Elon Musk, Counter-Elite

![]() Elon Musk, Leader of the Counter-Elites

Elon Musk, Leader of the Counter-Elites

Has a billionaire (other than Donald Trump) ever been this overtly political?

Has a billionaire (other than Donald Trump) ever been this overtly political?

Through their foundations and other vehicles, Bill Gates and Warren Buffett wield their might in more subtle ways than presidential politics. You can even say the same of Michael Bloomberg, his own short-lived run for president in 2019–2020 notwithstanding.

“Elon Musk joined Donald Trump onstage at a rally on Saturday night,” reports The Telegraph, “as the former president returned to the scene where he was fired at by a would-be assassin…

“There were clear differences this time around. The ex-president was speaking from a podium encased in bulletproof glass. The rooftop used by [Thomas] Crooks had been blocked from view by shipping containers and haulage trucks.”

But it’s Musk’s bunny-hopping appearance that commands our attention this morning.

Not because he said anything unique or newsworthy. (He called this year “the most important election of our lifetime.” Musk was born in 1971.)

No, it’s more than anything he said…

Whether he planned it or not, Musk has made himself the face of a counter-elite in the United States — maybe even more than Trump.

Whether he planned it or not, Musk has made himself the face of a counter-elite in the United States — maybe even more than Trump.

Counter-elite is a term coined by the Russian-American researcher and writer Peter Turchin.

In books like 2023’s End Times: Elites, Counter-Elites and the Path of Political Disintegration, Turchin lays out a thesis that you can’t have a civil war without competing groups of elites.

As he sees it, a united ruling elite can maintain control over a population indefinitely even in the face of major grassroots opposition. It’s only when the elites start fighting among themselves that the edifice starts to crack.

As we’ve chronicled before, there was almost no billionaire support for Donald Trump in 2016. The Wall Street Journal reported that nine of the 10 biggest donors gave to Hillary Clinton. (Home Depot’s Bernie Marcus was the 10th.) Among donations of $1 million or more, Clinton collected $180 million, compared with Trump’s $33 million.

Eight years later, Trump’s elite backers include Musk… the venture capitalist Marc Andreessen… and hedge fund operators Bill Ackman and Paul Singer. Andreessen was a Clinton supporter eight years ago. Ackman, too, has a history of backing Democrats and he supported Nikki Haley in the 2024 GOP primaries. Eight years ago, Singer was a Never-Trump Republican.

But Musk is sui generis among this group. Only he commands the status of a rock-star CEO, maybe the first since Steve Jobs. His ranking as the world’s richest man — at $244 billion, he comfortably outpaces No. 2 Jeff Bezos on the Forbes 400 — only adds to the mystique.

And he was largely apolitical until a few years ago; near as we can tell his “red pill” moment was when he kept Tesla’s factory in Fremont, California open in May 2020, defying Alameda County’s lockdown orders.

Earlier this year, we conducted an informal, open-ended survey of reader opinion about Musk.

Earlier this year, we conducted an informal, open-ended survey of reader opinion about Musk.

We welcomed everyone’s input, but we were especially interested in the opinions of the people who’d come aboard via Altucher’s Investment Network starting in late 2023.

At the risk of overgeneralizing, this is a group that bristles at the mention of anything adjacent to politics in this e-letter. Some are openly hostile to Donald Trump.

But in the main, the opinion toward Musk was favorable and the criticism was measured. I don’t remember anyone saying words to the effect of I hate that fascist and I will unsubscribe at the next mention of him.

This is good and healthy. Because while politics does alter flows of money, you should strive to avoid letting it affect your investment decisions.

Especially in light of Musk’s next big public appearance this coming Thursday.

With that in mind, did you miss our Elon Musk’s Road to $1 Trillion Summit last night?

There, we shared the results from months of research into the big Tesla announcement Musk is set to make on Thursday… and why we believe one tiny AI stock is essential to Tesla’s plans.

We’re looking at profit potential of 10X in the next year and 50X beyond that.

It’s still not too late to get caught up. Click here to get started.

![]() Bull Market Still Intact

Bull Market Still Intact

“Even with the distinct possibility of a short-term sell-off, I’d caution you not to bet against this bull market,” says Enrique Abeyta — the newest addition to the Paradigm Press team.

“Even with the distinct possibility of a short-term sell-off, I’d caution you not to bet against this bull market,” says Enrique Abeyta — the newest addition to the Paradigm Press team.

At one time, Enrique managed over $1 billion for a hedge-fund outfit. Like many denizens of the newsletter biz, he’s happier writing for an audience of everyday folks like you than he ever was amid the backstabbing, brownnosing culture of Wall Street. Among his bang-on market calls in recent years was amid the COVID crash: Within three days of the bottom in March 2020, he said stocks were a “screaming buy.”

Back to the present: “Going into October, the stock market has been higher for five months in a row,” he says in our new Truth & Trends e-letter.

“This has happened 28 times since 1954. And in all instances except one, it was higher one year later.” (The lone exception was 2018.)

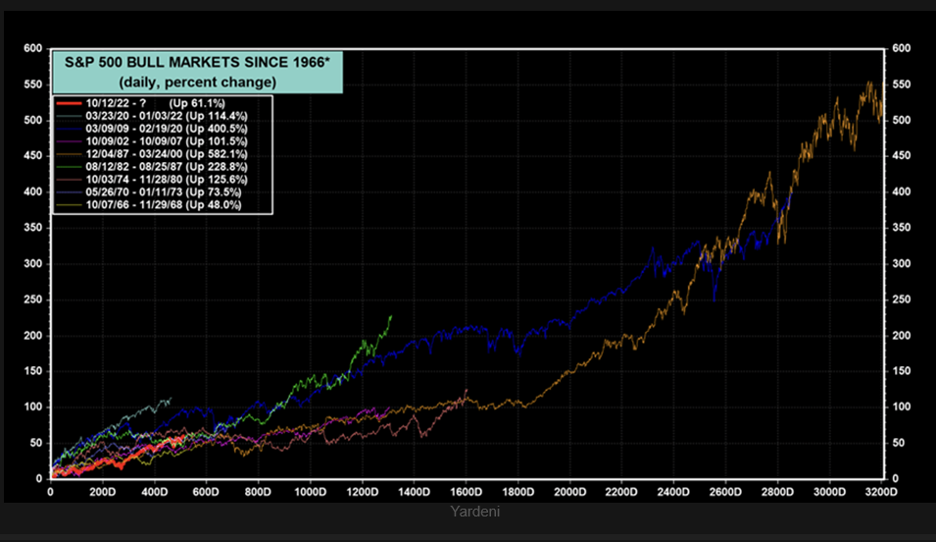

What’s more, Enrique shares a chart from the legendary market analyst Ed Yardeni — depicting every bull market since the 1960s.

“The current bull run that started in October 2022 has the stock market up a little over 60%,” Enrique says. “Only one of the previous bull markets has been up less than that. In fact, the average bull market in the last six decades has gone up more than 200%. And bull markets have also been getting longer and stronger.”

That said, don’t discount the likelihood of autumn volatility. “In the near term,” he says, “sentiment has gotten quite stretched. It’s now back to levels where the stock market has previously corrected.”

Possible catalysts for a downdraft include an escalating Middle East conflict — about which more shortly — and the proverbial October surprise ahead of Election Day.

For the moment, though, the stock market is quiet — the major averages down a half-percent or less to start the week. At 5,727 the S&P 500 sits only 35 points below its record close notched a week ago today.

For the moment, though, the stock market is quiet — the major averages down a half-percent or less to start the week. At 5,727 the S&P 500 sits only 35 points below its record close notched a week ago today.

Gold has sold off below $2,650 and silver has been slammed back below $32. Bitcoin, on the other hand, has rallied to within $250 of the $64,000 mark.

The biggest selling is in the bond market, pushing prices down and yields up. The yield on a 10-year Treasury note is back above 4% for the first time in over two months.

![]() Oil: Geopolitical Risk Still Underpriced

Oil: Geopolitical Risk Still Underpriced

Crude is up another two bucks to start the week, a barrel of West Texas intermediate now $76.56 — the highest since late August.

Crude is up another two bucks to start the week, a barrel of West Texas intermediate now $76.56 — the highest since late August.

Today is the anniversary of the Hamas attack inside Israel a year ago. The consensus among Israeli politicos a year later was captured last week by Naftali Bennett, who was prime minister for a year in 2021–22: “Israel has now its greatest opportunity in 50 years, to change the face of the Middle East.”

Presumably that entails Gaza, the West Bank, Lebanon, Yemen and Iran. Maybe Iraq and Syria too. Definitely Iran’s nuclear program — even though every year since 2007 U.S. intelligence has said there’s no evidence Tehran is working to make a bomb.

Assuming this “makeover” can be accomplished at all, it can happen only with support and cooperation from Washington — which would open up U.S. aircraft and bases in the region to attack.

In which case, $76.56 doesn’t begin to reflect the risk.

Even the mainstream is alert to the possibility: “$100 Oil Could Be the October Surprise No One Wanted,” says a CNN headline.

“Investors, having been burned by prior geopolitical scares that quickly fizzled, have grown numb to the cascade of crises around the world. This time they’re waiting for evidence of actual supply disruptions before bidding up the price of crude oil.”

Tehran could, if it wanted, easily shut down the Strait of Hormuz — only 21 miles wide at its narrowest point. Shut it down and large quantities of crude from Saudi Arabia, the United Arab Emirates, Iraq and Kuwait would be stranded.

“In such a scenario, global oil markets would be in uncharted waters,” says a report from Citigroup — “with oil prices likely experiencing a sharp and significant spike well past previous record highs.”

How high is that? The record remains $147 a barrel shortly before the 2008 financial crisis went critical.

That would be bad enough, but if you adjust for inflation it’s $215.

For the moment gasoline prices are under $3 a gallon in 18 states.

![]() Update: Helene, Quartz, Semiconductors

Update: Helene, Quartz, Semiconductors

The secretive Belgian conglomerate that controls the world’s sole source of high-purity quartz reports “significant progress” in recovering from Hurricane Helene.

The secretive Belgian conglomerate that controls the world’s sole source of high-purity quartz reports “significant progress” in recovering from Hurricane Helene.

As we mentioned a week ago today, the world’s semiconductor industry is surprisingly dependent on a mine site just north of Spruce Pine, North Carolina. The quartz that emerges from there is essential to make silicon wafers for semiconductor manufacturing.

Sibelco, the company that owns the mining complex, acknowledges that the area was “hit particularly hard.”

However, “The initial assessment indicates that our operating facilities in the Spruce Pine region have only sustained minor damage,” the company said in a statement issued Friday. “Detailed assessments are ongoing.”

Not a lot of transparency there. Author Ed Conway, who spotlighted Spruce Pine in his 2023 book Material World, believes it will be several months before the operation is back at pre-Helene capacity.

“It’s quite hard to imagine this won’t have at least some impact,” he writes at his Substack site.

To be continued…

![]() Mailbag: Middle East Mess

Mailbag: Middle East Mess

On the subject of the Middle East war metastasizing (and potentially driving oil over $100)... a reader responds to the mailbag section in Friday’s edition…

On the subject of the Middle East war metastasizing (and potentially driving oil over $100)... a reader responds to the mailbag section in Friday’s edition…

“Dave, I do not see how anyone can say that President Trump cannot handle Mideast policy better than Vice President Harris. He has already proven it during his first term, when there was much less trouble in southern Lebanon, Yemen, Gaza and Iran (primarily because he prevented Iran from financing terrorism to the degree we see at present).

“Furthermore, I have been an evangelical Christian for 40 years and lived in four different parts of the country. I have yet to find any who believe American foreign policy governs or influences the timetable for the return of Jesus. We do not believe you can play wag the dog with God. You do hear about such people on mainstream media documentaries, but I can tell that a lot of those people and all of their detractors generally have no understanding of the fundamentals of the faith and should be discounted as imposters.

“They may have churches, but they are not accurate representations of evangelical Christians and do not have the numbers to be the majority of evangelicals in President Trump's base, much less the majority of his base as a whole.

“Thanks for the free flow of opinion.”

Dave responds: Far be it from me to get in the middle of the internecine conflicts of someone else’s faith. Suffice to say that figures like Pastor John Hagee play an outsized and pernicious role in U.S. foreign policy under Republican administrations.

As for Trump… he nearly launched airstrikes on Iran in the summer of 2019 because Tehran shot down an American drone. It appears the only reason he didn’t follow through is that he turned on Fox News — and Tucker Carlson talked him down during the 8:00 p.m. EDT hour.

(Incredibly, the Democrats’ platform this summer slammed Trump for holding his fire on that occasion…)

But forget 2019: Just last week Trump was egging on Israel to “hit” Iran’s nuclear-energy facilities and “worry about the rest later.” Which, to reiterate today’s Bullet No. 3, cannot happen without U.S. support.

Remind me again how Trump is the “antiwar” candidate?

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets