Correction Hiding in Plain Sight

![]() Clarity Makes You Competitive

Clarity Makes You Competitive

Paradigm Press was built on a simple premise: Investors need clarity — not noise. And with the FREE Paradigm Press app, that clarity now reaches you faster than ever before.

Paradigm Press was built on a simple premise: Investors need clarity — not noise. And with the FREE Paradigm Press app, that clarity now reaches you faster than ever before.

Inside the app, every market alert, deep-dive insight and editorial hot take is delivered in real-time. No inbox hunting. No waiting for tomorrow’s issue. Just immediate, distilled analysis from the same team you already trust — all in one place.

And the real game-changer? The app’s Daily Feed. This isn’t a firehose of headlines or a copy-paste of Wall Street sentiment. It’s a living, rolling stream where Paradigm editors flag the shifts, signals and surprises that actually matter.

This week, that feed surfaced four themes worth your attention…

Trading Pro Enrique Abeyta — A Rolling Correction Hiding in Plain Sight

Trading Pro Enrique Abeyta — A Rolling Correction Hiding in Plain Sight

“The stock market has been undergoing a rolling correction over the last few months,” he writes. “It has not shown up as much in the major stock indexes as they are being powered by the largest stocks, but it can be seen in the majority of stocks.”

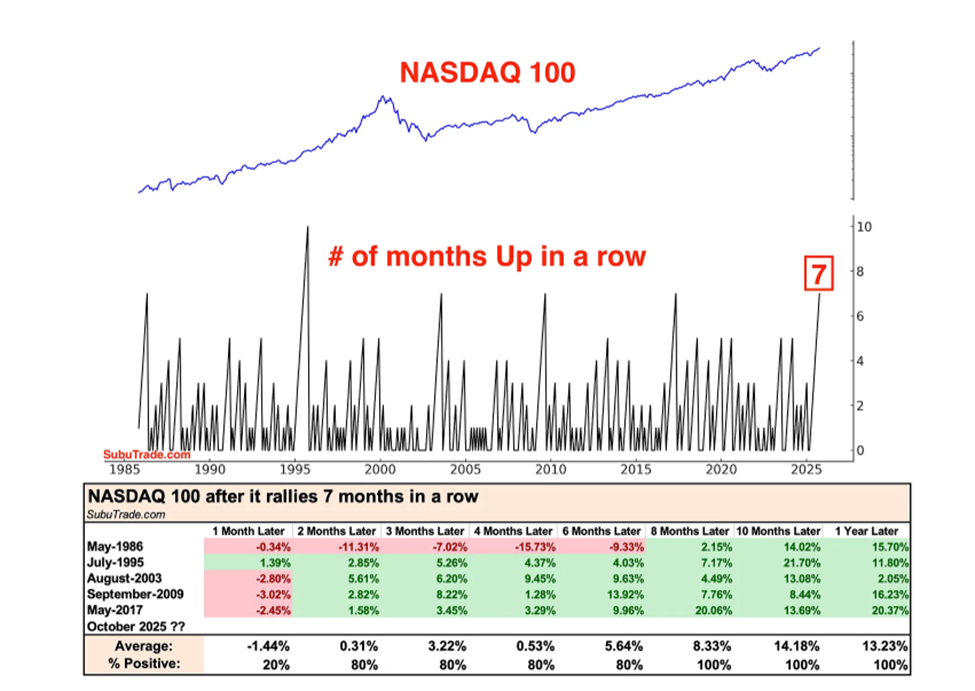

He highlights five historical periods when the Nasdaq-100 rose for seven-straight months — and in four out of those five instances, the following month turned negative.

“It is CURRENTLY down 1.26% for November,” Enrique notes. “Let’s see what happens for the rest of the month.”

For anyone lulled by surface-level analysis, this is the kind of hidden cycle Enrique specializes in calling out.

Editor Adam Sharp — Silver’s Breakout Setup

Editor Adam Sharp — Silver’s Breakout Setup

Adam flags a chart showing silver clawing its way back from its recent sell-off, now trading just under $54 an ounce.

“Silver has staged an impressive comeback,” he writes. “Here’s a six-month chart to give some perspective.

“If silver can move up a few more dollars to fresh all-time highs, it should be off to the races again.”

It’s a one-two punch: a metal regaining momentum and sitting on the doorstep of a technical breakout.

Our own Managing Editor Dave Gonigam — A Viral Screenshot You Shouldn’t Believe

Our own Managing Editor Dave Gonigam — A Viral Screenshot You Shouldn’t Believe

Dave highlights a piece of political misinformation circulating widely online — and why it should be ignored.

“As far as I can tell… this screenshot is not authentic,” he writes. “But it’s being spread far and wide on social media, including among Trump voters, because, under the circumstances, it seems just plausible enough.”

In an era when markets react to every headline, knowing what’s real — and what’s engineered for clicks — is half the battle.

Editor Sean Ring — A Housing-Crisis Icon Bows Out

Editor Sean Ring — A Housing-Crisis Icon Bows Out

Sean posts about an under-the-radar retirement (no, not that one; more on that in a moment).

“It’s the end of an era…

“Michael Burry, whom Christian Bale played in The Big Short, has retired from professional fund management.”

For a generation of investors shaped by 2008, Burry’s exit is more than a personnel change — it’s a bookmark in the history of modern markets.

The magic here isn’t just that you get Paradigm’s best ideas. You get them when they happen. No inbox delay. No wading through half your morning news sources just to figure out what actually matters.

The magic here isn’t just that you get Paradigm’s best ideas. You get them when they happen. No inbox delay. No wading through half your morning news sources just to figure out what actually matters.

This is the stuff our editors read, react to and riff on daily. And now you can see it all the instant they hit “publish.”

So readers never have to wonder: “Did I miss something important?”

If ever there were a time for an information upgrade, it’s in this uncertain market. Major movers are shifting: The Fed is unpredictable, geopolitics are volatile and investors are looking for up-to-the-minute research from credible analysts.

The Paradigm Press app meets that demand…

- Speed: Get critical ideas fast

- Coverage: All subscriptions, plus exclusive free resources, in one place

- Daily Feed: Out-of-the-box market insights that clear away the clutter.

To cut through today’s noise and uncertainty, a more effective tool is required. Discover for yourself by downloading the FREE Paradigm Press smartphone app for iPhone or Android.

The Paradigm Press app is built for the investor who wants less clutter, more precision — and real-time access to some of the sharpest minds in financial analysis.

The Daily Feed? That’s the icing on the cake: rapid-fire commentary and hot takes on every major shift, from stablecoins to the S&P 500.

The app is right there — when you need it most.

![]() “BTD!”

“BTD!”

It’s shaping up to be an interesting week for stock

It’s shaping up to be an interesting week for stock

If you’ve been following the Daily Feed in our app, you know context is key. Before we get into the market notes, here’s one more sharp-eyed read from Enrique Abeyta to frame what’s really happening.

It feels pretty painful out there in the stock market right now — especially in the more speculative stocks. A quick reminder, though, that the REAL companies have been performing very well: 82% of S&P 500 companies reported a profit beat and 77% reported better-than-expected sales. This is NOT how BEAR markets start. BTD!

BTD? Buy the dips…

Checking our screen, it’s just the DJIA that’s registering losses so far today. At the time of writing, the Big Board’s down 0.25% to 47,340.

Checking our screen, it’s just the DJIA that’s registering losses so far today. At the time of writing, the Big Board’s down 0.25% to 47,340.

The S&P 500 and Nasdaq, meanwhile, are clawing their way out of the red. The tech-heavy Nasdaq, in particular, is up 0.70% to 23,030 while the S&P 500 is up 0.45% to 6,765.

When it comes to the commodities complex, it’s a mixed bag. The price of crude’s up 2.45% to $60.15 for a barrel of West Texas Intermediate. But precious metals are getting clobbered. Gold’s down 2.10% to $4,105.40 per ounce. Silver? Down 3.70% to $51.20.

And there’s no way around it: Bitcoin’s having a no-good day. The flagship crypto is down in the dumps to $96,900. (Another Daily Feed bonus, apropos of BTC: “New tentative downside target is $84,100,” says editor Sean Ring.) Ethereum, however, is up 1.75% to $3,225.

![]() The Quantum Question

The Quantum Question

“What happens when quantum computing becomes real? Will the tech make all these recently built AI data centers obsolete?” a reader asks Paradigm editor Davis Wilson at our sister e-letter The Million Mission.

“What happens when quantum computing becomes real? Will the tech make all these recently built AI data centers obsolete?” a reader asks Paradigm editor Davis Wilson at our sister e-letter The Million Mission.

“To answer frankly, not at all,” Davis replies. “Quantum computers will eventually transform certain industries — helping scientists design new drugs, optimize global shipping routes or even break today’s encryption — but that’s still at least 10-plus years away.

“The machines we have now are tiny, unstable and need ultra-cold environments to function,” he adds. “Even once they mature, they won’t replace AI data centers.

“Quantum computers excel at very specific problems, but AI relies on a different kind of math that runs best on GPUs and traditional processors.

“Most experts expect a hybrid future: quantum chips will plug into existing cloud and AI systems as accelerators, not replacements. Think of them as powerful co-pilots that make AI faster or more energy-efficient in certain tasks.

“So no, today’s massive AI data centers aren’t going anywhere,” Davis concludes. “If anything, quantum computing will make them even more important as the backbone for next-generation tech.”

![]() Buffett: Before the Myth

Buffett: Before the Myth

Warren Buffett’s retirement became official the moment his farewell letter went out this week — a quiet but unmistakable closing chapter for a man who shaped market dynamics for 60 years.

Warren Buffett’s retirement became official the moment his farewell letter went out this week — a quiet but unmistakable closing chapter for a man who shaped market dynamics for 60 years.

“I still remember the first time I saw him in person back in 2003 at the Berkshire annual meeting in Omaha,” James Altucher says. “The Buffettpalooza.”

There were 20,000 people, Krispy Kreme donuts and a stampede across freshly cleaned floors where “everyone was slipping, falling, sliding.”

The night before that meeting, James met a man who had bought 200 Berkshire shares in 1976, sold half when they doubled and kept the rest forever.

Those remaining shares — worth $74 million — became the purest illustration of Buffett’s worldview: Wealth comes via patience, not cleverness.

“It’s not easy to find unusual things about Warren Buffett,” James writes, but he has always been drawn to the details that reveal who Buffett was before he became… BUFFETT.

“Why should you listen to me?” asks James. “Because I wrote THE book on Warren Buffett (even Buffett said so).”

“Probably the worst cover in the history

of the printing press,” says James.

James reminds readers, for instance, that Buffett’s worst investment wasn’t a billion-dollar oil bet but a Sinclair gas station where “he lost $2,000, when his savings were about $9,600 at the time.” That early sting, James believes, nudged Buffett toward the durable style that later defined Berkshire.

But the line James considers the truest window into Warren Buffett, the man, came from a shareholder’s question about how Buffett measured success. “I measure success by how many people love me. And the best way to be loved is to be loveable,” he said.

“And that,” James says, “was the most interesting thing I didn’t know about Warren Buffett.”

![]() De-Dollarization? Hold That Thought

De-Dollarization? Hold That Thought

Robinhood is testing a simple idea that somehow feels like a plot twist: cash, delivered to your door like late-night pad thai.

Robinhood is testing a simple idea that somehow feels like a plot twist: cash, delivered to your door like late-night pad thai.

This week, the brokerage teamed up with delivery app Gopuff to let customers withdraw money from their Robinhood bank accounts and have it delivered to their door in a sealed paper bag.

It’s available now in New York and coming soon to San Francisco, Philadelphia, Washington, D.C. and other major U.S. cities. The fee is $6.99 per delivery — unless you hold more than $100,000 across Robinhood accounts, in which case it drops to $2.99.

It’s a curious offering for a company that built its brand on digital everything. But Robinhood has been widening its scope since March, when CEO Vlad Tenev teased a suite of traditional and not-so-traditional banking perks. Discounted helicopter rides. A shot at Met Gala tickets. And now: cash on demand.

Deepak Rao, who runs Robinhood Money, frames it this way: “Everything gets delivered… from burritos to medicine,” he says. “Why not cash?”

To use it, customers need a Robinhood Gold subscription ($5 a month) plus at least $1,000 in direct deposits. Deliveries run 9 a.m. to 7 p.m., and Gopuff drivers won’t know whether the sealed bag contains dollar bills or diapers. But you’ll need to meet them at the door and provide a verification code.

Here’s the larger irony: At a moment when policymakers and financial media insist cash is dying — and in the very same week the U.S. Mint stopped producing the penny — Robinhood is betting on the opposite.

For all our talk about de-dollarization and a cashless future, the demand for physical currency isn’t disappearing. And there’s something heartening about that.

On the other hand…

The market moves fast: The Nasdaq is currently UP… That’s one more reason you should download Paradigm’s FREE app!

Take care, reader! Enjoy the weekend.