Apple’s Rare Earth Alliance

![]() Cupertino Meets Nevada

Cupertino Meets Nevada

Apple (AAPL) invested $500 million in Vegas-based MP Materials (MP), a move that’s shaking up global supply chains and challenging the dominance of international players in rare earth magnets.

Apple (AAPL) invested $500 million in Vegas-based MP Materials (MP), a move that’s shaking up global supply chains and challenging the dominance of international players in rare earth magnets.

Here’s why this is a game changer: MP Materials is widely recognized as the only fully integrated rare earth element (REE) producer in the United States.

Apple CEO Tim Cook himself calls this partnership a testament to “American innovation.”

He adds: “Rare earth materials are essential for making advanced technology, and this partnership will help strengthen the supply of these vital materials here in the U.S.”

Specifically, the neodymium magnet is a very strong, permanent magnet made from an alloy of neodymium, iron, boron and more. It’s the most powerful type of rare-earth magnet commercially available.

Courtesy: Ames Laboratory

These magnets are the backbone of iPhones, electric vehicles, wind turbines and, yes, even America’s next-generation defense technology.

According to Apple, the plan is to create “an entirely new pool of U.S. talent and expertise in magnet manufacturing,” with magnets from Texas shipped worldwide to feed the insatiable demand for REE-based products.

The Apple-MP alliance is all-in on transforming the industry, building not only massive manufacturing lines but also a dedicated rare earth recycling facility at Mountain Pass, California.

The Apple-MP alliance is all-in on transforming the industry, building not only massive manufacturing lines but also a dedicated rare earth recycling facility at Mountain Pass, California.

It’s a farsighted vision: American workers. American mining. American tech. The stuff Jim Rickards calls our “American Birthright.”

For years, the U.S. has been dangerously dependent on foreign (mainly Chinese) supply for REE.

That’s why Apple’s partnership with MP Materials marks more than a business deal; it’s a shot across the bow for global competitors and a clarion call to American miners and policymakers alike.

The plan is ambitious. Not only will MP ramp up magnet manufacturing for Apple, but the recycling operation at Mountain Pass will process scrap mining output as well as recycled feedstock from old iPhones.

Apple says nearly all the magnets in its devices are already made from 100% rare earths, and it’s working to innovate even further by exploring “novel magnet materials [to] enhance magnet performance.”

This collaboration represents a new dawn for American mining and manufacturing, laying the groundwork for a self-reliant nation, one powered by the ingenuity, grit and resolve that built America in the first place.

As the global appetite for rare earths grows, the world will be watching Apple and MP Materials deliver the supply chain independence Jim Rickards champions, inspiring a full-scale revival of America’s strategic industries.

One thing’s certain: The race for rare earth elements is on, and for those ready to mine, manufacture, build — and recycle — the future’s bright.

[Ed. note: This Thursday, July 31st, a major event tied to Apple is set to spark explosive gains — in one case, up to 7,100% in just six days.

This isn’t insider gossip or Wall Street rumor. Instead, it’s intelligence sourced directly from a top-secret AI tool — one used by only three entities globally, including a $48-billion hedge fund.

For reasons you’re about to see, you must act before 4pm ET on Thursday, or you could miss out on this trade opportunity entirely.]

![]() An Earnings Season Undercurrent

An Earnings Season Undercurrent

“The slow, steady grind continues this week,” says Paradigm’s pro market analyst Greg Guenthner. “[Monday] managed to eke out small gains.” But he warns momentum may be fading, with markets “starting the day off higher only to fade into red” as earnings season intensifies.

“The slow, steady grind continues this week,” says Paradigm’s pro market analyst Greg Guenthner. “[Monday] managed to eke out small gains.” But he warns momentum may be fading, with markets “starting the day off higher only to fade into red” as earnings season intensifies.

Greg highlights Novo Nordisk’s (NVO) cut to guidance, “due to what it says is lighter demand for Ozempic and Wegovy,” sending shares down “as much as 20%.”

This sets a tense backdrop for looming earnings from giants including META, MSFT, AAPL and AMZN. “Can these stocks impress investors? Or are we in for some corrective action should they come up short?”

Greg observes: “The breakneck rallies in the tech theme baskets are quickly cooling,” citing a “slow bleed lower” among AI, quantum, drone and flying car stocks.

Even the ARK Innovation ETF (ARKK), propped up recently by strong performers like Robinhood (HOOD) and Roblox (RBLX), “has made no progress since last Tuesday and is likewise at the mercy of key earnings reports.”

Looking at sector strength, Greg notes: “Semis are holding up decently well… AMD has been hot… and NVDA is quietly back on track.” Despite caution, “it’s hard to get too bearish with these stocks looking so strong.”

“Overall, my trading plan hasn’t changed. I’m not going to force anything in this tape,” Greg says.

“Overall, my trading plan hasn’t changed. I’m not going to force anything in this tape,” Greg says.

“Just a few weeks ago, we were able to rotate through several quick-hit trades because all the fast movers were only going up. Now that these red-hot areas of the market are cooling, I’m looking for additional cracks that could signal its time for stocks to finally consolidate or move lower for a few weeks, at minimum.

“It’s almost August, and we’ve yet to see any significant consolidation following the rally off the April lows. Seasonally, this is the perfect time for stocks to shake out some weak hands.”

Greg adds: “Remember, we’re almost exactly a year removed from the Yen scare that tanked the averages heading into August. While I’m not saying the same thing needs to happen again, it’s important to mentally prepare for these scenarios.

“This market has lulled many traders to sleep,” he concludes. “If you’re not ready for some downside, you can easily be caught off guard and make poor decisions.”

Taking a look at the stock market today, the Big Board is down 0.10% to 44,575. The tech-heavy Nasdaq, on the other hand, is up 0.25% to 21,155 while the S&P 500 is up 0.10% to 6,375.

Taking a look at the stock market today, the Big Board is down 0.10% to 44,575. The tech-heavy Nasdaq, on the other hand, is up 0.25% to 21,155 while the S&P 500 is up 0.10% to 6,375.

As for commodities, oil is up 0.60%, just under $70 for a barrel of WTI. Precious metals? Gold and silver are both losing steam. The price of gold’s down 0.80% to $3,354.10 per ounce, and silver’s down 1.40% to $37.75.

The crypto market, meanwhile, is in the green. Bitcoin is up 0.60% to $118,200 while Ethereum’s up 0.50% to $3,785.

Jim Rickards anticipates the Federal Reserve will continue its pause in cutting interest rates at this week’s FOMC meeting, keeping the federal funds target at 4.50%.

Jim Rickards anticipates the Federal Reserve will continue its pause in cutting interest rates at this week’s FOMC meeting, keeping the federal funds target at 4.50%.

He notes inflation has been creeping higher in recent months, while unemployment remains steady and low by historical standards, giving the Fed more reason to prioritize inflation over job growth for now.

Jim expects the Fed to signal ongoing caution, especially as Chair Jay Powell is unconvinced that recent tariff hikes won’t stoke further inflation.

Jim argues the Fed is “not leading the market, they’re following it,” pointing out that short-term market rates like Secured Overnight Financing Rate (SOFR) and Treasury bills are already below the Fed’s target.

He warns that continued pauses in rate cuts are less about stimulating the economy and more about the Fed lagging behind real economic conditions. “The truth is that the Fed does not understand the economy and is almost irrelevant.”

Tomorrow, we’ll feature Jim’s post-FOMC meeting roundup.

![]() Another Threat to the Power Grid

Another Threat to the Power Grid

The current national waiting time for a new transformer has soared to 127 weeks — more than two years. For highly specialized transformers, the wait can stretch as long as four years.

The current national waiting time for a new transformer has soared to 127 weeks — more than two years. For highly specialized transformers, the wait can stretch as long as four years.

Transformers lower high-voltage electricity so it’s safe for homes and businesses. While U.S. policy now encourages domestic manufacturing — with the Build America, Buy America rules — these requirements clash with the reality that only about 20% of the equipment used by America’s grid is made domestically.

Even without these rules, global demand is overwhelming. Elevated by “aging grid infrastructure, new renewable-energy generation, expanding electrification, increased EV charging stations, and new data centers...demand is coming from all over the world,” according to IEEE Spectrum.

Production is ramping up, but increases are slow, as many transformers must be custom-built for each installation rather than mass-produced. This complicates efforts to meet demand quickly.

A major concern lies beyond manufacturing delays: transformers are extremely vulnerable to electromagnetic pulses (EMPs) from solar storms (or atomic bombs).

A major concern lies beyond manufacturing delays: transformers are extremely vulnerable to electromagnetic pulses (EMPs) from solar storms (or atomic bombs).

While militaries have hardened their systems against EMPs, civilian infrastructure remains dangerously exposed. “Nothing comparable has been done for civilian infrastructure,” Oilprice.com notes, leaving the bulk of the grid open to catastrophic failure if such a massive event were to occur.

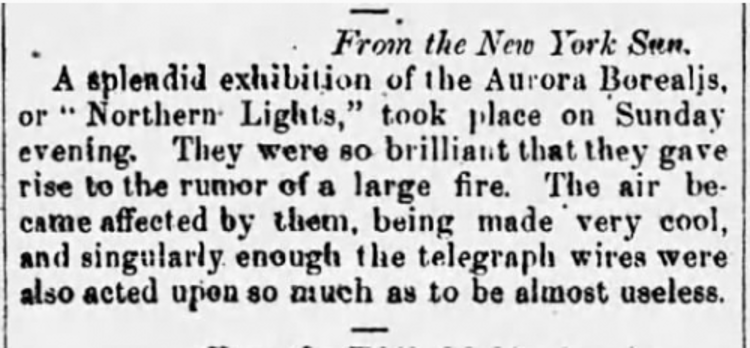

The last solar storm strong enough to cripple the grid happened in 1859, when society wasn’t nearly as electrified.

The Cahaba Gazette, Alabama: Sept. 9, 1859

Today, a similar event would be disastrous — and with multi-year waits for new transformers, recovery would be painfully slow. This critical vulnerability demands attention, as does the urgent need to upgrade our electrical infrastructure.

![]() Elon’s Long Game

Elon’s Long Game

“Tesla stock dropped 9% after reporting its second straight quarter of declining auto sales,” says Paradigm editor Davis Wilson at The Million MIsson

“Tesla stock dropped 9% after reporting its second straight quarter of declining auto sales,” says Paradigm editor Davis Wilson at The Million MIsson

“The company warned that more rough quarters could be ahead, thanks to softening demand and the expiration of EV tax credits.

“But instead of addressing the core business,” Davis says, “Musk went full showman.

“He promised that robotaxis would reach half the U.S. population by the end of this year — yet another bold claim that conveniently steers attention away from Tesla’s very real problems.

“It’s a pattern. Musk knows how to control the narrative better than anyone.

“When the numbers don’t cooperate, he sells the dream.

“And too often, people buy it. Please don’t be one of those people…

“Buried in Tesla’s earnings call,” Davis says, “was one quote that is worth paying attention to.”

“Buried in Tesla’s earnings call,” Davis says, “was one quote that is worth paying attention to.”

According to Elon…

Batteries are going to be a massive thing… I think not [many] people appreciate just how gigantic the scale of battery demand is.

The sustained power output from the U.S. grid is around 1 TW, but average usage is less than half of it. If you add batteries to the mix, you can run the power plants 24/7 at full capacity. More than doubling the energy output per year of the United States, just with batteries.

“While I don’t always trust Elon’s timelines, his insights into specific industries are hard to beat.

“If he’s right, lithium demand is poised to surge,” Davis notes. “I’ve been following Albemarle (ALB) and Lithium Americas (LAC) closely for nearly a decade.

“Right now, much like energy stocks in the late 2010s and after the COVID downturn, no one wants to touch them.

“But that’s often exactly when the biggest gains are made.”

Davis’ key takeaway: “Energy was once written off — until it wasn’t. The same setup could be unfolding for lithium today.”

We’ll be turning our full attention to lithium in Friday’s issue. You’ll want to stay tuned.

![]() Mailbag: She’s a Keeper?

Mailbag: She’s a Keeper?

“Brava to Emily Clancy. Please keep her around!” a contributor writes after reading last week’s “Got Flashlights?” issue.

“Brava to Emily Clancy. Please keep her around!” a contributor writes after reading last week’s “Got Flashlights?” issue.

“Her report was one of the most interesting and insightful commentaries I have read at 5 Bullets. No defaming people or outlandish promises. No disheartening attempts to win the good graces of Trump. Just well-presented facts and discussion of pertinent issues. A breath of fresh air. More please!”

“Thank you, Emily!” says another reader in response to Saturday’s highlight issue featuring a burger chain’s controversy.

“Thank you, Emily!” says another reader in response to Saturday’s highlight issue featuring a burger chain’s controversy.

“I used to live in San Jose. Best place I've ever lived. I wish I could afford it — and hoping California can heal from disastrous progressive government.

“I'm writing to thank you for the In-N-Out Burger story. I have so many great California memories and that's one of them. I live in Florida now, so I'm very interested in any possible plans to expand into the East.

“Do they still have protein burgers wrapped in lettuce instead of bread? Looking forward to finding out in person someday.”

Emily: Thank you so much for your kind notes. As far as I know, after eight years on the team, I’m not going anywhere!

And thanks for sharing your memories of In-N-Out Burger. Per your question: Yes, In-N-Out still offers their burgers “protein style,” which means the burger is wrapped in lettuce instead of a bun.

Courtesy: innoutmenus.com

Is it lunchtime yet?

Here’s hoping you get to enjoy one again soon out East!

Take care! We’ll be back again tomorrow with another round of 5 Bullets…

Best regards,

Emily Clancy

Associate editor, Paradigm Pressroom's 5 Bullets