Venezuela Was NEVER About Drugs

![]() It Was Never About Drugs

It Was Never About Drugs

Gee what was the title of our Nov. 18 edition?

Gee what was the title of our Nov. 18 edition?

And there was Donald Trump on Saturday, saying as much as he read from a prepared statement: “We’re going to have our very large United States oil companies… go in, spend billions of dollars, fix the badly broken infrastructure, the oil infrastructure, and start making money for the country.”

We’ll come back to the “making money” thought shortly — seeing as that’s our stock in trade.

But do note that when the deposed Venezuelan President Nicolás Maduro goes to court in New York today, there won’t be one word about fentanyl — because that word shows up nowhere in the 25-page indictment. (On the other hand, Maduro is charged with possessing machine guns in his own country — which somehow runs afoul of the 1934 National Firearms Act?!)

Also note Trump’s pardon late last year of the former Honduran president Juan Orlando Hernandez. Hernandez was doing 45 years for… drug trafficking.

Conventional wisdom has it that the story is already over. Reality check: It’s just beginning.

Conventional wisdom has it that the story is already over. Reality check: It’s just beginning.

The president who for years derided nation-building projects now says Washington will “run the country” of Venezuela “for the time being.”

“For the time being,” Trump has thrown Maduro’s opposition under the bus, knowing it has little public support, figuring he stands a better chance of stabilizing the situation with… Maduro’s vice president?!

Hmmm… Vice President Delcy Rodríguez’s father was tortured to death by a pro-Washington regime in 1976, when she was 6 years old. As far as she’s concerned, she says Maduro is still the rightful president.

Again, the story is just beginning — victory laps you see on social media notwithstanding.

Which brings us to the investment implications…

![]() About That Oil Bounty…

About That Oil Bounty…

Talking about investment prospects in post-Maduro Venezuela is as premature as it was with post-Saddam Iraq in 2003 or post-Gaddafi Libya in 2011.

Talking about investment prospects in post-Maduro Venezuela is as premature as it was with post-Saddam Iraq in 2003 or post-Gaddafi Libya in 2011.

Not that reality has dawned yet on Mr. Market this morning: The oil field services stocks like Schlumberger (SLB) and Halliburton (HAL) are both up over 6%.

But how likely is it, really, that “our very large United States oil companies” are poised to sweep into Venezuela and exploit the world’s biggest oil reserves after years of neglect under Maduro and his predecessor Hugo Chávez? And even if they do, how quickly would those reserves come into production?

“Oil is not water you just turn on from a faucet,” tweets an anonymous hedge fund portfolio manager.

“Oil is not water you just turn on from a faucet,” tweets an anonymous hedge fund portfolio manager.

“Look at the oil patches in the U.S. and Canada — these are world-class assets with the best infrastructure, labor and capital inflow on the planet. Go out there just once and see for yourself how oil is actually discovered, drilled and transported.

“Even in these top-tier jurisdictions, things don’t move that fast. And yet, you think infrastructure and networks that have been rotting for decades under underinvestment, neglect and corruption can just be restored overnight?”

That takes a massive infusion of capital — which is hard for the industry to justify when oil is trading near five-year lows.

And that’s assuming Venezuela does not descend into Iraq- or Libya-level chaos.

And that’s assuming Venezuela does not descend into Iraq- or Libya-level chaos.

The Venezuelan-American journalist José Niño foresees a worst-case scenario — “a multifactional civil war among heavily armed irregular forces, refugee flows dwarfing the current crisis and a protracted insurgency that could justify further U.S. intervention and spiral into a broader conflict that could attract irregular leftist forces from across the region.”

Trump refuses to rule out “boots on the ground” to impose Washington’s will on a country that’s more than twice the land area of Iraq — featuring everything from Andean mountains to Amazon jungle.

“This geographic complexity creates countless opportunities for asymmetric warfare,” Niño wrote last fall — “with mountainous terrain favoring defensive operations, urban centers ideal for guerrilla resistance and jungle regions providing sanctuary for irregular forces…

“It should be stressed that Venezuela’s official military doctrine has been explicitly designed around asymmetric warfare against a hypothetical U.S. invasion since the Chávez era. The strategy assumes initial conventional defeat followed by sustained guerrilla resistance — making occupation costly and politically unsustainable.”

And if Trump decides not to play ball with Acting President Rodríguez after all?

And if Trump decides not to play ball with Acting President Rodríguez after all?

That seems quite likely, by the way: “If she doesn’t do what’s right, she is going to pay a very big price, probably bigger than Maduro,” Trump told The Atlantic yesterday.

“The Venezuelan opposition itself is deeply divided,” Niño writes.

The Nobel Peace Prize-winning María Corina Machado gets all the headlines, begging for American-engineered regime change — but she doesn’t speak for all of Maudro’s rivals.

“Most people who want a military solution and a U.S. invasion do not live in Venezuela,” says Henrique Capriles — who lost an election to Maduro in 2013 and has stayed in Venezuela throughout. “They don’t even understand the consequences of it,” he told the BBC last summer.

He added pointedly to The New York Times, “Name one successful case in the last few years of a successful U.S. military intervention.”

A U.S. war game conducted during the first Trump administration concluded that U.S. intervention would result in “chaos for a sustained period of time with no possibility of ending it,” national security consultant Douglas Farah wrote in a report to Pentagon officials.

![]() The Rush to Gold

The Rush to Gold

The financial consequences of regime change in Venezuela extend far beyond energy.

The financial consequences of regime change in Venezuela extend far beyond energy.

A group of 17 former U.S. intelligence professionals wrote an open letter to Donald Trump in November, warning that “U.S. ‘maximum-pressure’ policies and saber-rattling in the Caribbean make us look like bullies throughout Latin America if not the world — a hegemon desperate to show it can act ruthlessly and with impunity in what it considers its backyard.”

And now that Maduro is in the dock?

A handful of financial professionals on X compare the present moment to Joe Biden’s decision four years ago to freeze the dollar-based assets of Russia’s central bank.

As we’ve hammered away in this space ever since, that one move prompted every government on less-than-friendly terms with Washington to wonder, Are we next?

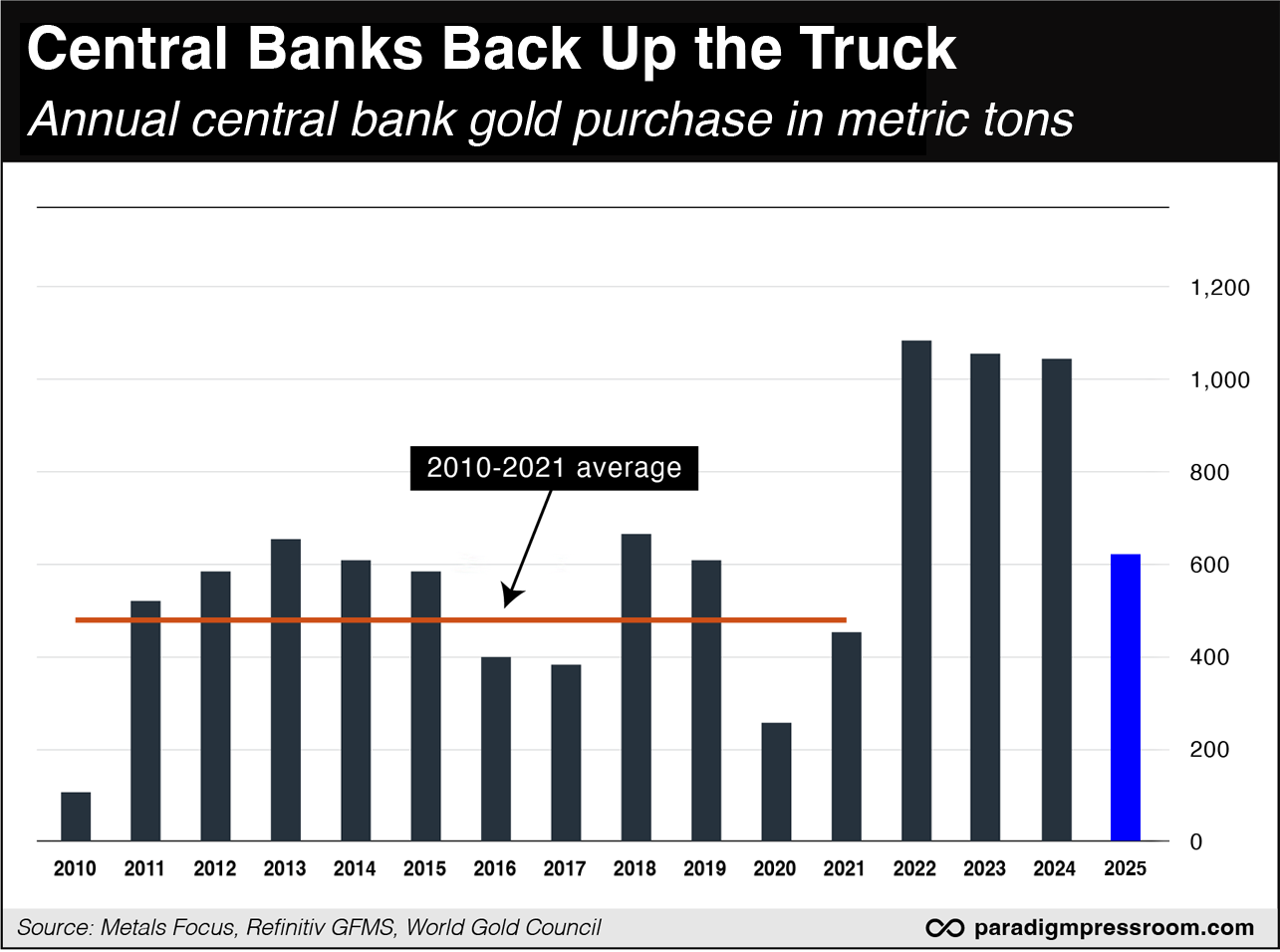

One more time, a chart we can’t share often enough — showing how central bank accumulation of gold soared since 2022. (The 2025 figures are through the end of the third quarter.)

“If the freezing of Russian assets in 2022 was the crack in the foundation of global finance, the capture of Nicolás Maduro in Operation Absolute Resolve is the sledgehammer,” says one observer. “When money isn’t safe, countries accelerate de-dollarization and diversify into hard assets like gold and Bitcoin that exist outside the ‘clutch’ of any single jurisdiction.”

U.S. regime change in Venezuela, “will be remembered in history for reasons most inside the West will have no understanding or comprehension of,” says the provocative Sirius Report account on X — which also invokes the Russian asset freeze. “Meanwhile the Global South will have finally had any lasting shred of doubt removed.”

One more…

Is it any coincidence gold is up $111 at last check to $4,441? Or that silver is up nearly four bucks to $76.59? Or that Bitcoin sits at a seven-week high near $94,000?

![]() Reaping the Whirlwind: China, Iran…

Reaping the Whirlwind: China, Iran…

Only hours before the U.S. operation to capture Maduro, he was meeting with a high-level delegation from China — led by President Xi Jinping’s special envoy to Latin America.

Only hours before the U.S. operation to capture Maduro, he was meeting with a high-level delegation from China — led by President Xi Jinping’s special envoy to Latin America.

As you might expect, Beijing does not look kindly on the regime-change op — the Chinese foreign ministry condemning the “U.S.’ blatant use of force against a sovereign state and action against its president.”

Important point: Secretary of State Marco Rubio says the U.S. blockade on sanctioned oil tankers entering and leaving Venezuela is still in place.

Last week, the shipping trade publication Lloyd’s List reported that a Chinese-flagged oil tanker, the Thousand Sunny, is on its way to Venezuela to load a shipment of crude. At present its position is about halfway between Africa and South America, which puts it on track for a mid-January arrival.

Context: China has become the biggest buyer of Venezuelan oil by far. It doesn’t particularly need Venezuelan crude; Beijing is simply propping up Maduro’s government.

Further context: As I noted in 5 Bullets last month, a Russian vessel delivering oil-processing chemicals to Venezuela arrived at its destination without challenge. Moscow would have surely viewed an attempted boarding/seizure by U.S. forces as an act of war. No doubt Beijing sees things the same way.

But if regime change in Venezuela doesn’t bring on a U.S.-China confrontation, it might clear the way for a renewed conflict in the Middle East.

But if regime change in Venezuela doesn’t bring on a U.S.-China confrontation, it might clear the way for a renewed conflict in the Middle East.

“I believe the true objective of the kidnapping operation to remove Maduro is to secure U.S. control of Venezuelan oil in anticipation of a disruption of the flow of oil from the Persian Gulf when Israel, with U.S. backing, launches a new attack on Iran,” writes former CIA officer Larry Johnson on his blog.

“I suppose you could say that Trump’s Monday [Dec. 29] meeting with Netanyahu, which coincided with the eruption of protests in Iran that were likely incited by the MEK — a terrorist group with direct ties to the CIA and Mossad — followed by the kidnapping of Maduro and his wife is just a happy series of coincidences… I don’t believe in coincidence.”

Already top Israeli politicians like former prime minister Yair Lapid are saying, “The regime in Iran should pay close attention to what is happening in Venezuela.”

As mentioned earlier, it’s highly unlikely Venezuelan oil production will be stepped up to any meaningful degree anytime soon — certainly not on Israel’s timetable.

So don’t rule out the possibility of a major disruption to Middle East oil supplies this spring or summer — with no Venezuelan production to make up for it.

On that note, let’s tie up some loose ends…

![]() Loose Ends

Loose Ends

The oil market is sniffing out no major changes as a consequence of the Venezuelan regime-change op.

The oil market is sniffing out no major changes as a consequence of the Venezuelan regime-change op.

At last check, a barrel of West Texas Intermediate is up a little less than a buck to $58.20. In other words, no new major constraints to supply… but also no immediate flood of new oil to the market.

As for the stock market, the major averages are all solidly in the green, with the Dow leading the way — up nearly 1.5% and over 49,000 for the first time. That makes sense, given the higher concentration of energy stocks in the Dow compared with the other major indexes and the knee-jerk reaction to the Venezuela news.

XLE, the big energy ETF, is up 2.4% as we write. Chevron (CVX), with existing operations in Venezuela that have been subject to on-again, off-again U.S. restrictions, is up over 5%. Exxon (XOM), which has spent years funding think tanks advocating for regime change in Venezuela, is up 2.5%.

The S&P 500 and the Nasdaq are both up a little less than 1% — neither in record territory, although the S&P is close.

We mentioned the huge rally in precious metals earlier. Copper, meanwhile, is in record territory, over $13,000 a ton.

The one economic number of note is the ISM manufacturing index — down from 48.2 in November to 47.9 in December. That’s weaker than expected.

Any number below 50 suggests a shrinking factory sector and except for two months early last year, the index has registered sub-50 readings consistently for three years.

We’ll leave it there for today. We’ll tackle more diverse subject matter and catch up on the mailbag tomorrow.

P.S. If memory serves, this might be only the third time I’ve devoted the entirety of an issue (more or less) to breaking news.

I daresay the first two have held up pretty well — the attempt on Donald Trump’s life 18 months ago and the immediate aftermath of Jan. 6 five years ago. Only one big flub in retrospect; there were definitely law enforcement who allowed protesters into the U.S. Capitol.

More tomorrow…