Not Just the Mag 7

![]() Not Just the Mag 7

Not Just the Mag 7

For all the sturm and drang in the stock market during November… it ended on Friday with a new all-time monthly high.

For all the sturm and drang in the stock market during November… it ended on Friday with a new all-time monthly high.

After Friday’s holiday-abbreviated trading session, the S&P 500 rested at 6,849. Granted, that was only microscopically higher than October’s monthly close of 6,840 — but small margins like these matter when looking at historical stock market data.

“This makes it seven months in a row” that the market has ended the month higher than it began — “something that has happened only about 15 times” since 1950, according to Paradigm trading pro Enrique Abeyta.

“Looking out three months, six months and one year later - this has been a very good sign for the stock market.”

Figures from Carson Investment Research show that when the S&P 500 notches seven straight months in the green, it’s up an average 3.9% after three months… 7.0% after six months… and 9.3% after 12 months.

What’s more, the story is not all about the Magnificent 7.

What’s more, the story is not all about the Magnificent 7.

The Mag 7 — Nvidia, Microsoft, Google/Alphabet, Facebook/Meta, Amazon, Apple and Tesla —

have powered much of the stock market’s rally from the S&P’s lows in October 2022. Which makes sense when you consider that those companies account for about 36% of the index’s market cap.

But if you look at the S&P minus the Mag 7, it also ended November at an all-time high. “This is real stock market strength,” says Enrique.

In addition, the S&P’s “advance/decline line” registered an all-time high. That means the share price of a growing number of S&P 500 companies is rising rather than falling.

“Strong breadth is the single-most important feature of a bull market,” Enrique asserts.

Perhaps not surprisingly, the market is taking a rest as the new week and month begin.

Perhaps not surprisingly, the market is taking a rest as the new week and month begin.

At last check the S&P is down a half percent on the day at 6,815. Given the furious run-up of the previous five trading sessions — a 4.8% rally — some backing and filling is to be expected at a time like this.

The Dow and the Nasdaq are likewise in the red, but not dramatically.

➢ One economic number of note: The ISM Manufacturing Index for November rings in at 48.2 — lower than October and lower than the guess of the typical Wall Street economist. As a reminder, numbers under 50 suggest the U.S. factory sector is shrinking — and except for two months in early 2025, the index has been under 50 consistently for the last three years.

![]() Precious Metals Want to Party, Too

Precious Metals Want to Party, Too

It’s not just stocks that registered new monthly highs at the end of November: So did precious metals.

It’s not just stocks that registered new monthly highs at the end of November: So did precious metals.

Gold ended the month at $4,217 — about 3.3% below its record daily close of $4,355.

“Thanks to this recent thrust, it’ll be a cinch to recapture the old highs before the end of the year,” writes the Rude Awakening’s Sean Ring in his monthly wrap-up of the chart action in every major asset class. “Once that’s captured, we can look forward to $4,916.”

Already the bid on the Midas metal is up to $4,235 this morning.

Meanwhile, silver ended November at an all-time daily high of $56.37. The $50 records of both 1980 and 2011 are fading into memory. It’s up another 2.7% this morning to $57.84.

“Some commentators are calling for a run to $72,” says Sean — “while my target is $70.50. Let’s see what Mr. Slammy tries this week, if he’s got any tricks left in his bag.”

As for the mining stocks, the HUI index is up modestly this morning to 681 — within spitting distance of the October high at 687.

➢ Elsewhere in the commodity space, oil is up nearly 1.4% to start the week at $59.34. But the chart action is not encouraging.

Alas, digital assets are starting the month on a very wrong foot.

Alas, digital assets are starting the month on a very wrong foot.

No sooner did the calendar turn to December in Greenwich Mean Time — five hours ahead of New York — than Bitcoin took a dramatic drop from $91,000 to nearly $84,000. That’s the lowest since mid-April.

Ethereum took a similar spill from over 3,000 to under $2,750 — the lowest since July.

“Bitcoin and Ethereum remain locked in their respective downtrends as the calendar flips to December,” Greg Guenthner writes at The Trading Desk. “That doesn’t bode well for speculators, who are still AWOL as melt-up season is supposed to kick into high gear.”

![]() Follow-Ups

Follow-Ups

Rolling blackouts are a sure thing if data center expansion continues unchecked in the mid-Atlantic and Great Lakes states.

Rolling blackouts are a sure thing if data center expansion continues unchecked in the mid-Atlantic and Great Lakes states.

So concludes Monitoring Analytics — an independent watchdog that keeps an eye on PJM, the nation’s biggest regional grid operator. PJM serves 65 million customers in 13 states stretching from New Jersey west to Illinois. Its service area includes Virginia’s “Data Center Alley,” home to the country’s biggest concentration of data centers.

A new report from Monitoring Analytics warns that PJM is looking to add data centers to the grid at such a furious clip that planned blackouts would be the only way to meet overall demand.

The report urges the Federal Energy Regulatory Commission to lower the boom on PJM — ordering it to make the operators of data centers wait in line until the grid can accommodate them.

“If PJM has an obligation to provide reliable service to all PJM loads, is it just and reasonable for PJM to add new loads that it cannot serve reliably?” Monitoring Analytics asks in the report. “The answer to that question is no.”

We’ve been warning regularly for nearly two years that AI is imposing demands on the power grid that the grid isn’t equipped to handle. Something’s got to give.

In the meantime, “independent power producers” that are not regulated utilities are turning into enormously profitable investments — as many Paradigm readers have discovered this year with plays like Constellation Energy (CEG).

With copper prices on the rise again, copper thefts are also on the rise again.

With copper prices on the rise again, copper thefts are also on the rise again.

It’s a reliable cycle we’ve chronicled for 15 years: Rising copper prices are an incentive for thieves looking to sell copper for scrap; manhole covers are a favorite target.

Today’s Wall Street Journal tells us that in Los Angeles, “Thieves have wreaked havoc in the area, prying open manholes, chipping away at asphalt and climbing trees and poles to cut and steal — and then resell — copper wires that transmit electrical signals for phone and internet lines.”

AT&T says the thefts have disrupted both internet and landline phone service — including 911 calls.

“From January to June of this year,” says the Journal, “9,770 incidents of intentional theft or sabotage on communications networks were reported, according to the Internet & Television Association, a trade group known as NCTA. That is nearly double the number reported in the prior six-month period. The attacks disrupted service for more than 8 million customers.”

Don’t expect this to change: The aforementioned Sean Ring tells us “copper’s rally is real, and it’s spectacular.” The red metal ended November at $5.19 a pound. It’s been coiling throughout October and November, ready to blast toward its record levels earlier this year around $5.90.

![]() Giant Silver Bar

Giant Silver Bar

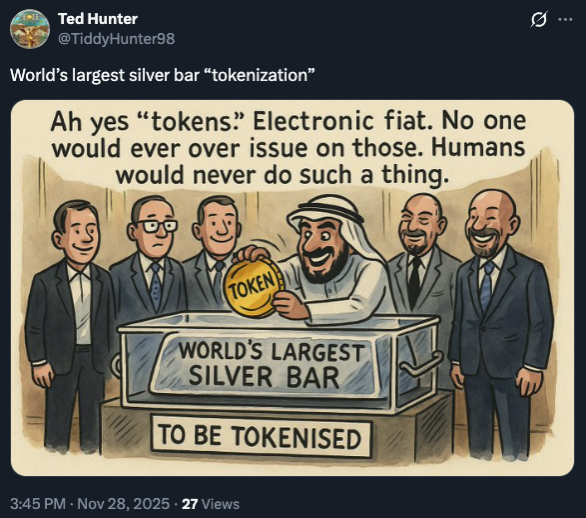

To celebrate the anniversary of its independence, the United Arab Emirates has rolled out the world’s biggest-ever silver bar.

To celebrate the anniversary of its independence, the United Arab Emirates has rolled out the world’s biggest-ever silver bar.

It’s over four feet long and weighs 1,971 kilograms. The latter number was not chosen at random but rather to mark the UAE’s formal independence from the United Kingdom 54 years ago tomorrow — Dec. 2, 1971.

A project of the Dubai Multi Commodities Centre, the bar has set a Guinness World Record.

We’ll do the math: 1,971 kg translates to 63,369 troy ounces — which at today’s prices is worth over $3.6 million.

“As part of a landmark project involving DMCC and leading industry players,” reports Mining.com, “the bar is now set to be tokenized through DMCC’s Tradeflow platform, marking the first time a Guinness-recognized metal bar will undergo tokenization under a regulated framework.”

The tokenization part of the announcement is getting the side-eye from some corners of social media…

Earlier this year the UAE rolled out the world’s biggest gold bar, weighing just over 300 kilograms or 9,645 ounces — valued as of this morning at nearly $41 million.

![]() Mailbag: Quality of Labor, Gold Perceptions

Mailbag: Quality of Labor, Gold Perceptions

“Speaking of good help being hard to find,” a reader writes as we tie up a few loose ends in the mailbag…

“Speaking of good help being hard to find,” a reader writes as we tie up a few loose ends in the mailbag…

“According to Google, ‘Approximately 77% of young Americans aged 17–24 cannot meet military enlistment standards, with the majority disqualified for reasons such as obesity, drug use, physical and mental health issues or a criminal record. Recent data indicates that only 23% of this age group is fully qualified to serve, a number that has declined in recent years.

“Even the military struggles to find good help.

“During the Vietnam War, when we had the draft, I don't know of anyone who didn't meet enlistment standards due to weight or intelligence. Go figure…”

After our Jim Rickards needled Goldman Sachs veteran Jim O’Neill for a failure to grasp gold’s significance, a reader writes…

After our Jim Rickards needled Goldman Sachs veteran Jim O’Neill for a failure to grasp gold’s significance, a reader writes…

“Lots of confusion everywhere; becoming increasingly difficult to have much confidence in anybody's view/opinion — even the so-called ‘experts’ often self-anointed or self-appointed.

“Methinks Mr. O'Neill should also have some additional thoughts about Bitcoin or other crypto as money (perhaps he does, yo no se) but I realize that that is now the establishment's truth — its gospel.

“Your insight and intellectual honesty is appreciated — a rare trait these days.”

Dave responds: We do what we can to keep it real. Thanks for the kind words!