Fear vs. Reality

![]() Fear vs. Reality

Fear vs. Reality

Rarely has the stock market staged a rebound as strong as the one since last Friday… and at the same time, investor sentiment has remained this gloomy.

Rarely has the stock market staged a rebound as strong as the one since last Friday… and at the same time, investor sentiment has remained this gloomy.

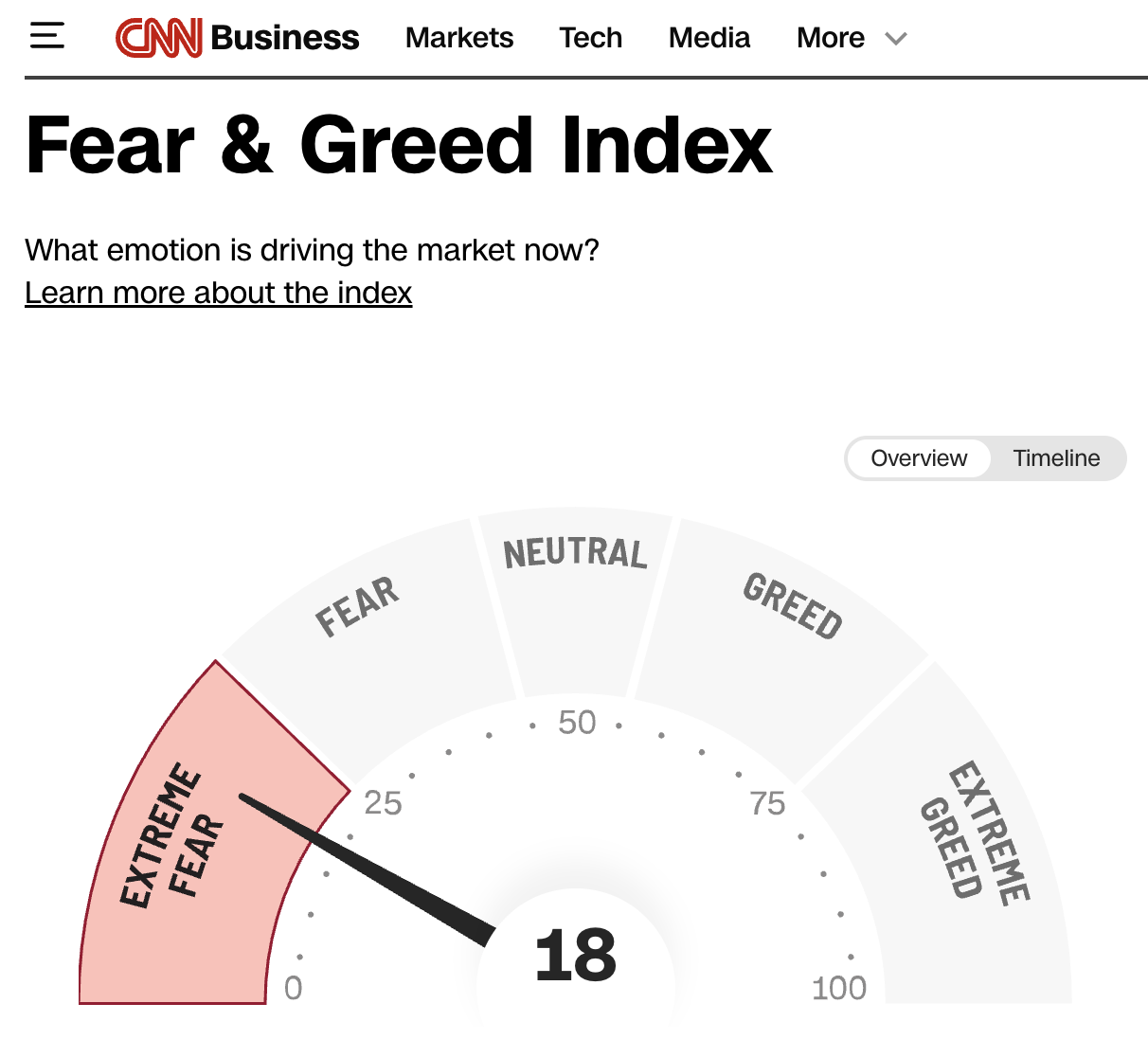

In recent years, CNN has published a “Fear & Greed Index” comprising seven market indicators – everything from momentum to breadth to options activity. Ranked on a scale of 1-100, anything under 25 is considered “Extreme Fear.” And that’s where the index has sat for nearly two weeks now.

“Sheer, unadulterated terror is gripping the average investor so tightly that they've parked a staggering $7.39 trillion in money market funds,” observes Paradigm trading pro Enrique Abeyta.

And yet… as Thanksgiving weekend approaches, the S&P 500 is up another 0.9% today at 6,826 – only 0.9% off its all-time closing high less than a month ago.

And yet… as Thanksgiving weekend approaches, the S&P 500 is up another 0.9% today at 6,826 – only 0.9% off its all-time closing high less than a month ago.

For whatever reason, sentiment is in the toilet amid a 5% pullback earlier this month – a totally normal occurrence, we’ll remind you.

Whether the buzz is about an AI bubble or Federal Reserve policy, the reasons don’t matter. Not if you’re serious about making money.

“This is the moment when fear and reality have completely diverged, creating an opportunity for those willing to see what's actually happening beneath the noise,” Enrique says.

Beneath the noise, “Corporate America delivered a powerhouse Q3 2025 earnings season,” says Enrique.

Beneath the noise, “Corporate America delivered a powerhouse Q3 2025 earnings season,” says Enrique.

“The S&P 500 achieved a blended year-over-year earnings growth rate of 13.1% — and an astonishing 82% of companies beat their earnings-per-share estimates.”

Across decades of market history, that’s a top-10% performance.

“This recent selloff reminds me of two previous pullbacks we have seen in the last 18 months,” Enrique continues.

“This recent selloff reminds me of two previous pullbacks we have seen in the last 18 months,” Enrique continues.

“Most folks will think of the massive ‘Trump Tariff Tantrum’ in April. But I think the better analogies are the selloffs in August 2024 and January 2025.”

Here’s a Bloomberg chart of the S&P 500 going back to mid-2024. Note the two red lines Enrique has added here.

In the summer of 2024, there was a freakout over the future of the “yen carry trade” – in which deep-pocketed investors around the world borrowed Japanese yen at next to no cost and invested in a host of assets all over the world that could generate a respectable return.

“This steep move lower was centered around the very best stocks in the stock market,” Enrique recalls – and as you can see, it had no staying power.

Then in early 2025 came the freakout over the Chinese AI engine DeepSeek. (Remember that?) In a single day, Enrique urged his premium subscribers to lay on three positions that all rose by double-digits in three weeks as the market staged a comeback (however brief it turned out to be).

Given the backdrop of strong corporate earnings – and a president who’s keen to boost his party’s chances in the midterm elections – “I think that right now we are on the verge of ANOTHER one of these moments,” says Enrique.

Before we move on to other matters, a quick pulse of assets apart from stocks…

Before we move on to other matters, a quick pulse of assets apart from stocks…

Gold is looking strong, up $38 to $4,157. Silver is looking stronger, up $1.49 and only a dime away from $53. (And the mining stocks are stout too, the HUI index up 3.7% to 656.)

Elsewhere in the commodity complex, crude languishes at $58.15. Going into the holiday weekend, the national average gasoline price is a nickel less than it was a week ago.

Crypto is showing signs of life again with Bitcoin less than $800 away from the $90,000 mark and Ethereum back over $3,000.

![]() As AI Goes, So Goes the Economy

As AI Goes, So Goes the Economy

You heard it here first: AI is the only thing propping up the U.S. economy.

You heard it here first: AI is the only thing propping up the U.S. economy.

Last month, we showed you how two economists – working independently – reached that conclusion. And last week, we showed you how the AI economy was decoupling from the “real economy” of retailing, freight hauling, etc.

Now the proposition has gone mainstream: “Economy Is Now Addicted to AI Spending,” screamed the front page of yesterday’s Wall Street Journal.

“The turbulence that hit stocks tied to artificial intelligence last week highlights a broader risk to the economy,” the article began. “Growth has become so dependent on AI-related investment and wealth that if the boom turns to bust, it could take the broader economy with it.

“Business investment in AI might have accounted for as much as half of the growth in gross domestic product, adjusted for inflation, in the first six months of the year. Rising AI stocks are also boosting household wealth, leading to more consumer spending, especially in recent months.”

Now that The Wall Street Journal is noticing, so is the White House.

Now that The Wall Street Journal is noticing, so is the White House.

That’s David Sacks, the venture capital guy who’s now Donald Trump’s AI and crypto czar.

The social media reaction has been… interesting. “AI czar setting up likely government support narrative,” tweets Edward Dowd, a former BlackRock manager who’s acquired a following as a financial renegade.

“Basically the economy is so hollowed out that the only game in town is the race to build the digital gulag. Good times.”

Sacks was compelled to reply – reminding us of the “no bailouts” promise he made earlier this month after OpenAI was proposing taxpayer-backed loan guarantees to finance its expansion.

“Puzzled that anyone could interpret [my] post as supporting a bailout. I’ve already opposed that. Nor do I believe one is needed.”

We’ll take Sacks at his word today. Then again, we remember government officials and bankers in 2007 and 2008 saying the banks would never need any taxpayer help…

![]() Lights Out

Lights Out

If the power grid runs into trouble this winter, it won’t necessarily be in the usual places.

If the power grid runs into trouble this winter, it won’t necessarily be in the usual places.

The North American Electricity Reliability Corporation is out with its annual “Winter Reliability Assessment.”

The good news is that despite the lack of investment in the power grid… and the skyrocketing demands that AI is placing on the grid… every region of North America is in good shape assuming there’s no heavy-duty winter weather.

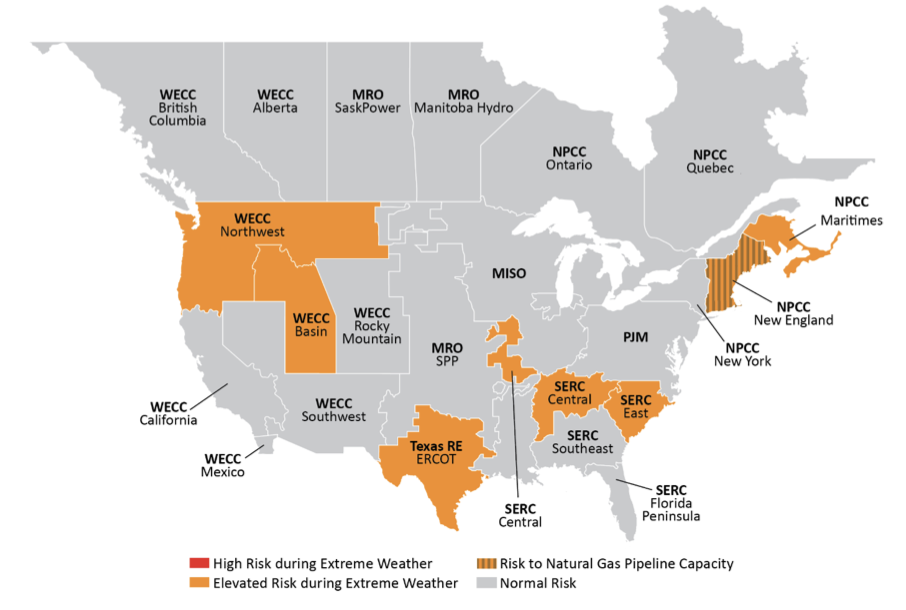

But in the event of “more extreme winter conditions extending over a wide area,” NERC’s report warns of “electricity supply shortfalls.”

Last winter, the risks were spread across a large swath of the country extending from the Dakotas down to Texas, and from the Great Lakes to the mid-Atlantic. As a polar vortex approached the eastern U.S. at the start of 2025, we chronicled how NERC warned of widespread outages if regional grid operators didn’t take preventive steps. (Fortunately, they did.)

Most of last year’s potential trouble spots are in the clear this year – except for Texas, where we spotlighted the risks in Monday’s edition of 5 Bullets. Elsewhere, the risk is elevated in New England, the Carolinas and the Pacific Northwest.

Here is NERC’s map spotlighting the regional grid operators potentially at risk during an extreme cold snap…

New England is at additional risk from depleted stockpiles of natural gas. That is, even if the grid itself can keep up with demand, there might not be enough gas on hand to feed the grid.

We’ve been warning regularly since mid-2022 that the steady closings of coal-fired and nuclear power plants were putting the grid at risk. And we amplified those warnings starting in early 2024 as AI data centers put additional demands on the grid.

This year, Paradigm readers started reaping the profits from this phenomenon as share prices of “independent power producers” that aren’t regulated utilities began to soar. On May 7, we offered a rare free pick in 5 Bullets – Constellation Energy – which is up 34% since. Meanwhile, Enrique Abeyta pinpointed a special trade for his paid readers, garnering 177% on Talen Energy.

As you can see, the risks haven’t gone away – and neither have the profit opportunities. Stay tuned in 2026.

![]() DOGE, We Hardly Knew Ye

DOGE, We Hardly Knew Ye

The federal agency DOGE is officially no more. You could make a strong case that it was never real to begin with.

The federal agency DOGE is officially no more. You could make a strong case that it was never real to begin with.

As you might recall, back when Elon Musk was Donald Trump’s chief campaign surrogate last year, Musk volunteered himself to run a “Department of Government Efficiency.”

A couple of weeks before Election Day, he told a Trump rally, “I think we can reduce the annual federal budget by at least $2 trillion per year.”

Literally a year ago today, your editor was already warning there might be less to DOGE than met the eye.

Then, even before Trump returned to office. Musk dialed back his ambitions from $2 trillion to $1 trillion. By April, the number was down to a mere $150 billion. Amid his falling-out with Trump, Musk relinquished his White House duties at the end of May.

Asked about DOGE’s status earlier this month, White House Office of Personnel Management director Scott Kupor said, “That doesn’t exist.” It is no longer a “centralized entity,” he told the Reuters newswire.

Asked about DOGE’s status earlier this month, White House Office of Personnel Management director Scott Kupor said, “That doesn’t exist.” It is no longer a “centralized entity,” he told the Reuters newswire.

Kinda premature, no? As a reminder, DOGE’s mandate to slash away at the size of government extended through July 4 of next year – a symbolic deadline coinciding with the nation’s 250th birthday.

Whatever meager savings DOGE achieved have been more than offset by brand-new boondoggles. As documented in this e-letter last month, Uncle Sam’s spending grew 3.9% from fiscal year 2024 to fiscal year 2025. Spending fell microscopically during the first eight full months of the Trump administration – but only because of some accounting gimmicks with the student loan program.

Meanwhile in October – the first month of fiscal year 2026 – federal spending totaled $689 billion, up a staggering 18% from October 2024.

That’s despite a “partial government shutdown” last month… and a Biden administration that was spending like mad a year earlier to boost Kamala Harris’ election chances.

No wonder gold is holding up so well after its recent downdraft. It’s the ultimate refuge from the U.S. dollar and U.S. Treasuries…

![]() Mailbag: The Tradition Continues

Mailbag: The Tradition Continues

About the American Farm Bureau Federation’s cost estimate of Thanksgiving dinner – spotlighted in Monday’s edition – a reader writes…

About the American Farm Bureau Federation’s cost estimate of Thanksgiving dinner – spotlighted in Monday’s edition – a reader writes…

“I can say for one that my cost for feeding 10 people in the beautiful state of California is a lot higher than the estimated amount of $55.18.

“My Thanksgiving costs including a Butterball turkey and all of the trimming was $186.12 for the estimated 10 that will be at our home this week. I can tell you this amount does not include any alcohol or drinks for the family either as I purchased those items at Costco as they are much cheaper there than at Vons grocery store where I purchased our items.

“I honestly do not know where these folks got their amount from. Did they include the actual prices from the ‘Golden State?’

“I had to comment on this because this is the second time I saw the comment about how much people are paying for the items to make a Thanksgiving dinner and they were so far off I felt my comments were necessary. I will have to manage our grocery bills for the next month much closer because of the higher costs. Things are still just too expensive.

“Thanks for reading my ramble!”

Dave responds: You’re now part of a time-honored tradition in these digital pages – ragging on the Farm Bureau for its perpetually lowball estimate, no doubt skewed by factory-farmed turkey, store-bought pie crust, etc.

Or as a reader said way back in 2016, “a Monsanto-laced GMO special Thanksgiving dinner that glows under a blacklight.”

Ah well. However much your feast ends up costing, we hope you spend it among people whose company you treasure… that you have much to be thankful for… and that the investment guidance we furnish at Paradigm Press contributed some small part to your blessings in 2025.