No Bailout for You, OpenAI

![]() No Bailout for You, OpenAI

No Bailout for You, OpenAI

OK, that didn’t take long.

OK, that didn’t take long.

When we left you yesterday, we were agog at the notion that OpenAI — the company behind ChatGPT — was talking openly about taxpayer-backed loan guarantees to finance its expansion.

Federal loan guarantees would “really drop the cost of financing,” said OpenAI CFO Sarah Friar.

Gee, ya don’t say!

The backlash on social media was so fierce that Friar had to issue a butt-covering “clarification” on her LinkedIn page. All she was really talking about when she used the word “backstop,” she said, was that “American strength in technology will come from building real industrial capacity which requires the private sector and government playing their part.”

We concluded our write-up with the observation that presumably someone in the White House took note of the torches-and-pitchforks reaction to Friar’s sense of entitlement.

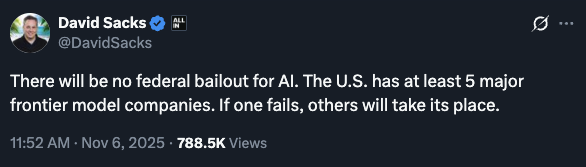

Oh, did someone ever notice. It got all the way up to David Sacks, the venture-capital guy who’s now the White House AI and crypto czar. And he laid down the law…

Oh, did someone ever notice. It got all the way up to David Sacks, the venture-capital guy who’s now the White House AI and crypto czar. And he laid down the law…

Sacks allowed Friar more grace than we did. “I don’t think anyone was actually asking for a bailout. (That would be ridiculous.)”

And he added this: “That said, we do want to make permitting and power generation easier. The goal is rapid infrastructure buildout without increasing residential rates for electricity.”

Good. We’ve been sounding the alarm about AI and electricity in these digital pages for nearly two years now.

But reliable power isn’t going to solve AI’s most fundamental problem — which we’ll tackle in Bullet No. 2…

![]() AI’s “Goodbye, AOL” Moment

AI’s “Goodbye, AOL” Moment

Remember AOL? For many people in the mid-1990s, America Online was their training wheels for the internet.

Remember AOL? For many people in the mid-1990s, America Online was their training wheels for the internet.

Back then, “AOL was the centralized network everyone knew,” recalls Paradigm’s AI authority James Altucher.

But over time, people discovered there was a whole new and exciting online world that existed outside of AOL’s walled garden. And it was no more difficult to access, really, than AOL itself.

“A decade later, AOL vanished, and the open internet built the modern world.”

As James sees it, AI’s most fundamental problem is that it’s still stuck in its AOL phase. Everything is centralized. AI is functioning in its own walled garden.

As James sees it, AI’s most fundamental problem is that it’s still stuck in its AOL phase. Everything is centralized. AI is functioning in its own walled garden.

“If I want to start an AI company today, I need permission from Nvidia for chips, permission from VCs for funding and permission from governments for licenses.

“That’s the chokehold. That’s what makes AI feel like it’s already been captured — before it even matured.”

Enter something called Bittensor.

Enter something called Bittensor.

“Since launch,” says James, “Bittensor has been proving that you can build companies without permission.

“Not through OpenAI, not through Google’s servers, but through a decentralized network where anyone — anywhere — can contribute compute, data or models… and earn.

“You don’t need anyone’s blessing. You don’t need venture capital. You just spin up a subnet — your own mini-network — and let anyone in the world compete to do the work.”

If that sounds like something crypto-adjacent, you’re absolutely right. Bittensor has a native token called TAO — whose price just hit a 10-month high while the rest of the crypto market was sinking.

The key is those subnets James mentioned: “Each subnet is like a startup. Some detect deepfakes. Some train LLMs. Some build 3D models. Others trade predictions. Every subnet has its own token (‘alpha tokens’), its own incentives and its own miners.

“Here’s the thing: to buy a subnet token, you need TAO. Every subnet purchase = TAO demand.

“That’s why we’re seeing TAO rise while the rest of crypto falls.”

TAO isn’t up because of hype. “It’s up because a fundamental repricing is underway — one that reflects a deeper truth: The world is shifting from permissioned progress to permissionless progress. Bittensor is one project leading the way.”

![]() Missing Data

Missing Data

For a second time, Wall Street traders are missing out today on a first-Friday-of-the-month ritual — poring over the monthly job numbers.

For a second time, Wall Street traders are missing out today on a first-Friday-of-the-month ritual — poring over the monthly job numbers.

The Bureau of Labor Statistics is affected by the “partial government shutdown” as much as most other agencies. And so there’s something of a data void.

➢ By the way: I’m noticing that “Epstein shutdown” is starting to catch on in certain corners of social media. I’ll take credit for starting that. Heh…

Stepping into the data void this week is the executive outplacement firm Challenger, Gray & Christmas. It issues a monthly job-cuts report. As it happens, job cuts soared in October to 153,074 — up 175% from October 2024.

In fact, this is the worst October report since 2003 — a month when the big box-office draw was a reboot of The Texas Chainsaw Massacre.

“Like in 2003, a disruptive technology is changing the landscape,” says Challenger’s chief revenue officer Andy Challenger. “At a time when job creation is at its lowest point in years, the optics of announcing layoffs in the fourth quarter are particularly unfavorable.”

Meanwhile, there’s a major economic number from China: Exports in October fell 1.1% in dollar terms year-over-year. It’s the first decline since February. The number is something of a surprise — and at least for the time being, it looks like a one-off.

What’s been a generally rotten week for stocks isn’t getting any better today.

What’s been a generally rotten week for stocks isn’t getting any better today.

The S&P 500 is down another 1% to 6,649. The Dow is holding up better, the Nasdaq is faring worse.

Gold is up nearly 50 bucks to $4,024 and silver has roared 70 cents higher to $48.65. Crude is stabilizing from this week’s sell-off at $59.60. Bitcoin hovers just over $101,000 and Ethereum a hair above $3,300.

![]() The Truth About Musk’s Trillion

The Truth About Musk’s Trillion

Talk about a misleading headline.

Talk about a misleading headline.

Today’s Wall Street Journal, front page, above the fold: “Musk’s Record Pay Plan Approved at Tesla. Investors vote in favor of $1 trillion package after CEO threatened to quit.”

It’s all true, as far as it goes. But it’s very incomplete, says colleague Davis Wilson. And we’ll hasten to add that Davis is no Musk fanboy: “I’ve said before that Tesla stock would probably trade around $50 if it weren’t for him.”

So here’s the reality: “This is not a $1 trillion payday. It’s a performance-based plan tied to some of the hardest business goals ever set.”

Musk didn’t even ask for $1 trillion in TSLA stock. He asked for 25% of the company’s voting power — up from roughly 15% now.

“His goal is simple,” Davis writes today at The Million Mission: “He wants enough control to guide Tesla’s long-term mission in AI, robotics and autonomy without being overruled by short-term investors or activists.”

And he’s going to have to earn that control — via a series of stepped-up performance goals. The final step is for TSLA to achieve a market cap of $8.5 trillion. Right now it’s about $1.5 trillion.

And he’s going to have to earn that control — via a series of stepped-up performance goals. The final step is for TSLA to achieve a market cap of $8.5 trillion. Right now it’s about $1.5 trillion.

And he can’t get there by playing accounting games. He also has to achieve the following milestones…

- 20 million vehicle deliveries (Tesla has delivered over 8 million so far)

- 10 million Full Self-Driving subscriptions

- 1 million bots delivered

- 1 million robotaxis in operation.

“On the financial side,” says Davis, “Tesla must achieve between $50 billion and $400 billion in annual adjusted profit. For reference, last quarter’s adjusted EBITDA was $4.2 billion.

“He’s got 10 years to reach these targets.”

Can he do it? Tesla’s board approved a pay package in 2018 that most observers thought was impossible to achieve. But Musk achieved every benchmark by 2021.

Davis’ bottom line: “The headlines calling this a ‘$1 trillion payday’ miss the point. It’s not about how much Elon Musk might earn. It’s about what Tesla will have to achieve for him to earn it.

“If he wins, shareholders win bigger. If he loses, they lose nothing.”

![]() Mailbag: Appliances

Mailbag: Appliances

“I have read with interest your ongoing correspondence/commentary with readers regarding refrigerators and how most appliances are now made overseas,” begins today’s mailbag.

“I have read with interest your ongoing correspondence/commentary with readers regarding refrigerators and how most appliances are now made overseas,” begins today’s mailbag.

“One reader expressed her belief that today's refrigerators are made to last five or six years while older American-made refrigerators lasted much longer. I can't really speak to today's refrigerators and how long they hold up but I can tell you about my own fridge.

“My fridge is a General Electric Frost Free model that came with my house, which was built in 1973 and in which I have lived since 1977, so I know it is original equipment. Not only does the fridge keep on going but the ice maker still works, too. I've been waiting for years for one or both of them to break down but so far that's a no-go. I shudder to think what would happen if I had to buy a new fridge since old reliable just keeps on going or what it would cost to replace or repair that old ice maker, which keeps on churning out ice cubes.

“By the way, my General Electric stove, also from 1973, continues to serve on a daily basis. Over the past 48 years, I did have to replace my dishwasher, washing machine and clothes dryer, once each. The filter in the dryer needs to be replaced but that part is no longer made or available anywhere. I'd hate to have to replace the perfectly good dryer just because of a wire mesh filter.

“I offer this information to verify and support the point made by your reader that the old U.S.-made products were far superior to today's models, at least as far as durability is concerned.”

“I bought a new Maytag washer this spring (anyone remember the Maytag repairman commercials?),” writes another.

“I bought a new Maytag washer this spring (anyone remember the Maytag repairman commercials?),” writes another.

“It is a Whirlpool product and made in America. It lasted exactly three months. Whirlpool owns Maytag and they use the local low bidder for warranty work. It took eight weeks to get it repaired. I don't think manufacturing location is the only factor in quality. The replacement parts were defective new out of the box two times.

“Back in the good old days I would look in the local bargain finder and buy a used ‘heavy duty’ washer or dryer. Brand didn't matter and it seemed like they lasted forever. My wife would be jonesing for a new set long before they expired.”

“I got a laugh out of your ‘justifying’ purchasing a counter-top ice maker,” a reader writes in response to my own fridge frustrations.

“I got a laugh out of your ‘justifying’ purchasing a counter-top ice maker,” a reader writes in response to my own fridge frustrations.

“I could only ‘justify’ spending money on some good old-fashioned ice trays after my LG ice maker stopped working after four years!”

Dave: Yeah, that’s where my mind was too at the outset. But like many appliances, the quality of ice cube trays ain’t what it used to be!