The NVDA Trap

![]() Strong Earnings, Stealth Selloff

Strong Earnings, Stealth Selloff

“The stock market has been in a stealth selloff for the past few months,” says Paradigm’s pro trader Enrique Abeyta.

“The stock market has been in a stealth selloff for the past few months,” says Paradigm’s pro trader Enrique Abeyta.

“Even while the major indexes were hitting new highs just a few weeks ago, the majority of stocks were actually moving lower.

“Now this correction has begun to impact the larger indexes, despite strong earnings results from companies recently.

“The latest example is Nvidia,” he reminds.

“Even though the company reported exemplary numbers on its earnings call last week, the stock ended the following day down 3.15%.

“Nvidia’s latest earnings report — as they all do — brought up speculation over the AI bubble.

“My view is that we absolutely are in a bubble. But the key is to understand what exactly a ‘bubble’ means for stocks and how it plays out over time.”

“My view is that we absolutely are in a bubble. But the key is to understand what exactly a ‘bubble’ means for stocks and how it plays out over time.”

“Each time a revolutionary technology like AI comes along, we get extreme levels of investor enthusiasm with it.

“There’s intense speculative activity with investors misallocating large amounts of their capital.

“A lot of capital goes into companies that will never achieve any success,” says Enrique. “For a period of time, these are the best stocks in the entire market.

“Unfortunately, most of these stocks will lead to steep losses. And in many cases, the shares will be worthless.

“Is that what’s happening right now? I don’t think so… At least, not yet.

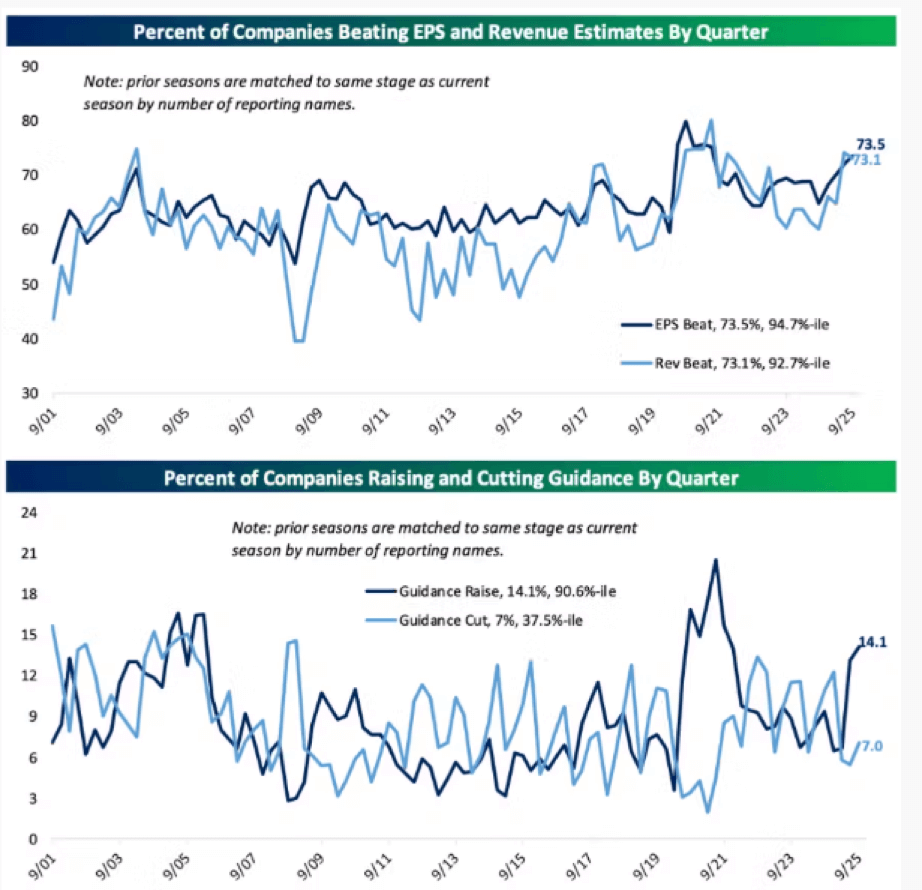

“Especially not when you see the strong earnings like we saw this last quarter. Not just for Nvidia, but for a broad swath of companies.

“Here are some charts from Bespoke Investment Group showing how this most recent quarter ranks relative to other quarters historically.”

Q3 2025 was one of the strongest earnings seasons in recent years: By early November, nearly 90% of S&P 500 companies beat profit estimates, more than 75% topped revenue forecasts and overall earnings grew about 13% year-over-year.

“I’ve invested professionally through bubbles before. I saw the 2008 crash coming. I wasn’t surprised when the dot-com bubble burst,” says Enrique.

“I’ve invested professionally through bubbles before. I saw the 2008 crash coming. I wasn’t surprised when the dot-com bubble burst,” says Enrique.

“And I can tell you this is not how the bubble bursts.”

Even when it inevitably does, Enrique has a winning strategy:

“First, we focus on buying real businesses that will succeed even if AI spending falls. They may not reach the same height of growth, but they will grow nevertheless.

“Second, we are disciplined with our profit- and loss-taking. This allows us to make sure we keep our gains if the market heads for a lengthy pullback.

“But it’s my strongly held view that the current bull market has plenty of time left. It’s not time to panic (yet).

“That brings me to one last point,” he adds. “We have a rare opportunity to make a ton of money while the majority of investors sit on the sidelines.”

[A chain reaction has begun on Wall Street, one that could send a whole series of stocks absolutely exploding over the next year.

“And this Tuesday, Nov. 25 at 11 a.m. (ET), I’m going to prove it to you,” Enrique says.

Click here to register for The Paradigm Alpha Summit on Tuesday.

Your attendance at Tuesday’s event is completely FREE. All you need to do is register with the link above to reserve your spot.

“At the event, I’ll reveal the name and ticker symbol of my #1 stock that I believe is set to explode by Dec. 2,” Enrique adds, “100% free, no credit card required.”

Reserve your spot today!]

![]() The Great Crypto Disconnect

The Great Crypto Disconnect

Crypto is sending mixed signals — record adoption, but painful price action.

Crypto is sending mixed signals — record adoption, but painful price action.

“After 10 years in this space, I don’t think I’ve seen a disconnect this sharp,” admits Paradigm’s crypto expert Chris Campbell. “Crypto got everything it wanted (and more)… and yet, it’s never looked so dismal.”

So what’s really happening? Chris says the downturn “isn’t your average bear.” Liquidity is tight, and “when liquidity is low, crypto gets punched first.” But there’s more going on: “By the looks of it, big players are being forced to sell, and they’re doing it in the worst, most awkward way possible.

“It’s like a couple of Goliaths are walking through a crowd of hobbits, shoving everyone around,” he says. They’re “selling at the same time every day,” seemingly without regard for price or news. The data, Chris says, “fits the story of a forced liquidation.”

Also, Japan may be an outsized part of the problem. “Japan is being hit with a financial storm: interest rates jumped, the stock market fell fast and the yen lost value.” Because Japan is a major global lender, “trouble there quickly spreads everywhere else,” pulling money out of riskier assets like crypto and tech.

Meanwhile, “most asset managers have underperformed the market this year,” forcing them to “chase performance” in tech and AI stocks — leaving crypto behind temporarily.

Still, blockchain activity tells a completely different story. Stablecoin volume has exploded — from $7.6T (2023) to over $18T (2024), with 2025 on pace to surpass that. DeFi and tokenized assets are booming. And users: “100 million people used crypto in 2020… we’ll hit 860 million this year.

“Look, we get it,” he says. “The volatility is uncomfortable. It’s annoying. But it’s temporary.”

His bottom line: “Right now, James Altucher and I are buyers.” Chris’s advice is simple: “Don’t overcommit. Don’t use leverage. Dollar-cost average. Buy high-quality (Tier 1) assets.”

Bitcoin’s still sliding today — down 0.50% to $87,000. Ethereum, on the other hand, is retracing its steps: 0.70% to $2,850.

Bitcoin’s still sliding today — down 0.50% to $87,000. Ethereum, on the other hand, is retracing its steps: 0.70% to $2,850.

As for the major U.S. stock indexes, they’re all in the green at the time of writing. The tech-driven Nasdaq, in particular, is up 2.30% to 22,795 while the S&P 500 is up 1.35% to 6,690. The Big Board, meanwhile, is up 0.60% to 46,515.

Notably, Google’s parent company Alphabet is approaching a $4 trillion market value, set to become the third U.S. company to reach that milestone.

Shares jumped more than 5% today to a record $315.90, bringing its valuation to $3.82 trillion — up about 70% this year and outpacing other Mag 7 rivals, including Microsoft, Amazon, Nvidia and Apple.

Alphabet regained momentum via its new AI model Gemini 3 — as well as Berkshire Hathaway’s $4.3 billion investment in Q3. The company likewise weathered antitrust scrutiny, avoiding a court-ordered breakup (despite being found to hold an illegal search-engine monopoly).

Still, Alphabet’s rapid rise has sparked debate over inflated tech valuations and potential echoes of the dot-com bubble. Analysts, however, see its vast cash flow, custom AI chips and dominant search business as strong advantages in the ongoing AI race.

Finally, checking on commodities, crude is up 0.60% to $58.40 for a barrel of WTI. Precious metals? Gold is up 0.30% to $4,091.50 per ounce, and silver is up 0.50% to $50.15.

![]() Data Centers Freeze the Grid?

Data Centers Freeze the Grid?

The rapid expansion of data centers is more than just a tech boom — it’s raising the stakes for all of us when winter hits.

The rapid expansion of data centers is more than just a tech boom — it’s raising the stakes for all of us when winter hits.

The Lone Star State, for one, is drawing massive data-center requests thanks to abundant renewable energy, plentiful natural gas and a business-friendly climate.

OpenAI is developing, for instance, its flagship “Stargate” campus in Abilene, Texas, with a planned power draw of 1.2 gigawatts — roughly the output of a large nuclear plant.

Meanwhile, the North American Electric Reliability Corporation (NERC) flagged the grid-impact risk of data centers operating 24/7:

- “Strong load growth from new data centers and other large industrial end users is driving higher winter electricity demand forecasts and contributing to continued risk of supply shortfalls.”

That’s not a theoretical worry. Remember Winter Storm Uri in February 2021, when freezing temperatures triggered simultaneous surges in heating demand and massive power-plant failures? In Texas, more than 4.5 million people lost power for several days.

Now add relentless data-center demand into the mix — and you get a grid that might buckle under extreme winter conditions.

Now add relentless data-center demand into the mix — and you get a grid that might buckle under extreme winter conditions.

In the region managed by the Electric Reliability Council of Texas (ERCOT) — which covers about 90% of the state’s electric load, including major cities such as Dallas–Fort Worth, Houston, San Antonio and Austin — large-load interconnection requests have surged past 200 gigawatts. Roughly 70% of those requests are tied to data centers, according to ERCOT filings.

And per NERC’s 2025–26 assessment, “Winter electricity demand is rising at the fastest rate in recent years, particularly in areas where data center development is occurring.”

What this means for you: Even though the grid is rated reliable under ordinary conditions, the real risk emerges during a week-long deep freeze — with plants offline, gas supply constrained, batteries depleted and lighting up server racks instead of homes.

You might think “data centers don’t affect me,” but when they pull gigawatts and stretch supply, you face the same blackout risk Texas lived through.

“Power shortfalls and rolling outages really could happen [in] certain regions” of the U.S., warns Rob Gramlich of Grid Strategies. “Those are unacceptable to everybody in the United States.”

![]() The Gold Standard of Transparency

The Gold Standard of Transparency

Sen. Mike Lee (R-UT) has introduced the Gold Reserve Transparency Act of 2025, a push to conduct the first full audit of America’s gold reserves in more than half a century.

Sen. Mike Lee (R-UT) has introduced the Gold Reserve Transparency Act of 2025, a push to conduct the first full audit of America’s gold reserves in more than half a century.

The House bill (H.R. 3795) was introduced by Rep. Thomas Massie (R-KY) on June 6; Sen. Lee announced the Senate companion last week.

According to Lee, “Americans should know whether their literal national treasure is safe and accurately accounted for. That means passing the Gold Reserve Transparency Act, opening Fort Knox, U.S. Mint Facilities and the Federal Reserve Bank of New York to an audit, and then making the results public.”

The Senate bill lays out a sweeping mandate: Within nine months of enactment, the Government Accountability Office (GAO) must hire a qualified external auditor to perform a full assay, inventory and audit of all U.S.-owned gold reserves — including deep storage — assess physical security measures and account for any encumbrances (leases, swaps) or purchases/sales over the past 50 years.

Reports would then be submitted to Congress and the Secretary of the Treasury and published in full, with only security-sensitive details redacted.

“The Federal Reserve and Treasury should not be permitted to operate in secrecy, especially when it comes to the most important monetary asset on the planet, i.e. gold,” says former Congressman Ron Paul.

“Restoring trust as to America’s gold-holdings is more important than ever when foreign central banks are scrambling to stockpile gold at incredible rates.”

No scheduled vote is on either chamber’s calendar yet. We’ll keep you posted.

![]() Inflation Takes a Holiday (Allegedly)

Inflation Takes a Holiday (Allegedly)

If the American Farm Bureau Federation’s (AFBF) Thanksgiving grocery tally for 2025 sounds like a fantasy, you’re not alone.

If the American Farm Bureau Federation’s (AFBF) Thanksgiving grocery tally for 2025 sounds like a fantasy, you’re not alone.

Since 1986, the Farm Bureau has tracked the cost of a “classic” Thanksgiving meal for 10 — turkey, stuffing, sweet potatoes, rolls with butter, peas, cranberries, a veggie tray and pumpkin pie with whipped cream.

This year’s total: $55.18.

Courtesy: American Farm Bureau Federation

That’s down 5% from 2024 and the lowest average since 2021, according to the AFBF’s annual survey.

The biggest bargain? The bird itself. A 16-pound frozen turkey comes in around $21.50, more than 16% cheaper than last year. That’s a welcome shift after two years of elevated prices from avian flu and feed costs. “It’s encouraging to see some relief in the price of turkeys, as it is typically the most expensive part of the meal,” says AFBF economist Faith Parum.

Dinner rolls and stuffing also eased in price. But the humble veggie tray is up 61%, and sweet potatoes have jumped 37% — thanks to hurricane damage in North Carolina (the country’s top sweet-potato producer).

Across U.S. regions, the South remains the cheapest place to feast ($50.01), while the West once again claims the priciest spread ($61.75).

Leftovers? Maybe. Liquor? Not included — and if history’s any guide, it might cost more than the turkey itself.

Still, even as prices wobble from year to year, there’s one constant worth remembering: However much the dinner costs, the chance to gather is, as they say… priceless.