AI “Shows Its Work”

![]() AI “Shows Its Work”

AI “Shows Its Work”

“We're witnessing something truly historic — the birth of machines that can actually think and reason,” says Paradigm’s AI authority James Altucher.

“We're witnessing something truly historic — the birth of machines that can actually think and reason,” says Paradigm’s AI authority James Altucher.

“This isn't just about computers getting faster or smarter. This is about machines developing real problem-solving abilities.”

Big claim, we know. As the saying goes, extraordinary claims require extraordinary proof.

James brings the goods in today’s installment of the Paradigm team’s 2025 predictions…

While most of us were gearing up for the holidays, James says “the world’s top AI companies unveiled new artificial intelligence models so advanced they can solve complex math problems better than most humans.”

While most of us were gearing up for the holidays, James says “the world’s top AI companies unveiled new artificial intelligence models so advanced they can solve complex math problems better than most humans.”

On Dec. 19, Google released Gemini 2.0 Flash Thinking. James says this model “can work through problems step-by-step, just like a person would.”

The next day, OpenAI — the company behind ChatGPT — took the wraps off its own model called o3.

“The timing wasn't a coincidence,” James tells us. “These companies are locked in an intense battle for AI supremacy.

“Both of these models use something called ‘chain-of-thought’ — basically teaching AI to show its work, like your math teacher always wanted. Instead of just spitting out an answer, these models break down problems into smaller pieces and work through them one at a time.

“Think of it like teaching a child to solve 247 + 385. Instead of just guessing, they learn to add the ones column first, then the tens, then the hundreds.

“This might sound simple, but it's revolutionary for AI,” James goes on.

“This might sound simple, but it's revolutionary for AI,” James goes on.

“Previous AI models often struggled with complex problems because they tried to solve everything at once. These new models are different. They take their time, think things through and explain their reasoning along the way.

“The results are impressive. OpenAI's o3 model can now solve graduate-level physics problems and write sophisticated computer code. In fact, o3 has achieved scores that put it in the top 1% of competitive programmers worldwide.

“It can even solve complex math problems that stumped earlier AI models just a few months ago.

“Google's Gemini 2.0 Flash Thinking is showing similar capabilities. It can analyze both text and images together, making it more versatile than previous models.

“What's even more remarkable is how quickly this technology is advancing,” James enthuses.

“What's even more remarkable is how quickly this technology is advancing,” James enthuses.

“OpenAI just released their previous model, o1, a few months ago. Now o3 is already here and performing dramatically better.”

Key point: “Every time AI gets smarter, it creates new opportunities for companies to make money.

“Think about it: As AI gets better at solving complex problems, more businesses will want to use it. They'll use it to write better software, design new products and solve difficult engineering challenges.

“Some companies are already using AI to speed up drug discovery and improve medical diagnoses. Others are using it to optimize supply chains and reduce energy consumption in data centers.

“The possibilities seem endless. And we're still in the early stages. The companies that successfully harness this technology could create generational wealth for their shareholders,” James concludes.

“The possibilities seem endless. And we're still in the early stages. The companies that successfully harness this technology could create generational wealth for their shareholders,” James concludes.

Among them is the AI chip giant Nvidia — which we’ll remind you is up 187% so far in the Altucher’s Investment Network portfolio.

“Just training these new AI models,” says James, “requires millions of dollars worth of specialized computer chips. And as the models get more complex, they need even more powerful hardware to run them.”

With that in mind, Nvidia CEO Jensen Huang will take the stage this coming Monday evening at the Consumer Electronics Show in Las Vegas. And James believes Huang will use that venue to make an earth-shaking announcement.

The profit potential coming on the back of this announcement could be enormous. James says, “We’ve seen similar events produce peak gains as high as 2,350%... 5,133%... and even 7,100% in only six days.”

What might this announcement be? James thinks he knows based on the information served up by his own AI tool — as he’ll show you when you follow this link.

![]() Follow-Ups: U.S. Steel, Winter Power Outages

Follow-Ups: U.S. Steel, Winter Power Outages

Shares of U.S. Steel (X) have tumbled 5.2% so far today — now that Joe Biden has nixed a takeover bid by Japan’s Nippon Steel.

Shares of U.S. Steel (X) have tumbled 5.2% so far today — now that Joe Biden has nixed a takeover bid by Japan’s Nippon Steel.

The announcement this morning wasn’t a total surprise; we anticipated the move last month. Biden cited risks to “national security” — even though Japan has been a steadfast U.S. ally for nearly 80 years.

Nippon Steel promised to plow $2.7 billion into U.S. Steel’s archaic and decrepit American operations. That wasn’t chump change: Barron’s says it amounts to two years of U.S. Steel’s operating profits.

Now that’s all up in the air: U.S. Steel says without an infusion of Nippon Steel’s cash, it might have to close factories in Pennsylvania. By most accounts a firm majority of U.S. Steel workers were on board with the deal, even if leadership of the United Steelworkers Union was not.

According to Paradigm’s natural resources expert Byron King — who grew up in the shadow of U.S. Steel’s Pittsburgh operations — none of this would be an issue were it not for the name of the company.

“If U.S. Steel was named Monongahela River Steel, it would be a no-brainer,” he tells us. “But the name alone has certain optics that alarm Biden and Trump.”

Yes, Trump opposes the deal as well.

It’s all so silly. The name notwithstanding, U.S. Steel hasn’t been the biggest U.S. steelmaker for a long time. Based on market cap, it’s No. 4 behind Reliance, Steel Dynamics and No. 1 Nucor.

At this point, finding another buyer for U.S. Steel might be a non-starter. In late 2023, No. 5 steelmaker Cleveland-Cliffs (CLF) submitted a low-ball offer — barely half that of Nippon Steel’s.

But Bloomberg News says since then CLF has been busy digesting its acquisition of the Canadian steelmaker Stelco — “and waffled on whether it would still want all or some of US Steel."

As a polar vortex bears down on the eastern United States, the rickety power grid might not be able to keep up.

As a polar vortex bears down on the eastern United States, the rickety power grid might not be able to keep up.

On New Year’s Eve, the North American Electric Reliability Corp. issued a call to arms that’s “chilling” in two senses of the word.

“I'm asking everyone in the electricity supply chain, from natural gas producers to pipeline operators, to system operators, to power generators and the utilities themselves, to take all appropriate actions to ensure that we can maintain an uninterrupted supply of electricity to customers,” said a video message from NERC President Jim Robb.

In a separate statement, NERC says it’s “especially concerned about natural gas supply given the significant amount of production in the mid-Atlantic and Northeast.”

Absent “all appropriate actions,” the system risks a rerun of the outages in Texas in early 2021… and the Christmas Eve cold snap of 2022 that hit the mid-Atlantic.

As we reminded you throughout 2024, the power grid’s capacity is no bigger now than it was more than a decade ago — and at a time when power-hungry AI is imposing ever-greater demands on the grid.

![]() Santa’s a No-Show

Santa’s a No-Show

Santa Claus has only a few hours left to show up at Wall Street’s chimney.

Santa Claus has only a few hours left to show up at Wall Street’s chimney.

As we mentioned yesterday, there’s a precise definition for the term “Santa Claus rally” — encompassing the final five trading days of the year, and the first two of the new year. The current window opened on Christmas Eve, and slams shut at the close today.

Going into this window, the S&P 500 sat at 5,974. As we write this morning, it’s at 5,908. The index needs to rally another 1.1% just to equal its level at the start of the window. Anything can happen, but it seems unlikely…

In years when a Santa Claus rally doesn’t materialize, the market is typically only 0.4% higher six months later. And that’s an average — encompassing painful years like the 2000 dot-com bust and the 2008 financial crisis.

So why didn’t the Santa Claus rally materialize?

So why didn’t the Santa Claus rally materialize?

“Here’s my best guess,” Greg Guenther writes his Trading Desk readers: “First, Trump’s victory emboldened the bulls and pulled much of what would have been the December melt-up gains ahead by a month. November featured a massive crypto breakout and a stock market run that featured some pretty bubbly groups extending higher.

“So I think it’s fair to say that the market became way too frothy by the time December rolled around. That’s when market breadth began to deteriorate. Fewer and fewer stocks were moving higher, and we once again found ourselves in a market propped up by the mega-caps and many of the bigger breakouts started to reverse.”

All that said, “I don’t want to put too much emphasis on this week’s action,” Greg avers. “But it’s clear many traders are spooked right now. The S&P and Nasdaq Composite haven’t posted a gain since before Christmas. Buyers will need to step in sooner rather than later.”

Dollar strength against other major currencies isn’t helping the U.S. stock market.

Dollar strength against other major currencies isn’t helping the U.S. stock market.

Yesterday the U.S. dollar index (DXY) broke above 109, the highest since late 2022. All else being equal, a strong dollar translates to weak stocks — as foreigners have to pay more in their own currency to buy American multinationals’ goods.

Seen in the context of a strong dollar, gold continues to be remarkably resilient — trading today at $2,641. That was an all-time high in late September. It just feels rotten because of the monster rally to nearly $2,800 by late October.

Crude is up another 1% today to $73.87, the highest since mid-October.

Bitcoin is suddenly back within $1,700 of the $100,000 level — and smaller alt-coins are rallying in sympathy.

➢ One economic number of note: The December ISM Manufacturing Index clocks in at 49.3 — better than expected, but at under 50 it still suggests the U.S. factory sector is shrinking. With the exception of one month last spring, the index has been stuck under 50 since late 2022.

![]() Biotech Booster

Biotech Booster

“A big catalyst looms for the biotech industry in a couple of weeks,” says Paradigm biotech specialist Ray Blanco.

“A big catalyst looms for the biotech industry in a couple of weeks,” says Paradigm biotech specialist Ray Blanco.

The annual J.P. Morgan Healthcare Conference starts a week from Monday in San Francisco.

“The JPM Conference often sets the tone for where biotech stocks run in a given year,” says Ray — “and with the subpar performance for the sector over the past couple of years, I’m expecting we’ll start to see a reversion to mean and bios starting to outperform.

“The JPM Healthcare Conference is where money meets science — institutional investors, Big Pharma dealmakers and ambitious biotechs all packed into the same hotels trying to make magic happen.

“Companies love to drop big news during their presentations. Clinical trial results, new partnerships, even full-blown takeovers often get announced when everyone's in town. With all eyes on biotech, positive news tends to move stocks more than usual.”

Ray will be keeping extra-close tabs on the names he follows for both his Catalyst Trader advisory and the Paradigm Mastermind Group. If you subscribe to either of those services, watch your inbox…

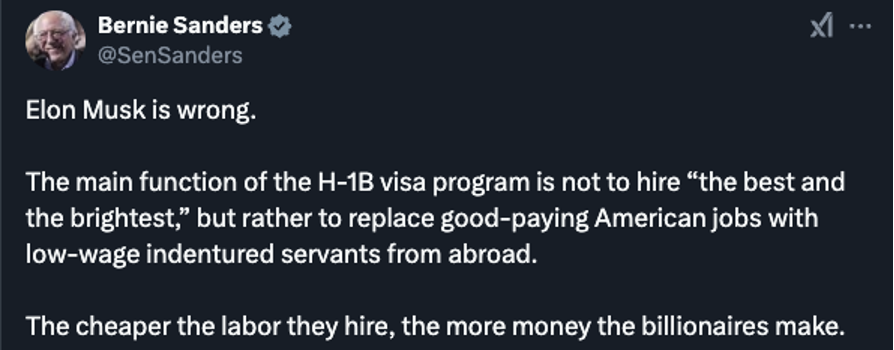

![]() The H-1B Visa Commotion

The H-1B Visa Commotion

In the mailbag, one of our regulars is kicking the hornet’s nest of H-1B visas.

In the mailbag, one of our regulars is kicking the hornet’s nest of H-1B visas.

(If you’re not familiar with the commotion, today’s edition of the Rude Awakening from colleague Sean Ring is a good place to get acquainted.)

“With the row going on at X over H-1B visas,” our reader writes, “I had seen that Eric Weinstein wrote a paper on how the government in cooperation with corporations uses false claims of labor shortages to import workers from abroad to suppress wages.

“While his paper is limited to discussing workers with Ph.D.s in the STEM disciplines and from 1998, the practice is not only still well and alive today, but also expanded beyond just workers with Ph.D.s in STEM fields as I can personally attest to. Companies don't fight over new engineers, and schools put great effort into herding kids into STEM disciplines.

“I was glad I read the paper and learned something new, as disheartening as it was to find out the practice has been going on longer than I've been alive, and I encourage anyone who wants to learn more about it to read it as well.

“Hard to call it a Happy New Year with the way this one seems to be starting, but I'm not about to write off the other 363 days just yet. Here's to wishing everyone the best!”

Dave responds: And likewise to you — thanks for weighing in.

I don’t have a whole lot to say on the subject, not right now anyway. What’s striking to me is how quickly some of MAGA Nation has turned on Elon Musk — and to some extent, even on Donald Trump after his remarks at a New Year’s Eve press gaggle.

Meanwhile, look who’s on board with the claim that corporate America is gaming the H-1B visa system…

Obviously it’s still early days — but I’ve already seen more than one commentator remark that if Trump fails to get a handle on the abuse in the system, he’s doomed to a Democratic landslide in the 2026 midterms. We shall see…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets