Got Flashlights?

![]() Signs of the Times

Signs of the Times

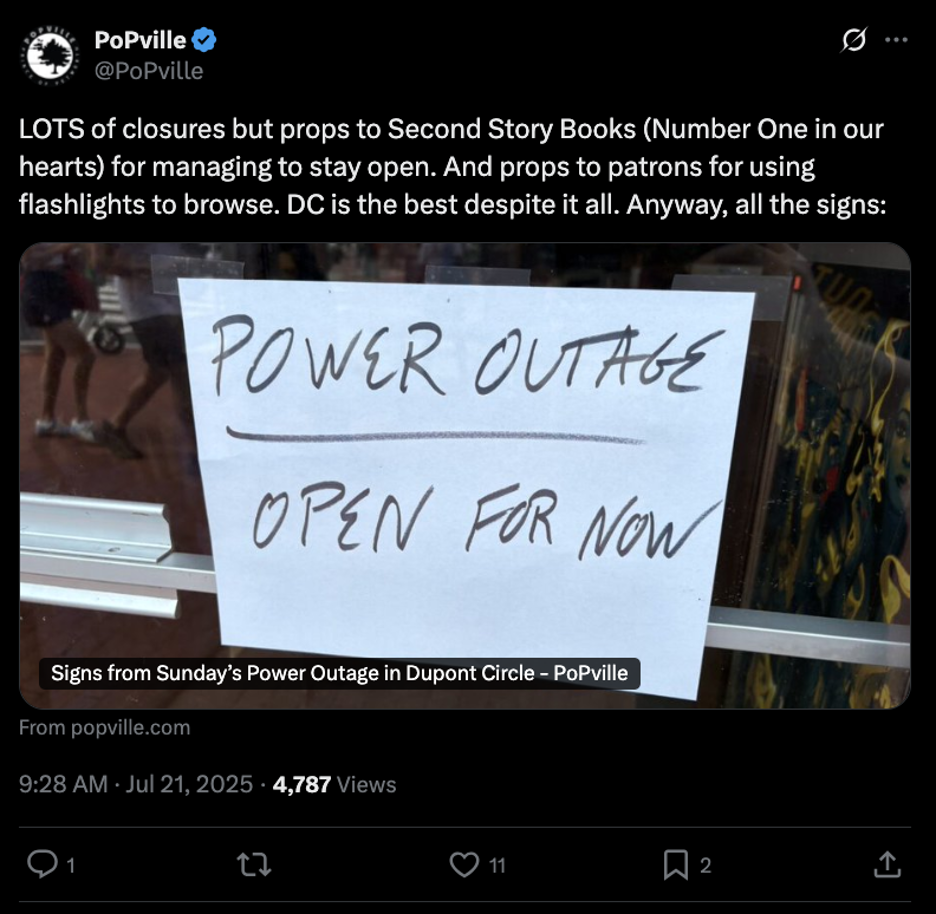

Residents near Dupont Circle in D.C. experienced multiple power outages this past weekend, highlighting the serious strain on Pepco’s service in the PJM region.

Residents near Dupont Circle in D.C. experienced multiple power outages this past weekend, highlighting the serious strain on Pepco’s service in the PJM region.

The trouble started last Thursday after a reported equipment failure and fire at Pepco’s 22nd Street substation, triggering blackouts that have affected about 1,800 customers.

Darkened streets, shuttered businesses and no air conditioning — in the middle of a D.C. July! — have turned this outage into far more than a minor inconvenience.

Pepco says outages stem from “equipment issues, along with increased demand from summer heat and intermittent storms,” which have overloaded the system.

Crews have been working nonstop to repair the damage, but outages are expected through the end of July. And Pepco spokesperson Rod Wilson warns more customers may face intentional outages (aka rolling blackouts) to protect the grid from wider failures.

As the grid groans under the strain, this is a stark reminder: The power problems gripping the PJM region are only getting worse…

That growing pressure was reflected just days ago in PJM Interconnection’s latest capacity auction, where prices surged to $329.17 per megawatt-day — a full 22% higher than last year’s record highs.

That growing pressure was reflected just days ago in PJM Interconnection’s latest capacity auction, where prices surged to $329.17 per megawatt-day — a full 22% higher than last year’s record highs.

This auction sets the price paid to power plants for guaranteeing electricity during peak demand, and the jump shows just how tight the supply-demand balance has become across PJM’s 13-state grid plus D.C.

These payments are separate from what power companies earn by selling electricity day to day. Instead, they’re meant to guarantee that power will be available during critical times — think very hot summer days or freezing winter nights.

Notably, one independent producer secured 6,702 megawatts in the auction, which translates to about $805 million in revenue for the 2026–27 time period. That’s a big win for the company, and a sign of what’s happening across the industry.

So what’s driving the price spike?

In short, demand is growing — fast. Much of it is coming from massive data centers, especially in Virginia's “Data Center Alley,” which is one of the most high-powered tech hubs in the world.

In short, demand is growing — fast. Much of it is coming from massive data centers, especially in Virginia's “Data Center Alley,” which is one of the most high-powered tech hubs in the world.

These facilities, which support things like cloud storage and AI computing, use massive amounts of electricity around the clock.

But the grid’s supply hasn’t kept up. With fewer power plants being built in recent years — and several coal and nuclear plants decommissioned — the PJM territory is facing a severe crunch.

The Pennsylvania-New Jersey-Maryland Interconnection (PJM) is in off-white…

That imbalance is causing auction prices to soar, making it more profitable for existing power providers — and heartening investors. Shares of other companies in the region, like NRG Energy and Constellation Energy, have already climbed on the news.

This latest auction result is a signal that the energy landscape in the U.S. is shifting fast.

More people, more technology and more extreme weather mean more electricity demand. And unless new supply comes online soon, companies already in place, particularly those with major positions in the PJM grid, are likely to benefit.

For those of us who've been following this story closely — especially Paradigm’s Enrique Abeyta at The Maverick trading service — the big-picture takeaway is clearer than ever: Power producers with strong footholds in high-demand regions are in a position to thrive.

The market’s rewarding that level of preparation, so when The Maverick opens to new subscribers, you’ll be the first to know.

![]() Clearing the Runway

Clearing the Runway

The Federal Aviation Administration (FAA) has taken a step into the future of flight by revamping its regulations on light-sport aircraft. In a move welcomed by pilots and manufacturers alike, the new Modernization of Special Airworthiness Certification (MOSAIC) rule dramatically paves the way for innovation.

The Federal Aviation Administration (FAA) has taken a step into the future of flight by revamping its regulations on light-sport aircraft. In a move welcomed by pilots and manufacturers alike, the new Modernization of Special Airworthiness Certification (MOSAIC) rule dramatically paves the way for innovation.

Transportation Secretary Sean Duffy captures the sentiment: “Our recreational pilots and plane manufacturers have correctly noted outdated regulations were inhibiting innovation and safety… Let’s bring this industry into a new age!”

The MOSAIC rule isn’t a minor update; it’s a game changer:

- Increased weight and speed limits: Light-sport aircraft can now be heavier and faster, opening up options for stronger, safer designs

- More versatility: The rule allows for retractable landing gear and additional seating, making these planes more practical

- “New types of propulsion and modern avionics”: Simplified flight controls, for instance, are now permitted, encouraging manufacturers to experiment with the latest tech

- Expanded pilot privileges: Sport Pilot license holders can now operate a broader range of aircraft.

As aviation policy writer Eli Dourado points out: Strict regulations have slowed the pace of progress for years. “The system of permissionless innovation under which the Wright brothers worked,” he reminds, “is directly responsible for us having aviation at all.

“The safety continuum makes sense,” Dourado concedes at Substack. “At the other end, [there] are some pretty big benefits to allowing experimentation.”

“The safety continuum makes sense,” Dourado concedes at Substack. “At the other end, [there] are some pretty big benefits to allowing experimentation.”

Dourado points out, for instance, that advancements — like the use of composite materials in plane manufacturing — often appear on small aircraft first, then trickle up to large airliners.

Another overlooked advantage? Relaxed rules make it easier for newcomers to the industry to hire talent.

“You could have trouble finding engineers with Part 25 experience” — think Boeing and Airbus engineers — “but fortunately, it's relatively easy to find engineers who have built experimental or Part 23 aircraft before,” Dourado explains.

“Basically, there are huge benefits to having a bias toward allowing innovation and experimentation, and there are actually huge safety costs to overregulating this industry,” says Reason, “since innovation will be crippled and we'll lose out on unseen, unknowable advancements.”

As Dourado concludes, the FAA is “opening the door to a bigger market and vastly more innovation.”

[Congrats, by the way, to Paradigm Mastermind Group subscribers for cashing out half their position on an “air Uber” play yesterday — for a stellar 96% gain!]

![]() Big Tech Winners (and One Loser)

Big Tech Winners (and One Loser)

Three “Magnificent 7” tech giants reported earnings on Wednesday afternoon.

Three “Magnificent 7” tech giants reported earnings on Wednesday afternoon.

Bad news first: Tesla (TSLA) earnings basically stunk. The company’s revenue was $22.5 billion, slightly above forecasts, but still down 12% compared to the same quarter last year — marking Tesla’s largest quarterly revenue drop in over a decade.

Vehicle deliveries dropped to 384,000 for the quarter, down from 444,000 a year ago. And Tesla’s profit from its everyday business dropped 42% YoY, falling to less than $1 billion. (Notwithstanding, the company ended the quarter with a strong cash position of nearly $37 billion.) Today? TSLA shares are down over 9%.

This in contrast with Google’s parent company Alphabet (GOOG) which reported strong Q2 2025 earnings, beating expectations with revenue of $96.4 billion versus the $94 billion forecast and earnings per share (EPS) of $2.31 versus $2.18 expected. Revenue rose 14% year-over-year, driven by 32% cloud growth and solid gains in search and YouTube ads.

Despite strong profitability, Google raised its capital expenditures forecast to about $85 billion for 2025 — up from $75 billion. GOOG shares are up about 1% today.

Finally, Microsoft (MSFT) reported solid results with revenue of about $70.1 billion, up 13% year-over-year, driven by continued demand for its cloud services and AI offerings.

Operating income increased 16% to $32 billion, and net income rose 18% to $25.8 billion, leading to diluted earnings per share (EPS) of $3.46 — again, beating expectations. At the time of writing, MSFT is up over 1%.

As for the broader stock market today, two of the three major indexes are in the green. The S&P 500 and Nasdaq are both up about 0.20% to 6,370 and 21,000 respectively. The Big Board, meanwhile, is down 0.50% to 44,795.

As for the broader stock market today, two of the three major indexes are in the green. The S&P 500 and Nasdaq are both up about 0.20% to 6,370 and 21,000 respectively. The Big Board, meanwhile, is down 0.50% to 44,795.

Taking a peek at commodities, the price of crude is up 0.40% to $65.55 for a barrel of WTI. Precious metals, on the other hand, are slumping today. Gold is priced at $3,372.50 per ounce, and silver — at $39.22 — is down 0.70%. Not to be forgotten, Bitcoin’s hanging out at $118,525. But Ethereum’s charging up 2.25% to $3,680.

Last, in terms of market notes, we have a few middling economic numbers to report, including a few surprises:

- Jobless claims for the week ending July 19 unexpectedly fell by 4,000 to 217,000, marking the sixth-consecutive weekly decline and the lowest level since April. This figure was notably below forecasts, which expected claims to rise to about 227,000

- Flash PMI (Purchasing Managers’ Index) for July: The services sector is growing steadily, with a PMI reading of 55.2 — its highest reading in seven months. But manufacturing is contracting for the first time this year, with a PMI of 49.5 (below 50 indicates shrinking activity). Composite PMI hit 54.6, suggesting the U.S. economy is expanding at a 2.3% annualized rate, up from an estimated 1.3% last quarter.

And new home sales in June reached a seasonally adjusted annual rate of 627,000, which is slightly higher than the 623,000 in May. Year-over year, however, this figure is 6.6% lower and seriously below analysts’ expectation of 650,000 sales.

![]() Just up Ahead: Gold $4,000

Just up Ahead: Gold $4,000

“We are entirely comfortable saying that gold will reach $4,000 per ounce (or higher) before the end of 2025,” forecasts Paradigm’s macro maven Jim Rickards.

“We are entirely comfortable saying that gold will reach $4,000 per ounce (or higher) before the end of 2025,” forecasts Paradigm’s macro maven Jim Rickards.

Gold has entered a powerful new phase, Jim notes, reaching all-time highs above $3,400 per ounce in July. This marks an extraordinary surge from its October 2022 level near $1,620 — representing a 110% gain in less than three years.

The price surge took off notably in 2024, supported by expectations of Federal Reserve interest rate cuts, geopolitical tensions — especially in the Middle East — and major economic events.

A few key milestones for gold? A peak around $2,685 per ounce following a Fed rate cut in late 2024 plus a steady climb thereafter driven by central bank buying and safe-haven demand.

On the supply-demand side, global annual gold mining production has remained steady at about 3,500 metric tonnes for the past decade, while central banks — particularly Russia and China — have ramped up reserves from about 600 metric tonnes in 2010 to over 2,000 tonnes each today.

Other nations like Turkey, India and Kazakhstan are also significant buyers, creating strong demand amid limited new supply. “With supply constant and demand surging, gold [declines] will be short-lived as the central banks put a de facto floor under the price…

“At the same time, gold’s upside is unlimited,” Jim says. “There’s a simple bit of math combined with behavioral psychology that could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.

“At the same time, gold’s upside is unlimited,” Jim says. “There’s a simple bit of math combined with behavioral psychology that could propel gold prices to the $10,000 per ounce level in far less time than most analysts believe.

“What investors don’t realize [is] that each $1,000 per ounce gain is easier than the one before,” Jim notes. For example, moving from $1,000 to $2,000 is a 100% increase, but from $3,000 to $4,000 is only about a 33% increase.

“This math” — and investor psychology — “is what gives rise to a gold buying frenzy,” he adds. “Once the frenzy kicks in those $1,000 benchmarks will be surpassed quickly. That’s why $4,000 per ounce is a comfortable forecast.

“And that’s why it’s not too late to become a gold investor,” says Jim. “Gold buying has been limited mostly to central banks and large institutions such as sovereign wealth funds (SWFs). Retail interest in the U.S.,” he says, “has been slight.

“Don’t kick yourself about the gains you’ve missed,” he emphasizes. “Instead, look forward to the gains that are coming.”

[Memo From Jim Rickards: “When I first dropped my ‘American Birthright’ prediction,” says Jim, “I thought this $150 trillion mineral boom was on a slow burn — giving us 18–24 months before the next big mining catalyst. I was wrong. Dead wrong.

“China’s mineral export bans have forced the president to act fast, accelerating the timeline. Now, Phase II of Trump’s mineral boom is about to kick off in mere days.

“From my sources, three small mining companies, each under $500 million market cap, are positioned to benefit massively, servicing a $150 trillion national security-backed initiative. These firms could dominate a $100 billion market within a year, with potential gains of 1,000% or more each.

“I want you in early,” Jim adds. “Watch my briefing now.”]

![]() “Dollar Store” Diplomacy

“Dollar Store” Diplomacy

Indian cops discovered a wild diplomatic scheme fit for a comedy: a full-blown “embassy” tucked inside a rental near New Delhi.

Indian cops discovered a wild diplomatic scheme fit for a comedy: a full-blown “embassy” tucked inside a rental near New Delhi.

Harshvardhan Jain, 47, cosplayed as an ambassador for exotic-sounding countries like Seborga and Westarctica (Spoiler: You won’t find them on an official map). He promised overseas jobs and collected cash for the dream.

When police swooped in on Jain’s operation, the place had all the trimmings. International flags? Check. Four cars with counterfeit diplomatic license plates? Absolutely. A stash of nearly 4.5 million rupees (about $52,095) and assorted foreign currencies? Of course.

Courtesy: Uttar Pradesh Police Special Task Force

Jain’s flair for the dramatic didn’t stop there; police found doctored photos of him arm-in-arm with several world leaders, plus fake official seals from India’s foreign ministry and about three dozen other countries, all part of the stagecraft.

His performance, unfortunately for Jain, got bad reviews from law enforcement. Alongside impersonating an ambassador, he’s been hit with charges of forgery and laundering money through shell companies abroad.

As authorities shut down his “embassy,” one wonders: Was Jain just auditioning for the next Borat sequel?

Take care, reader! We’ll have a fresh 5 Bullets on Friday…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets