The Mexican-American War of 2025

![]() The Mexican-American War of 2025

The Mexican-American War of 2025

“I expect a shooting war between Mexico and the U.S. in the near future,” Paradigm’s Jim Rickards said in this space during early February.

“I expect a shooting war between Mexico and the U.S. in the near future,” Paradigm’s Jim Rickards said in this space during early February.

“The Mexican drug cartels are planning to use drones for aerial attacks on Immigration and Customs Enforcement. This is war. Trump, [Secretary of State Marco] Rubio and [Defense Secretary Pete] Hegseth won't put up with it for much longer.”

Nearly seven months have gone by since.

A hint at what’s to come arrived on Aug. 12 — when the State Department issued an updated travel advisory for Mexico.

A hint at what’s to come arrived on Aug. 12 — when the State Department issued an updated travel advisory for Mexico.

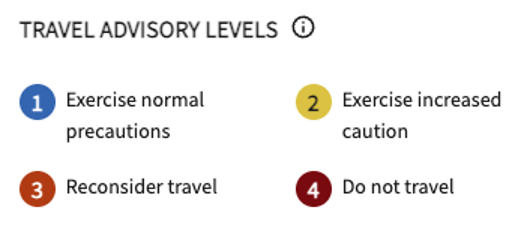

Understand, the State Department has four levels of travel advisories…

Mexico as a whole is considered Level 2. As such, U.S. government employees may not travel between cities after dark and must “rely on dispatched vehicles from regulated taxi stands or app-based services like Uber or Cabify and may not wave down taxis on the street,” according to the State Department. U.S. citizens in Mexico are advised to do likewise.

Several individual Mexican states are at higher levels. Of the six states bordering the United States, three are at Level 3 and a fourth, Tamaulipas, is at Level 4.

In Tamaulipas, “heavily armed members of criminal groups often patrol the state, especially along the border region from Reynosa to Nuevo Laredo,” says the State Department website.. “They act without fear of punishment in these areas, and local law enforcement has limited capacity to respond to crime.”

Now, the latest: “The Trump administration has directed the military to prepare for lethal strikes against cartel targets inside Mexico,” reports the independent journalist Ken Klippenstein — citing “three military sources.”

Now, the latest: “The Trump administration has directed the military to prepare for lethal strikes against cartel targets inside Mexico,” reports the independent journalist Ken Klippenstein — citing “three military sources.”

No, there would be no involvement on the part of the Mexican government. Trump “has shown himself to be willing to take unilateral action despite potentially negative political ramifications,” according to a “senior intelligence official.”

The ball got rolling last month during a meeting at NORTHCOM headquarters in Colorado Springs, as Klippenstein reports…

NORTHCOM has tasked its subordinate Special Operations Command (called SOCNORTH) to undertake “operational preparation of the battlespace” inside Mexico to set the stage for future military operations, and to prepare cartel-related “target packages” for potential strikes and “direct action” attacks on the ground against high-value individuals, compounds and supply chain targets associated in particular with the Sinaloa Cartel and the Jalisco New Generation Cartel. Direct attacks could also involve air and drone strikes.

“Direct action” is a term special operations forces use to describe small-scale offensive operations carried out by Army Green Berets, Navy SEALs or Marine Corps raiders. Think of the airstrikes on Iran this summer as a kind of direct action, against a discrete target with a “strategic” or national purpose.

It’s hard to imagine air strikes alone achieving the objective — whatever the objective might be, and that seems very fuzzy at the moment. “Destroy” Sinaloa or the Zetas? Good luck with that.

Which means at some point, the Pentagon would deploy “door-kickers” in cartel country.

Which means at some point, the Pentagon would deploy “door-kickers” in cartel country.

They would face a formidable opponent. Back in February we cited Cato Institute scholar Brandan Buck: “Sending U.S. Special Operations into a direct confrontation with the Mexican cartels would pit them against a near-peer competitor, who, like the Taliban, would likely enjoy the direct or tacit support of the local populace and the luxury of hiding in punishing terrain.”

But unlike the Taliban, the cartels would likely start to employ the tactics they use at home inside the United States.

For instance, as the military affairs podcaster Bill Buppert said in an interview last spring, it’s highly likely the cartels would pin down the identities of special forces soldiers — and proceed to attack their families and homes.

And then what?

In any event, “a cartel war is guaranteed to fail because the illicit drug trade is not something that can be fixed by military means,” writes the foreign policy researcher Daniel Larison. “It is setting the U.S. military up for another mission that is doomed from the start.”

➢ And at the same time, there’s increasing chatter about U.S. military action against Venezuela. Asked on Friday about the prospect of American “boots on the ground,” White House press secretary Karoline Leavitt refused to rule it out.

![]() Intel Inside? More Like *Government* Inside

Intel Inside? More Like *Government* Inside

Intel isn’t the first — and it definitely won’t be the last.

Intel isn’t the first — and it definitely won’t be the last.

After we hit “send” on Friday’s timely edition of these 5 Bullets, the White House confirmed that the U.S. government would take a 10% share of Intel.

“The stake is worth around $8.9 billion,” according to CNBC — “some of which will come from grant funding associated with the CHIPS Act while the rest will be under separate government allocations for programs associated with making secure chips.”

In other words, no new outlays of taxpayer funds.

What’s more, it seems Uncle Sam got a bargain price. If the government’s stake is 10% of the company valued at $8.9 billion, that values the whole company at $89 billion. But in mid-August, INTC’s market cap was about $107.5 billion.

Still, free-market purists are appalled.

The announcement comes only a few weeks after the government announced it would take a 15% stake in the rare-earths firm MP Materials (a move that proved enormously profitable for Altucher’s True Alpha subscribers — a 918% gain).

On CNBC this morning, National Economic Council Director Kevin Hassett said more such deals are in the offing.

“The president has made it clear all the way back to the campaign, he thinks that in the end, it would be great if the U.S. could start to build up a sovereign wealth fund. So I’m sure that at some point there’ll be more transactions, if not in this industry then other industries.”

[Not up to speed on a sovereign wealth fund? Check out this morning’s edition of our sister e-letter, The Rundown.]

This is one instance in which the old Wall Street saying about “buy the rumor, sell the news” does not apply. INTC rallied 5.5% on Friday… and it’s up another 1.2% as we write today.

![]() The Fed’s Big Oopsie

The Fed’s Big Oopsie

The Federal Reserve is trying to put the inflationary genie back in its bottle.

The Federal Reserve is trying to put the inflationary genie back in its bottle.

We mentioned the annual “Jackson Hole speech” delivered by Fed chair Jerome Powell in Friday’s edition. The big headline was that Powell all but cleared the way for the Fed to start cutting interest rates again next month.

But a bigger, more long-term story emerged from Powell’s speech that deserves our attention today.

➢ For the moment we’ll leave aside the sheer evil of a deliberate effort to cut the value of your dollars in half over the course of 36 years…

But in the wake of the 2008 financial crisis, inflation frequently ran less than 2% during the 2010s. So by 2019, rumblings began to emerge from the Fed in the form of speeches and policy papers: Going forward, the aim might be to exceed the 2% target, basically to make up for lost time.

Amid the COVID lockdowns in the summer of 2020, the Fed made it formal policy: As Fed Governor Lael Brainard said at the time, “Some modest temporary overshooting... would help offset the previous underperformance.”

The rest is history: The overshoot was neither modest nor temporary.

The rest is history: The overshoot was neither modest nor temporary.

The mad COVID spending, starting under Trump and accelerating under Biden, necessitated levels of Fed money printing that led to inflation of the sort Americans hadn’t experienced in decades.

And so during his speech on Friday, Powell announced the Fed is scrapping the “overshoot” policy. Officially, the aim once more is for 2% inflation.

Too late. As we’ve said time and again for the last couple of years, recent history in developed economies demonstrates that once inflation sails past 5% — as it did in 2022 — it typically takes a decade to get back to “normal” 2% inflation.

That means the winning asset classes for the rest of the 2020s will be very much like the ones of the inflationary 1970s — precious metals, base metals, energy. Commodities. Natural resources. Tangible stuff.

And this time, you can probably add some crypto to the mix…

Mr. Market’s sugar high from Powell’s speech on Friday didn’t last long.

Mr. Market’s sugar high from Powell’s speech on Friday didn’t last long.

The S&P 500 rallied 1.5% Friday… but as we check our screens today, it’s pancake-flat at 6,463. The Nasdaq is up about a quarter percent, while the Dow is down about a half percent.

Precious metals are likewise quiet after Friday’s gains, gold at $3,371 and silver at $38.73. But crude is up nearly 2% and back within reach of $65 a barrel — a level last seen on Aug. 6.

Bitcoin’s own sugar high on Friday had no staying power at all: After a vertical rally past $117,000 the flagship crypto sits under $113K.

![]() Comic Relief

Comic Relief

We don’t have much to say about the overhaul of Cracker Barrel that you probably haven’t read elsewhere, but we did get a chuckle out of this…

We don’t have much to say about the overhaul of Cracker Barrel that you probably haven’t read elsewhere, but we did get a chuckle out of this…

That said, the same tweet with the identical wording appears under many, many different accounts on X. Bots much? And where did it originate?

![]() Mailbag: Buybacks

Mailbag: Buybacks

“A thought came to mind while reading your stock buyback musings,” writes one of our regular correspondents.

“A thought came to mind while reading your stock buyback musings,” writes one of our regular correspondents.

“The thought connected corporate maneuvering with that criticism you repeatedly face of ‘Why so much politics in your free newsletter?’

“Most people believe economics is about making, producing and exchanging value, ultimately building prosperity. But that’s not the age-old game of political economy: the money game. While the masses attempt to create and exchange value, power players maneuver for ownership. The goal is owning. Though money does represent power, the wealthy know ownership turns money into enduring control.

“Inflation (deliberate devaluing of money), debt and deficits — none of these matters —savvy players of the money game focus on the goal. Shrewd players see money as melting ice cubes or hot potatoes. Currency is energy in motion. A cunning player’s goal is to grab every dollar passing through the system, from wages to government largesse to corporate profits (hence the Republicans' Big Beautiful Bill and stock buybacks), and flip it into ownership of land, businesses and influence. That’s how the few in the know dominate — not by making, that is creating value, but by owning.

“The deliberate manipulation of the money game corrupts the American economy and, in turn, American society. Donald Trump and his cronies are monetizing politics like never before. Government isn’t governing — it’s extracting. The cabal at the top grows richer while the masses grow poorer, angrier and more disenfranchised. Many are even conned into cheering for their own exploitation, repeating the lies that keep them loyal to a rigged game.

“The truth that changes everything is that money is not the prize; it’s just bait. Ownership is the lever of power. Until the masses realize how the money game is played, they’ll keep playing blind and keep losing.

“Awareness is the first step. I applaud you for your straight shooting and encourage you to keep spreading the truth. Once people begin to see the game clearly, they can start playing differently.

“Who knows, maybe someday we might even choose to implement a system that creates, not extracts — a historical first.”

Dave responds:The extraction has been ongoing for decades. The “privatized profits, socialized risks” of the banks… the depredations of the health care cartel and the military-industrial complex… higher education… Big Agra…

“Extraction” is an apt word, too — it was the occasion for an epic cable news rant in 2011 that I remember fondly if no one else does.

What’s different now is that there seem to be competing factions of elites fighting over the spoils — while normie Americans who aren’t consumed by political tribalism are just trying to keep their heads down and their purchasing power intact.

Fortunately, our whole reason for being at Paradigm is to help with the latter…

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets