In AI We Trust

![]() A Tale of Two Economies

A Tale of Two Economies

AI is the only thing propping up the U.S. economy — and the U.S. stock market.

AI is the only thing propping up the U.S. economy — and the U.S. stock market.

After the market closed yesterday, Nvidia reported its quarterly numbers. Sales leaped 62% year-over-year to a record $57 billion. The Wall Street Journal says the results helped “soothe market jitters” over whether there’s “an artificial intelligence bubble.”

We’ll leave it to others to debate that question today. We’ll also sidestep the seemingly circular nature of AI investment — which the Journal recently described like so: “Nvidia invests in OpenAI, OpenAI buys computing power from Oracle, Oracle buys chips from Nvidia.”

Rather, we devote Bullet No. 1 to the proposition that the “AI economy” has decoupled from the “real economy” where everyday Americans are trying to get by and feed their families.

Rather, we devote Bullet No. 1 to the proposition that the “AI economy” has decoupled from the “real economy” where everyday Americans are trying to get by and feed their families.

It’s a situation that’s been brewing long before AI burst into public consciousness with the release of ChatGPT 3.5 in November 2022.

Way back in 2017 we cited research from Williams Market Analytics that showed only five Big Tech companies accounted for the bulk of the S&P 500’s gains over the preceding four years.

Apple, Microsoft, Google, Facebook and Amazon appreciated 225% in that time. The rest of the index — which we called “the S&P 495” — grew a mere 27%.

By mid-2023, this elite group of five companies broadened slightly. Bank of America analyst Michael Hartnett coined the term “Magnificent 7” — adding Nvidia and Tesla to the group.

Since then it’s become a widespread trope — comparing the immense outperformance of the Mag 7 with the “S&P 493.” Year-to-date the Mag 7 have appreciated about 40% — while the other 493 stocks as a group are up only 7%.

But if you widen the telescope a bit, you find an even more striking concentration of wealth and prosperity.

But if you widen the telescope a bit, you find an even more striking concentration of wealth and prosperity.

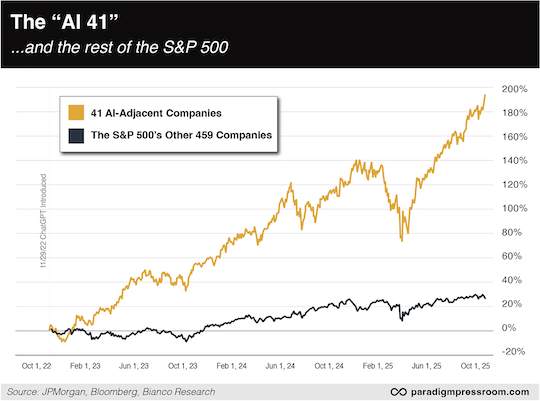

New research from JPMorgan finds that 41 AI-adjacent companies account for 47% of the S&P 500’s market cap — nearly half!

Since the release of ChatGPT 3.5 in late 2022, these 41 stocks have appreciated 194%. The other 459 companies in the S&P 500 have grown a mere 27% — and they’ve basically gone nowhere for close to a year now.

Granted, “the top 41 stocks in the S&P 500 will always account for around 50% (or more) of the S&P 500's market capitalization. Nothing new here,” says Jim Bianco of Bianco Research.

“What is different now, however, is that 47% of the Index's capitalization is based on a single theme: AI,” he continues. “This is unique and represents the most significant concentration around a single theme ever…

“What is different now, however, is that 47% of the Index's capitalization is based on a single theme: AI,” he continues. “This is unique and represents the most significant concentration around a single theme ever…

“Anyone who owns a broad-based equity index ETF now has roughly half their investment exposed to AI. And nearly 75% of their gains since late 2022 have come from AI.”

Again, our point today isn’t about whether AI is in a bubble: It’s about the fact that anything not AI is in a world of hurt. UPS and Verizon are cutting thousands of jobs. Freight traffic on trucks and trains is slowing appreciably.

And when it comes to corporate earnings, NVDA might be delivering boffo numbers… but other sectors are sucking wind. In retail, Home Depot and Target both delivered disappointing results this week. (Walmart is doing all right, but Walmart always does all right.)

At some point, this disparity will resolve itself. Either AI is in for a retrenchment, or the “real economy” will start to catch up with AI.

For the sake of both prosperity and social order… let’s hope it’s the latter.

Either way, it’s shaping up to be a major theme for 2026 — maybe the major theme. Our editors will sniff out the indicators and warnings and help you position your portfolio accordingly.

![]() NVDA Reaction: “Gap and Crap”

NVDA Reaction: “Gap and Crap”

And then there’s the reaction to the release of NVDA’s numbers — an event the media likens these days to “the ‘Super Bowl’ for the entire market.”

And then there’s the reaction to the release of NVDA’s numbers — an event the media likens these days to “the ‘Super Bowl’ for the entire market.”

At first, it was euphoric — NVDA shares rising as much as 6% in after-hours action yesterday. But by the time of the open this morning, that gain was pared to about 3.5%. And as lunchtime approached on the East Coast, NVDA was barely in the green compared with yesterday’s close.

“NVDA's ‘gap and crap’ action is concerning for the short-term trajectory... not just for this stock, but for the entire AI area,” says Paradigm’s Zach Scheidt, analyst for Altucher’s True Alpha and Rickards’ Insider Intel.

“A pullback following strong earnings could erode confidence and reset stock prices.

“The GOOD news is that traders (like us) will have a smorgasbord of stocks to choose from, trading at lower prices and ready to rebound.”

The action in NVDA is translating to the action in the broad market indexes.

The action in NVDA is translating to the action in the broad market indexes.

The S&P 500 opened the day nearly 1.6% higher — but as midday approached that gain had been cut to about a third of a percent, the index resting at 6,662. The story is similar in the Nasdaq, up less than a half percent at midday.

Precious metals are having a reset day — gold down slightly to $4,061 but silver down 1.5% to $50.51. Crude is little changed at $59.27. Crypto can’t pick itself up off the floor after yesterday’s beatdown — Bitcoin just over $88,000 and Ethereum down to $2,863.

Congratulations are in order for readers of Rickards’ Crisis Trader — who booked 125% gains this morning playing put options on Texas Instruments (TXN). That’s an outstanding gain in only 2½ months.

Also in the mix today is the delayed release of the September job numbers.

Also in the mix today is the delayed release of the September job numbers.

This report was supposed to come out on Oct. 3 — but then came the “partial government shutdown” two days earlier. So the September numbers are out 49 days late.

In any event, the wonks at the Bureau of Labor Statistics conjured 119,000 new jobs for the month — way more than the typical Wall Street economist was expecting. The official unemployment rate ticked up to 4.4% — the highest reading in nearly four years.

This September report will be the only employment data the Federal Reserve can evaluate ahead of its next decision on interest rates due Dec. 10.

There will be no October employment report because BLS employees were furloughed that month instead of surveying businesses and households about how they’re doing. And the November report will come out later than usual, Dec. 16.

Looking at the futures markets this morning, traders are pricing in only a 40% probability of a third consecutive rate cut…

![]() Gold: Still Misunderstood After All These Years

Gold: Still Misunderstood After All These Years

The mainstream still doesn’t “get” gold.

The mainstream still doesn’t “get” gold.

Or so our own macro maven Jim Rickards concludes after reading an article by Goldman Sachs veteran Jim O’Neill.

O’Neill is a heavy hitter in finance. He’s the guy who in 2001 coined the term “BRIC” to describe the ascending economies of Brazil, Russia, India and China. In time, the BRICs evolved into a formal organization now comprising 10 countries and frequently using gold as a means to bypass the U.S. dollar in cross-border transactions.

“He’s at the center of high-end public intellectual discussion about monetary systems and international finance,” Jim tells us. “So it’s curious to read an article by O’Neill that shows how little he understands about gold.

“On the one hand, O’Neill acknowledges the powerful price performance of gold, not just in the past few years, but in the entire first quarter of the 21st century…

“On the other hand, O’Neill can’t quite bring himself to acknowledge that gold is money and is the premier long-term store of wealth among all assets,” Jim continues.

“On the other hand, O’Neill can’t quite bring himself to acknowledge that gold is money and is the premier long-term store of wealth among all assets,” Jim continues.

“He states that the pullback in the gold price may be the end of the recent rally. He seems almost relieved at that because it obviates any further effort to understand gold. Sorry, Jim. The gold price pullback from $4,400 to $3,950 per ounce is already over and gold has rallied back to $4,100 with more gains to come.”

In addition, “O’Neill falls back on the classic explanation that gold does well in a declining interest rate environment because gold has no yield, so lower interest rates lower the opportunity cost of holding gold. But O’Neill gets it wrong again. Gold had one of its strongest runs (1978–1981) when interest rates were as high as 20%.

“O’Neill just doesn’t get it. Maybe I can help,” Jim offers.

“Gold is simply the noncurrency yardstick for measuring currencies. When gold ‘doubles’ from $2,000 to $4,000, nothing really happened to gold. What happened was that the dollar fell by 50% when measured in weight of gold. That’s all.

“Those waiting for a dollar collapse missed it. The collapse already happened. And they missed it because they don’t understand gold.”

![]() Comic Relief

Comic Relief

Today’s grim chuckle ties into both our Bullet No. 1 today and our Bullet No. 1 on Tuesday…

Today’s grim chuckle ties into both our Bullet No. 1 today and our Bullet No. 1 on Tuesday…

We got a lot of reaction to our Venezuela edition Tuesday — and we’ll get to that tomorrow. In the meantime, let’s tend to a couple of other topics in the inbox…

![]() Mailbag: Mamdani, Plaskett

Mailbag: Mamdani, Plaskett

“Interesting Buck Sexton analysis of Mamdani, and shortsighted,” a reader writes after last week’s forecast for New York City under its incoming mayor.

“Interesting Buck Sexton analysis of Mamdani, and shortsighted,” a reader writes after last week’s forecast for New York City under its incoming mayor.

“If anything we should’ve learnt from the Biden administration that it doesn’t matter if you have an incompetent at the top (don’t disagree with Buck on that about Mamdani) but what should terrify him is the team around him, and boy! That’s very scary.

“I live outside the city 1999–2019, to see NYC go from scary to epitome of the greatest city in the world (not in disagreement with Buck there) and to the ****hole it has become. It’s very sad. I told friends to leave the city before it’s too late, I’m in western Pennsylvania and don’t regret a moment of it.

“I read with interest and sympathy about NYC's newly elected, err... dummy, Mamdani as mayor,” writes one of our regulars. “A know-nothing, no-experience train wreck that hopefully because of that won't really be able to move the bar, much.

“I read with interest and sympathy about NYC's newly elected, err... dummy, Mamdani as mayor,” writes one of our regulars. “A know-nothing, no-experience train wreck that hopefully because of that won't really be able to move the bar, much.

“Over here in Seattle, we seem to have elected an almost mirror image of a know-nothing, done-nothing mayor-elect, Katie Wilson. I am hopeful that this no-connection, doesn't-know-how mayor-elect can't do a darn thing here in Seattle too.

“Sadly, I think with both of these, I can predict higher taxes on the horizon.

“Heavy sigh — love the 5.”

“I don't appreciate hearing conservative wanks wax deplorable about NYC,” reads a counterpoint.

“I don't appreciate hearing conservative wanks wax deplorable about NYC,” reads a counterpoint.

“Wanks like them have threatened to leave forever (see Daily Show supercut) and they are always welcome to leave. Please do. Good riddance.”

Moving on: After our latest foray into the intersection between Jeffrey Epstein and JPMorgan Chase, an alert reader wrote in…

Moving on: After our latest foray into the intersection between Jeffrey Epstein and JPMorgan Chase, an alert reader wrote in…

“Hi Dave — I'm sure you recall that Del. Stacey Plaskett (D-Virgin Islands) was the one who threatened Matt Taibbi during the Twitter Files hearings.

“I forget the precise wording of her threat, but knowing you, you do remember. Curious if she got on the House Intelligence Committee before or after? And I presume she does not get a committee vote?

“Keep up the great work!”

Dave responds: Ah yes. Plaskett was the Dems’ designated attack dog on censorship.

As you’ll recall, Taibbi was among the journalists who exposed how Biden administration officials leaned on executives at what was then still called Twitter — demanding censorship of posts and accounts that ran counter to official narratives about COVID, among other topics.

After Taibbi testified in 2023 to the House Subcommittee on the Weaponization of Government, Plaskett — the ranking Democrat on the subcommittee at that time — sent Taibbi a letter accusing him of lying to Congress and threatening him with five years of prison. (The whole thing was preposterous, as Taibbi laid out in painstaking detail at the time.)

Now a follow-up to Monday’s edition: There’s been shocking fallout from the revelations that Jeffrey Epstein was feeding questions to Plaskett via text message during a congressional hearing in 2019.

Now a follow-up to Monday’s edition: There’s been shocking fallout from the revelations that Jeffrey Epstein was feeding questions to Plaskett via text message during a congressional hearing in 2019.

On Tuesday night, the House voted on the matter of whether to boot Plaskett from the House Intelligence Committee.

The resolution failed by a vote of 209-214. Every Democrat voted to keep her on the committee. And so did three Republicans. Three more Republicans voted “present.”

That’s because the Dems threatened a retaliatory vote on removing Rep. Cory Mills (R-Florida) from the Armed Services Committee. As one anonymous congressmember put it to independent reporter Breanna Morello, “Republican leadership sent three Republicans on a kamikaze mission to save Cory Mills.”

The resolution against Mills “hones in on an array of allegations,” reports the Axios site — “including domestic abuse, stolen valor and financial misconduct, all of which he denies.”

Hmmm… I dunno, it seems as if conduct like this potentially opens him up to blackmail? (Do not click if you don’t want to read explicit text messages.)

So there you go. Each side protects its own worst actors.

Which is why the full story of Jeffrey Epstein’s relationships with powerful figures in government, finance and media will never come to light.

And the beat goes on…