America’s Birthright Enters the AI Age

![]() American Birthright, Now Powering AI

American Birthright, Now Powering AI

Here’s an interesting variation on the “American birthright” theme of Paradigm’s Jim Rickards.

Here’s an interesting variation on the “American birthright” theme of Paradigm’s Jim Rickards.

The Trump administration is opening up four parcels of federal land to host data centers — the better to meet AI’s exploding demand for computing power.

As a reminder, the essence of the Birthright idea is that the Trump administration is keen to tap into the energy and mineral wealth on federal lands — a bounty valued at $150 trillion.

But with this new announcement, it’s clear that Trump and his cabinet have more than mining and drilling in mind. Building data centers on federal property is also in the mix.

According to the NextGov website, “the facilities include Idaho National Laboratory, Oak Ridge Reservation, Paducah Gaseous Diffusion Plant and Savannah River Site, where private sector partners will develop AI data center and energy generation infrastructure.”

The announcement came last Thursday, hours after Donald Trump signed another executive order on AI.

“By leveraging DOE land assets for the deployment of AI and energy infrastructure, we are taking a bold step to accelerate the next Manhattan Project — ensuring U.S. AI and energy leadership,” says Energy Secretary Chris Wright.

“These sites are uniquely positioned to host data centers as well as power generation to bolster grid reliability, strengthen our national security, and reduce energy costs.”

“The plan aims to address one of the largest challenges facing the energy sector,” reports Politico’s energy unit – “how to find enough electricity to support a technology boom and ensure the United States stays competitive with China in developing AI technologies.

“The plan aims to address one of the largest challenges facing the energy sector,” reports Politico’s energy unit – “how to find enough electricity to support a technology boom and ensure the United States stays competitive with China in developing AI technologies.

“According to the Lawrence Berkeley National Laboratory, data centers could consume roughly 12% of U.S. electricity by 2028.”

For the moment, it’s too soon to suss out which companies might benefit from this announcement – and what an ideal investing strategy might be. We’ll stay on the case, though.

Having said that, there’s another development on the Birthright front that merits your immediate attention.

Having said that, there’s another development on the Birthright front that merits your immediate attention.

“When I first released my ‘American Birthright’ prediction,” says our Jim Rickards, “I thought this $150 trillion mineral boom would unfold slowly.”

Jim figured on an 18-24 month timeframe. But everything changed when China imposed export controls on rare-earth elements – and the Trump administration responded quickly.

Bottom line: “Three small companies stand to profit the most from President Trump’s mineral initiatives,” says Jim. “My research shows these three companies could dominate a $100 billion market within the next 12 months – creating potential gains of over 1,000% each.”

To learn how you can collect your share from what Jim calls “Phase II” of the Birthright story, just follow this link.

![]() A Week of Thrills ‘n’ Chills! (Yawn)

A Week of Thrills ‘n’ Chills! (Yawn)

“This could be the most consequential week for the economy in years,” CNN tells us.

“This could be the most consequential week for the economy in years,” CNN tells us.

Wow! It might be the most unforgettable week since the week of June 11, 2018 — when Bloomberg said we should brace ourselves for “the world economy’s most important week of the year.”

The G-7 summit had just wrapped up, Donald Trump was meeting with North Korea’s Kim Jong Un, most of the world’s major central banks were holding meetings or issuing statements…

Yeah, you don’t remember any of that, do you?

But this is what the media does now and then to try to command your attention.

Don’t get us wrong: CNN’s laundry list this morning is, if nothing else, comprehensive: “A slew of crucial economic data is set for release this week, including the jobs report, inflation, consumer confidence and corporate earnings. We’ll get the first glimpse at America’s second-quarter gross domestic product, the broadest measure of the economy.

“And, most crucially, the Federal Reserve will decide whether to cut rates or hold steady one more time. As if that weren’t enough, Trump’s trade policies also come due…”

All of it is short-term consequential, and we’ll of course keep tabs on it. But the media needs to get a grip: A few years hence, no one’s going to look back on the week of July 28, 2025 and say, Whoa, that changed everything!

Amid the backdrop of a trade agreement between the United States and the European Union, the major U.S. stock indexes start the week barely in the green.

Amid the backdrop of a trade agreement between the United States and the European Union, the major U.S. stock indexes start the week barely in the green.

Only four more days remain before Trump’s self-imposed tariff deadline: If other countries don’t come to terms, Washington will impose tariffs at or near the levels announced on “Liberation Day” last April 2.

Yesterday, Trump reached an agreement with EU leaders — in which Europe’s exports to America will be subject to a 15% tariff.

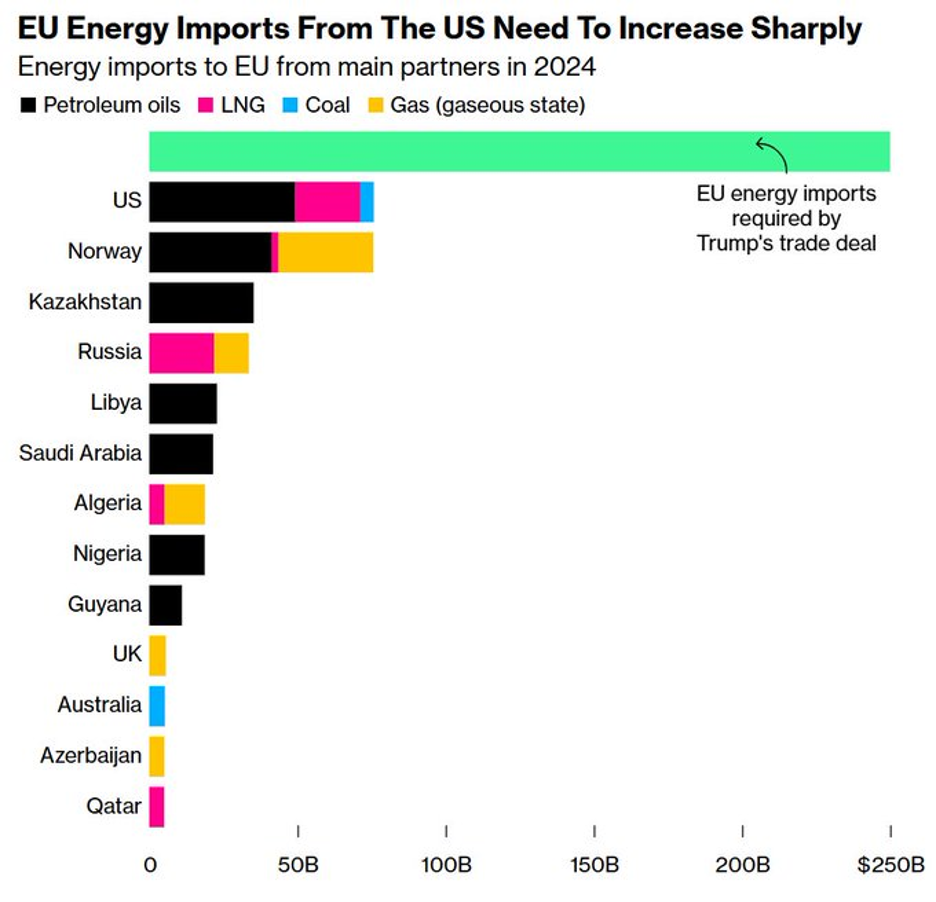

But once again, the details are fuzzy. Supposedly Europe is going to buy $250 billion of American energy every year for the next three years.

That’s going to be a steep climb based on this Bloomberg chart, drawn on figures from the EU’s statistics agency Eurostat.

In a similar vein, we’re now learning how Japan is going to be “investing” $550 billion in U.S. projects under its deal struck with Washington last week. Turns out that according to Japan’s chief negotiator, at least 98% of that total will be in the form of loans.

At the same time, some other trade-and-tariff deadlines are shifting…

At the same time, some other trade-and-tariff deadlines are shifting…

- The August 12 target to reach a deal with China will likely be pushed back another 90 days. U.S. and Chinese negotiators are meeting today in Stockholm, Sweden

- Trump has suddenly shortened the September 2 deadline for Russia to reach a cease-fire with Ukraine. Now he says it’s “10-12 days.” So, no later than Aug. 9 – at which point Russia’s trading partners will supposedly be subject to “secondary tariffs” of 100%.

In the meantime, the S&P 500 is still inching higher into record territory — up five points at last check and only seven points away from the 6,400 mark. The Nasdaq is also up a tad from Friday’s record close.

In the meantime, the S&P 500 is still inching higher into record territory — up five points at last check and only seven points away from the 6,400 mark. The Nasdaq is also up a tad from Friday’s record close.

Gold continues to lose ground after last week’s smackdown — off another $23 to $3,312. Silver is flat at $38.08. Bitcoin hovers just over $118,000.

The big mover today is crude — up 2% at $66.49 after the OPEC+ nations announced no changes to their current production policy.

![]() The Most Hated Tax Cut In History (Still)

The Most Hated Tax Cut In History (Still)

Donald Trump might be proud of his “Big, Beautiful Bill” but a majority of Americans don’t care for it, if a Wall Street Journal poll is to be believed.

Donald Trump might be proud of his “Big, Beautiful Bill” but a majority of Americans don’t care for it, if a Wall Street Journal poll is to be believed.

The poll finds only 42% of those surveyed supporting the bill, while 52% oppose it. Obviously there’s a huge partisan split… but among independents, 54% disapprove.

“Nearly 70% of overall poll respondents said the law would help the wealthy,” says the WSJ summary — “while just 7% said that group would be hurt. At least half of poll respondents said the legislation would harm poor people, the working class, Social Security beneficiaries, the U.S. economy, Medicaid recipients, nutrition-assistance recipients and the federal budget deficit.”

None of this is especially surprising. Trump was fixated on a kitchen-sink tax-and-spending bill that in its final form ran to 887 pages.

There was no effort to sell the American people on the necessity of the bill’s most important provision — making the 2017 Trump tax cuts permanent. No one was out there screaming to folks that if Congress didn’t act, Obama-era tax rates would come back. No one warned folks in the 22% tax bracket that they’d be going back to 25%, for example.

Really, how many people were even aware of that possibility?

Then again, the Trump 45 administration screwed the PR pooch with the original tax cuts, too.

Then again, the Trump 45 administration screwed the PR pooch with the original tax cuts, too.

“The Most Hated Tax Cut In History” I called it one day in 2019.

For too many Americans, the benefits of the tax cuts were neither tangible nor visible.

➢ Contrast all of this with the Dubya Bush tax cuts early in this century — when folks got a check in the mail.

Supposedly the GOP learned its lesson this time around, says the Journal: “Some new tax cuts started this year and will show up in larger tax refunds in early 2026 — before the midterms. That was an intentional choice in contrast to the 2017 tax law.”

We shall see…

![]() Passings: Tom Lehrer

Passings: Tom Lehrer

Just in case you’re of a certain age – honestly your editor is too young – the song satirist Tom Lehrer has died. He was 97.

Just in case you’re of a certain age – honestly your editor is too young – the song satirist Tom Lehrer has died. He was 97.

Lehrer’s imagination summoned a brilliantly mordant take on nuclear war – a topic we muse on in this space now and then because there won’t be any economy or markets for us to write about if nukes start flying.

Enjoy this rendition of “We Will All Go Together When We Go”...

Lehrer wrote and performed little after the early 1970s – perhaps because, as he once remarked, “Political satire became obsolete when Henry Kissinger was awarded the Nobel peace prize.”

At least Lehrer had the satisfaction of seeing Henry the K kick the bucket first. RIP…

![]() “We Used To Make **** In This Country”

“We Used To Make **** In This Country”

“JOB WELL DONE!!” a reader enthuses after our 2025 update of “From JFK To Jeffrey Epstein.”

“JOB WELL DONE!!” a reader enthuses after our 2025 update of “From JFK To Jeffrey Epstein.”

But he wishes for more…

“I would like to see your indepth analysis a bit more tied to the ‘numbers’ of how our markets behaved or the impact on the GDP or other measures.

“Perhaps more simply put: Correlate the JFK killing to financial/economic etc. changes — on a yearly basis? — up to Epstein's death. How all the fine points you are making may have impacted our economy/investments/returns, etc.?

“I very much appreciate the history but request that your findings be tied more to what happened to our economy from the early 1960s to today. THANKS!”

Dave responds: An intriguing inquiry… but this isn’t a case where stock market averages or GDP figures tell the whole story.

Obviously both of them have soared in the last six decades. But what about the rising standard of living and the shared sense of middle-class prosperity that marked the era between the end of World War II in 1945 and JFK’s murder in 1963?

It’s gone.

Counterfactual history is always a dicey thing… but perhaps JFK would not have embarked on his successor’s ruinously expensive “guns and butter” program. LBJ’s mushrooming welfare-warfare state proved so costly that by 1971, Richard Nixon blew up the Bretton Woods agreement and severed the dollar’s final link to gold.

Without any gold backing for the currency, it was easy-peasy for Washington to crank out all the dollars it wanted, send them overseas and get voluminous inexpensive consumer goods in return. Such a deal!

But the result was the hollowing-out of America’s industrial capacity and the “financialization” of the economy.

In the immediate post-WWII years the FIRE sector (finance, insurance, real estate) made up under 10% of the economy. Nowadays it’s between 20-25%.

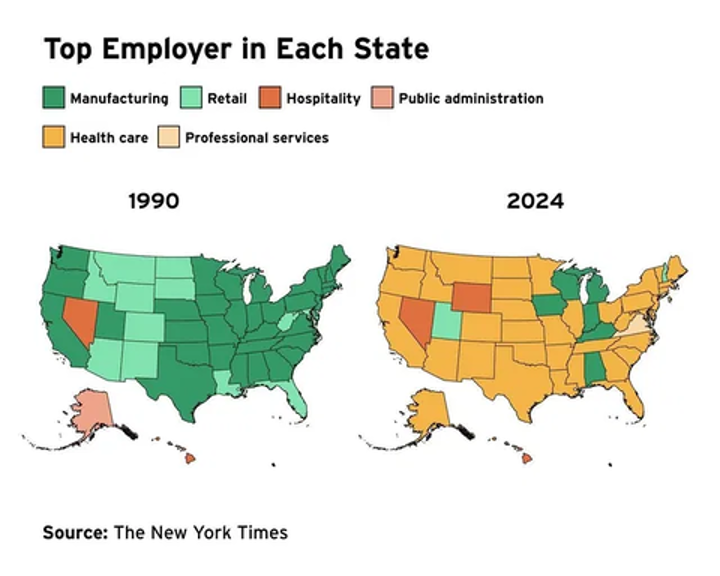

Meanwhile, here’s a map that’s been making the rounds online in recent weeks. I can’t vouch that it’s 100% accurate. But look at how health care — a profoundly extractive industry as I chronicled this past spring — has become the leading employer in over half the states.

The present state of affairs was summed up neatly more than 20 years ago by the union boss Frank Sobotka during Season two of The Wire: “We used to make s*** in this country, build s***.

“Now we just put our hand in the next guy’s pocket.”

It can’t last forever. It nearly came to an end in 2008 and again in 2020 — but both times, the powers that be conjured gobs and gobs of additional funny money to keep the scam going a while longer.

Next time, you’ll want to own as much tangible wealth, and the companies that produce it, as you can — gold, silver, copper, uranium and so on.

Real things will matter again as the post-JFK, post-Bretton Woods “financialized” economy goes through an inevitable reset.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets