Tesla’s Loss, Your Gain

![]() Tesla’s Loss, Your Gain

Tesla’s Loss, Your Gain

It might come as a surprise to most Americans… but global registrations for electric vehicles swelled by 20% last year, according to new figures from the consulting firm Benchmark Mineral Intelligence.

It might come as a surprise to most Americans… but global registrations for electric vehicles swelled by 20% last year, according to new figures from the consulting firm Benchmark Mineral Intelligence.

EVs!? Who cares about those anymore?

To be sure, EVs have lost their cachet in the U.S. market. Sales flatlined in 2025. At year’s end, Ford wrote down a $19.5 billion investment in EVs. General Motors, for its part, took a $6 billion hit. Tesla’s domestic sales peaked in 2023.

- In retrospect, the turning point for EVs in this country came right around this time in 2024: It was a huge news story when legions of Tesla owners in Chicago found themselves stranded and/or unable to charge their vehicles. Turns out batteries and chargers don’t work very well during a cold snap. And it wasn’t even that cold in the scheme of things — about 10 above.

In the rest of the world, however, EVs are still hot and happening — and there’s a lucrative investment angle that’s not obvious on the surface.

In the rest of the world, however, EVs are still hot and happening — and there’s a lucrative investment angle that’s not obvious on the surface.

“Analysts from both the International Energy Agency and BloombergNEF estimate that EV sales will make up 40–50% of all vehicle sales by 2030,” says Paradigm’s newest contributor — natural resources pro Matt Badiali. “This industry is booming.”

Which means battery metals are likewise booming. “The supply/demand outlook for those metals remains strong.

“But one metal stands out as the biggest winner for investors,” Matt tells us — “copper.

“But one metal stands out as the biggest winner for investors,” Matt tells us — “copper.

“Copper is the metal of electricity. Aluminum can substitute for it in some situations (like power lines). But if you want an electric motor, you have to use copper. And every EV needs electric motors.

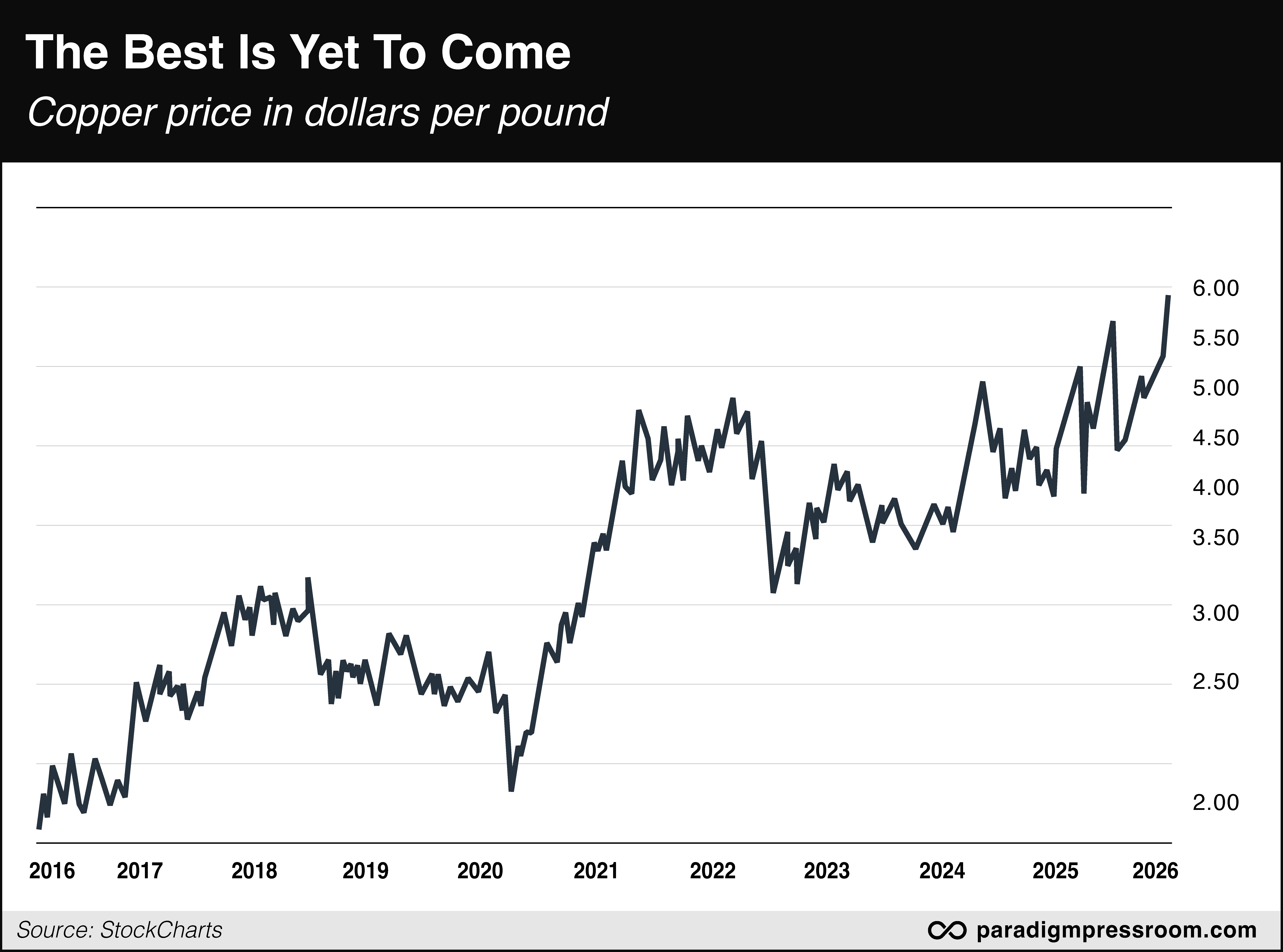

“In 2015, EV copper demand was 56,000 metric tons. It grew 1,650% to 1 million metric tons in 2025. That demand growth drove copper prices higher.”

Check out this chart of the copper price going back 10 years. This week the red metal crossed over a record $6 a pound…

Don’t get the wrong idea: “This trend will continue for the next five years, at least,” Matt says.

Don’t get the wrong idea: “This trend will continue for the next five years, at least,” Matt says.

“The Copper Development Association forecasts copper demand for EVs to hit 2.5 million metric tons by 2030. Analysts at JP Morgan expect a deficit of 330,000 metric tons in 2026.

“This trend will get a further boost by demand from AI datacenters. The sudden boom in electricity and batteries will further impact copper prices. There is no substitute for copper in many electrical uses.”

As we mentioned only yesterday, Amazon has signed a deal with Rio Tinto for exclusive access to the copper coming from a mine in Arizona that came into operation last year. It’s the first such deal — but it won’t be the last.

How to play the trend? Matt likes the Global X Copper Miners ETF (COPX).

“Owning a basket of these miners reduces common risks from individual companies,” he says.

“For most portfolios, a position in COPX is the perfect exposure to the copper market.” [Dave’s disclosure: I’ve been steadily building a position in COPX since 2021.]

![]() Not Just Tech Anymore

Not Just Tech Anymore

It’s no longer technology pulling the stock market train here in early 2026.

It’s no longer technology pulling the stock market train here in early 2026.

On the Daily Feed section of the Paradigm Press mobile app, trading pro Enrique Abeyta draws our attention to an intriguing stat from Turning Point Market Research.

Every one of the S&P 500’s 11 sectors now sits above its 200-day moving average. That’s everything from information technology to financials to utilities.

“Since 1928,” Enrique says, “the S&P 500 has delivered an annualized return of 11.5% once this happens.”

Another tailwind for stocks — a peaceful bond market.

Another tailwind for stocks — a peaceful bond market.

Just as the VIX measures volatility in stocks, the MOVE index measures volatility in bonds. The MOVE index has been falling steadily ever since the “Liberation Day” scare last April.

Key point: “When the MOVE index is high (or going higher), stocks struggle,” Enrique says. “When it collapses, stocks — especially small stocks — can soar.”

The MOVE now sits at lows last seen in 2021. “Bullish for small caps across the board.”

Intriguing, no?

This is your friendly reminder that the Paradigm Press mobile app delivers access to market insights like these that you won’t find anywhere else. Better yet, it gives you clean, easy-to-navigate access to all of your paid publications without sifting through a cluttered email inbox. Download the app right here and see for yourself.

As the week winds down, watching the major U.S. stock indexes is like watching paint dry.

As the week winds down, watching the major U.S. stock indexes is like watching paint dry.

None of the averages has budged more than a tenth of a percent as we write. At 6,949 the S&P 500 rests about 28 points below Monday’s record close.

Gold has slipped below $4,600 for the moment and silver is getting a much-needed reset — down $3.62 at last check to $88.73. (More about silver momentarily…)

Not much change in crypto compared with 24 hours ago — Bitcoin just under $95,000 and Ethereum below $3,300.

The lone economic number of interest today is industrial production — up 0.4% in December, according to the Federal Reserve. All told, 76.3% of America’s industrial capacity was in use last month — slightly better than a year earlier, but well below the long-term average.

![]() Wars and Rumors of Wars

Wars and Rumors of Wars

Oil prices are back on the rise as new rumors swirl about a U.S. attack on Iran.

Oil prices are back on the rise as new rumors swirl about a U.S. attack on Iran.

When we left you yesterday, it seemed as if Donald Trump was satisfied that Iran’s crackdown on protesters was over and he was not inclined to launch a follow-up attack to the one he launched last summer. The oil price tumbled over 4% as a consequence.

Rumors abounded that an attack was imminent on Wednesday night. The much-followed “OSINTdefender” account on X claimed there were possible explosions in Tehran — and then the post was deleted because “the source appear to be a bit flimsy [sic].”

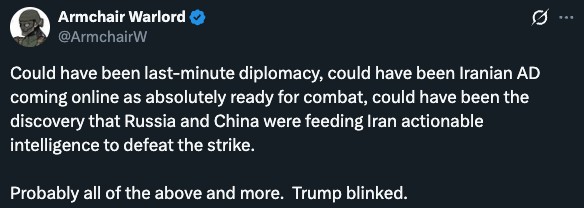

It’s possible an attack was called off at the last minute, for reasons still unknown.

But as our favorite political reporter Michael Tracey reminds us, Trump pulled a feint just before last summer’s airstrikes…

Amid that backdrop, a barrel of West Texas Intermediate is up over 1% on the day — back within 15 cents of $60.

![]() Discounted Silver! (For a Few Seconds…)

Discounted Silver! (For a Few Seconds…)

The action in silver this week is so wild that for a brief time, the U.S. Mint was selling it at a discount.

The action in silver this week is so wild that for a brief time, the U.S. Mint was selling it at a discount.

On Wednesday, the spot price of silver sailed toward $93 an ounce — which was problematic because the Mint was charging $91 for uncirculated U.S. Silver Eagles.

Evidently the Mint is such a slow-moving beast that rather than adjust the price higher, it simply pulled its silver offerings off its website.

“Due to rapidly rising metal costs, silver numismatic (collectible) products have been temporarily removed from sale as we evaluate pricing across our entire numismatic portfolio,” a notice explains.

“Products will be placed back on sale as soon as prices are adjusted. American Eagle Silver bullion coins remain available for purchase through our network of authorized purchasers.”

Is it that hard to adjust the prices on the website? Or has the Mint’s inventory been cleaned out?

“The U.S. Mint has suspended silver sales before, but those suspensions were attributed to inventory shortages and supply chain disruptions, not to rising bullion prices,” writes one Stuart Englert on his Substack page.

“Between 2008 and 2010, extreme demand forced the U.S. Mint to ration and temporarily suspended sales of American Silver Eagles several times due to a shortage of blanks to make the bullion coins. At the time, some industry observers attributed the shortages to kinks in the supply chain or a manufacturing bottleneck.”

Ditto in 2020 amid the pandemic disruptions.

Silver Eagles are still available at most online dealers at the usual markup. Nothing at Costco, though…

![]() You’ve Got to Be Kidding…

You’ve Got to Be Kidding…

Apparently this is how management at CBS News thinks they can revive their brand…

Apparently this is how management at CBS News thinks they can revive their brand…

What were they thinking!? [CBS mockups posted by Zeteo News]

What were they thinking!? [CBS mockups posted by Zeteo News]

So we should back up a bit: Last year, CBS parent Paramount came under the control of nepo-baby David Ellison, son of Oracle co-founder Larry Ellison. The younger Ellison hired free-speech hypocrite Bari Weiss to try to make CBS News relevant again.

So far, it’s not working.

For instance, Weiss’ interview with Charlie Kirk’s widow Erika last month garnered a measly 72,000 views on YouTube after two days. On TV, viewership totaled about 1.5 million — a fraction of the audience that watched the Army-Navy football game beforehand.

Meanwhile, viewership of the CBS Evening News under Weiss-appointed anchor Tony Dokoupil is down 23% compared with already-pitiful levels a year ago — when Norah “Noron” O’Donnell was still at the desk.

- Sidebar: As you might know, your editor worked 20 years in broadcast news until walking away from the racket in 2007. The trade has become so irrelevant, so inconsequential to public discourse, that I’d never even heard of Tony Dokoupil until maybe 18 months ago.

And so Weiss or one of her minions thought it would be a good idea to spice up the network’s flagship newscast with a segment called “Whiskey Fridays With Tony Dokoupil.”

"Some staff were only first made aware of it as they encountered CBS testing set designs of a faux-stocked bar in the newsroom, featuring a large sponsor banner for Jack Daniel’s," tweets reporter Prem Thakker of the Zeteo News site.

The humiliation was such that CBS went into instant damage-control mode: It’s just a concept!

The humiliation was such that CBS went into instant damage-control mode: It’s just a concept!

"This is not a segment for broadcast. This is not a real title. This is not a real sponsor. And this is not a real story,” says a CBS statement to People magazine. “This is simply an experimental mockup the graphics team created with placeholder text for a potential non-televised, in-person private event.”

Uh-huh.

Having been unwittingly dragged into the fray, Jack Daniel’s parent Brown-Forman had to issue its own statement: “Jack Daniel’s is not involved in any such segment, nor do we have any awareness of the segment and any potential partnerships or sponsorships.”

As one wag on X put it, “Amazing that even Jack Daniel’s was like, ‘Do not involve us in this dork s***.’”

The fiasco is especially amusing to us here at Paradigm — where for 20 years we’ve conducted rollicking panel discussions under the name “Whiskey Bar,” both at in-person conferences and online.

And they’ve gone over with audiences way better than anything out of CBS News lately…