Wall Street’s Backseat Drivers

![]() Second Thoughts About Buybacks

Second Thoughts About Buybacks

Maybe people got the wrong idea?

Maybe people got the wrong idea?

Last week your editor engaged in a little rant about share buybacks.

On further inspection, I suspect a few people took it the wrong way — that I think it’s a bad thing under all circumstances when companies repurchase their shares.

The reality is much more complex — a reality Sean Ring laid out later in the week at our sister e-letter The Rude Awakening. “Stock buybacks are neither inherently angelic nor demonic,” he wrote — “they’re a tool.

“In the right hands, at the right price, they’re a disciplined way to reward investors. In the wrong hands, they’re corporate theater: flashy, expensive and ultimately hollow.”

Today we add another Paradigm voice to the mix…

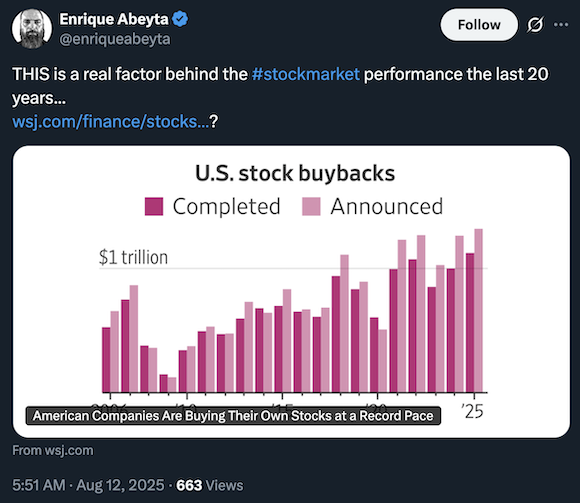

When it comes to buybacks, “most pundits and talking heads have no idea what they’re talking about,” wrote our hedge fund veteran and trading pro Enrique Abeyta last spring.

When it comes to buybacks, “most pundits and talking heads have no idea what they’re talking about,” wrote our hedge fund veteran and trading pro Enrique Abeyta last spring.

As a case study he pointed to the auto repair retailer AutoZone. Since at least 1998, AZO has been aggressively buying back shares — reducing the share count nearly 10x.

As it happens, its net income has grown more than 10x during the same time frame.

And the share price? Since 1991, up a staggering 47,535%.

“This is obviously an example of a buyback that has been great for shareholders,” Enrique says. ”In fact, it's one of the most successful in financial history.”

Devil’s advocate time: What if AZO had taken its cash and plowed it into growing the business rather than buying back shares?

Devil’s advocate time: What if AZO had taken its cash and plowed it into growing the business rather than buying back shares?

Why didn’t the company use that money to invest in new plants and equipment, expand its operations, hire more people?

“The argument that companies are better off investing in the business is the most common criticism of buybacks,” Enrique writes — “but it suffers from one of the greatest fallacies we see in financial analysis: that outsiders can make better judgments than management teams in terms of running the business.

“Management teams aren't perfect, but most of them did not get there by accident. They are skilled professionals who also have much more information than any outsider.

“What is most galling, honestly, is that financial analysts and politicians who criticize them are completely unqualified to make these kinds of determinations. Most of them have never run anything, much less a large publicly traded company.”

Enrique didn’t name names in his article, but some of the most vocal “backseat drivers” in this regard include analysts at J.P. Morgan Research, Sen. Elizabeth Warren (D-Massachusetts), and Robert Jackson Jr. — an appointee to the Securities and Exchange Commission during Trump’s first term.

“Almost always, a company that's buying back stock would rather invest more in the business if it had the opportunity,” Enrique says.

“Almost always, a company that's buying back stock would rather invest more in the business if it had the opportunity,” Enrique says.

Which was the point I was trying clumsily to make last week when I spotlighted the fact that U.S. companies are buying back shares during 2025 at the fastest pace since at least the early 1980s.

“Good for Wall Street, bad for Main Street,” I said.

But I wasn’t faulting management for making the decisions they made. In many cases, the decision to buy back shares is the only rational choice from a menu of bad alternatives.

If the political atmosphere is too uncertain to justify investments in growing the business — whether it’s Obamacare in the early 2010s, COVID policies in the early 2020s or on-again, off-again tariffs now — then yes, the most sensible use of corporate cash is to return it to shareholders in the form of a buyback. Or perhaps a higher dividend.

It’s been wonderful for Wall Street… as Enrique pointed out on X last week (his account is definitely worth a follow if you want a sense of how he thinks)...

But imagine how much more prosperous the country as a whole would be if corporate America weren’t so gun-shy because of knee-jerk, shortsighted decisions by Bush, Obama, Biden and Trump — and of course, the know-it-alls at the Federal Reserve.

Bottom line: Complain about buybacks if you want… but make sure to put the blame where it belongs.

![]() August AI Scare

August AI Scare

Gee, what was it we were saying here last Thursday about the buildout of AI infrastructure approaching “bubble” territory?

Gee, what was it we were saying here last Thursday about the buildout of AI infrastructure approaching “bubble” territory?

Shares of Nvidia fell out of bed yesterday — ending the day down 3.5%. That dragged down the Nasdaq, which closed down 1.4%... and the S&P 500, which slipped 0.6%.

Those losses continue today — the Nasdaq down another 1.4% as we write, and the S&P down 0.7%. (Perspective, though: At 6,367 this morning, the S&P sits a mere 1.6% below its record close last Thursday.)

Last week in this space, the aforementioned Enrique Abeyta warned that the buildout of AI infrastructure was approaching an unsustainable pace — and that Nvidia could be set up for a spectacular fall similar to that of Cisco’s during the dot-com bust of 2000–2002.

Yesterday’s drop coincided with two events…

- OpenAI’s Sam Altman suggesting we’re in an AI bubble — although he didn’t use the b-word. “Are investors over excited? My opinion is yes”

- A report from MIT claiming that “95% of organizations are getting zero return” from their investments in generative AI.

It’s at this moment we have to caution that these events aren’t the reason the market is taking a spill.

It’s at this moment we have to caution that these events aren’t the reason the market is taking a spill.

The financial media are always on the lookout for “reasons” the market is moving up or down. But as Enrique would tell you, the market was already overstretched. Altman and MIT aren’t the reasons for this midweek drop; they’re the excuse. If it weren’t Altman and MIT dragging down the market, it would be something else.

In any event, hot money flooding out of stocks is flowing into both bonds and precious metals. The yield on a 10-year Treasury sits at 4.28% while gold has rallied $28 to $3,342. And silver’s gain is a touch stronger, up 1% to $37.67.

No such luck for Bitcoin though, still languishing under $114,000. Crude is up modestly to $62.71.

➢ The big retail earnings number today comes from Target. Like Home Depot yesterday, Target missed the estimates of Wall Street analysts but stuck to its outlook for the rest of the year. Unlike Home Depot yesterday, Target gave its CEO the heave-ho after 11 years, replacing him with a company lifer. The Street does not like the move, sending TGT shares down 8%.

![]() Russia: Same as It Ever Was

Russia: Same as It Ever Was

“The prospect for a successful negotiation to end the war in Ukraine is zero,” writes the former CIA analyst Larry Johnson.

“The prospect for a successful negotiation to end the war in Ukraine is zero,” writes the former CIA analyst Larry Johnson.

“Trump continues to mistakenly believe that he simply needs to get Putin and Zelenskyy together, who will hammer out a deal.”

Perhaps you noticed we’ve been oddly quiet in recent days about Donald Trump’s Russia-Ukraine diplomacy.

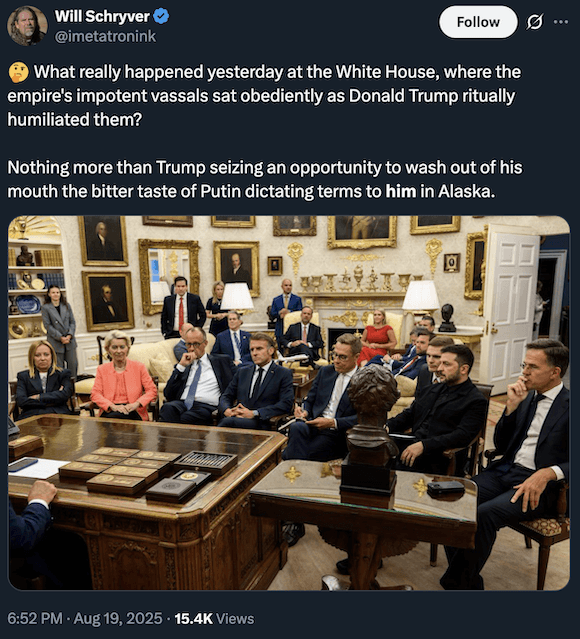

It’s not for the lack of activity — the Trump-Putin summit in Alaska Friday, the Trump gathering with Zelenskyy and European leaders at the White House Monday.

But nothing has fundamentally changed. Trump “holds the cards” over Zelenskyy and the Europeans… but Putin holds the cards over Trump.

The big thing that came out of Monday’s Oval Office get-together was a comical scheme for the United States to sell weapons to the European Union, which would then furnish them to Ukraine.

As one wag pointed out on X, “The U.S. doesn’t have the weapons to sell, the Europeans don’t have the money to buy and Kyiv doesn’t have the soldiers to use them. Other than that it’s a foolproof plan.”

So much for the leverage Trump thinks he has over Putin.

Meanwhile, in the absence of written pledges that Ukraine will stay out of NATO and that NATO missiles will stay out of Ukraine… Putin will carry on with his objective of destroying the Ukrainian army so Western leaders can never again use it to threaten Russia.

Meanwhile, the administration clings to the illusion that it has leverage over Putin with sanctions and “secondary tariffs.”

Meanwhile, the administration clings to the illusion that it has leverage over Putin with sanctions and “secondary tariffs.”

Ahead of Monday’s meeting at the White House, Trump confidant Peter Navarro placed an Op-Ed in the Financial Times, berating India for buying Russian crude.

He pointed out what we’ve pointed out for some time: Until Washington and Brussels imposed sanctions on Moscow after the Ukraine invasion in 2022, less than 1% of India’s crude imports came from Russia. Now it’s over 30%. India buys Russian oil… refines it into gasoline, diesel and jet fuel… and sells it to willing customers in Asia, Africa and Europe.

To punish India, the Trump administration has imposed a 25% tariff on U.S. imports from India — on top of an existing 25% tariff.

Navarro’s petulant screed could have just as easily been written by one of Joe Biden’s Russophobe advisers like Antony Blinken or Victoria Nuland…

India’s dependence on Russian crude is opportunistic and deeply corrosive of the world’s efforts to isolate Putin’s war economy. In effect, India acts as a global clearinghouse for Russian oil, converting embargoed crude into high-value exports while giving Moscow the dollars it needs.

[The dual tariffs] will hit India where it hurts — its access to U.S. markets — even as it seeks to cut off the financial lifeline it has extended to Russia’s war effort. If India wants to be treated as a strategic partner of the U.S., it needs to start acting like one.

Yeah, India’s prime minister seems to have made his choice.

Yeah, India’s prime minister seems to have made his choice.

”Indian Prime Minister Narendra Modi hailed Russian leader Vladimir Putin as a ‘friend’ while his government moved to bolster relations with China,” Bloomberg reports — “another sign India is tilting away from the United States in the face of President Donald Trump’s tariff threats.”

Modi met yesterday with China’s powerful foreign minister Wang Yi — Wang’s first visit to India in three years. In a few days, Modi is scheduled to make his first trip to China in seven years to meet with President Xi Jinping.

China and India are traditional rivals with an unresolved border dispute — but Trump & co. seem to be pushing them into each other’s arms…

![]() BigCharts, RIP

BigCharts, RIP

Evidently no one else will miss it, but we want to tip our hat to the BigCharts website before it goes dark tomorrow. It’s the real end of an era.

Evidently no one else will miss it, but we want to tip our hat to the BigCharts website before it goes dark tomorrow. It’s the real end of an era.

BigCharts got its start in Minneapolis in 1997 — serving up stock charts during the heady days when everyday folks were getting their first internet connection, and trying their hand at the stock market without the hassle of making a phone call to a brokerage rep who painstakingly read back every order for accuracy before executing it.

(Yes, I’m old enough to remember.)

“One of the defining experiences of my life,” recalled one of the site’s co-founders, Jamie Thingelstad, in 2020. “I love that the site is still around, serving charts for all that want! I’m sure code I wrote is still running on it.”

Thingelstad and crew sold out early — April 1999 — to the outfit that was then called CBS MarketWatch. CBS sold MarketWatch to Dow Jones & Company in 2005; Dow Jones was acquired by Rupert Murdoch’s News Corp. in 2007.

Alas, it seems the Murdoch fam has decided BigCharts has outlived its usefulness.

No doubt the interface still looks like something out of 2004. But for some of us fuddy-duddies, its minimalism was the charm: Plug in any ticker symbol and you’d get a glance at the one-year performance that loaded instantly. Its more sophisticated features were blessedly simple and intuitive.

Contrast that with most chart sites today — laden with bells and whistles that slow down performance, with the default setting of a one-day chart because apparently no one has an attention span anymore.

Which is exactly what you’ll get starting tomorrow when BigCharts redirects to MarketWatch.

And so we give BigCharts its due today before it goes to that great server in the sky. RIP.

[Oh, and if you have any suggestions for a site that kinda-sorta replicates the BigCharts experience, drop me a line: feedback@paradigmpressroom.com.]

![]() Mailbag: Rare Earths, Microsquash

Mailbag: Rare Earths, Microsquash

“Enrique recommended this stock. You should be pushing it,” writes a reader singing the praises of USA Rare Earth Inc. (USAR).

“Enrique recommended this stock. You should be pushing it,” writes a reader singing the praises of USA Rare Earth Inc. (USAR).

“It has one of the best CEOs in the business. It will be a multibagger for sure. With a government contract it will equal MP Materials going into 2026.”

Dave responds: USAR was a textbook trade in Enrique’s premium trading advisory The Maverick. Last month, readers garnered a 49.9% gain in only eight days.

And that came on the heels of a 19.5% gain in 15 days on Pan American Silver last May… and 20.5% in three days on the energy company Vistra Corp.

Enrique has latched onto Jim Rickards’ “American Birthright” theme — capitalizing on a new boom in natural resources — but he’s brought his own trader’s spin to it.

“We don’t need a five-year payoff,” he says. “We’re looking for 10%, 20%, even 50% moves that can play out in days or weeks. And this theme keeps delivering them.”

[At the moment The Maverick is closed to new subscribers. We’ll let you know when it’s open again.]

Back to USAR: To be clear, the firm has not yet scored a deal with the U.S. government comparable to that of its fellow rare-earth name MP Materials — but the possibility certainly can’t be ruled out.

“I've had the same issue with Microsoft Hotmail filtering out ALL Paradigm Press emails,” a reader chimes in about the trouble some of our subscribers have on Microsoft email platforms.

“I've had the same issue with Microsoft Hotmail filtering out ALL Paradigm Press emails,” a reader chimes in about the trouble some of our subscribers have on Microsoft email platforms.

“I stopped receiving your emails for several YEARS. Even after updating my contact and spam settings. It took me a lot of troubleshooting to fix — and I had to re-subscribe to Paradigm.

“Microsoft sucks!”

Dave: Not only am I old enough to remember buying and selling stocks on the phone, I also remember the Outland comic strip and its occasional references to “Microsquash.”

In any event, our email sending team — yes, it takes a team of people to oversee such a seemingly simple thing — is still working with Microsoft to hash things out. We appreciate your continued patience!

P.S. Happy 90th birthday to former Rep. Ron Paul (R-Texas). Here’s a good (and timely) tribute — although I’m sure it’s not the only one.