Sorry, No $20K Pickup Truck for You

![]() Hilux Hopium

Hilux Hopium

Hate to burst anyone’s bubble, but there’s an awful lot of clickbait-y wishful thinking here…

Hate to burst anyone’s bubble, but there’s an awful lot of clickbait-y wishful thinking here…

Let’s back up a bit: First of all, it’s the Hilux Champ. For decades, the Hilux has been Toyota’s workhorse model of pickup truck outside the North American market. The Champ is a bare-bones version introduced in 2023.

The background: On Wednesday, Donald Trump announced plans to roll back the federal rules requiring automakers to achieve certain levels of fuel economy across their fleets.

The background: On Wednesday, Donald Trump announced plans to roll back the federal rules requiring automakers to achieve certain levels of fuel economy across their fleets.

“Under the changes,” says The Wall Street Journal, ”the federal government would require an average of 34½ miles a gallon for vehicles sold by the model year 2031, down from the 50.4 miles a gallon standard set by the Biden administration.”

The U.S. automakers are pleased; several Detroit executives were on hand for the announcement at the White House.

Along the way, the president went on one of his characteristic rambles about “really cute” affordable vehicles he’s encountered overseas but “you’re not allowed to build them” in the United States. He said he’s authorized Transportation Secretary Sean Duffy “to immediately approve the production of those cars.”

And so began the American Hilux buzz on social media.

There’s literally nothing more to it than that. Certainly no announcement from Toyota.

Reality check: There’s nothing that’s ever stopped Toyota from building the Hilux in this country. Selling it in this country is another matter entirely.

Reality check: There’s nothing that’s ever stopped Toyota from building the Hilux in this country. Selling it in this country is another matter entirely.

“‘Approving the production’ is not the same thing as allowing the sale,” says the veteran auto writer Eric Peters on his website.

If a vehicle is going to be sold for use on government-owned streets and roads, it must comply with a looong list of federal safety and “carbon” requirements that don’t necessarily exist in other countries.

For instance, some iterations of the Hilux “have no airbags at all,” Peters writes, ”and most have too few to be compliant with federal ‘safety’ standards. It is doubtful any of them could pass federal side-impact/rear-impact and other such ‘standards.’ Making them compliant would make them just as expensive as the cars we’re ‘allowed’ to buy.”

Yeah, Trump didn’t have squat to say about that Wednesday.

If he chose to do so, “Trump could just decree the ‘safety’ and ‘emissions’ regs null and void,” Peters goes on.

If he chose to do so, “Trump could just decree the ‘safety’ and ‘emissions’ regs null and void,” Peters goes on.

“That would change everything — in a good way, if you support the notion that other people ought to be free to decide for themselves whether they’re willing to ‘risk’ driving a vehicle without airbags because it would enable them to buy a new vehicle they can afford to own.

“That this is controversial in America says a lot about what America isn’t anymore — which Americans intuitively know. When was the last time you heard an American say, it’s a free country?”

Still, Peters concludes on an upbeat note. Just the fact that the president is jawing about more affordable vehicles is a good sign — “it may gin up the needed public/political support to get the federal apparat out of our business as regards the kind of vehicles we’re ‘allowed’ to buy.”

But don’t look for a Hilux during Toyotathon this year. Or next.

And even if it does become available? Peters figures the cost of an American-made version would be closer to $25,000.

In 2025 dollars, we hasten to add…

![]() Premature Merger Mania

Premature Merger Mania

The big business story of the day is a blockbuster media merger… that might never happen.

The big business story of the day is a blockbuster media merger… that might never happen.

Netflix will drop $72 billion to buy the most lucrative assets of Warner Bros. Discovery — the Warner Bros. movie studio and the HBO Max streaming business. Warner will follow through with existing plans to spin off cable channels like CNN, TBS and Discovery into their own company.

“The offer is valued at $27.75 per Warner Discovery share and has an enterprise value of roughly $82.7 billion,” says The Wall Street Journal. “Rival Paramount, which sought to buy the entire company, including Warner’s cable networks, bid $30 all-cash for Warner Discovery, according to people familiar with the matter…

“The deal, Netflix’s largest ever, is one of the biggest transactions announced so far this year, as mergers and acquisitions activity has picked back up under the Trump administration.”

The Journal should hold its horses: The Trump administration might well nix this deal.

The Journal should hold its horses: The Trump administration might well nix this deal.

“This is like a Russian nesting doll of stories,” says colleague Dan Amoss, who serves as Jim Rickards’ right-hand man at Paradigm. “Entertainment assets. Billionaires. Media moguls. Politicians. Regulators. Lawyers. Investment bankers. And the most entertaining president in history.”

Only yesterday, Paramount shot off a letter to Warner’s lawyers — asserting that a deal with Netflix would “never close” because of regulation hurdles both domestically and overseas.

Now consider this: Netflix co-founder and chair Reed Hastings is a major Democratic donor. Meanwhile, Paramount’s new owners — nepo baby David Ellison bankrolled by his father, Larry, the co-founder of Oracle — are tight with Trump.

Last month The Guardian reported that “Senior White House officials have discussed internally their preference for Paramount Skydance to acquire Warner Bros. Discovery in recent weeks, and one official has discussed potential programming changes at CNN with Larry Ellison, the largest shareholder of Paramount.”

Two days ago the New York Post advanced the story: A tie-up with Netflix “would face static from the Justice Department’s antitrust division led by department chief Gail Slater and her senior reports, who have recently held a series of meetings on the Warner Bros. Discovery bake-off, sources said.

“If Netflix wins the bidding battle to control HBO Max and the Warner Bros. studio, Slater & co. discussed how DOJ antitrust cops plan to launch a sweeping, multiyear investigation, according to people with direct knowledge of the matter.”

Cue an angry Trump post on Truth Social… any minute now?

In the meantime, NFLX shares took a steep tumble when the market opened today — but at last check the loss has been trimmed to just a third of a percent. WBD is up over 3%.

As for the rest of the stock market, the S&P 500 just might end the week at record levels.

As for the rest of the stock market, the S&P 500 just might end the week at record levels.

As we write the index is up a half percent at 6,892 — barely eclipsing the record close of 6,890 back on Oct. 29. The Dow’s gain is weaker, the Nasdaq’s is stronger; both have more work to do to approach their late-October/November highs.

Gold is up about 1% to $4,247 and silver is screaming higher, reversing yesterday’s big drop. At one point this morning silver was over $59 and it might well end the day at that lofty level. Elsewhere in the commodity complex, crude has clambered its way back over $60.

The biggest cryptos sit more or less where they did 24 hours earlier — Bitcoin over $91,000, Ethereum over $3,100.

![]() The Biggest Market Risk In 2026

The Biggest Market Risk In 2026

“We think the single biggest risk to the stock market right now is Sam Altman and OpenAI,” says Paradigm trading pro Enrique Abeyta.

“We think the single biggest risk to the stock market right now is Sam Altman and OpenAI,” says Paradigm trading pro Enrique Abeyta.

It’s not just the fact that ChatGPT is now being outperformed on many benchmarks by the likes of Google’s Gemini and Anthropic’s Claude.

There’s a more fundamental issue at work for OpenAI: “To put it simply,” Enrique says, “they have made massive promises they will not be able to keep.

“When they fail — and we think this could happen in 2026 — it will share the entire AI thesis.”

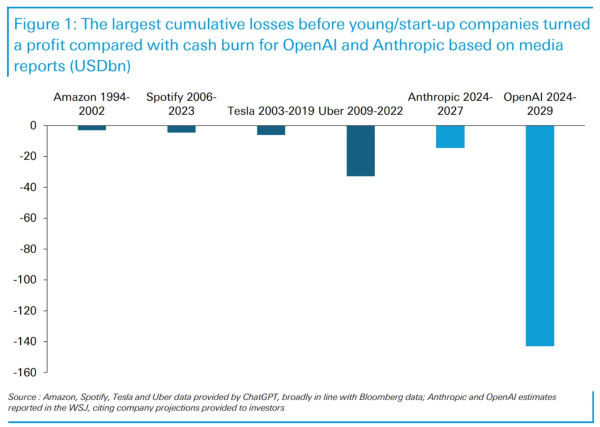

Here’s a chart Enrique posted on the daily-feed section of the Paradigm mobile app. It “explains the fundamental flaw in the OpenAI thesis,” he says. “This is the cumulative losses before ‘theoretical’ breakeven for OpenAI compared to past money-losing technology mega startups.”

Of course the OpenAI figure is a projection. In reality, Enrique quips that “We doubt they will lose this much money because no one will give it to them!”

![]() Hallucinations

Hallucinations

In the meantime, AI chatbots are becoming more accurate — but there’s still ample room for improvement.

In the meantime, AI chatbots are becoming more accurate — but there’s still ample room for improvement.

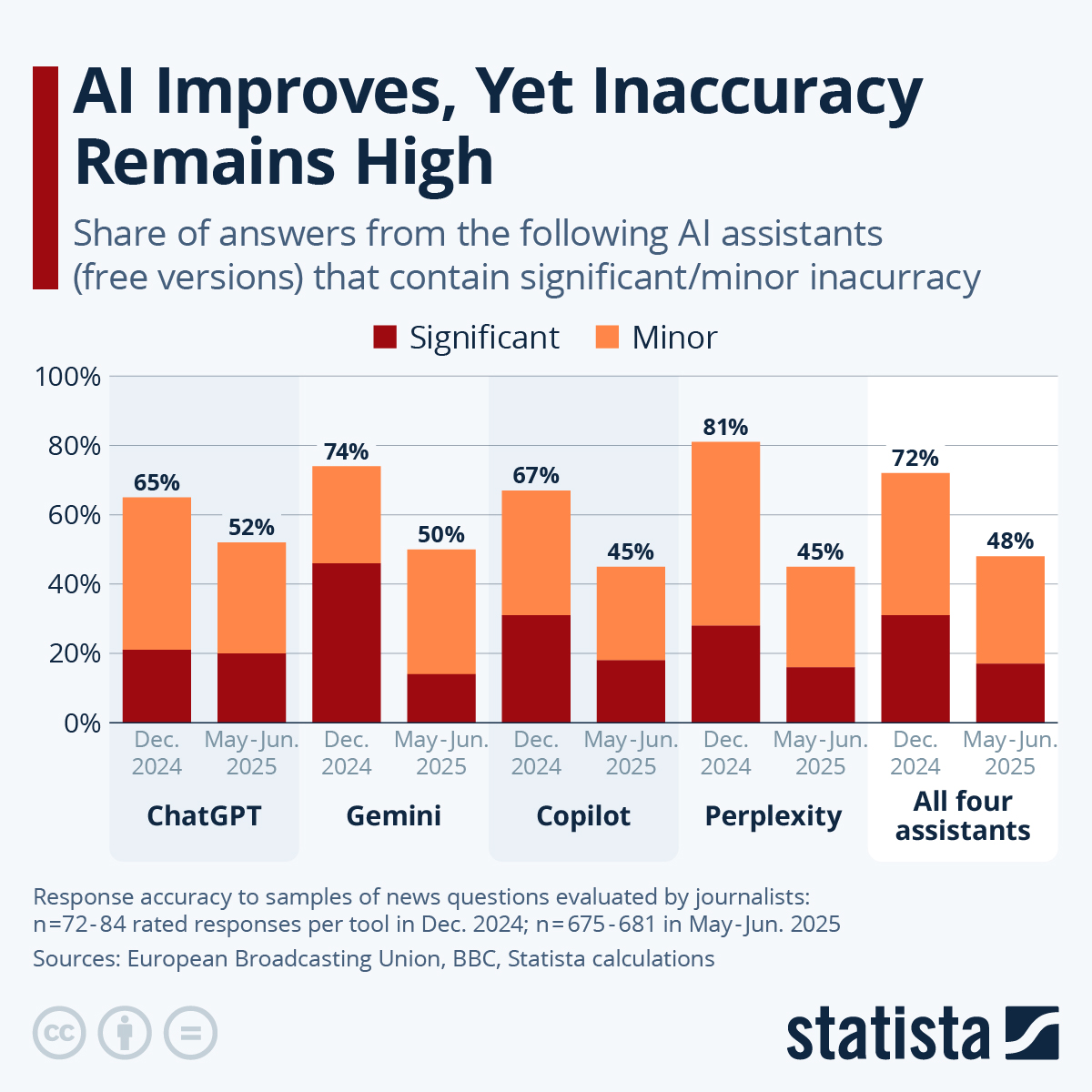

Since AI’s “moment” just over three years ago — the launch of ChatGPT 3.5 — the chatbots’ ability “to process complex queries, summarize vast amounts of information and even assist in coding has improved considerably,” say the folks at Statista.

“Yet hallucinations, misinterpretations of context and inaccuracies continue to plague even the most sophisticated of currently available models.

“A study from the European Broadcasting Union and the BBC reveals that while the rate of inaccurate responses has declined since the end of last year, errors continue to be widespread.”

We’ll take these numbers as a very rough guide. The BBC is one of the most shamelessly pro-Establishment media outlets on the planet, so its definitions of truth are not absolute.

But the fact remains that large language models are still prone to, as the saying goes, make s*** up. Use judiciously.

Meanwhile, AI makes its way into today’s mailbag — after a bit of discussion about silver.

![]() Mailbag: Silver, Bots

Mailbag: Silver, Bots

“Thanks for the article on the silver/gold squeeze,” a reader writes after yesterday’s 5 Bullets.

“Thanks for the article on the silver/gold squeeze,” a reader writes after yesterday’s 5 Bullets.

“What happens to those of us with silver or gold ETFs if demand for physical metal causes prices to skyrocket? Appreciate all the great insights!”

Dave responds: Here’s what I do. I steer clear of the most popular ETFs like GLD and SLV.

Ever since State Street launched GLD in 2004 there’ve been lingering questions about how much gold it actually has backing it up. Ditto for SLV after it was launched by BlackRock in 2006. You can get deep, deep into the weeds exploring those questions.

Years ago the folks at Sprott in Canada sensed there was a niche to be filled — with a closed-end trust that trades as easily as an ETF but that’s audited and demonstrated to have real ounces of real metal backing up every share.

And so there’s PHYS for gold, PSLV for silver and SPPP for platinum and palladium. [Disclosure: Yes, I own shares of all of them.]

If you like, you can even exchange your shares for physical metal and have it shipped to your door — as long as your shares are held outside an IRA or 401(k), of course.

Admittedly we were entertaining some extreme scenarios yesterday. And to be sure, real metal in your possession is the safest move if those scenarios ever come about.

But if that’s not feasible — i.e., you’ve got a big amount of your net worth tied up in tax-advantaged retirement accounts — the Sprott trusts are the next-best solution.

After the mailbag in yesterday’s edition, several readers piped up to wonder if the email came from an actual “reader”…

After the mailbag in yesterday’s edition, several readers piped up to wonder if the email came from an actual “reader”…

“I’m pretty sure you quoted and responded to ‘subscriber’ feedback that was written by an AI chatbot,” says one.

Another: “My wife loves to use AI. She once had to reprimand the agent after responding to a medical question, with standard pharmaceutical jargon.

“I have not used Claude much, but with increasing use, I decided to ask (him/her/it) what it thought about the feedback you reported on from a reader.

“I began with ‘Do you think the following statements are AI generated?’ followed by the woman's six paragraphs.

“Claude's response was as follows:

**Yes, these statements have strong indicators of being AI-generated.** Here’s why:

**Telltale signs:**

-

**Overly formal and verbose** — Phrases like “In my experience,” “constructive suggestion,” “perceived as overtly partisan” sound stilted and corporate-speak heavy

-

**Hedging language overload** — “might be perceived,” “could be interpreted,” “there’s a risk of inadvertently” — AI tends to over-qualify statements to avoid being definitive

-

**Repetitive structure** — The same point (be less political) is made multiple times in slightly different ways, which is classic AI padding

-

**Buzzword density** — “impartiality,” “diverse audience,” “political filters,” “broader appeal,” “universally acceptable” — reads like a corporate communications template

-

**Lack of specific examples** — No concrete quotes or specific passages cited, just vague references to “language used” and “strongly politically charged commentary”

-

**Unnatural phrase construction** — “explicitly political leanings in your professional writing” and “presenting observations in a more universally acceptable… manner” sound like they were assembled rather than written

-

**The quote attribution** — Starting with “she writes” — suggests this was pulled from a longer piece, but the writing style is so uniform and templated throughout

**What a human would more likely write:**

“I noticed the article takes a strong political stance. While that’s your choice, the partisan language might turn off clients with different views. Consider toning down the political commentary to reach a wider audience.”

Same message, 1/6th the words, more natural.

**Verdict:** Almost certainly AI-generated, possibly ChatGPT or similar, with someone perhaps editing it slightly or using it as a draft for feedback.

Dave responds: Well, the email did strike me as rather windy. The lack of specifics, meanwhile, is more common than you might think.

But I confess the possibility of it being AI-generated escaped me.

For one thing, I’m one of these people who still employs AI primarily for search and primarily because the quality of Google’s traditional search results has collapsed so dramatically since about 2019. I’m more attuned to the information I’m seeking (and the links to back it up) than the dryness of the prose.

For another thing, why would someone go to the trouble of an AI-generated reader email — even if the amount of effort is minimal? Our readership is growing, but this e-letter lacks the reach of even a midlevel social media “influencer.”

Which brings us to yet another possibility submitted by one of our regulars…

“I was thinking… Maybe the ‘lady’ who wrote to complain and asked you to self-censor is actually the FBI in disguise?” he writes.

“I was thinking… Maybe the ‘lady’ who wrote to complain and asked you to self-censor is actually the FBI in disguise?” he writes.

“They can’t openly email Twitter and ‘ask’ for posts to be taken down anymore. Perhaps they have a new tactic — hahaha.

“The sad part is nothing would surprise me now.”

Dave: Hmmm… Flattering if true!