The S&P 500 and DJIA hit new intraday highs today, extending their strong start to 2026. But the rally appears to be stalling…

The Dow’s now pulled back 180 points to 49,280; at the same time, the S&P 500 is still in the green — up 0.10% to 6,950. The tech-heavy Nasdaq, on the other hand, is up 0.45% to 23,650.

As for commodities, Venezuela will ship sanctioned oil to the U.S. on an ongoing basis, according to White House sources. The president says the initial tranche will total 30–50 million barrels, sold at market price — with deliveries expected to continue indefinitely. Proceeds will be held in U.S.-controlled accounts and released at Washington’s discretion.

Energy Secretary Chris Wright confirmed the arrangement today, saying the U.S. will market both stored Venezuelan crude and future production. Oil that previously flowed largely to China will now be rerouted directly to U.S. ports.

The price of crude, at the time of writing, is down 1.30% to $56.38 for a barrel of WTI. According to CNBC taking data from Reuters: “Oil prices slip as traders react to expected increased supply from Venezuela.” Huh. But Valero Energy (VLO) shares are up 4.15%.

Precious metals? Gold and silver are both in the red: down 0.55% (to $4,469.70 per ounce) and 3.90% (to $77.90) respectively. More on silver in a moment.

Finally, the crypto market is likewise in the red; Bitcoin’s pulled back 1.30% to $91,385 while Ethereum’s lost 2.45% to $3,160.

![]() Existing Mines Beat Blueprints

Existing Mines Beat Blueprints

“Precious metal miners have done very well over the past year. But today I’m going to show why silver miners in particular have much further to run,” says The Daily Reckoning editor Adam Sharp.

“Precious metal miners have done very well over the past year. But today I’m going to show why silver miners in particular have much further to run,” says The Daily Reckoning editor Adam Sharp.

In 2025, gold rose about 70%, but silver did even better, jumping over 150%. At first glance, it might seem logical to assume mining profits rose by similar percentages.

But as Adam explains, mining profits don’t rise in a straight line with metal prices. That’s because most mining costs are relatively fixed. Once those costs are covered, each additional dollar increase in the price of silver flows disproportionately to the bottom line.

Adam points to Pan American Silver (PAAS) as a clear, real-world example. The company publishes its all-in sustaining cost (AISC), a widely followed metric that captures the cost to produce each ounce of metal.

In Q1 2024, Pan American’s AISC for silver was about $16.68 per ounce, while its realized silver price averaged $22.61. That left a margin of about $6 per ounce.

Fast-forward to Q3 2025 and the picture changes dramatically. Average silver prices climbed to around $39 per ounce, while costs edged slightly lower. Profit per ounce rose to around $23 — nearly four times the margin from early 2024.

And that’s before considering higher price scenarios. “If silver stays around the current $80 level and their costs stay around $16 per ounce, the profit per ounce will rise to a crazy $64,” Adam says. “So from Q1 2024 to Q1 2026, many silver miners’ profitability per ounce has increased by a ridiculous 10X.”

Margins are one thing. Volume is another. “In Q3 2025, PAAS produced around 5.5 million ounces of silver. If they maintain that production in this current quarter” — at current prices — “the company could earn about $352 million in three months, from silver alone,” says Adam.

But silver isn’t the company’s only revenue stream. In the same quarter, Pan American produced about 183,000 ounces of gold, at an AISC near $1,697 per ounce, adding another powerful profit driver.

“That is a very long way of saying that silver (and gold) miners are absolutely printing money in this environment,” Adam emphasizes.

“That is a very long way of saying that silver (and gold) miners are absolutely printing money in this environment,” Adam emphasizes.

Why is this an unusually favorable setup? Mining is energy-intensive. Diesel and gasoline can account for up to 15% of operating costs. That makes today’s sub-$60 oil environment a meaningful tailwind.

Adam says this setup may rival — or even exceed — past bull markets. “I would argue this is one of the all-time great environments for miners.”

Established miners have a clear advantage. Unlike explorers and developers, they already operate permitted, long-life mines. New projects, by contrast, still face years — often decades — of regulatory reviews, financing and construction before they ever produce an ounce, especially outside the U.S.

Adam’s takeaway: “I want to primarily invest in the companies making a killing today,” he says. “Not ones that have a long road of capital raises and permitting ahead of them.

“Hopefully this [helps] explain why despite huge gains over the past year, I haven’t sold a single silver miner,” he concludes. “And I have no plans to anytime soon.”

![]() Davos Stops Dissembling

Davos Stops Dissembling

There’s something almost reassuring about Davos in January. Like clockwork, the world’s power trippers and control freaks gather in the picturesque Swiss ski town.

There’s something almost reassuring about Davos in January. Like clockwork, the world’s power trippers and control freaks gather in the picturesque Swiss ski town.

But in January 2024, our managing editor Dave Gonigam noticed something unusual at the World Economic Forum. Amid performative panic over “misinformation” and hypothetical pandemics, a few heavyweight figures in finance did something that wasn’t supposed to happen: They acknowledged Donald Trump might not be the cartoon villain of Davos’ imagination.

Trump wasn’t exactly embraced. Just… quietly acknowledged. JPMorgan’s CEO Jamie Dimon, for instance, who spent most of his professional life orbiting Democratic politics, admitted that Trump had been “kind of right” on NATO, immigration, trade and China. Not a love letter; just a balance-sheet observation.

At the time, it felt faintly subversive. (Maybe even a slip of the tongue chalked up to altitude sickness?) After all, Davos is a place where acceptable opinions are carefully curated.

Now, Microsoft, crypto company Ripple and management consulting firm McKinsey have each agreed to pay up to $1 million to sponsor “USA House,” a Davos venue that will serve as a base for U.S. government officials during President Trump’s visit later this month. (JPMorgan Chase has also been approached to participate, though the bank has not publicly confirmed whether it will sign on.)

The venue itself is a small 19th-century church just outside the forum’s official security perimeter — which somehow feels like a metaphor.

Courtesy: X

To be clear, Davos has always had its unofficial “house” system. Countries and corporations convert shops and hotels into networking hubs every January.

What’s different this year is that U.S. companies are no longer quietly hedging. They’re openly positioning themselves around power brokers in Trump’s political orbit — a shift that sits neatly alongside the WEF’s 2026 theme: “A Spirit of Dialogue.”

And they’re doing it in the most Davos way possible: discreetly, at a premium price, while pretending it was always part of the plan.

![]() James Altucher: Right on the Money

James Altucher: Right on the Money

“Bull’s-eye… James Altucher was right on target with this one! Zing! Spot-on!” writes an enthusiastic contributor about our New Year’s Day 5 Bullets edition, featuring five of James’ 2026 predictions.

“Bull’s-eye… James Altucher was right on target with this one! Zing! Spot-on!” writes an enthusiastic contributor about our New Year’s Day 5 Bullets edition, featuring five of James’ 2026 predictions.

I’m signing off for the day… Take care, reader!