Uncle Sam’s Stock-Buying Spree

![]() Uncle Sam’s Stock-Buying Spree

Uncle Sam’s Stock-Buying Spree

Donald Trump is ready for the next target in his merger-and-acquisition spree.

Donald Trump is ready for the next target in his merger-and-acquisition spree.

After the federal government declared last Friday it would take a 10% stake in Intel, Commerce Secretary Howard Lutnick says the Trump administration is looking next at military contractors.

Asked this morning on CNBC whether other companies doing business with the feds are fair game, Lutnick replied, “Oh there’s a monstrous discussion about defense.”

He described Lockheed Martin, the world’s biggest military contractor, as “basically an arm of the U.S. government.”

He has a point. Last year, 73% of LMT’s total revenue came from U.S. government contracts.

Really, Lockheed’s fate has been tied to that of Uncle Sam’s going as far back as 1971 — when the company was on the verge of bankruptcy and the Nixon administration engineered a bailout in the form of $250 million in taxpayer-backed loans.

(Hey, that was a big amount of money back then…)

You take the government’s money, you dance to the government’s tune.

You take the government’s money, you dance to the government’s tune.

That’s always been the case. Federal subsidies leave you open to federal influence.

But until now it was never really in-your-face.

In many realms, Donald Trump doesn’t break from “norms” of governance as much as he simply says the quiet part out loud.

And so when Intel spent much of this year flailing for direction, Trump insisted last week that $8.9 billion in federal aid awarded during the Biden administration be converted into a government ownership stake totaling 10% of the company.

As I said just yesterday, it wasn’t the first such deal: The feds took a 15% stake in the rare earth firm MP Materials. There’s also the new stake in U.S. Steel.

And as we see today, it won’t be the last.

You might or might not like this “state capitalism” or “command capitalism.” But whatever your opinion, you have to understand how it will massively alter the flows of trillions of dollars.

You might or might not like this “state capitalism” or “command capitalism.” But whatever your opinion, you have to understand how it will massively alter the flows of trillions of dollars.

With that as the backdrop, we’re making an essential addition to the Paradigm team this week.

He’s Buck Sexton. You might recognize him as a radio talk-show host; in many cities he and his partner Clay Travis took over Rush Limbaugh’s old time slot.

But what makes him valuable to us — and to you, the reader — is his unique level of access inside the Trump White House, unlike anyone else in the newsletter biz.

Which is how he recently learned about an effort every bit as ambitious as the Manhattan Project during World War II.

The short story: The feds will be throwing their weight behind a technology priority so big, it will pump $2.2 trillion into the U.S. economy. The beneficiaries will include several small and little-known companies poised to deliver huge gains to early investors.

(Maybe the feds will take a stake in these firms, maybe not. Either way, the profit potential is undeniable.)

We’ll leave it there for today. Expect to hear more from Buck Sexton later this week — and over the holiday weekend.

In the meantime we turn our attention to the big market-moving story of the day…

![]() (Virtual) Standoff at the Fed

(Virtual) Standoff at the Fed

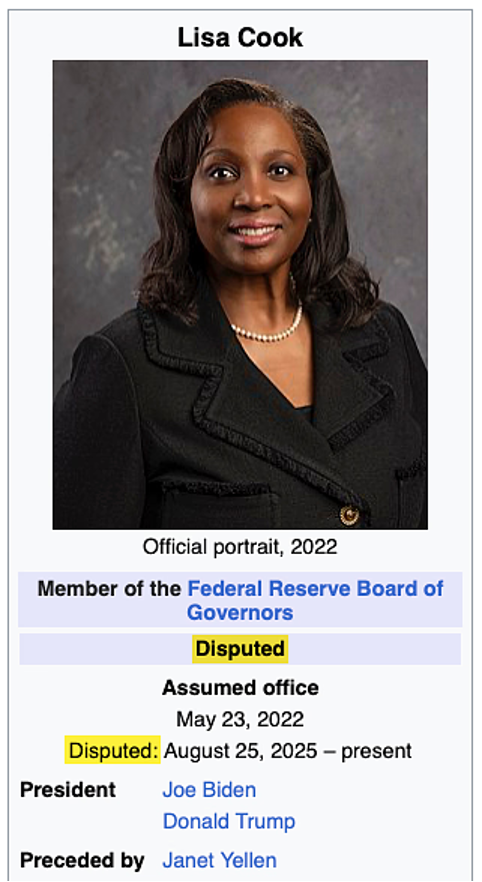

Well now, here’s a first. From the Wikipedia page of Federal Reserve Governor Lisa Cook…

Well now, here’s a first. From the Wikipedia page of Federal Reserve Governor Lisa Cook…

Last night, Trump informed Cook via a letter that she was fired. “I have determined that there is sufficient cause to remove you from your position.”

Cook, for her part, says she’s going nowhere. “President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so. I will not resign.”

Indeed she plans to sue — and she’s hired Washington super-lawyer Abbe Lowell to make her case. Lowell’s clients in the recent past have run the gamut from Hunter Biden to Ivanka Trump and her husband Jared Kushner. (Hmmm…)

So far today, there’s no evidence of an armed standoff outside the Marriner Eccles building in Washington — entertaining as such a prospect might be.

So let’s dig into this “for cause” business — because that’s at the heart of when the president has the authority to fire a Fed governor.

So let’s dig into this “for cause” business — because that’s at the heart of when the president has the authority to fire a Fed governor.

Last month when Trump was making noises about firing Fed chair Jerome Powell, Paradigm’s Jim Rickards dusted off his Wall Street lawyer credentials to help us unpack the legalities.

“In most circumstances,” Jim said, “cause would include any crime or even noncriminal activities if they constituted material misrepresentations, violations of internal policies and procedures, ignoring bad acts by others and any breaches of fiduciary duties to the institution. It might also apply to other breaches that might not be crimes such as fudging expense reports, diverting funds for unauthorized uses, etc.”

Does firing a Fed official simply for not lowering interest rates fast enough for the president’s liking constitute “cause”? Hard saying. Certainly it’s never been tested in court.

But lying on a mortgage application? That’s more clear-cut.

But lying on a mortgage application? That’s more clear-cut.

In 2021, Cook bought two homes — a house in Michigan (she was a professor at Michigan State at the time) and a condo in Georgia.

“They were purchased within two weeks of each other,” writes Eric Salzman for Matt Taibbi’s Racket News project — “and Cook listed both as her primary residence on her mortgage applications.”

➢ This primary-residence thing is not to be trifled with. When my wife and I moved to the Upper Midwest some years ago, we had a notion of arriving at our new home on the day of our wedding anniversary; we liked the symbolism. Well, that was the plan until we realized our anniversary fell just outside the 60-day window in which mortgage lenders typically expect you to move into a primary residence after closing. We adjusted our moving date accordingly.

“Unless Cook can show that this is all a big mistake,” Salzman writes, “she committed a felony.”

The head of the Federal Housing Finance Agency, Bill Pulte, has referred Cook’s case to the Justice Department.

“Was she targeted by Pulte?” asks Salzman. “Probably, although Pulte stated this was part of a wider investigation into mortgage fraud.”

The legacy media are all verklempt about “an extraordinary assault on the independence of the U.S. central bank,” as the Financial Times put it.

The legacy media are all verklempt about “an extraordinary assault on the independence of the U.S. central bank,” as the Financial Times put it.

Fed “independence” is a joke: Back in the 1960s, President Lyndon Johnson shoved Fed chair William McChesney Martin into a wall to reinforce his wishes for lower interest rates.

But much as we sneer at the Fed in these virtual pages, lots of people in financial markets take the Fed and its alleged independence very seriously.

Thus, the dollar is down today relative to other major currencies. And yields on U.S. Treasuries are up.

“Markets run on confidence. The dollar’s dominance runs on confidence. And Fed independence has always been a pillar of that system,” writes Paradigm’s recovering investment banker Sean Ring in today’s Rude Awakening.

“If traders, investors and foreign governments start to believe the Fed is no longer insulated from politics, they’ll price that risk in. That means higher borrowing costs for America. That means more volatility.

“But luckily for us, that means gold and silver should start ripping higher in their roles as safe havens.”

Indeed, the gold price popped last night in electronic trading shortly before Trump’s announcement — the latest in a series of suspicious market moves this summer.

Indeed, the gold price popped last night in electronic trading shortly before Trump’s announcement — the latest in a series of suspicious market moves this summer.

At last check, the Midas metal is up nearly $22 to $3,386 — a two-week high. Silver’s gain is weaker, up 7 cents to $38.57.

After modest losses yesterday, the major U.S. stock averages are all in the green, but not by much. The S&P 500 is up less than four points to 6,442.

Oil is falling hard from three-week highs, a barrel of West Texas Intermediate down over 2% to $63.41.

➢ One economic number of note today: Durable goods orders fell 2.8% last month, but the number was skewed by a drop in aircraft orders. If you exclude aircraft and military hardware — both very lumpy from month to month — orders for “core capital goods” registered a solid 1.1% jump.

![]() Tesla Insider Speaks Up

Tesla Insider Speaks Up

“This wasn’t a carefully scripted investor day or a viral tweet,” says Paradigm contributor Davis Wilson, editor of our sister e-letter The Million Mission.

“This wasn’t a carefully scripted investor day or a viral tweet,” says Paradigm contributor Davis Wilson, editor of our sister e-letter The Million Mission.

Davis was privy last week to some remarkable insights about one of the most buzzy companies of the past decade — Tesla.

He had an off-the-record dinner with a senior engineer working on Tesla’s batteries. From that dinner, Davis gleaned three insights that “challenge the narrative Wall Street keeps recycling about this company.”

The first insight is that battery range won’t matter in a future of driverless cars — because in that future, “consumers aren’t tied to the car in their driveway,” says Davis. “They’re hailing rides from an autonomous fleet.

“If one vehicle runs low on charge, it simply drives itself to the nearest charger, recharges and returns to service.”

Thus Tesla isn’t worried about better batteries as much as it is about maintaining a reliable charging network — and making sure that network’s supply chain isn’t dependent on China.

The engineer’s second insight: “Elon is the single node in a lot of decisions that slows Tesla’s progress.” That is, Elon Musk insists on making the final call when it comes to all manner of Tesla’s operations. As Davis sums up, “When one person insists on weighing in on everything — big and small — you create a bottleneck.”

The final insight: Even this Tesla insider thinks TSLA stock is overvalued.

The final insight: Even this Tesla insider thinks TSLA stock is overvalued.

“Tesla’s valuation has always been polarizing,” Davis reminds us. “At Tesla’s current $1T valuation, the company is worth more than Ford, GM, Toyota, Volkswagen, Stellantis, Mercedes, Lucid and Honda COMBINED… despite selling a fraction of the vehicles.

“Bulls argue it deserves the premium because Tesla is really an AI, energy and robotics company rolled into one. Bears argue the fundamentals can’t support it.

“Hearing an insider lean toward the bearish view gives that argument more weight. When the people building the product think the market has gotten carried away, it’s worth paying attention.”

![]() Comic Relief

Comic Relief

From the annals of depreciating fiat currency…

From the annals of depreciating fiat currency…

![]() Mailbag: Extraction

Mailbag: Extraction

The mailbag in yesterday’s edition struck a chord in a way I didn’t quite expect.

The mailbag in yesterday’s edition struck a chord in a way I didn’t quite expect.

“Spot-on,” wrote one reader. “Hyperinflation, wealth extraction and private ownership at the public's expense have been part of the ‘economic plan’ for several decades now. Politics is wrapped up in it and can't be avoided.

“Everyday people who are trying to avoid the upper crust's stupidity have been screwed by unrealistic ‘neoclassical’ economic models. Call it what you want. ‘Liberalization, deregulation and privatization.’ ‘Free markets and free trade.’ ‘Globalization.’ It was all a massive failure for the working class.

“The only way out seems to be to run your own business, bank locally, acquire property and precious metals and defend your family.

“Keep the recommendations coming. We need all the help we can get.”

Another reader followed the link to our voluminous archives and a 2021 edition about “extraction.”

“Do you have ‘“Extraction” in one chart’ updated to 2025?” he inquires. “I am sure it is on the same trajectory, and likely steeper. Thank you for the Ratigan rage! Love the 5.”

Dave responds: I’ve searched high and low for a more current version of that chart ever since I first ran across it in Marc Faber’s Gloom, Boom and Doom Report in 2013.

That said, one of the economists who compiled the chart issued a paper last year on the same general theme, updated through 2022.

His conclusion is that the upheaval wrought by the government’s reaction to COVID made the income disparity even worse than it was before — stimmy checks notwithstanding.

From 2019–2022, the bottom 99% saw their after-inflation incomes grow by 1.0% — compared with the top 1%, who enjoyed 16.1% growth.

“Hence,” wrote UC-Berkeley economist Emmanuel Saez, “top 1% families captured 81% of total real income growth per family” during that four-year span.

As for the first reader’s comment, the power elite in this country have so thoroughly corrupted the meaning of terms like the “free market”... that in a Cato Institute/YouGov survey this spring, 62% of adults under 30 have a favorable view of socialism.

And yes, that’s up meaningfully from the pre-pandemic year of 2019.

I’ve said it before this year in different contexts and I’ll say it again now: However much gold and Bitcoin you hold as a hedge against the debasement of the U.S. dollar, it’s probably not enough.

Best regards,

Dave Gonigam

Managing editor, Paradigm Pressroom's 5 Bullets