Trump: “Let’s Blow This TACO Stand”

![]() Trump: “Let’s Blow This TACO Stand”

Trump: “Let’s Blow This TACO Stand”

The TACO trade is falling apart as a new week begins.

The TACO trade is falling apart as a new week begins.

The term “TACO” as applied to finance began with Financial Times columnist Robert Armstrong three months ago. At the time, Donald Trump had a tendency to back down from his most extreme tariff threats against other countries.

Thus, TACO — “Trump always chickens out.”

Right or wrong, the term took off on Wall Street and in the financial media. And on the assumption that “chickening out” generally translates to “rising stock prices”... well, the TACO trade has been a winner. From the date of Armstrong’s column (May 2) through Friday’s market close, the S&P 500 rose 9.7%. Not bad for three months!

And that includes Friday’s steep drop of 1.6% — brought on in part by the realization that Trump might not back down after all.

The key date to watch this week is Thursday — when twin tariff deadlines loom.

The key date to watch this week is Thursday — when twin tariff deadlines loom.

The one that’s getting all the buzz is the one mentioned here on Friday — a raft of tariffs Trump declared against dozens of countries, with rates ranging between 10–50%.

In theory, there’s still time between now and Thursday for those countries’ leaders to come to terms with Washington on a trade deal. But how likely is that at this stage?

But it’s the other tariff deadline Thursday, the one getting much less publicity, that could have more impact. That’s the one targeting anyone who buys energy from Russia. Unless Russia and Ukraine reach a ceasefire in the next three days, all countries that buy Russian energy will be subject to a tariff of 100%.

That would include major trading partners like China and the European Union.

Between the tariff threats and Friday’s punk job numbers — more about those in Bullet No. 3 — the vibe coming into this week is… disquieting. “Trump Tariffs Inject More Uncertainty Into Global Economy,” says a CNBC headline, accompanied by the same stock photo of “worried trader” the station always trots out at times like these.

And yet… three of Paradigm’s top gurus are coalescing around one company they agree is a screaming “buy.”

And yet… three of Paradigm’s top gurus are coalescing around one company they agree is a screaming “buy.”

That includes our macroeconomics maven Jim Rickards — who’s very choosy about stocks and who’s told his readers all along to ignore the TACO talk.

It also includes our AI-and-crypto bull James Altucher — who frequently takes issue with Jim Rickards’ outlook.

And it includes our hedge fund veteran Enrique Abeyta — a trader’s trader who zeroes in on price action more than on macroeconomic and fundamental factors.

Only twice in our firm’s history have all three of these gentlemen agreed on a single name…

- Palantir Technologies — last year’s top performer in the S&P 500. Paradigm’s official position is up 820% in 18 months

- MP Materials — a very recent winner spotlighted in this space. In only two weeks, our official recommendation leaped 918%.

This time the potential gains are even greater — by our team’s calculations, 1,494% by next year… 3,523% by the end of Trump’s term… even a staggering 18,015% by the end of the decade.

Paradigm Mastermind Group members will be getting this recommendation later in the week. If you’re not among them, you won’t want to miss a one-of-a-kind event called The Paradigm All-In Summit.

It’s set for Thursday at 1:00 p.m. EDT. Attendance is free, but we do ask that you sign up in advance so we know how many people to expect.

Sign-up is as simple as clicking on this link; we’ll email you everything you need to know so you’ll be ready for Thursday.

Clicking the link above automatically registers you for The All-In Summit. By reserving your spot, you will receive event updates and offers. We will not share your email address with anyone. And you can opt out at any time. Privacy Policy.

![]() About Friday’s Sell-Off…

About Friday’s Sell-Off…

Now to put the market jitters in further context: Stocks were due for a rest. If it weren’t tariffs and the job numbers, it would be something else.

Now to put the market jitters in further context: Stocks were due for a rest. If it weren’t tariffs and the job numbers, it would be something else.

Going into Friday’s sell-off, Paradigm chart hound Greg Guenthner wrote the following to his Truth & Trends readers: “The S&P 500 would have to drop nearly 7% just to retest its 200-day moving average. The red-hot Nasdaq Composite would need to fall 10% to retest the same level.

“Neither move would meaningfully impact their longer-term uptrends.”

Greg sees parallels between the post-”Liberation Day” rally that started April 9, 2025… and the rally that started March 23, 2020. That’s when the Federal Reserve cranked up the printing presses amid COVID lockdowns.

Five years ago, he says, “The rally off the COVID lows topped out in late August and produced not one but two meaningful corrective moves of approximately 10% heading into the start of the fourth quarter.” Take a look…

“A seasonal slowdown or sell-off would also make sense here,” Greg goes on. “August has a reputation as an unpredictable and sometimes tumultuous month. September also tends to be volatile. Turning to the post-election year cycle, we tend to see the market peak in late July/early August and remain choppy through late October.”

If you want to pinpoint a date when the market could launch a new rally, Greg suggests Oct. 17 — which is options expiration Friday. Mid-October marked the start of healthy rallies in both 2022 and 2023.

In the meantime, the major stock indexes are bouncing off of Friday’s lows.

In the meantime, the major stock indexes are bouncing off of Friday’s lows.

In early Monday trade, the S&P 500 is up more than 1%, back over 6,300. The Dow’s gains are more modest, the Nasdaq’s stronger.

As for nondollar assets, gold is back within about $20 of $3,400; silver is back over $37. Bitcoin is staging a recovery from a late July-early August slump. From lows near $112,000 early Sunday it’s back over $115K.

Elsewhere, oil is down over 2.5% to $65.70 after several OPEC nations including Saudi Arabia announced another production boost. For all intents and purposes, the production cuts put into place during 2023 have all been reversed now.

![]() About the “Rigged’ Job Numbers…

About the “Rigged’ Job Numbers…

The monthly job numbers are indeed “RIGGED” — but not necessarily in the way Donald Trump means it.

The monthly job numbers are indeed “RIGGED” — but not necessarily in the way Donald Trump means it.

As mentioned here on Friday, the July job numbers came in weaker than expected. Further, the June and May numbers were revised sharply downward.

After Emily hit “send” on that edition, Trump fired Erika McEntarfer — commissioner of the Bureau of Labor Statistics — complete with an accusation that she gamed the stats to make him look bad.

The reality is that the monthly job numbers have been gamed for decades.

The reality is that the monthly job numbers have been gamed for decades.

The 10% unemployment rate during Barack Obama’s first term (2010) was not the same 10% unemployment rate during Ronald Reagan’s first term (1982–83).

In the interim, the wonks at the Bureau of Labor Statistics steadily redefined what it meant to be “unemployed.”

During the Reagan years, the official “U-3” unemployment rate included part-timers who wanted to work full time. It also included folks who’d given up looking for work.

But in the decades since, those people were increasingly excluded from U-3.

Folks who’d given up looking for work and hadn’t looked for work in at least 12 months? They just didn’t count anymore. Meanwhile, those who’d given up looking for work within the previous 12 months, as well as the part-timers seeking full-time gigs, got lumped into a new unemployment rate called “U-6.”

The consequences of all this statistical sleight-of-hand have been dramatic.

The consequences of all this statistical sleight-of-hand have been dramatic.

In May of 2023, for instance, the official U-3 unemployment rate was a stellar 3.6%. But if you ran the numbers the way they were in the early 1980s, it would be…

[drumroll, please…]

… 24.7%.

That’s according to economist John Williams, who’s made a career out of running the numbers the old-fashioned way at his Shadow Government Statistics research firm.

We’ll leave it to others to analyze whether the 2025 job numbers have been jimmied to make Trump look bad.

But at least now you know some history about how the numbers have long been fiddled with to make the job market look better than it really is.

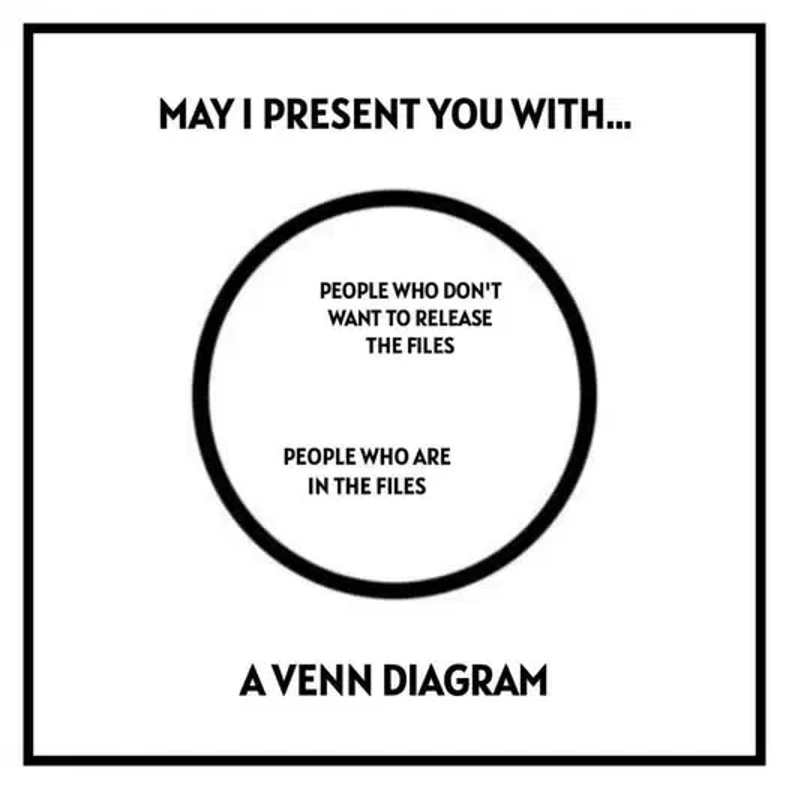

![]() Comic Relief

Comic Relief

This meme more or less speaks for itself…

This meme more or less speaks for itself…

Just a reminder about why we keep getting mileage out of the Epstein story: He was a finance guy, after all — and one whose sources of wealth remain a mystery to this day.

Furthermore, Epstein’s connections spotlight the intersection of finance, politics and media.

There’s still no better illustration of this phenomenon than something I wrote in the summer of 2019, about an elite party held one night in the Hamptons. It turned out that at the very moment the party was underway, Jeffrey Epstein was being arrested on federal charges of trafficking underage girls.

![]() The Mailbag: Misperceptions

The Mailbag: Misperceptions

“I think you did a good job of explaining some terms and how things will work in areas of crypto,” a reader writes after James Altucher’s guest essay last week.

“I think you did a good job of explaining some terms and how things will work in areas of crypto,” a reader writes after James Altucher’s guest essay last week.

[We’ve been at this long enough to know there’s a “but” coming…]

“BUT James and Paradigm are continuing to distract people by promoting the same cryptos that got a free pass and CNBC and others push as well.

“Yes, Ethereum did improve things, which is good. And they will rise in price and BTC could double, but you are not talking about the little elephant in the room that is the ONLY crypto with LEGAL clarity that it is NOT a security.

“This crypto is better than both of the others in the long run, certainly percentage-growthwise. Once the CLARITY Act passes, the flood gates will open. Ethereum has improved, but it still is not as good nor as connected worldwide with institutions and banks as Ripple and its XRP.

“I can only assume that Paradigm along with the other big insiders do not want the XRP price to go up yet so they can buy in early before the 18–20 companies get their ETF approval to list it. Those ETFs will dwarf Ethereum and could surpass BTC with speed and market cap.”

Dave responds: I assure you that no Paradigm editor would ever resort to the kind of front-running you describe.

Believe me, whenever James Altucher and Chris Campbell have the conviction that a certain crypto is about to take off like a rocket thanks to a regulatory catalyst… they collaborate with our marketing folks to get the word out.

Think about it. Why would they want to deprive readers of such a terrific opportunity? The basic business proposition in our line of work is this: Our editors prosper when our readers prosper.

The simple fact is that at this time, James and Chris lack the conviction you have.

In the past, I’ve even spoken with Chris about the fervor bordering on obsession that some people have with XRP (along with Iraqi dinar and Indonesian rupiah banknotes, it seems).

Those folks are entitled to their opinions. But Chris and James have done the work, and they’re not persuaded. No ulterior motives.

It’s that simple. Just wanted to nip any misperceptions in the bud…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets

P.S. Apologies in advance, but due to extenuating circumstances your 5 Bullets experience this week might be a little unusual. Some days like today you’ll hear from me. Others you might be treated to a guest essay. Too, the arrival times of your issues might be irregular (like today).

Thanks for your patience. We’ll be back to a more regular rhythm late this week or early next.