Change We Must

![]() Change We Must

Change We Must

“One of the most difficult concepts to accept in the economy and markets is change,” says Paradigm trading pro Enrique Abeyta.

“One of the most difficult concepts to accept in the economy and markets is change,” says Paradigm trading pro Enrique Abeyta.

Enrique is the first to acknowledge that investors have lost untold amounts of money by saying This time is different.

But at the same time, you can also lose money by witnessing change that’s taken place… and denying it’s real.

Which brings us to a classic observation of Warren Buffett…

Which brings us to a classic observation of Warren Buffett…

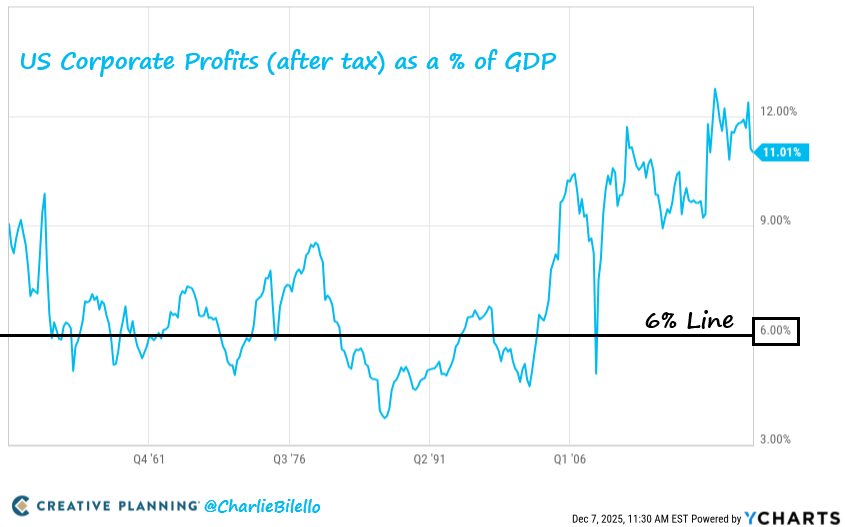

"You have to be wildly optimistic to believe that corporate profits as a percent of GDP can, for any sustained period, hold much above 6%."

Corporate profits as a percentage of GDP is one of the metrics Buffett has long relied on to determine whether the broad stock market is over- or undervalued.

That quote, by the way, comes from an interview with Fortune in November 1999. It’s become legendary because, as it turned out, the dot-com bubble was only weeks away from bursting. The Nasdaq slid 78% from early 2000 through late 2002.

Now… check out a chart Enrique spotted over the weekend — going all the way back to the end of World War II, when Buffett was still a teenager.

Now… check out a chart Enrique spotted over the weekend — going all the way back to the end of World War II, when Buffett was still a teenager.

Look what’s happened since the rebound from the 2007–09 financial crisis. Corporate profits as a percent of GDP have been far over the 6% level and indeed have spent most of that time over 9%.

“We are now at 16 years and counting,” Enrique says. “Is that ‘sustained’?”

I can hear an objection already: Yeah, look at all the funny money printed by the Federal Reserve since 2008… and all the wild federal spending since 2020. Of course the money would find its way into financial assets.

And your point?

Object to the policy all you want, but the S&P 500 has grown over 10X from its March 2009 lows.

Like or not, that’s change.

“You have to invest in the market environment you have… not the one you want,” Enrique reminds us.

“You have to invest in the market environment you have… not the one you want,” Enrique reminds us.

“A strong technical picture is supported by falling interest rates, strong earnings and lower energy prices.

“On top of that, the Trump administration has plummeting approval ratings and a midterm election next year that will define his legacy.

“My view is he will do anything — legal or illegal — to get this stock market higher and secure a victory in the midterms.

“It may end badly, but that’s where we are right now.”

![]() Market Miscellany

Market Miscellany

Gee, what was it we said here Friday about the Netflix-Warner Bros. tie-up being anything but a done deal?

Gee, what was it we said here Friday about the Netflix-Warner Bros. tie-up being anything but a done deal?

Last night, Donald Trump told reporters “there could be a problem” with the deal owing to Netflix’s existing “big market share.”

This morning, Paramount launched a hostile bid — offering $108 billion for the entirety of Warner Bros. Discovery. That contrasts with Netflix’s agreement to pay $72 billion for the WB movie studio and HBO Max — excluding the cable channels like CNN and Discovery.

Paramount CEO David Ellison tells CNBC that his is the “superior alternative” and is more likely to meet with regulators’ approval.

On the theory Paramount has the inside track, Paramount shares are up 7.3% on the day while Netflix is down 4.3% (on top of Friday’s losses). WBD, the object of this bidding war, is up 4.9%.

As for the major indexes, they’re all starting the week in the red — if only a bit.

As for the major indexes, they’re all starting the week in the red — if only a bit.

The S&P 500 is down about a third of a percent at 6,847. The Dow’s losses are similar, while the Nasdaq is down less than a quarter percent. “Large caps only need one solid trading day to post new all-time highs,” observes The Trading Desk’s Greg Guenthner.

Congratulations are in order for Catalyst Trader readers. This morning Ray Blanco urged them to sell half their position in the developer of an oral weight-loss drug. That’s a 182% gain in seven months. Plus, on Friday Rickards’ Strategic Intelligence readers took a 78% gain on B2Gold Corp.

Not much movement in precious metals with gold just under $4,200 and silver a few pennies under $58. Crude has tumbled back below $60, a barrel of West Texas Intermediate down nearly a buck to $59.15.

Bitcoin is holding the line on $90,000 and Ethereum is sitting tight just over $3,100.

U.S. tariffs haven’t put a dent in China’s export machine.

U.S. tariffs haven’t put a dent in China’s export machine.

China’s customs administration reports that exports in the first 11 months of the year have topped $1 trillion — exceeding 2024’s all-year record total.

The figures show November exports rose 5.9% year-over-year. That’s even though Chinese exports to the United States have fallen 29% during the same period. Clearly the rest of the world is stepping up to buy the consumer-y crap that’s become more expensive for Americans.

![]() Lights Out

Lights Out

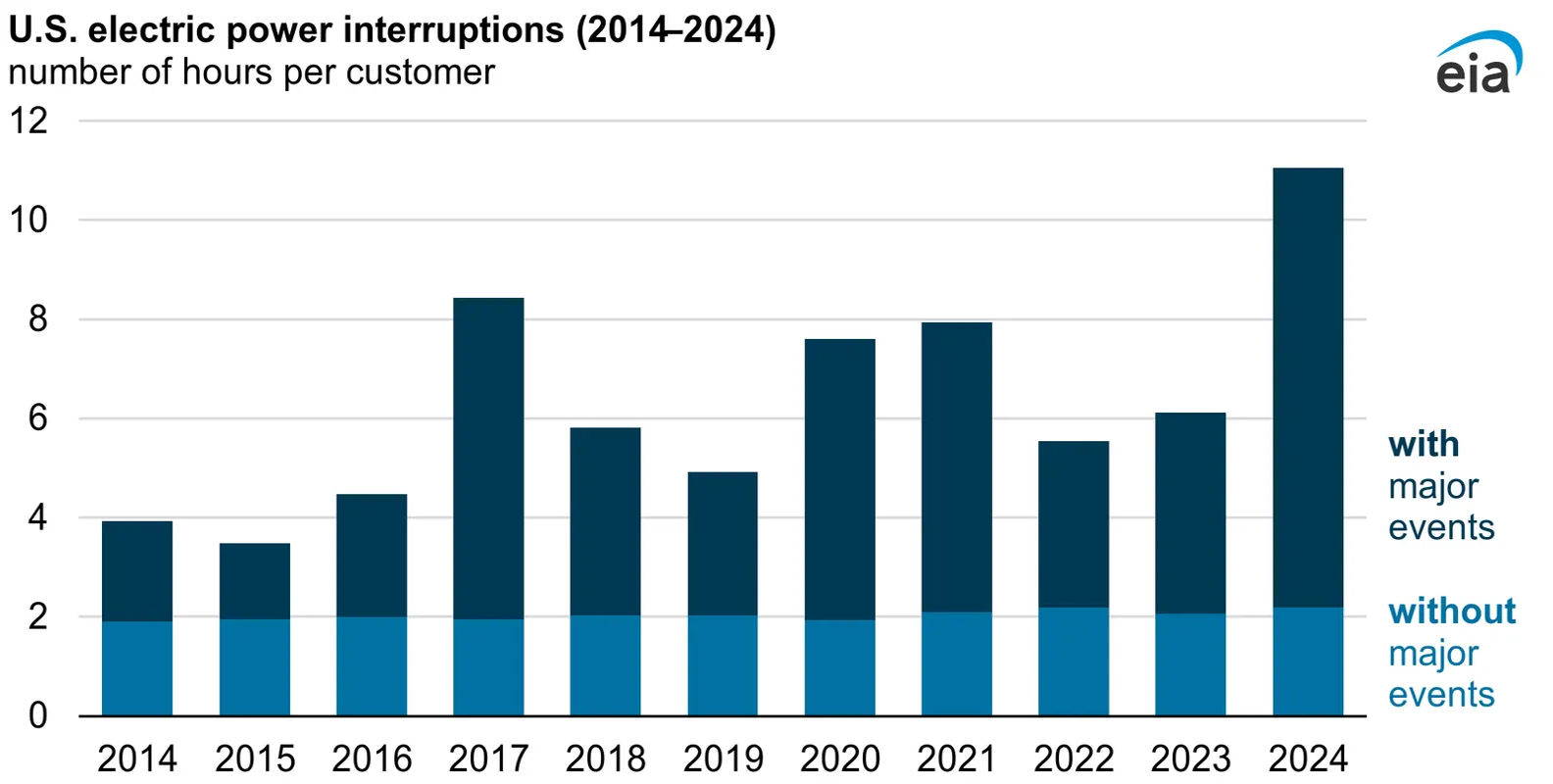

It turns out 2024 was a terrible year for power outages.

It turns out 2024 was a terrible year for power outages.

The U.S. Department of Energy is out with a report showing U.S. electricity consumers experienced an average 11 hours of power outages last year.

That’s nearly twice as many as the annual average during the preceding decade.

Of course, averages are deceiving: Many people caught up in Hurricanes Helene and Milton went without power for days or weeks. Hurricanes accounted for 80% of the total lost hours.

“Interruptions attributed to major events averaged nearly nine hours in 2024, compared with an average of nearly four hours per year in 2014 through 2023,” says the report. “Service interruptions that aren’t triggered by major events routinely average about two hours per year.”

We’ve been warning about the fragility of the power grid since mid-2022. Much of the grid is 30 years old, and portions are 50 years old.

And with the intense demand from AI data centers — a phenomenon we started discussing nearly two years ago — the situation is sure to get worse.

Paradigm readers have profited throughout 2025 playing the “independent power producers” that are not regulated utilities, and more opportunities are likely to present themselves in 2026. Stay tuned…

![]() Stop, Thief! (Self-Checkout)

Stop, Thief! (Self-Checkout)

Maybe we’ve reached “Peak Self-Checkout.”

Maybe we’ve reached “Peak Self-Checkout.”

LendingTree recently commissioned a survey revealing 27% of consumers who’ve used self-checkout say they’ve purposely taken something without scanning it — up from 15% two years ago.

Generationally, millennials lead the way — with 41% saying they’ve done it, followed by 37% of Gen Z adults. Only 2% of Boomers fessed up to it.

As the NewsNation network reports, “When asked why they stole, 47% said the current financial climate has made it difficult to afford essentials. Nearly as many (46%) cited higher prices.” Meanwhile, 35% say self-checkout amounts to “unpaid work,” so taking a small item “feels like compensation.”

Several retailers are rethinking self-checkout — notably Dollar General, which said last year it removed self-checkout from 12,000 stores. The company was upfront about the reasons — the “ongoing challenge from shrink.”

“I get that people are frustrated,” says LendingTree analyst Matt Schulz, “but no one should encourage people to walk away from a retailer without paying for something.”

![]() Mailbag: Spinning a Gold Scenario

Mailbag: Spinning a Gold Scenario

“What if the U.S. Treasury were to intentionally cause the avalanche in physical gold demand — spiking prices in order to revalue its gold holdings at substantially higher prices?” a reader muses.

“What if the U.S. Treasury were to intentionally cause the avalanche in physical gold demand — spiking prices in order to revalue its gold holdings at substantially higher prices?” a reader muses.

“They could create $2 or $3 trillion of balance sheet headroom to enable the Fed to buy longer-term treasuries managing the long end of the yield curve.

“Combined with the Fed bringing down the overnight rate and the GENIUS Act creating demand for short-term Treasuries, borrowing costs for consumers, businesses and the U.S. government could be reduced substantially.

“If done before the midterm elections, it could be the answer to the whole affordability conversation (until the inevitable inflation sets in later).”

Dave responds: Can’t rule anything out, I suppose.

That said, Treasury Secretary Scott Bessent has been fairly clear. He got a lot of buzz earlier this year when he promised the administration was hatching a scheme to “monetize the asset side of the U.S. balance sheet for the American people.”

Asked later about whether that included revaluing the gold — still officially on the Treasury’s books at $42.22 an ounce — he said that’s “not what I had in mind.”

Plus, a high gold price almost always correlates with a lack of confidence in either the U.S. dollar, U.S. Treasury debt — or both. That’s probably not the message the administration wants to telegraph, however unintentionally.

Still, there’s no shortage of other catalysts to trigger a supply squeeze. Keep stacking!