This Is How the Dollar Dies

![]() So Much for Those “Punishing” Tariffs

So Much for Those “Punishing” Tariffs

Let’s see — Donald Trump’s punitive tariffs on India took effect shortly before Labor Day. How effective are they?

Let’s see — Donald Trump’s punitive tariffs on India took effect shortly before Labor Day. How effective are they?

That effective, huh?

As you might recall, over the summer Trump imposed a 50% tariff on imported goods from India — half of which was meant to punish India for its imports of Russian oil.

India and China have been more than happy to buy the Russian oil that Europeans have sworn off ever since Russia’s invasion of Ukraine in 2022. Trump and his team are displeased: White House adviser Peter Navarro says India’s purchases are “funding Putin’s war machine.”

Last week, the Reuters newswire reported that India’s purchases of Russian oil in November were likely to total 1.86 million barrels per day — up sharply from October, indeed the highest monthly total since July.

Across the non-Western world, the message governments are sending to Washington, D.C. these days is: We’re done with being bossed around by you.

Across the non-Western world, the message governments are sending to Washington, D.C. these days is: We’re done with being bossed around by you.

For U.S. leaders, it was fun while it lasted — an era that began with the fall of the Berlin Wall in 1989 and America’s ascent to the status of sole superpower.

“What we say goes,” President George H.W. Bush said during the Gulf War in 1991.

In retrospect, it’s safe to say that era ended with Joe Biden’s unprecedented sanctions on Russia after the Ukraine invasion in 2022. Washington froze the dollar-based assets of Russia’s central bank. Leaders of every government in the world on less-than-friendly terms with Washington started to ask, Are we next?

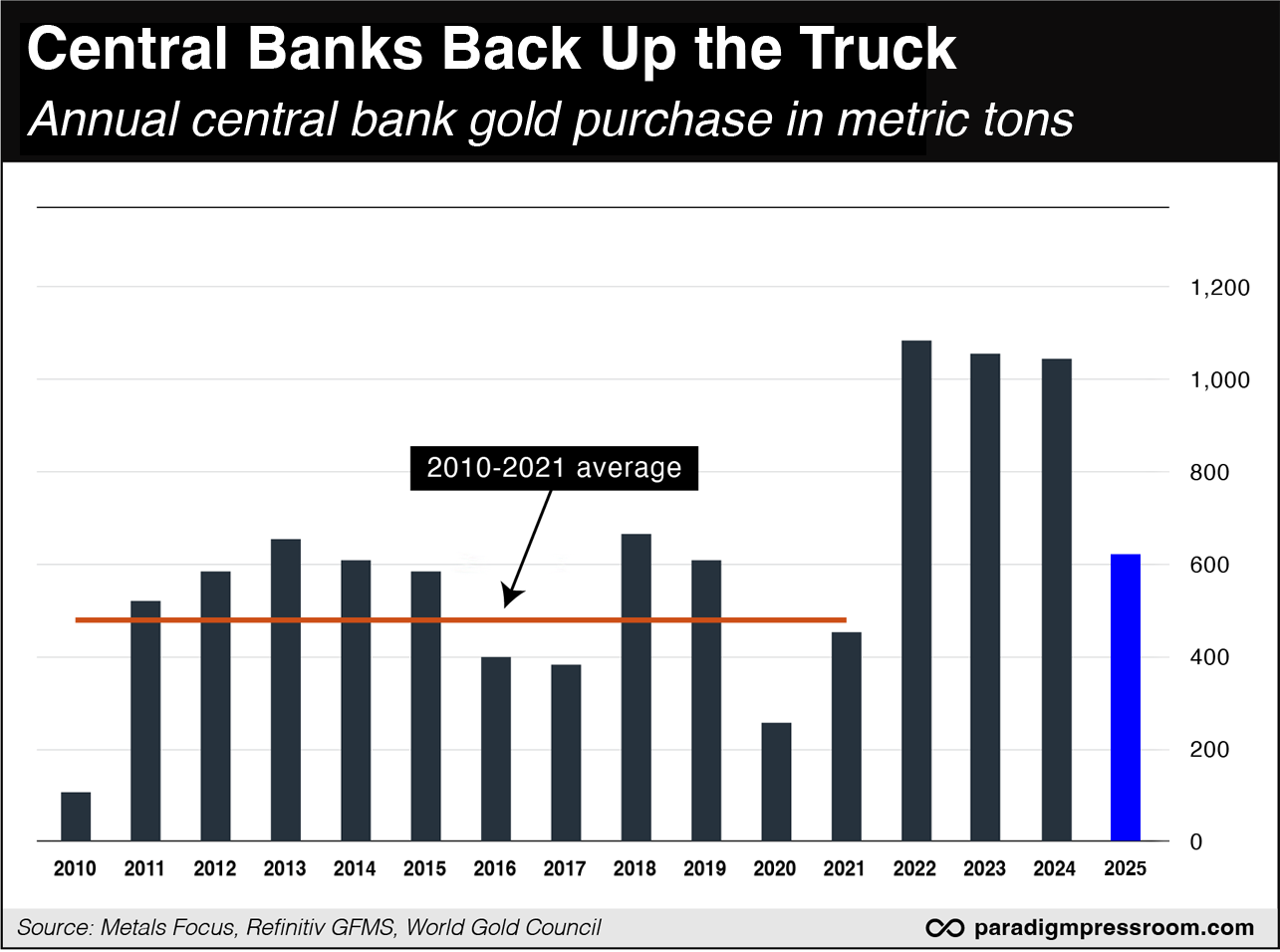

Ever since, central banks have been accumulating gold at a record pace. It’s no coincidence the gold price has been setting records routinely since 2023. We can’t show this chart often enough…

Now the blowback is taking place worldwide — with Russia setting the pace.

Now the blowback is taking place worldwide — with Russia setting the pace.

As our own Jim Rickards has reminded us for years, Russia’s gold reserves as a percentage of its economy are the biggest in the world.

That’s enabled Moscow to withstand the sanctions: As Jim wrote his Strategic Intelligence readers yesterday, “Russia has made almost as much mark-to-market profit on its gold (about $200 billion) as the U.S. and EU have threatened to steal from Russia’s cash reserves (also about $200 billion).”

The newest development is this: Russia’s central bank says that “its sales and purchases of gold in the domestic market for the budget reserve, the National Wealth Fund (NWF), have been increasing in recent years due to the enhanced liquidity of gold,” according to another Reuters report.

“In 2023, Russia excluded the U.S. dollar, euro and other Western currencies from the currency structure of its fiscal reserves, which are now held in China's yuan and gold, with target shares of 60% and 40%, respectively.”

But it’s not just India and Russia (and China) thumbing their nose at Washington. An even more startling example comes from another member of the BRICS constellation of countries.

![]() Brazil: “Yeah, We’re Just Gonna Ignore Your Sanctions”

Brazil: “Yeah, We’re Just Gonna Ignore Your Sanctions”

“Brazil Defied Trump and Won” says a not-inaccurate New York Times headline.

“Brazil Defied Trump and Won” says a not-inaccurate New York Times headline.

Brazil’s former president Jair Bolsonaro recently began a 27-year prison sentence for plotting a military coup to stay in office after losing his reelection bid in 2022.

Bolsonaro’s fellow populist Donald Trump waged serious economic warfare to prevent this outcome — demanding the Brazilian authorities drop the charges — and failed.

One of those weapons was a 50% tariff.

As we pointed out over the summer, it was a novel use of tariffs — not to “level the playing field” when it comes to trade, nor to raise revenue for a cash-strapped federal government, but to meddle in the political affairs of other countries.

In addition, Trump imposed sanctions on Alexandre de Moraes, the Brazilian Supreme Court justice overseeing Bolsonaro’s case.

In addition, Trump imposed sanctions on Alexandre de Moraes, the Brazilian Supreme Court justice overseeing Bolsonaro’s case.

Trump’s beef with de Moraes goes beyond the prosecution of Bolsonaro. De Moraes also oversees Brazil’s censorship of social media — exercising extraordinary powers that the Biden administration could only dream of.

Twelve days ago, Trump lifted the stiffest of the tariffs on Brazil — even though Bolsonaro’s fate was sealed.

That included the tariffs on Brazilian beef and coffee. Coincidentally or not, Americans have been paying sharply higher prices for beef and coffee in recent months.

In late October, Trump had a friendly meeting with the man who defeated Bolsonaro in the 2022 elections — Luis Inacio Lula da Silva. Trump says his ongoing talks with Lula are showing progress.

As for Bolsonaro, Trump says only, “That’s too bad.”

“The Trump administration just crippled one of the U.S.’ most potent weapons — its sanctions regime,” observes Glenn Greenwald.

“The Trump administration just crippled one of the U.S.’ most potent weapons — its sanctions regime,” observes Glenn Greenwald.

Mr. Greenwald, the journalist and civil libertarian, is a U.S. citizen who’s lived in Brazil for most of the last two decades.

As he recently tweeted, “Some high-up in the [White House and State Department] are still pushing Treasury to enforce these sanctions against Brazilian banks and even U.S. tech firms, but this is the first time a country simply told the U.S. it would ignore sanctions -- and even threatened banks and companies inside its borders with punishments if they abided by U.S. sanctions -- and got away with it completely.

“Brazil just created a model for countries to ignore U.S. sanctions by proving that the U.S. won't back up their vows.”

And it seems that model is being followed on the other side of the Atlantic. Read on…

![]() Dollars for Oil? Not (Necessarily) In Nigeria

Dollars for Oil? Not (Necessarily) In Nigeria

“Nigeria Ignites a Global Rebellion Against the Dollar Rule” says a recent headline at the website Front Page Africa.

“Nigeria Ignites a Global Rebellion Against the Dollar Rule” says a recent headline at the website Front Page Africa.

Perhaps you saw a few weeks ago when Trump issued the following warning on his Truth Social site: “If the Nigerian Government continues to allow the killing of Christians, the U.S.A. will immediately stop all aid and assistance to Nigeria, and may very well go into that now disgraced country, ‘guns-a-blazing,’ to completely wipe out the Islamic Terrorists who are committing these horrible atrocities.”

In the same way that drugs are a pretext for Trump to pursue Venezuela’s oil reserves, oppression of Christians is a pretext for Trump to pursue Nigeria’s oil reserves. Nigeria is Africa’s biggest crude producer, and the 15th largest in the world.

And the Nigerian government is taking halting steps toward accepting payment for oil in currencies other than the U.S. dollar.

And the Nigerian government is taking halting steps toward accepting payment for oil in currencies other than the U.S. dollar.

In the summer of 2024, Reuters reported that the state oil company NNPC won approval “to sell crude in the naira currency to the mega Dangote refinery effective immediately to help ease foreign exchange pressure.”

In October of 2024, the country’s Federal Executive Council cleared the way for even more widespread sales of oil in the naira.

These aren’t broad, sweeping moves — the reality is that oil buyers have way more dollars than they have naira — but the symbolism still matters.

At the Front Page Africa site, writer Julius T. Jaesen II makes a direct link to Trump’s warnings: “President Trump just threatened military action against a sovereign African nation for making an economic decision about its own oil exports... And the most shocking part [is that] Nigeria isn’t backing down.

“For the first time in decades, we’re witnessing an African nation look the United States directly in the eye and say no, not just to our demands but to our threats.”

![]() This Is How the Dollar Dies

This Is How the Dollar Dies

There’s a lot of noise and misunderstanding when it comes to the dollar surrendering its status as the world’s reserve currency.

There’s a lot of noise and misunderstanding when it comes to the dollar surrendering its status as the world’s reserve currency.

Your editor has been following the “de-dollarization” phenomenon since 2014 — the ongoing effort among governments in the Global South to get out from under the dollar’s influence.

A lot of internet screamers try to convince you there will be ONE BIG ANNOUNCEMENT any day now in which the dollar will collapse and life as you know it will be over. (The “Operation Sandman” rumors of 2023 were an especially silly example.)

The reality is that de-dollarization is a process, not an event.

Paradigm macro maven Jim Rickards reminds us that it took 30 years for the British pound to surrender its status as the globe’s reserve currency to the dollar — from the outbreak of World War I in 1914 to the Bretton Woods agreement of 1944.

The transition from the French franc to the pound during the 19th century also took many years — as did the transition from the Dutch guilder to the franc in the 18th century.

A quarter of the way into the 21st century it’s still hard to envision what the new reserve currency might be: The euro was never a credible competitor to the dollar and China’s government imposes so many restrictions on the yuan that it can’t mount a credible challenge, either.

At best, economists can merely foresee that the dollar’s share of global transactions will continue its steady decline.

But this much is already apparent: The BRICS nations are developing an alternative payments system, bypassing the dollar, with gold as its foundation.

Between that and continued central bank gold buying (see the chart above)... the dollar price of gold can only go higher from here. Act accordingly.

And don’t overlook silver. That’s Bullet No. 5 as we turn our attention to the market action today…

![]() Waking up to Silver Realities

Waking up to Silver Realities

The mainstream is starting to figure out that global silver supplies are tight.

The mainstream is starting to figure out that global silver supplies are tight.

“A record amount of silver flowed into London in October to ease a historic squeeze in the world’s biggest trading hub for the metal,” Bloomberg reports, “but this has put other centers under pressure. Inventories in warehouses linked to the Shanghai Futures Exchange recently hit the lowest in nearly a decade, and the cost of borrowing the metal over one month remains elevated.”

The article cites an analyst at the big French bank BNP Paribas noting that the gold-silver ratio — literally the price of gold divided by the price of silver — has sunk to near 70, a level last seen in 2020.

Right, but what does that actually mean?

“The gold-silver ratio has fallen to levels that force systematic funds to rebalance into silver,” says colleague Sean Ring in today’s Rude Awakening. Sean’s article — along with Adam Sharp’s Daily Reckoning yesterday — fill in the blanks the mainstream still hasn’t figured out. Adam sees a path to $200 silver, while Sean says $100 is inevitable.

In the meantime, the white metal is holding on to most of yesterday’s big gains at $57.85.

In the meantime, the white metal is holding on to most of yesterday’s big gains at $57.85.

But gold is losing ground — off $40 to $4,190. And the mining stocks are correcting sharply, the HUI index down 3% at last check.

As for the broad stock market, the major indexes are trying to regain yesterday’s lost ground. At last check the S&P 500 is up a third of a percent to 6,836.

Crypto is rebounding smartly, Bitcoin back above $91,000 and Ethereum a hair over $3,000 again.

We’ll wrap it up with a deep thought for the day…

We’ll wrap it up with a deep thought for the day…