Silver Squeeze 2025 (Update)

![]() The Silver Squeeze of 2025 (Update)

The Silver Squeeze of 2025 (Update)

“Silver has officially broken out again, and depending on which charts you’re looking at, the next target is either $71 or $77,” colleague Sean Ring writes in our sister e-letter The Rude Awakening.

“Silver has officially broken out again, and depending on which charts you’re looking at, the next target is either $71 or $77,” colleague Sean Ring writes in our sister e-letter The Rude Awakening.

Now that the white metal has broken through $60 for the first time, the mainstream is starting to notice.

And the mainstream takes are oh-so-predictable.

And the mainstream takes are oh-so-predictable.

“A mix of forces are boosting silver, including the weakened dollar, tariff politics and supply shortages,” says The Washington Post. “Especially critical in recent weeks, though, is the growing expectation that the Federal Reserve will announce another rate cut this Wednesday as the U.S. economy continues to slow down. Analysts say that’s likely to further pressure the dollar lower while lifting silver — a classic safe-haven asset — even higher.”

The BBC: “Investors tend to move money into precious metals like gold and silver as interest rates come down and the U.S. dollar weakens. The U.S. central bank is widely expected to cut its main interest rate by a quarter of a percentage point on Wednesday.”

Seriously? Tariffs? The Fed?

The Fed embarks on a rate-cutting cycle every few years and there’s almost zero correlation with the price of precious metals. The Fed cut rates steadily during the second half of 2019 and the price stayed mired under $20.

“When the D.C. deep state elite start talking about a precious metal move, it means that they must be feeling the seismicity,” observes Paradigm’s metals-and-mining authority Byron King.

“When the D.C. deep state elite start talking about a precious metal move, it means that they must be feeling the seismicity,” observes Paradigm’s metals-and-mining authority Byron King.

The reality is that this move has been “decades in the making, with the kickoff under Biden and grabbing Russian assets.”

For sure. We can’t say it often enough: Freezing the dollar assets of Russia’s central bank in 2022 touched off a scramble for gold among the world’s central banks. As Jim Rickards often reminds us, “Gold is a physical nondigital asset that cannot be stolen, frozen or seized provided it is in safe storage.”

It was inevitable silver would catch up to gold’s move — and then surpass it. That’s how it always goes during an epic precious-metals rally.

Byron points out another factor that files under the mainstream radar — the industrialization of China. All those solar panels they’re making for the rest of the world? They need silver!

Those are long-term factors, however. In the short term, a “silver squeeze” is still underway.

Those are long-term factors, however. In the short term, a “silver squeeze” is still underway.

We described the dynamics last Thursday — silver being loaded on cargo jets for transport out of London and into New York and Shanghai. Demand for physical metal is catching up with the demand for silver futures contracts on the Comex in New York. Lease rates on physical silver are through the roof.

Six days later, there’s no sign of the squeeze letting up.

“A steady, orderly rise would tell us the market is adjusting to new fundamentals,” says Sean Ring. “But this isn’t orderly. It smells like fear. It feels like a squeeze. And it carries the subtle warning that the plumbing behind the scenes is clogging up…

“Silver lease rates are still elevated versus normal, with very short tenors reportedly in the midteens to several tens of percent annualized, compared with a long-run ‘normal’ well under 1% per year.

“Deliverable inventories on major exchanges are shrinking at a pace we haven’t seen since the 2011 squeeze. And the usual liquidity providers are stepping back because the spreads are too unpredictable to quote safely.

“When a bullion bank bleeds, it doesn’t show up on CNBC. It shows up in the market microstructure. Banks that normally dominate the market start behaving like they’re afraid of taking the wrong side of the trade.

“If silver keeps rising in this jagged, disorderly pattern, someone is getting crushed behind the curtain. And once a bank is cornered, the problem is no longer price volatility, but systemic risk.”

Word.

Back to the chart action: “I’ll stick with $71 for now, and there it’ll take a breather,” Sean says. “Once silver gets watered and fed, $102 is the next long-term price target.”

![]() Bubble Babble

Bubble Babble

When The New York Times frets on its front page about an AI bubble, you can be confident there’s still ample time before the bubble bursts.

When The New York Times frets on its front page about an AI bubble, you can be confident there’s still ample time before the bubble bursts.

“Share prices of some AI companies have risen dramatically in a short time,” says the article accompanying that headline — “and tech companies are spending billions to build data centers and microchip plants to power the boom.

“While investors and analysts see good reasons to justify the exuberance behind the nearly 50% increase in the S&P 500 over the past two years, some warn that current valuations still rest on a big bet on the future.”

You want to know when the AI bubble will burst?

When the mainstream stops publishing articles like this and adopts the narrative that the AI economy has put the stock market on a permanently higher trajectory and trees grow to the sky.

We’re not there yet.

Ironically, the Times article acknowledges as much — invoking the December 1996 remark by Federal Reserve Chair Alan Greenspan about “irrational exuberance” in internet stocks.

Ironically, the Times article acknowledges as much — invoking the December 1996 remark by Federal Reserve Chair Alan Greenspan about “irrational exuberance” in internet stocks.

Greenspan wasn’t wrong — but he was early, and you wouldn’t have wanted to bet against the dot-coms. The S&P 500 doubled in the three years following Greenspan’s warning. Only then came the inevitable collapse.

As John Maynard Keynes once said, “The market can remain irrational longer than you can remain solvent.”

In fact, if you want to use the dot-com bubble and bust as your guide, there’s still a long way to go.

In fact, if you want to use the dot-com bubble and bust as your guide, there’s still a long way to go.

Here’s a chart of the Nasdaq composite index from Bespoke Investment Group. It shows the dot-com rally then and the AI rally now.

The starting point then was the release of the Netscape Navigator web browser and the starting point now is the release of ChatGPT 3.5.

The parallels — at least so far — are eerie. Notice the dip in the red line coinciding with the market’s 5% pullback last month. There was a similar pullback in late 1997 coinciding with a currency crisis in Asia.

If past is prologue, a steeper pullback is on the horizon next summer and fall. Back in 1998 the catalyst was the Russian government defaulting on its debt — which took down the U.S. hedge fund Long Term Capital Management.

And then comes the blowoff top in 2027.

No guarantees, but that’s how it’s shaken out for the last three years. We’ll check in on this chart from time to time during 2026…

As for today, Mr. Market is marking time until the Federal Reserve makes its next call on interest rates.

As for today, Mr. Market is marking time until the Federal Reserve makes its next call on interest rates.

As mentioned yesterday, nearly everyone expects the Fed to trim the fed funds rate another quarter percentage point this afternoon. The drama lies in how much dissent there is among the members of the Fed’s Open Market Committee, and how Fed Chair Jerome Powell spins that dissent during his post-decision press conference. (As always, we’ll follow up tomorrow with the help of Jim Rickards.)

At last check the S&P 500 is pancake flat relative to yesterday’s close, sitting at 6,841. The Dow is slightly in the green, the Nasdaq slightly in the red.

While silver continues to hold the line on $60, gold is struggling to hold onto the $4,200 level. As for digital nondollar assets, Bitcoin remains over $92,000 and Ethereum has climbed over $3,300.

![]() Venezuela: Action Imminent?

Venezuela: Action Imminent?

Oil has sunk under $58 for the first time this month, even as it appears Washington is closer to making some sort of military move on Venezuela.

Oil has sunk under $58 for the first time this month, even as it appears Washington is closer to making some sort of military move on Venezuela.

After several days docked in the Virgin Islands, the aircraft carrier USS Gerald Ford has made its way back toward Venezuela.

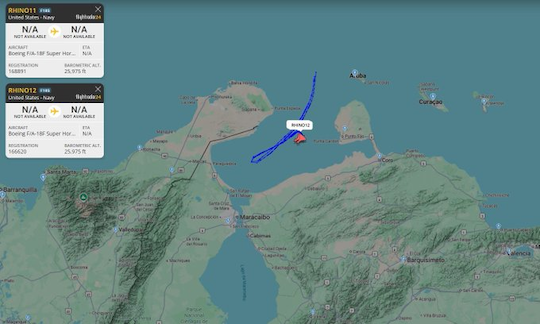

Yesterday, two U.S. Navy F/A-18 fighter jets were spotted by flight trackers deep inside the Gulf of Venezuela — perhaps trying to light up Venezuelan radar. The Pentagon is spinning it as a “routine training flight.”

As we laid out last month, an American regime-change op in Venezuela has nothing to do with drugs and everything to do with oil and other natural resources. As we also said last month, public support for regime change is sorely lacking. And unlike in the run-up to the Iraq War in 2003, there’s been no sustained propaganda campaign to generate such support.

Trump is refusing to rule out a ground invasion, but as long as support remains lacking, it seems unlikely.

More likely are other options he’s said to have reviewed — sending in troops to capture airfields and oil wells, or perhaps dispatching special forces to capture or kill President Nicolas Maduro.

And then what?

And then what?

“In my estimation, it is an inexplicably stupid and highly risk-laden undertaking to try to insert SOFs [special operations] and Marines,” tweets the military analyst William Schryver.

“And, notwithstanding the fact that Venezuela is a minor military power, they do possess a handful of potent tools capable of inflicting damage against the U.S. Navy and U.S. aircraft.”

Even if no harm comes to U.S. troops, “a military intervention in the region is likely to have the opposite effect as intended — it could spur a massive refugee crisis, elevate anarchic narco groups and tempt China to quietly intervene to make Washington waste its time,” says Curt Mills, editor of The American Conservative.

Sounds a little like Libya — where Barack Obama pulled off regime change in 2011, deposing Col. Muammar Gaddafi. It unleashed a massive refugee crisis in Europe and to this day there are still rival governments fighting for control of Libya…

![]() Thought for the Day

Thought for the Day

Ahead of today’s Fed decision and the power struggle over Fed policy, a timely reminder…

Ahead of today’s Fed decision and the power struggle over Fed policy, a timely reminder…

![]() Mailbag: Canadian Liquor, Tax-Resisting Heroine

Mailbag: Canadian Liquor, Tax-Resisting Heroine

“Alberta liquor isn't fully privatized,” writes a reader from Canada’s energy capital after yesterday’s 5 Bullets.

“Alberta liquor isn't fully privatized,” writes a reader from Canada’s energy capital after yesterday’s 5 Bullets.

“We have AGLC — Alberta Gaming, Liquor and Cannabis. ‘AGLC controls the importation, manufacture, sale, possession, storage, distribution and use of liquor in Alberta.’

“The actual liquor stores are privately owned. I think Saskatchewan is similar.

“It was our premier's choice to not do something stupid. Free trade is better for everyone.

Diplomacy (lost art) is better for everyone, and really, how do you win against a country 10 times our size that our country has become fat and lazy depending on, with Mr. Trump as leader?”

After the subject of “shadow work” came up in yesterday’s edition, a reader weighed in with a blast from the past.

After the subject of “shadow work” came up in yesterday’s edition, a reader weighed in with a blast from the past.

“The late patriot Vivien Kellems refused to collect taxes on that basis, citing it for what it is: INVOLUNTARY SERVITUDE.”

Dave responds: Wow, it’s been decades since I first read about her in Murray Rothbard’s For a New Liberty.

Born in 1896, Kellems founded her own company in 1927, manufacturing custom grips to move electrical cables through tight spaces.

But what put her on the map was her resistance to Washington’s “unfunded mandate” requiring employers to collect withholding taxes — implemented in the 1940s as a wartime measure, but kept in place after World War II was over.

(Amazing how that works, right?)

Wrote Rothbard: “As the intrepid Connecticut industrialist Vivien Kellems argued years ago, the employer is forced to expend time, labor and money in the business of deducting and transmitting his employees' taxes to the federal and state governments—yet the employer is not recompensed for this expenditure.”

Kellems herself was more pithy: "If they wanted me to be their agent, they'd have to pay me, and I want a badge."

She fought the feds from 1948 all the way up to her death in 1975. Her heirs had to fork over $265,000 in back taxes.

Shortly before she died, Kellems told the Los Angeles Times, “Our tax law is a 1,598-page hydra-headed monster and I'm going to attack and attack and attack until I have ironed out every fault in it."

We’re not sure what yardstick Kellems was using to arrive at that total… but conservative estimates put it between 4,200 and 6,900 pages now.

And that’s just the statues, not the regulations and case law…