Silver Rumors

![]() Here We Go Again

Here We Go Again

The rumor surfaces every few years. And every few years we have to smack it down here in these virtual pages.

The rumor surfaces every few years. And every few years we have to smack it down here in these virtual pages.

The rumor has to do with an imminent catalyst for a steep jump in precious metals prices.

Fair warning: We’re going to get a bit into the weeds today. But we owe it to you to do a little debunking just in case you run across this rumor on your favorite social media feed.

In recent days the rumor has caught on again because of the tightness in the silver market we mentioned on Tuesday.

In recent days the rumor has caught on again because of the tightness in the silver market we mentioned on Tuesday.

Since October, huge quantities of physical silver have been moving around the world. The Grok AI engine, drawing from nearly a dozen articles in the business press, summarizes it like so…

In October 2025, a severe supply squeeze gripped London's silver market — the world's largest trading hub — triggered by earlier outflows of metal to New York amid U.S. tariff uncertainties, compounded by surging global demand from industrial uses, ETF inflows and seasonal buying in India ahead of Diwali.

This created a historic arbitrage opportunity, drawing nearly 54 million troy ounces (over 1,600 tons) from U.S. Comex warehouses (down 697 tons) and China's Shanghai Futures Exchange (17 million ounces withdrawn), replenishing London vaults with the largest inflow in nine years and easing local borrowing costs from over 30% to around 5%.

However, this redistribution strained other hubs, with Shanghai inventories plummeting to 920 tons — the lowest since 2015 — amid ongoing structural deficits exceeding 600 million ounces since 2021, keeping one-month lease rates elevated and underscoring silver's persistent tightness.

This “silver squeeze” is what propelled the spot silver price from about $46 only two months ago to over $57 this morning.

This “silver squeeze” is what propelled the spot silver price from about $46 only two months ago to over $57 this morning.

Demand for physical metal is catching up with the demand in the “paper silver” market — that is, silver futures traded on the Comex in New York.

For the time being, traders are content to roll their contracts forward or take a cash payout when those futures expire. But hypothetically, they have the right to demand delivery in physical metal.

Predictably, several observers of the precious metals markets are stepping forward with lurid predictions that all hell is about to break loose.

Predictably, several observers of the precious metals markets are stepping forward with lurid predictions that all hell is about to break loose.

Case in point: Bill Holter, a veteran of A.G. Edwards among other firms. In a recent interview on the USAWatchdog podcast, he points out that annual global silver production of about 850 million ounces isn’t enough to keep up with demand.

“The rumor is somebody has put in a $20 billion order, which would mean 400 million ounces,” he says. “If that is the case, that order cannot be met, and that will create shark-infested waters... If somebody stands for delivery and it looks like it may be difficult for them to get delivery, then everybody is going to stand for delivery because they know that their contracts are worthless.”

From there, “One day you will see a huge [price] spike, but markets won’t open after that. That will cascade. What will happen is all the Comex contracts for both silver and gold will default.”

Silver futures would be effectively worthless — while real hold-in-your-hands silver would be worth hundreds of dollars an ounce.

But there’s a problem — several problems, actually — with this scenario. Read on…

![]() “Stand for Delivery” (Yeah, Good Luck With That)

“Stand for Delivery” (Yeah, Good Luck With That)

“For years, gold bugs implored futures traders to ‘stand for delivery’ on the Comex,” Paradigm macro maven Jim Rickards wrote in 2016 — when rumors of this sort were rippling through the gold market.

“For years, gold bugs implored futures traders to ‘stand for delivery’ on the Comex,” Paradigm macro maven Jim Rickards wrote in 2016 — when rumors of this sort were rippling through the gold market.

“If every long in the futures market put in a notification that they wanted to take physical delivery instead of closing out or rolling over their contracts, the result would be one of the greatest short squeezes and price spikes since ‘Big Jim’ Fisk and Jay Gould tried to corner the private gold market in 1869. (Fisk and Gould’s corner failed when the U.S. Treasury unexpectedly made public gold available to bail out the shorts.)

“But this scenario is unlikely to play out in the way the gold bugs wish, for several reasons,” Jim went on.

“But this scenario is unlikely to play out in the way the gold bugs wish, for several reasons,” Jim went on.

“The first is that the Comex has emergency powers to prevent longs from taking delivery in a way that disrupts the orderly functioning of the market. The Comex rule book makes it clear that a futures exchange is for hedging, price discovery and legal speculation, but is not a source of supply. (Physical delivery is permitted, but only enough to keep the paper price ‘honest.’ The irony, of course, is that the paper price is anything but honest, due to manipulation.)

“Another rule allows Comex officials to change the rules as needed in emergencies (something the Hunt brothers experienced when they tried to corner the silver market in 1980). The fact that longs know they cannot take delivery in the end is a major deterrent to the attempt.”

There’s one more reason the precious metals longs don’t squeeze the precious metals shorts. Jim sums it up in two words: “It’s illegal.”

There’s one more reason the precious metals longs don’t squeeze the precious metals shorts. Jim sums it up in two words: “It’s illegal.”

“Most major participants in the gold market (banks, dealers and hedge funds) are regulated by one or more of the Federal Reserve, U.S. Treasury, SEC or CFTC,” he explains. (And he’s been a lawyer for banks, dealers and hedge funds, so he’d know.)

“Applicable laws contain strict anti-fraud and anti-manipulation rules, including jail time in cases of willful and knowing violations.”

So a rogue hedge fund manager out there might want to call BS on the whole Comex scheme… but he thinks better of it, lest the full weight of Uncle Sam’s prosecutorial apparatus comes crashing down on him.

Don’t get the wrong idea: Precious metals could still experience a super-spike — just not for the “stand for delivery” reasons you hear from the usual suspects.

Don’t get the wrong idea: Precious metals could still experience a super-spike — just not for the “stand for delivery” reasons you hear from the usual suspects.

It comes back to “avalanche theory” — Jim’s popularization of the science called complexity theory.

“A single snowflake,” he reminds us, “can turn a seemingly stable snowpack into a roaring avalanche that destroys everything in its path. Once the snowpack is arranged in an unstable way (like the gold market today), a single snowflake can unleash carnage. Of course, a single snowflake is so small you never see it coming.

“What this means is that the super-spike in gold [and silver] prices will not come from any of the obvious sources but from an unexpected source.”

It could be the bankruptcy of a medium-size gold dealer. It could be lawmakers in Washington talking about new reporting requirements for gold dealers. Or it could have nothing to do with gold: It could be a war or another pandemic that frightens people into safeguarding wealth.

“It doesn’t matter,” Jim sums up. “Once the avalanche begins, there’s no stopping it.

“It doesn’t matter,” Jim sums up. “Once the avalanche begins, there’s no stopping it.

At that point, the hedge funds can demand physical delivery of gold without fear of prosecution. If a hedge fund tries to start an avalanche, it’s manipulation. But if the avalanche starts from another source, then a hedge fund piling on is ‘normal’ market conduct.

“Since every gold market participant knows there’s not enough physical gold to go around, everyone will demand physical gold at once. No one wants to be left holding the bag.

"What happens when there's a panic and everyone demands their gold at once?" he goes on. "And how does this end?

"There are a few ways… and none of them good.”

Unless you have physical gold and silver in your possession already. Act accordingly.

Now on to other matters…

![]() Bad News Is Good News (Jobs)

Bad News Is Good News (Jobs)

In the absence of official government jobs data, Mr. Market and the Federal Reserve are glomming onto whatever private-sector data can be found. And it’s all bad.

In the absence of official government jobs data, Mr. Market and the Federal Reserve are glomming onto whatever private-sector data can be found. And it’s all bad.

Because of the 43-day “partial government shutdown,” the Bureau of Labor Statistics won’t even try to assemble an October jobs report. And the November numbers — which ordinarily would come out tomorrow — won’t be released until Tuesday, Dec. 16.

That’s after the Federal Reserve makes its next decision about short-term interest rates on Wednesday the 10th.

Yesterday we mentioned how the payroll firm ADP found that private-sector employers cut 32,000 jobs in November — contrasting with expectations for 20,000 jobs added.

Today brings another discouraging number: The Challenger Job-Cut Report from Challenger, Gray & Christmas finds that U.S. employers cut 71,321 positions in November.

To be clear, this report does not attempt to figure out how many jobs might have been added. Still, it’s concerning that this job-cut number is up 24% from November 2024.

And the cuts took place in every industry group other than utilities.

But on the theory that a weakening job market translates to Fed interest-rate cuts, stocks have rallied both yesterday and today.

But on the theory that a weakening job market translates to Fed interest-rate cuts, stocks have rallied both yesterday and today.

All of the major U.S. stock indexes are in the green as we write, the S&P 500 up a tenth of a percent at 6,856. The S&P is only a half percent away from reclaiming its record close notched on Oct. 29.

And why not? Activity in the futures markets shows an 87% likelihood the Fed will trim the benchmark fed funds rate next week — which would be the third cut since September.

Elsewhere, gold is holding steady just over $4,200 — but Mr. Slammy came for silver big-time today. The $57 handle we mentioned off the top? That’s down nearly $1.50 from yesterday. Crude is up over 1% but still under $60.

Crypto is consolidating after yesterday’s big gains, Bitcoin a little over $92,000 and Ethereum at $3,163.

![]() Economic Warfare Blowback

Economic Warfare Blowback

Now a follow-up to Tuesday’s edition — all about governments around the world thumbing their noses at the economic dictates of Washington, D.C.

Now a follow-up to Tuesday’s edition — all about governments around the world thumbing their noses at the economic dictates of Washington, D.C.

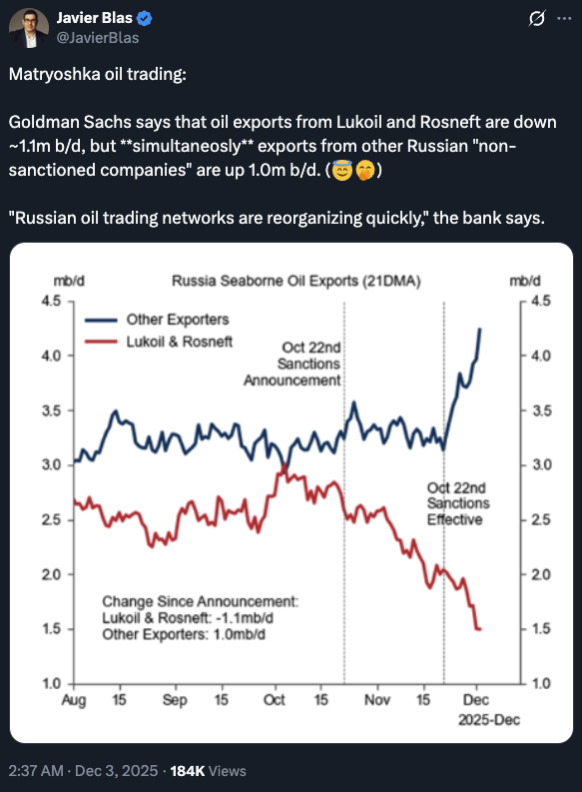

In October, the Trump administration tried to amp up the pressure on Russia to reach a cease-fire with Ukraine by imposing sanctions on Russia’s two biggest oil producers — Rosneft and Lukoil.

Last month, the Treasury Department issued a statement crowing that the sanctions “are having their intended effect of dampening Russian revenues by lowering the price of Russian oil and therefore the country's ability to fund its war effort against Ukraine."

Not so much, says a tweet from Bloomberg’s straight-shooting energy and commodities reporter Javier Blas…

Where there’s a will there’s a way, right?

Meanwhile, Russia’s President Vladimir Putin got an exceptionally warm welcome today from India’s Prime Minister Narendra Modi.

Meanwhile, Russia’s President Vladimir Putin got an exceptionally warm welcome today from India’s Prime Minister Narendra Modi.

Modi greeted Putin at the New Delhi airport — something he’s done only a handful of times with other heads of state since becoming prime minister in 2014 — before piling into a Toyota Fortuner to head into the city.

Best of friends [as posted on the @narendramodi X account]

It was three months ago when our Jim Rickards went semi-viral on X with a post spotlighting the smiles and handshakes among Putin, Modi and China’s President Xi Jinping at a summit in China. Together they’re forming a formidable anti-Washington bloc capable of withstanding sanctions and other forms of economic warfare.

It was an avoidable outcome if Donald Trump and Joe Biden had exercised smart diplomacy — but it was not to be.

Now, as mentioned here Tuesday, Washington imposes a 50% tariff on imports from India to punish India for its Russian oil purchases… and India just keeps on keepin’ on.

And that Tuesday edition continues to draw reader reaction…

![]() Mailbag: “My Constructive Suggestion…”

Mailbag: “My Constructive Suggestion…”

For a second day running, we’re taking heat from a reader who interpreted Tuesday’s 5 Bullets as a slam on the current president.

For a second day running, we’re taking heat from a reader who interpreted Tuesday’s 5 Bullets as a slam on the current president.

“It became quite clear throughout the article that there is a strong critical stance taken regarding a particular political figure,” she writes.

“While personal opinions are certainly valid, I believe some of the language used, specifically when addressing political affiliations or leadership, might be perceived as overtly partisan rather than purely objective or analytical.

“In my experience, many professional audiences and clients hold a wide range of political views. When professional content incorporates what could be interpreted as strongly politically charged commentary or critiques, there's a risk of inadvertently alienating a significant portion of your readership or client base.

“Maintaining a degree of political neutrality or presenting observations in a more universally acceptable and less confrontational manner can often help in fostering broader appeal and ensuring your professional message is received without immediate political filters.

“My constructive suggestion would be to consider moderating the explicit political leanings in your professional writing.

“This approach could help in preserving an image of impartiality and ensure that your valuable insights reach and resonate with an even wider, more diverse audience, without risking the alienation of potential or existing clients who may hold differing political perspectives.”

Dave responds: Thank you for your feedback.

So a couple of things: One, it’s impossible to assess markets and the economy without assessing the actions of politicians and central bankers. As it happens, almost all of them are fools, knaves or both — drunk with hubris that they can push a button here, pull a lever there and get a predictable result with no second-order effects or unintended consequences.

In that light, I’m thoroughly impartial — my contempt is universal. Thus, in the current politically polarized climate I’m going to offend someone no matter what I say.

Inevitably there will be “drive-by” readers who get the idea I take one side or another — and there’s nothing I can do about that.

The alternative is to crank out material that’s bland, vanilla, milquetoast — which is a sure way to put myself out of work!